This version of the form is not currently in use and is provided for reference only. Download this version of

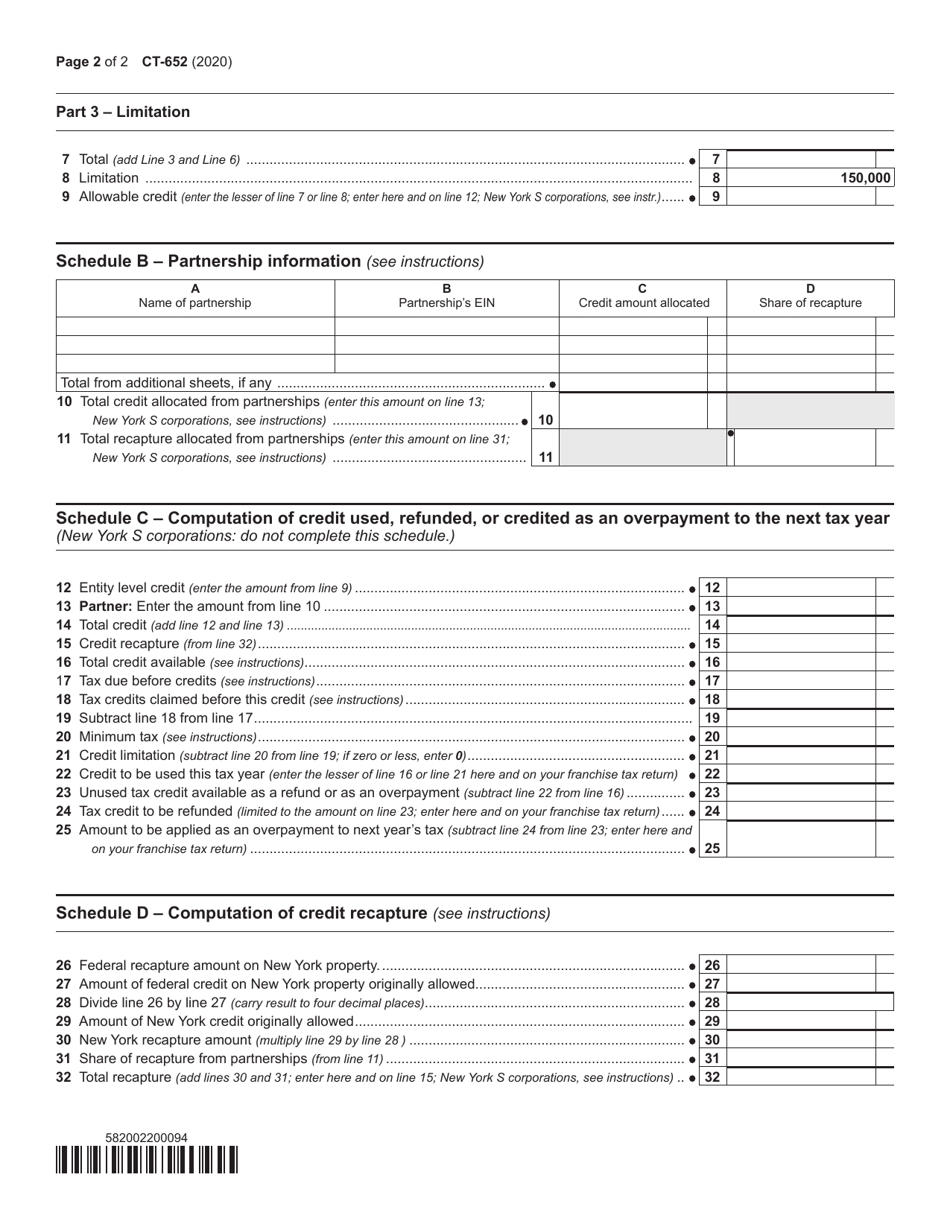

Form CT-652

for the current year.

