This version of the form is not currently in use and is provided for reference only. Download this version of

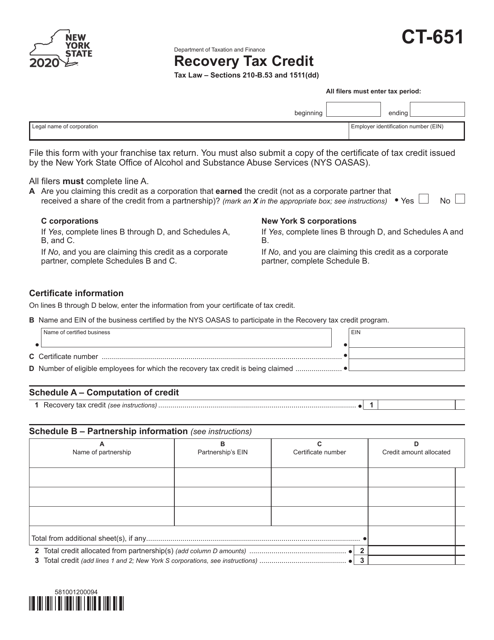

Form CT-651

for the current year.

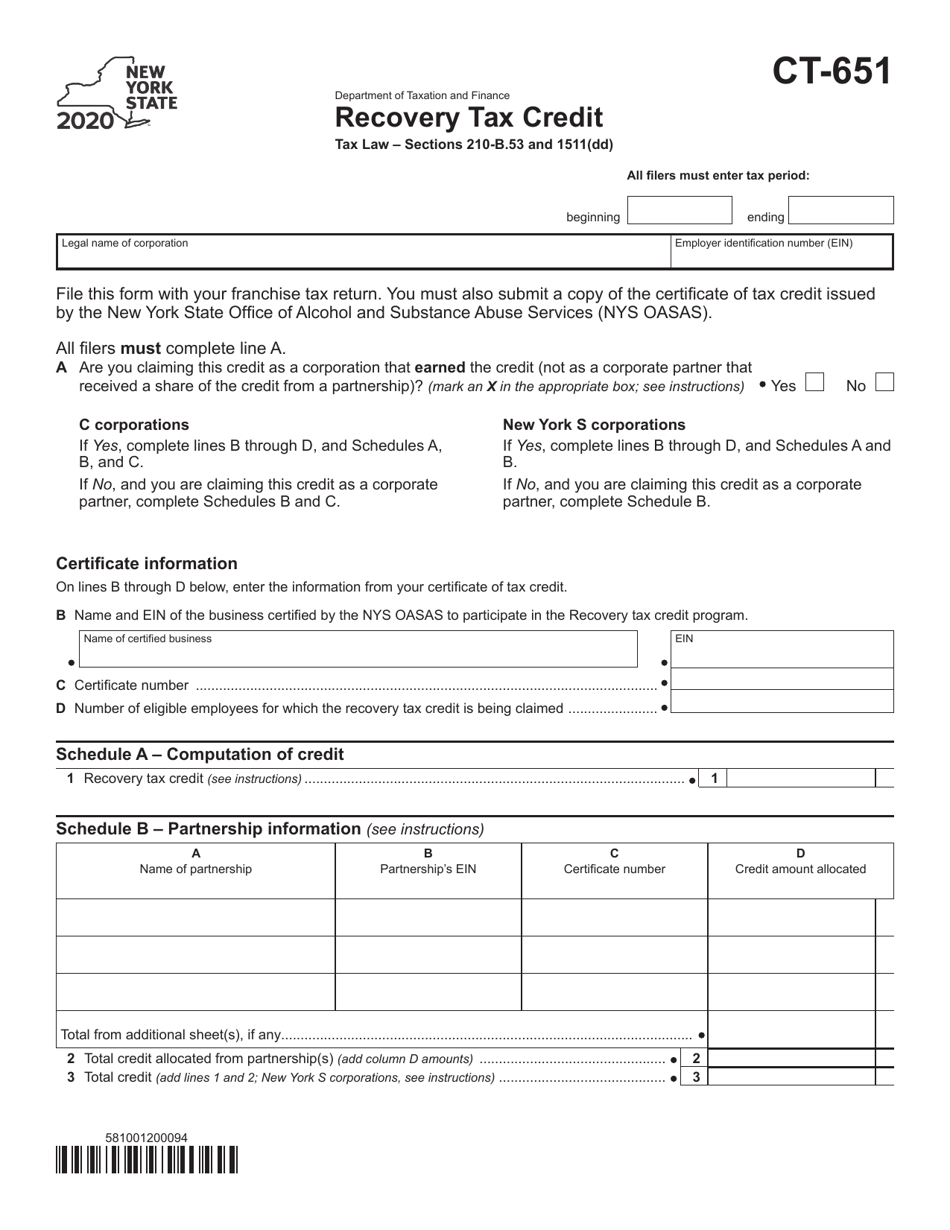

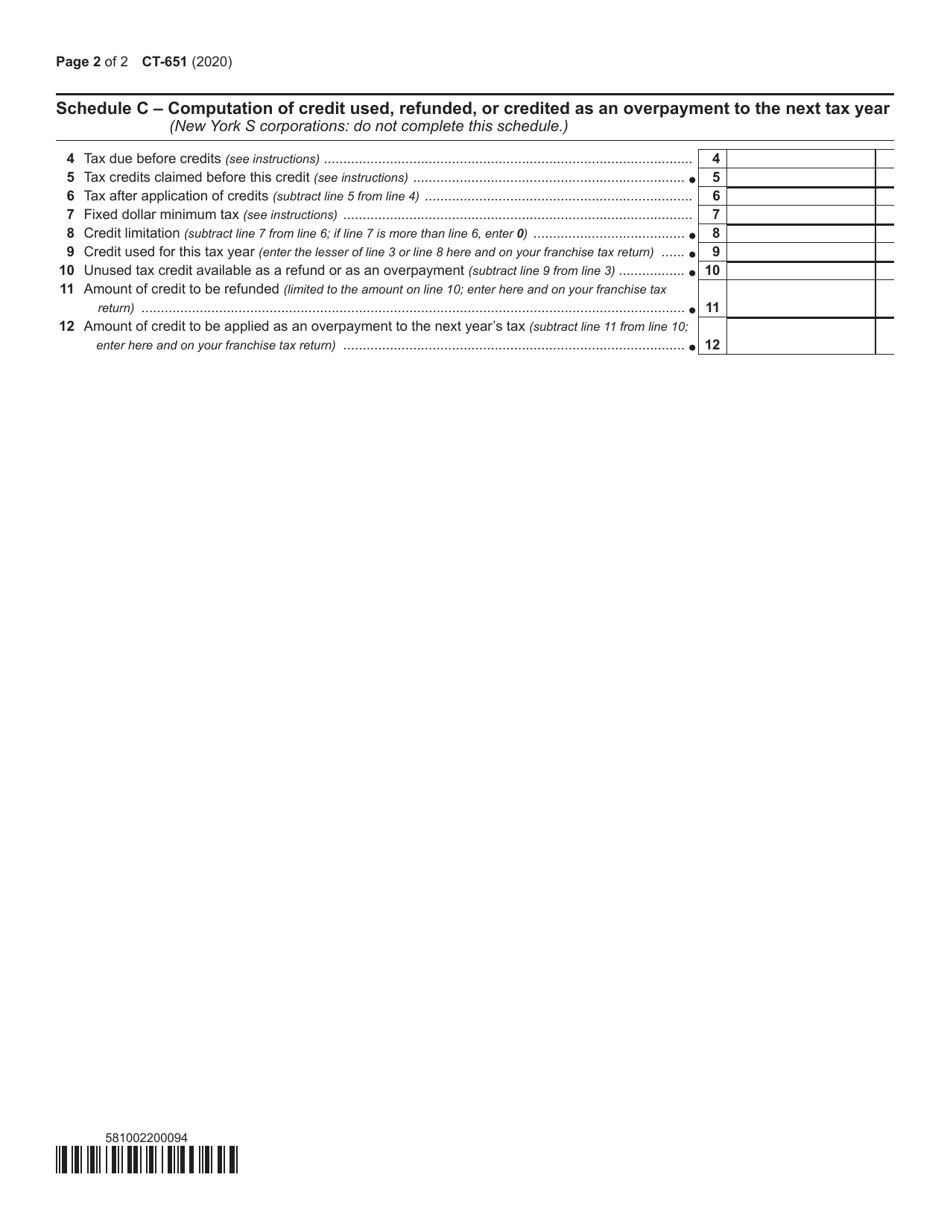

Form CT-651 Recovery Tax Credit - New York

What Is Form CT-651?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-651?

A: Form CT-651 is a tax form used to claim the Recovery Tax Credit in New York.

Q: What is the Recovery Tax Credit?

A: The Recovery Tax Credit is a tax credit designed to provide relief to individuals and businesses affected by the COVID-19 pandemic.

Q: Who is eligible to claim the Recovery Tax Credit?

A: Eligibility for the Recovery Tax Credit varies depending on individual circumstances. It is best to consult the instructions for Form CT-651 or seek professional tax advice.

Q: Are there any penalties for late filing or failure to file Form CT-651?

A: Penalties may apply for late filing or failure to file Form CT-651. It is recommended to file the form on time or seek professional tax advice if you're unable to meet the deadline.

Q: What supporting documents are required to file Form CT-651?

A: The specific supporting documents required may depend on individual circumstances. It is advisable to review the instructions for Form CT-651 or consult a tax professional for guidance.

Q: Is the Recovery Tax Credit taxable?

A: The taxability of the Recovery Tax Credit depends on individual circumstances. It is recommended to consult a tax professional for guidance on how the credit may impact your taxes.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-651 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.