This version of the form is not currently in use and is provided for reference only. Download this version of

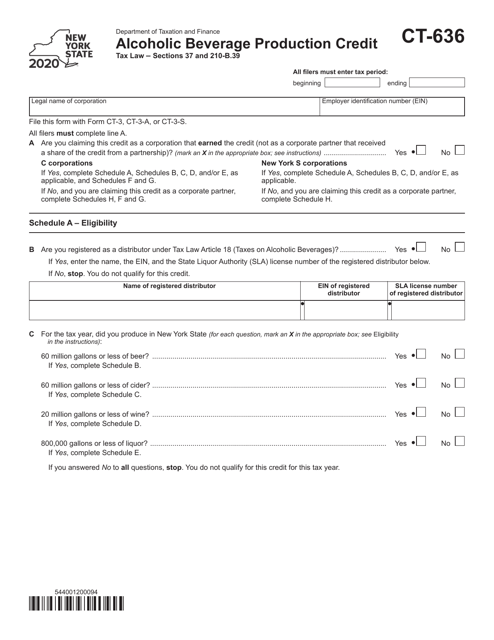

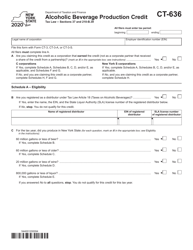

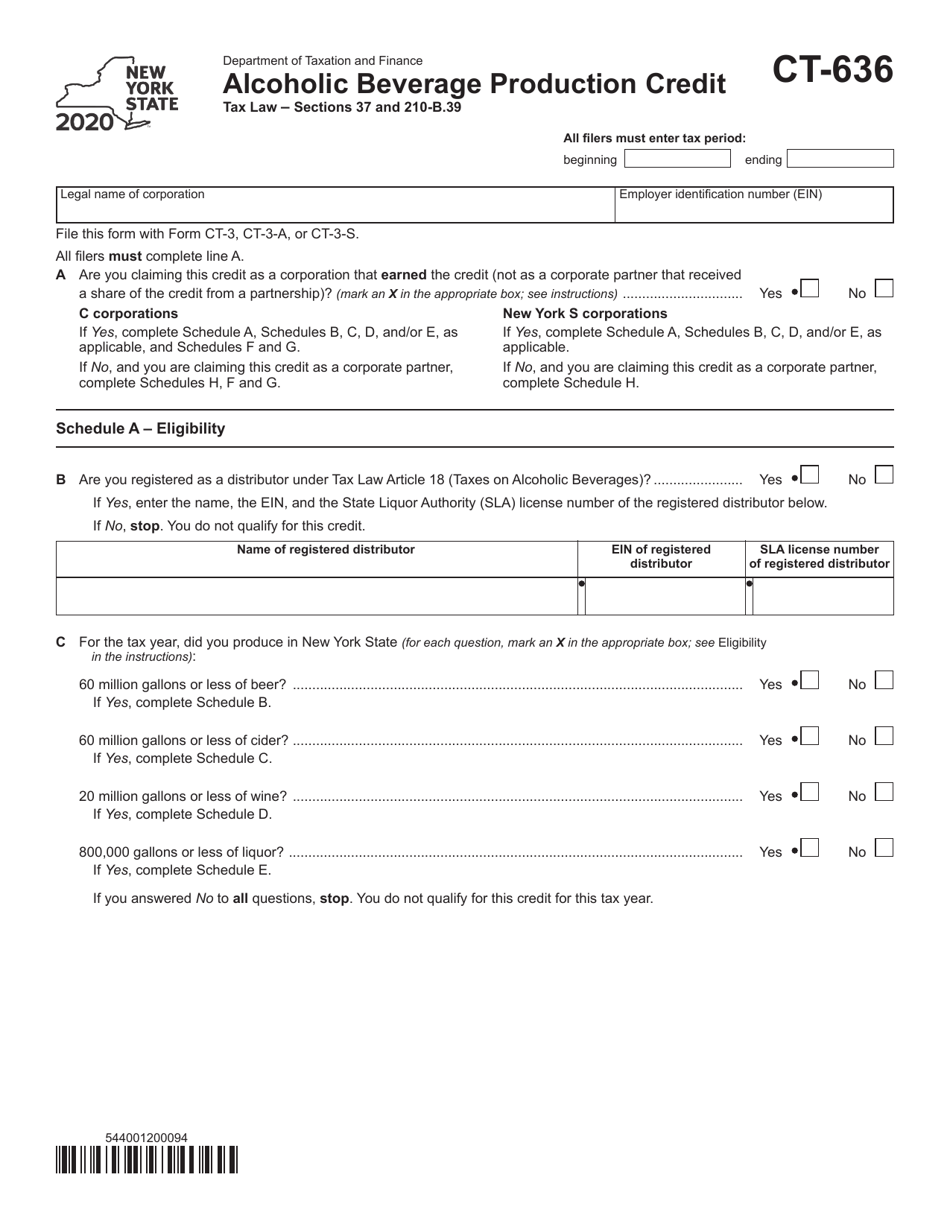

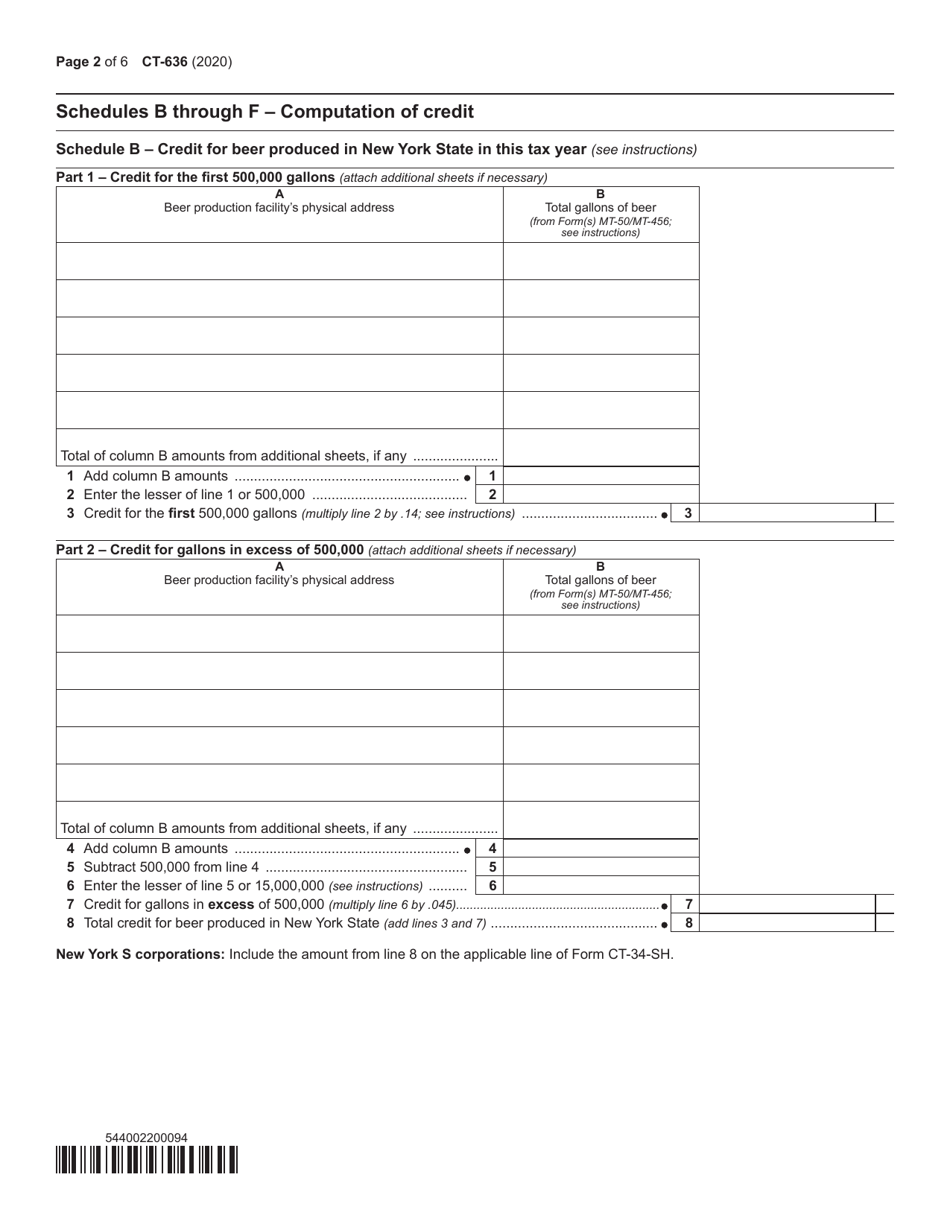

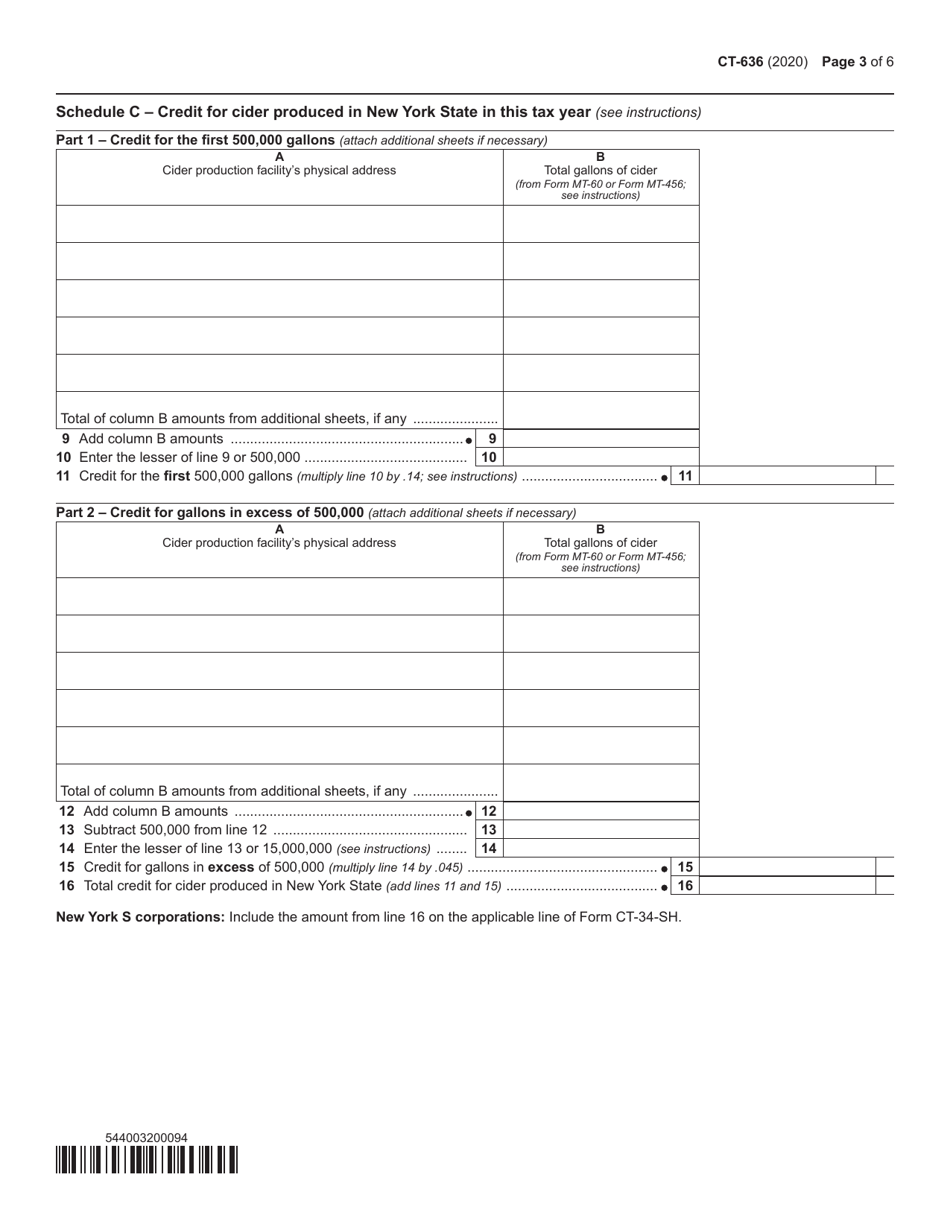

Form CT-636

for the current year.

Form CT-636 Alcoholic Beverage Production Credit - New York

What Is Form CT-636?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-636?

A: Form CT-636 is the Alcoholic Beverage Production Credit form for New York.

Q: What is the Alcoholic Beverage Production Credit?

A: The Alcoholic Beverage Production Credit is a credit available to certain New York businesses engaged in the production of beer, cider, wine, or liquor.

Q: Who is eligible for the Alcoholic Beverage Production Credit?

A: Eligible businesses include wineries, breweries, distilleries, and cideries that meet certain criteria.

Q: What expenses can be claimed with this credit?

A: Qualified expenses include production costs, marketing expenses, and certain licensing fees.

Q: How much is the credit?

A: The credit amount varies based on the type of alcohol produced and the volume produced.

Q: How can I claim the Alcoholic Beverage Production Credit?

A: To claim the credit, you must complete and file Form CT-636 with the New York State Department of Taxation and Finance.

Q: When is the deadline for filing Form CT-636?

A: The deadline for filing Form CT-636 is generally the same as the deadline for filing your New York State business tax return.

Q: Is there any additional documentation required?

A: Yes, you may need to provide supporting documentation to substantiate your claimed expenses.

Q: Can I claim this credit if I produce alcoholic beverages for personal use only?

A: No, the credit is only available to businesses engaged in the commercial production of alcohol.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-636 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.