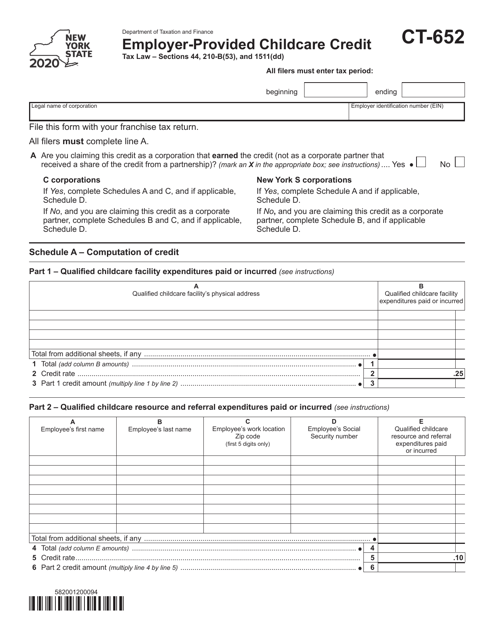

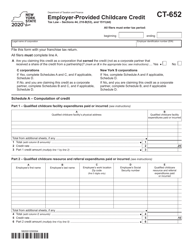

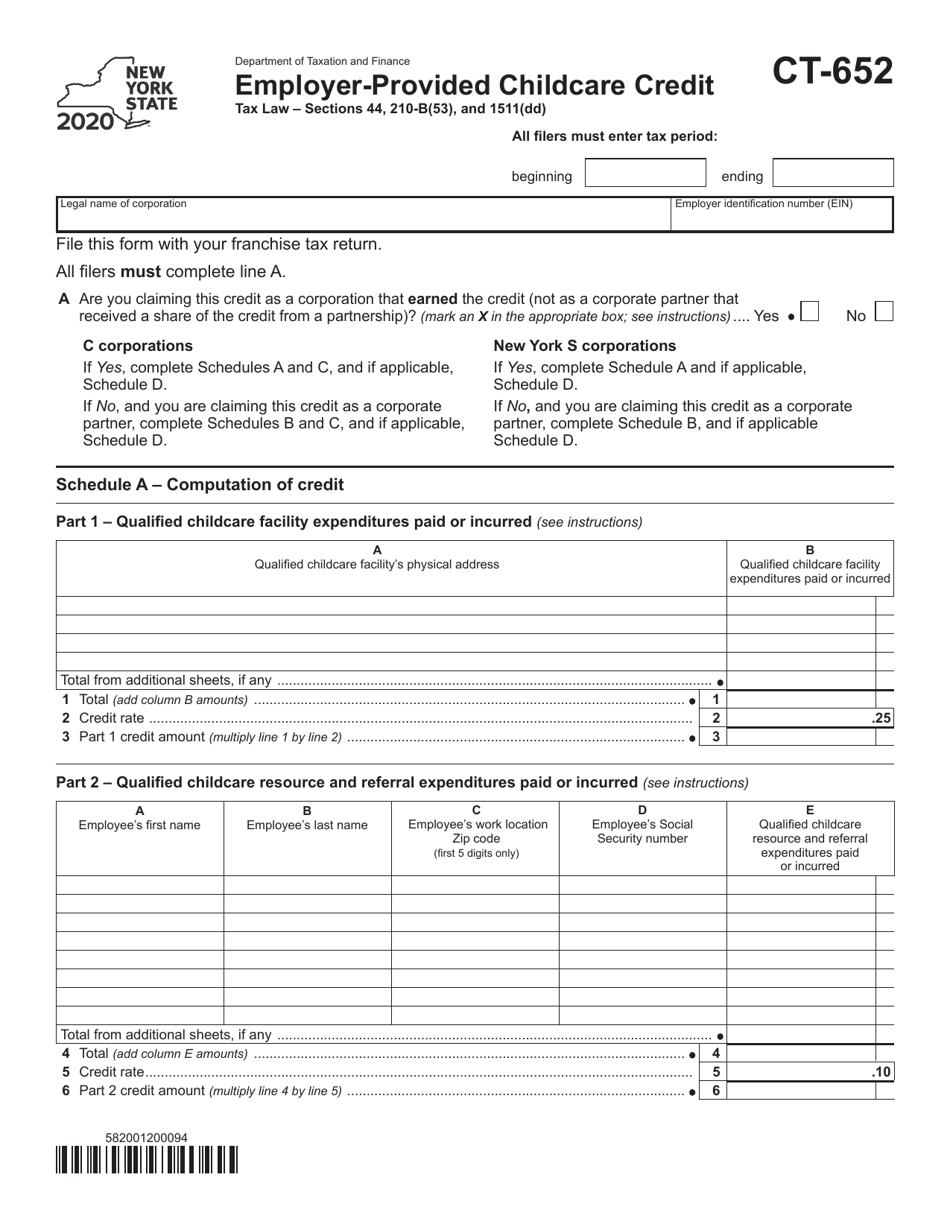

Form CT-652 Employer-Provided Childcare Credit - New York

What Is Form CT-652?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-652?

A: Form CT-652 is the Employer-Provided Childcare Credit form specific to New York.

Q: What is the purpose of Form CT-652?

A: The purpose of Form CT-652 is to claim a credit for the cost of providing childcare to employees.

Q: Who can use Form CT-652?

A: Employers in New York who have provided childcare services to their employees can use Form CT-652.

Q: What expenses can be claimed on Form CT-652?

A: Expenses such as providing qualified childcare services, maintaining a qualified childcare facility, and paying qualified childcare providers can be claimed on Form CT-652.

Q: How do I file Form CT-652?

A: You can file Form CT-652 along with your New York state tax return.

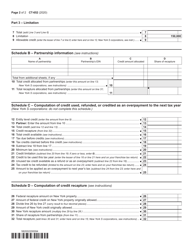

Q: Are there any limitations to claiming the Employer-Provided Childcare Credit?

A: Yes, there are certain limitations such as the credit being limited to a percentage of the federal credit and the credit being subject to phase-out for higher-income taxpayers.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-652 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.