This version of the form is not currently in use and is provided for reference only. Download this version of

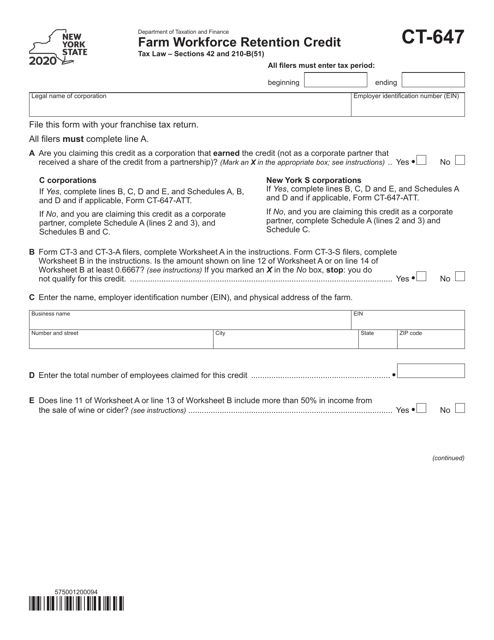

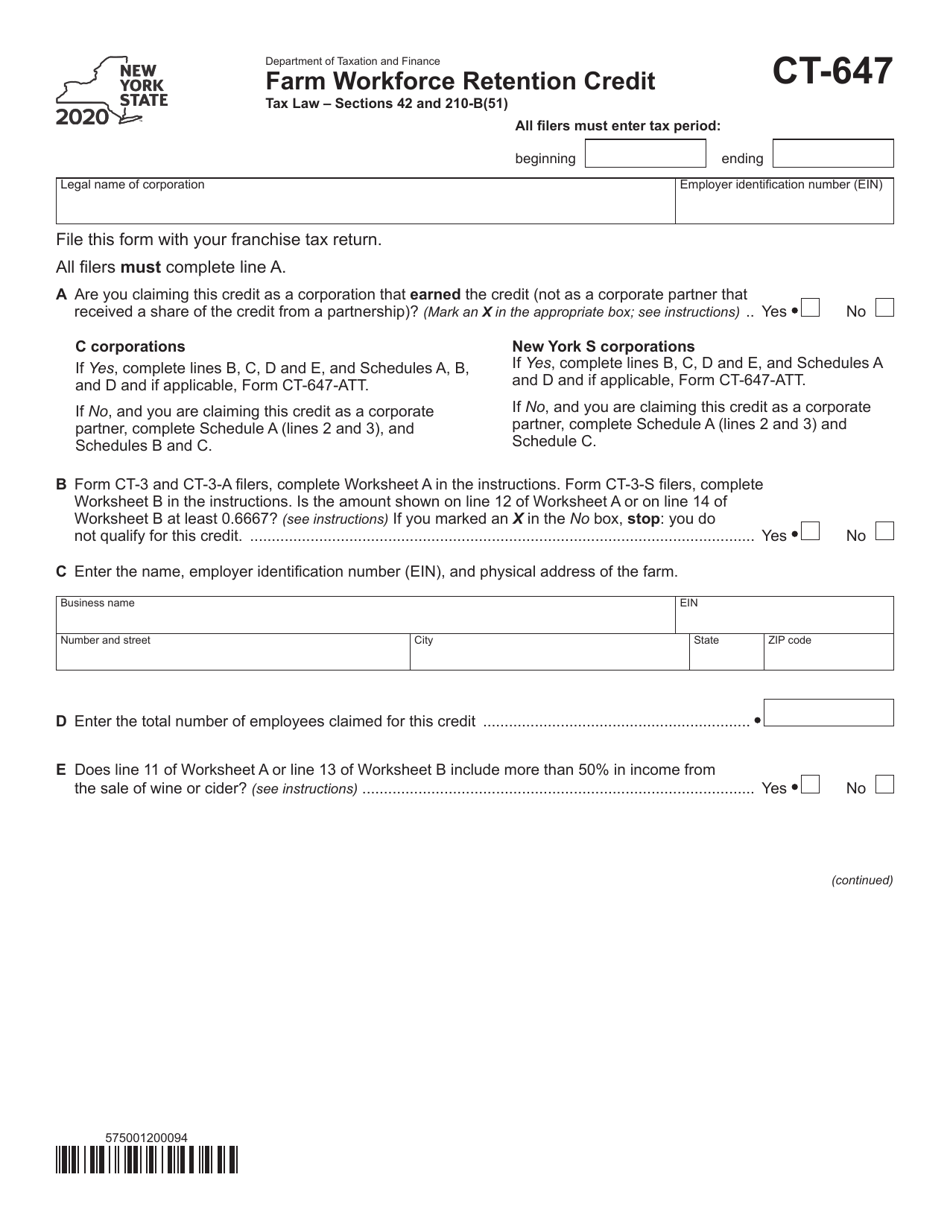

Form CT-647

for the current year.

