This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-607

for the current year.

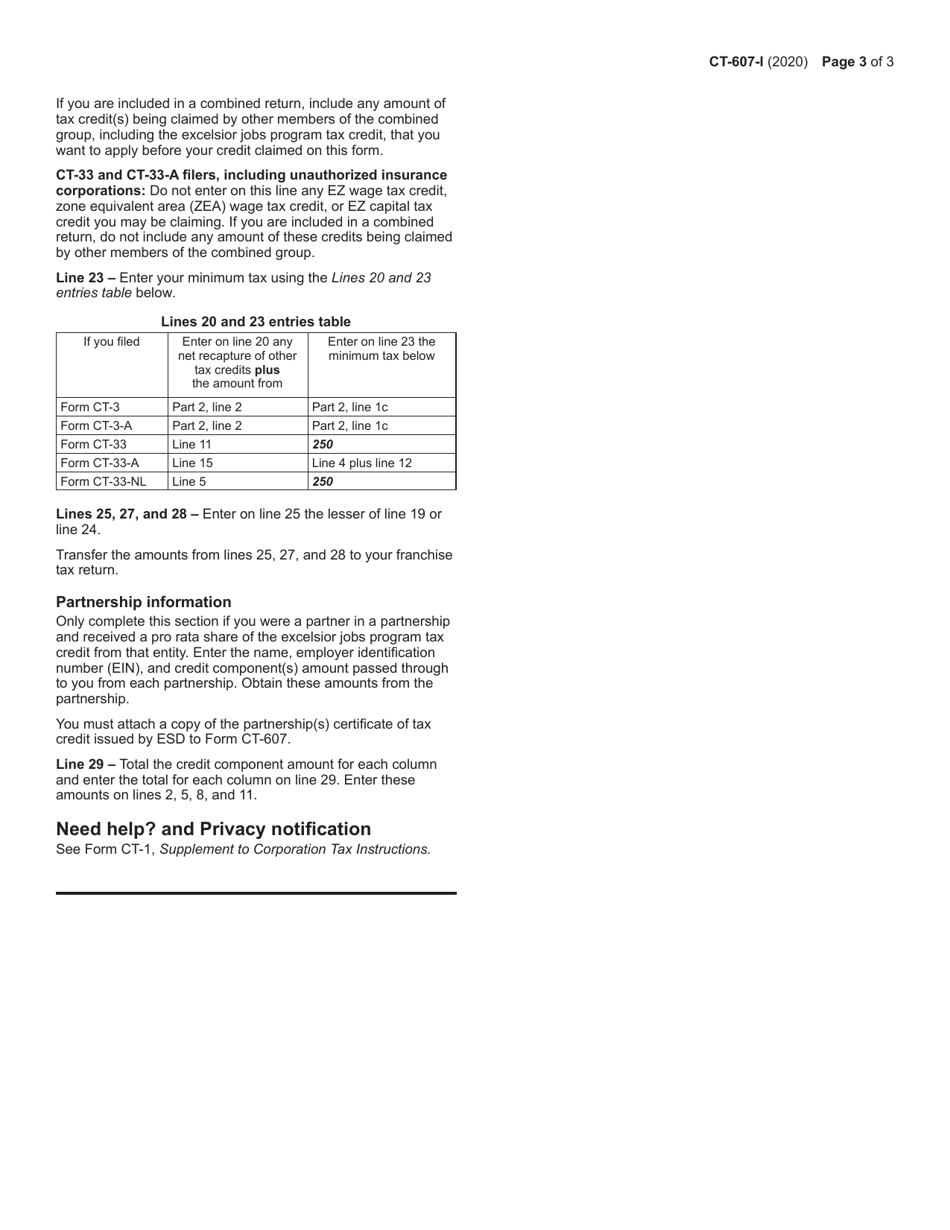

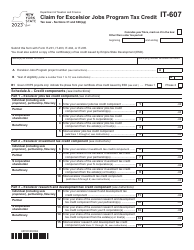

Instructions for Form CT-607 Claim for Excelsior Jobs Program Tax Credit - New York

This document contains official instructions for Form CT-607 , Claim for Excelsior Jobs Program Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-607 is available for download through this link.

FAQ

Q: What is Form CT-607?

A: Form CT-607 is the claim form used to apply for the Excelsior Jobs Program Tax Credit in New York.

Q: What is the Excelsior Jobs Program Tax Credit?

A: The Excelsior Jobs Program Tax Credit is a tax incentive program in New York that provides tax credits to businesses that create or retain jobs in certain industries.

Q: Who is eligible to file Form CT-607?

A: Businesses that participate in the Excelsior Jobs Program and meet the criteria set by the program are eligible to file Form CT-607.

Q: What information is required on Form CT-607?

A: Form CT-607 requires information about the business, the jobs created or retained, and the amount of tax credit being claimed.

Q: When is the deadline to file Form CT-607?

A: The deadline to file Form CT-607 is generally within 3 years from the end of the tax year in which the job creation or retention occurred.

Q: Are there any supporting documents required with Form CT-607?

A: Yes, businesses are required to submit supporting documents such as payroll records, job creation or retention documentation, and proof of eligibility for the Excelsior Jobs Program.

Q: How long does it take to process Form CT-607?

A: The processing time for Form CT-607 varies, but businesses can expect a response from the New York State Department of Taxation and Finance within a few months.

Q: Can I claim the Excelsior Jobs Program Tax Credit in addition to other tax incentives?

A: Yes, businesses may be eligible to claim the Excelsior Jobs Program Tax Credit in addition to other tax incentives, as long as they meet the requirements of each program.

Instruction Details:

- This 3-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.