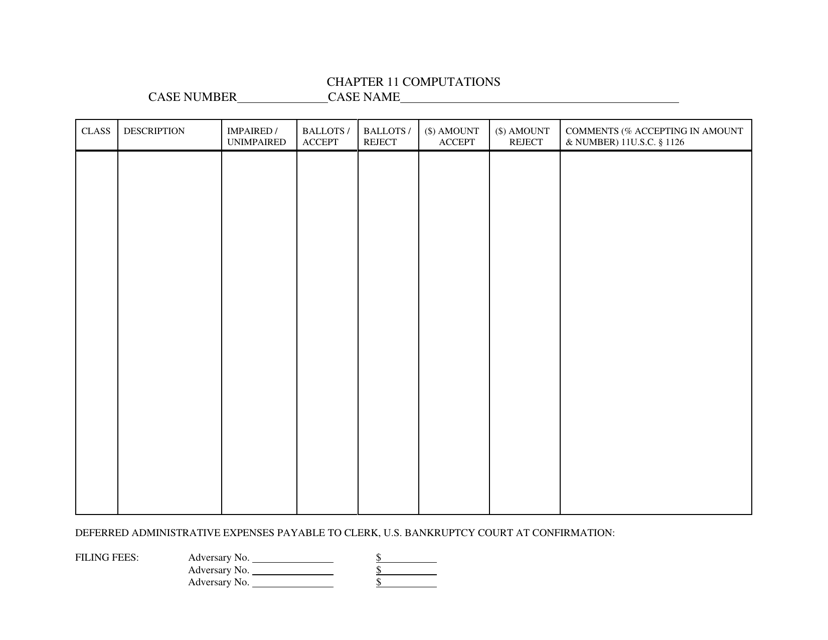

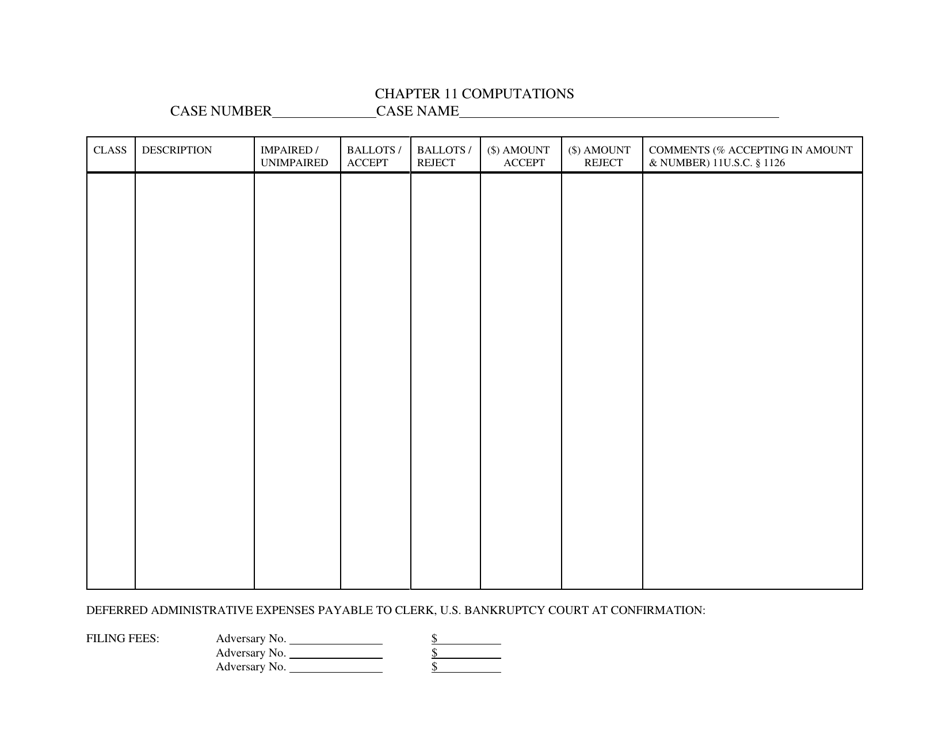

Chapter 11 Computations - North Dakota

Chapter 11 Computations is a legal document that was released by the United States Bankruptcy Court for the District of North Dakota - a government authority operating within North Dakota.

FAQ

Q: What is the tax rate in North Dakota?

A: North Dakota has a state sales tax rate of 5%.

Q: Are there any additional local taxes in North Dakota?

A: Yes, some cities and counties in North Dakota may have additional local sales taxes.

Q: What is the income tax rate in North Dakota?

A: North Dakota has a progressive income tax system with five tax brackets ranging from 1.1% to 2.9%.

Q: Is there a property tax in North Dakota?

A: Yes, North Dakota imposes property taxes on real estate.

Q: How are property taxes calculated in North Dakota?

A: Property taxes in North Dakota are calculated based on the assessed value of the property and the local mill levies.

Q: Is there a vehicle registration tax in North Dakota?

A: Yes, North Dakota imposes a motor vehicle excise tax based on the value of the vehicle.

Q: What is the sales tax rate for vehicle purchases in North Dakota?

A: The sales tax rate for vehicle purchases in North Dakota is 5% of the purchase price.

Q: What is the tax rate for tobacco products in North Dakota?

A: The tax rate for cigarettes in North Dakota is $0.44 per pack.

Q: Is there a tax on alcohol in North Dakota?

A: Yes, North Dakota imposes a tax on alcohol based on the type and volume of the beverage.

Q: Are there any other taxes or fees in North Dakota?

A: Yes, there may be various other taxes and fees in North Dakota, such as a lodging tax and a gaming tax.

Form Details:

- The latest edition currently provided by the United States Bankruptcy Court for the District of North Dakota;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the United States Bankruptcy Court for the District of North Dakota.