This version of the form is not currently in use and is provided for reference only. Download this version of

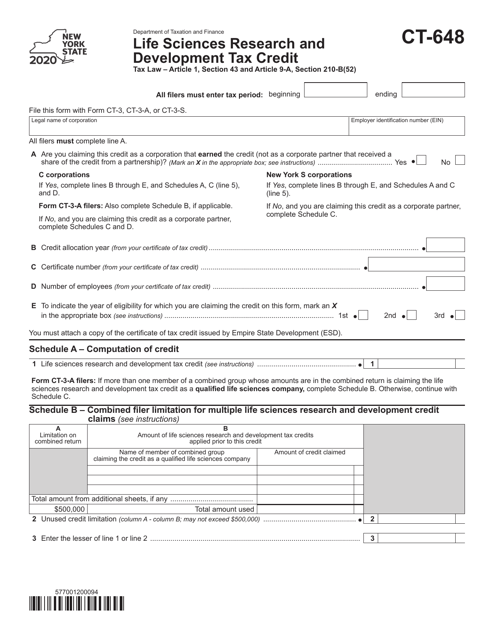

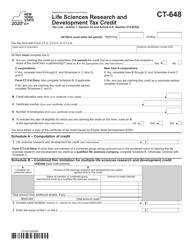

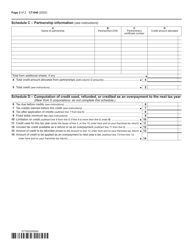

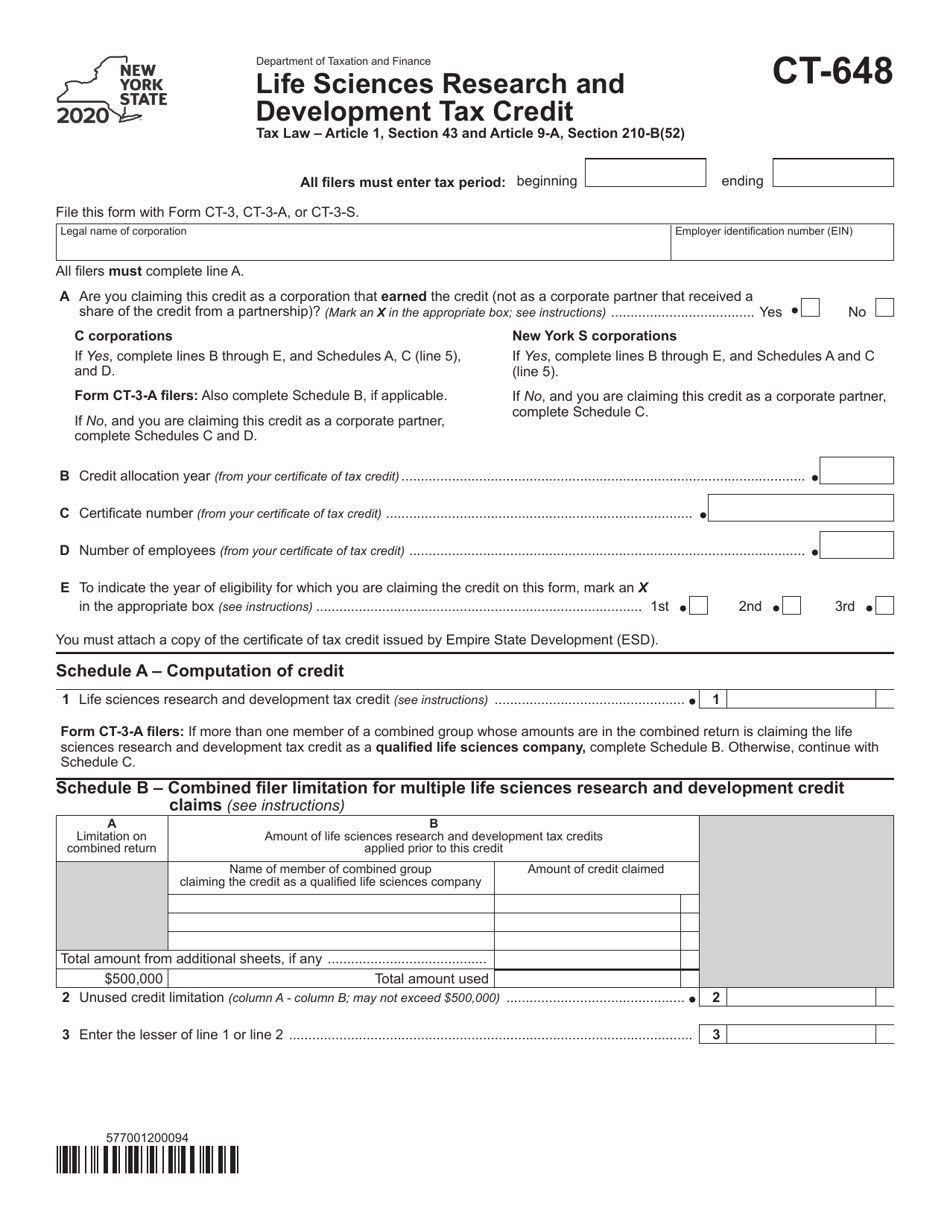

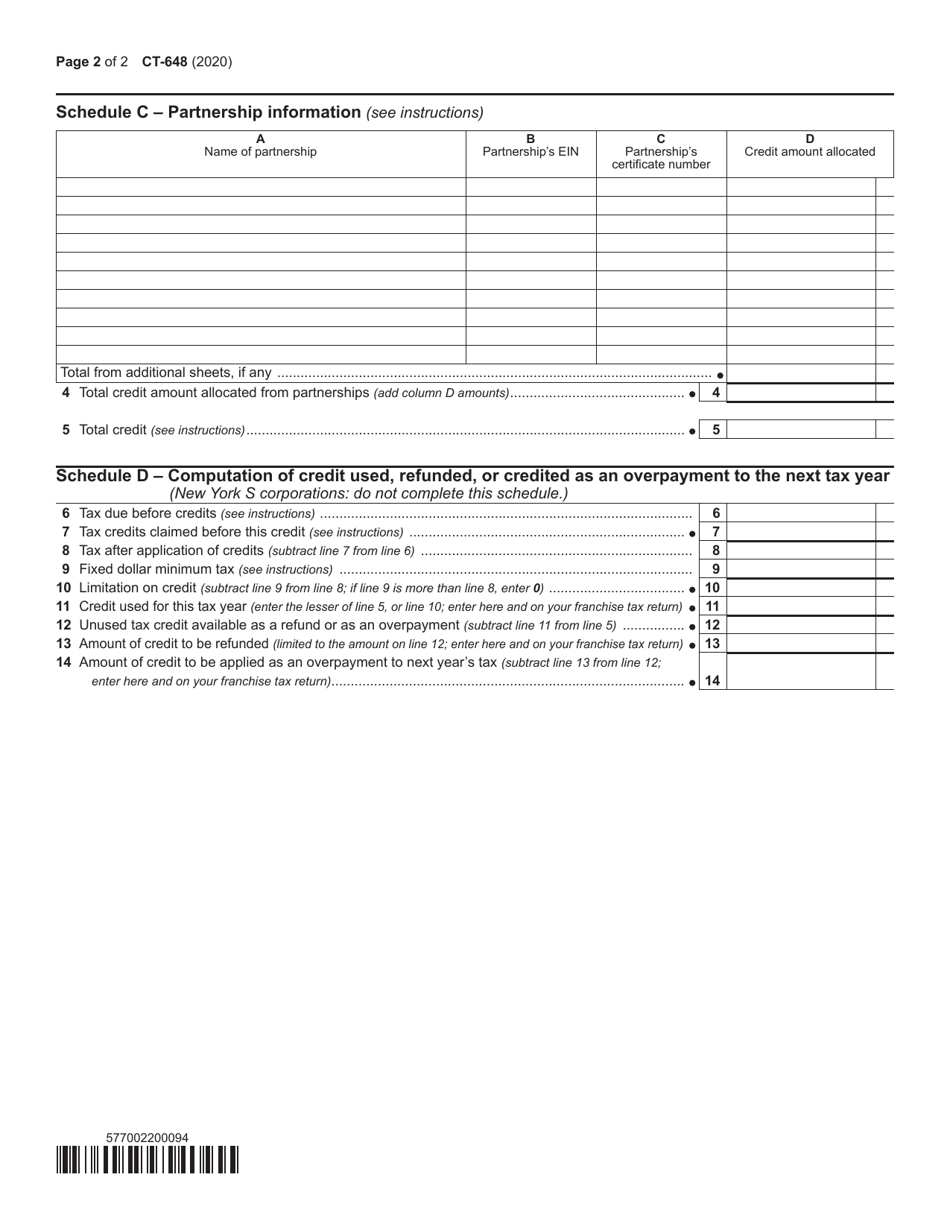

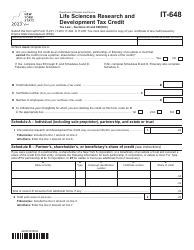

Form CT-648

for the current year.

Form CT-648 Life Sciences Research and Development Tax Credit - New York

What Is Form CT-648?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-648?

A: Form CT-648 is the Life Sciences Research and Development Tax Credit form for the state of New York.

Q: Who is eligible to claim the Life Sciences Research and Development Tax Credit?

A: Eligible taxpayers include businesses engaged in life sciencesresearch and development activities in New York.

Q: What is the purpose of the Life Sciences Research and Development Tax Credit?

A: The purpose is to encourage and support life sciences research and development activities in New York.

Q: How is the credit calculated?

A: The credit is calculated as a percentage of qualified research expenses incurred in New York.

Q: What are qualified research expenses?

A: Qualified research expenses include wages, supplies, and contract research expenses related to eligible research activities.

Q: How can I claim the Life Sciences Research and Development Tax Credit?

A: The credit can be claimed by completing and filing Form CT-648 with the New York State Department of Taxation and Finance.

Q: Are there any limitations or restrictions on the credit?

A: Yes, there are certain limitations on the credit, including a maximum credit amount and a phased-in credit rate based on the taxpayer's research and development expenditures.

Q: Are there any deadlines for claiming the credit?

A: Yes, the credit must be claimed on the taxpayer's annual New York State tax return by the due date, including extensions.

Q: Can the Life Sciences Research and Development Tax Credit be carried forward or refunded?

A: Yes, any unused portion of the credit can be carried forward for up to 15 years or refunded if the taxpayer meets certain criteria.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-648 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.