Form CT-647 Farm Workforce Retention Credit - New York

What Is Form CT-647?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-647 Farm Workforce Retention Credit?

A: Form CT-647 is a tax form used in New York to claim the Farm Workforce Retention Credit.

Q: Who can claim the Farm Workforce Retention Credit?

A: Farmers who employ qualified employees on their farms in New York can claim this credit.

Q: What is the purpose of the Farm Workforce Retention Credit?

A: The credit is designed to incentivize farm owners to retain their workforce and promote stability in the agriculture industry.

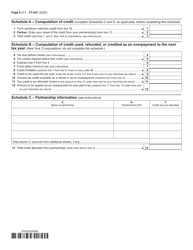

Q: What are the qualifications for the Farm Workforce Retention Credit?

A: To qualify, farmers must meet certain requirements such as having eligible employees, a qualifying farm operation, and meeting wage-related criteria.

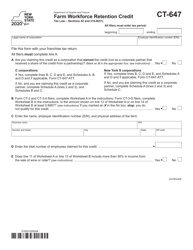

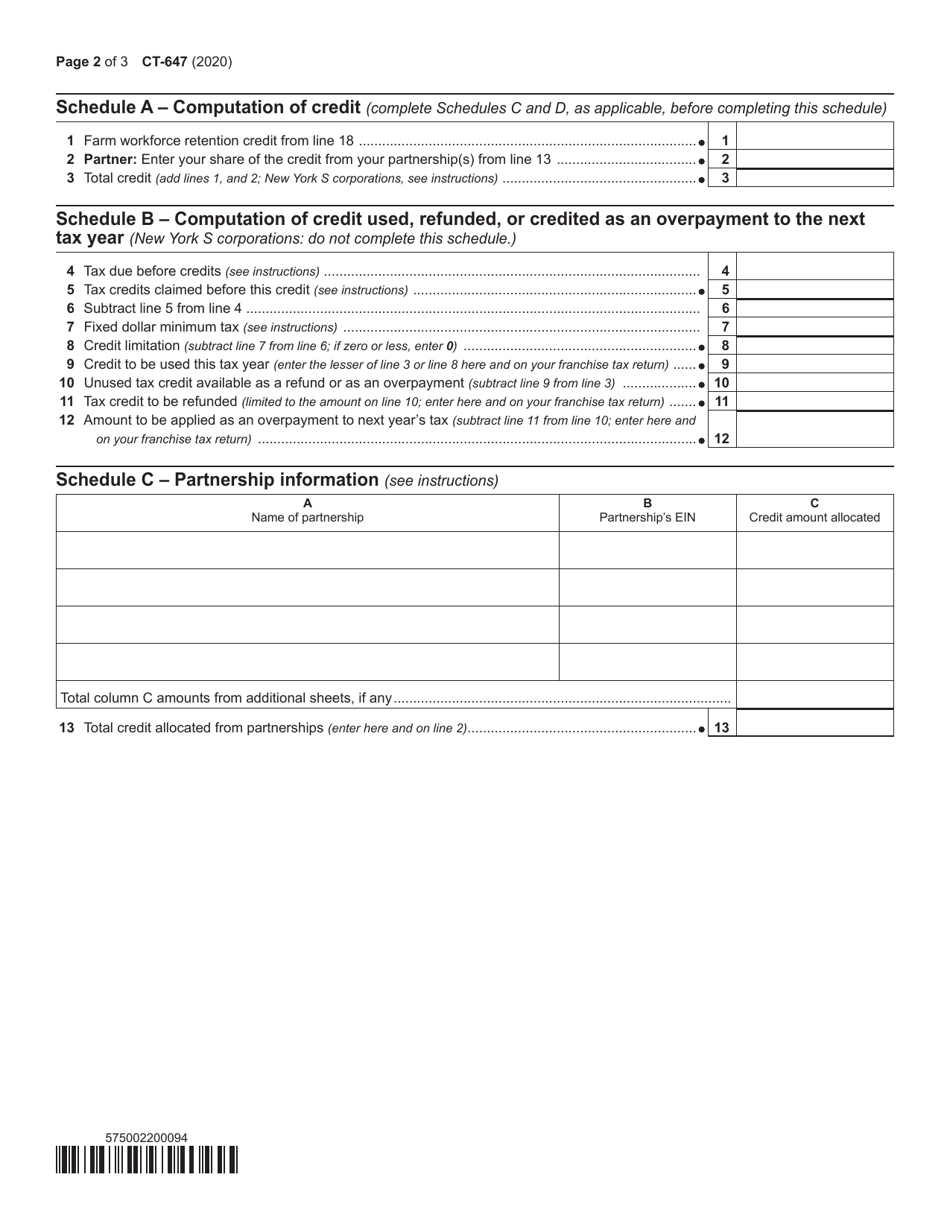

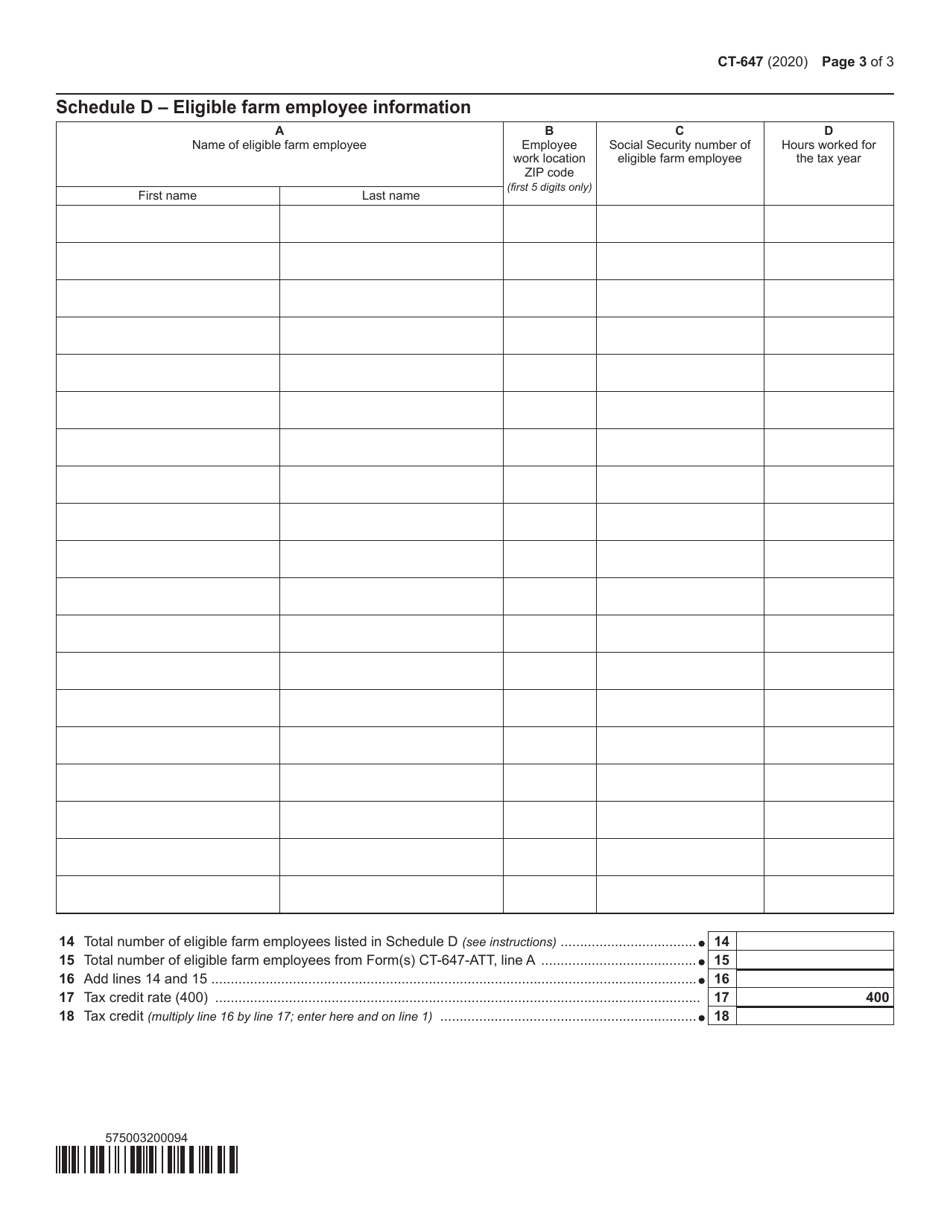

Q: How is the credit calculated?

A: The credit amount is based on eligible employee wages and is subject to certain limitations.

Q: When is the deadline to file Form CT-647?

A: The due date for filing Form CT-647 is the same as the due date for the corresponding income tax return, generally on or before April 15th of the following year.

Q: Is the Farm Workforce Retention Credit refundable?

A: No, the credit is nonrefundable, which means it can reduce the tax liability to zero but cannot result in a refund.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-647 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.