This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-640

for the current year.

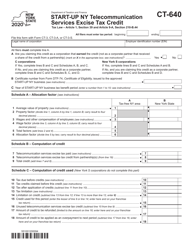

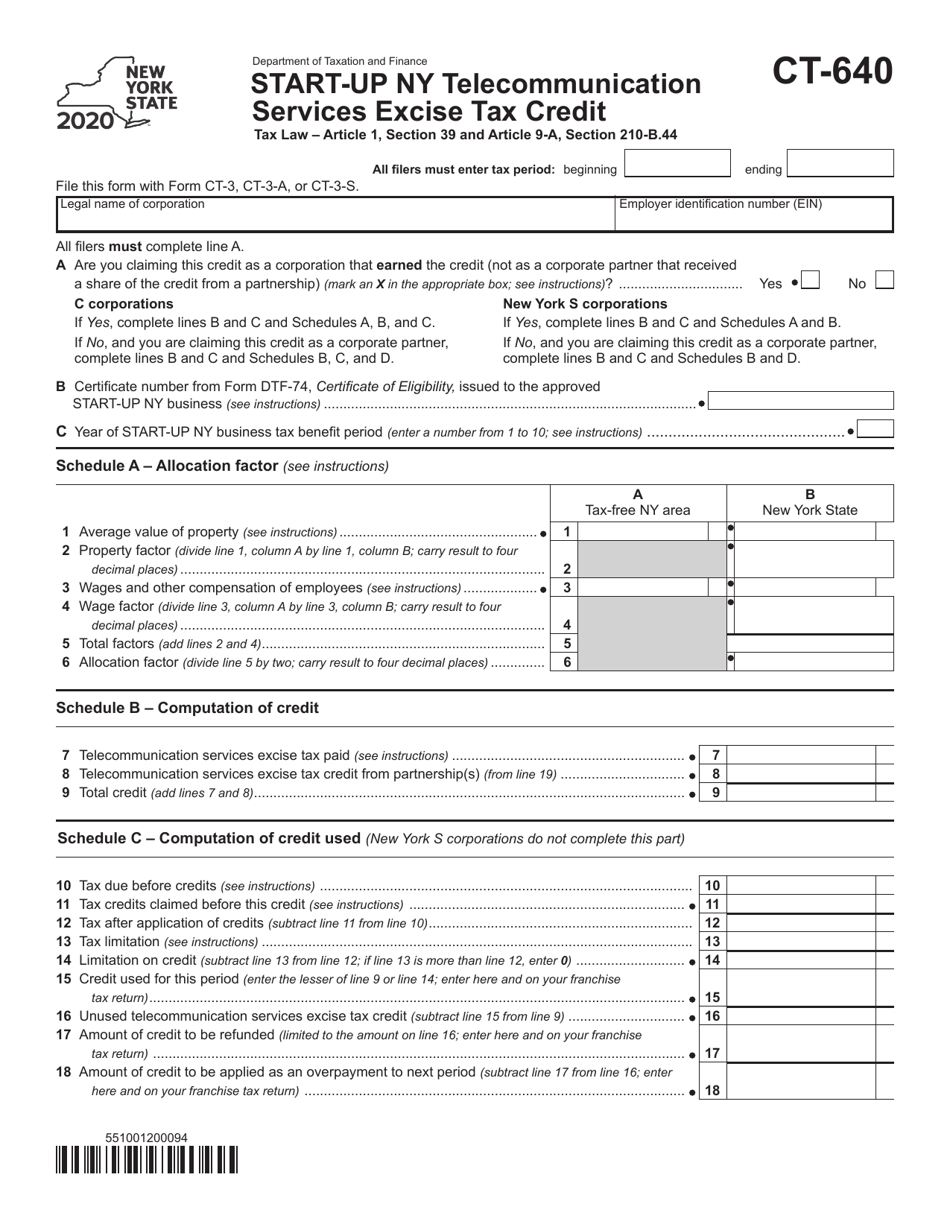

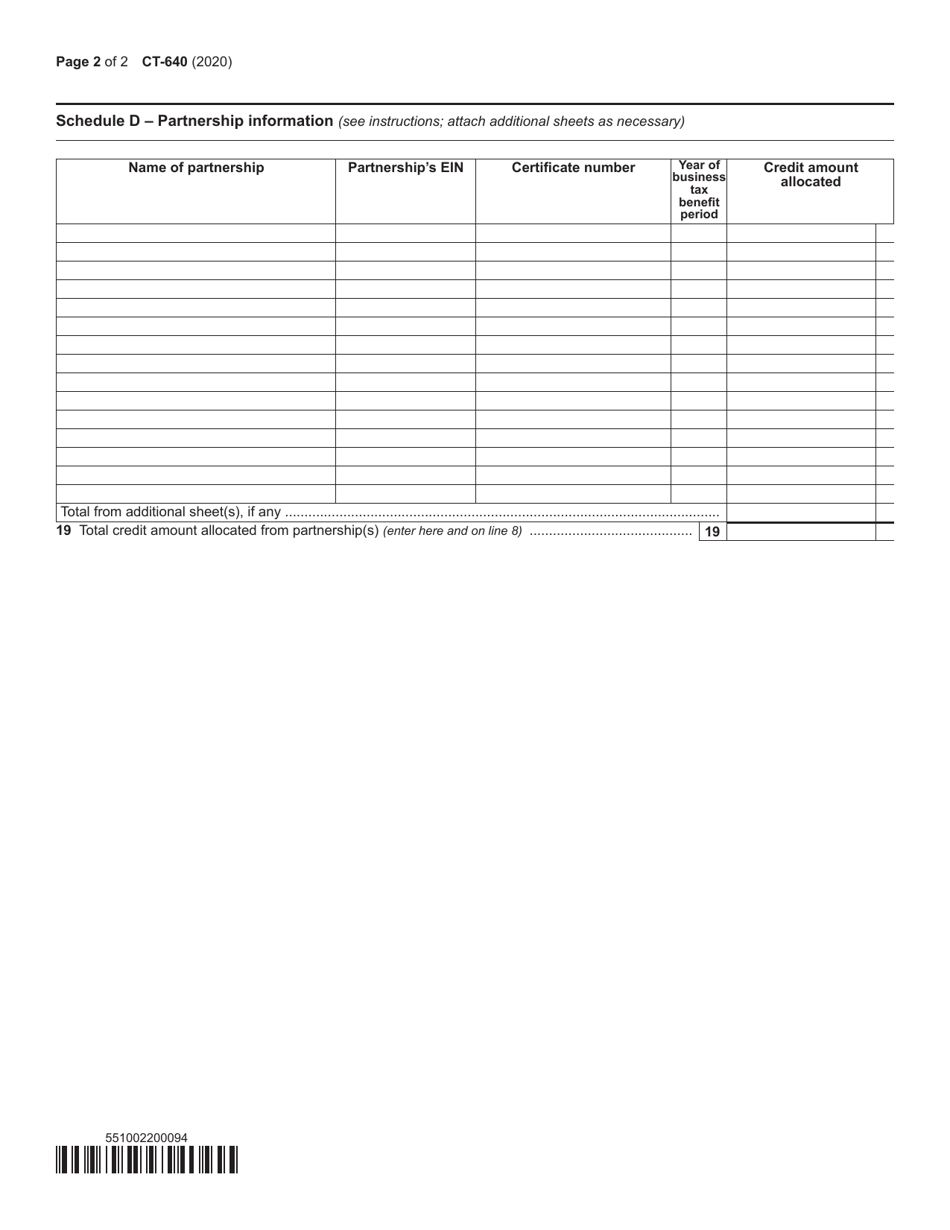

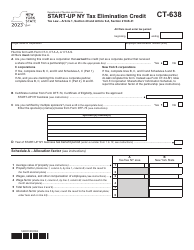

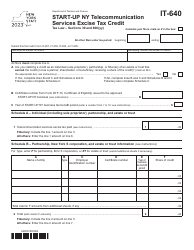

Form CT-640 Start-Up Ny Telecommunication Services Excise Tax Credit - New York

What Is Form CT-640?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-640?

A: Form CT-640 is a tax form used in New York.

Q: What is Start-Up NY?

A: Start-Up NY is an economic development program in New York.

Q: What is the purpose of the Start-Up NY Telecommunication Services Excise Tax Credit?

A: The purpose of the tax credit is to incentivize telecommunication services companies to locate and expand in New York.

Q: Who is eligible for the Start-Up NY Telecommunication Services Excise Tax Credit?

A: Telecommunication services companies that are approved and participate in the Start-Up NY program may be eligible for the tax credit.

Q: What does the tax credit provide?

A: The tax credit provides a reduction in the excise tax on telecommunication services.

Q: Are there any filing requirements for the Start-Up NY Telecommunication Services Excise Tax Credit?

A: Yes, eligible companies must file Form CT-640 annually to claim the tax credit.

Q: Is the tax credit refundable?

A: No, the tax credit is not refundable.

Q: Are there any restrictions or limitations on the tax credit?

A: Yes, there are certain restrictions and limitations on the tax credit. It is advisable to consult with a tax professional or refer to the instructions for Form CT-640 for more information.

Q: Can I claim the tax credit if I am not a telecommunication services company?

A: No, the tax credit is specifically for telecommunication services companies participating in the Start-Up NY program.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-640 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.