This version of the form is not currently in use and is provided for reference only. Download this version of

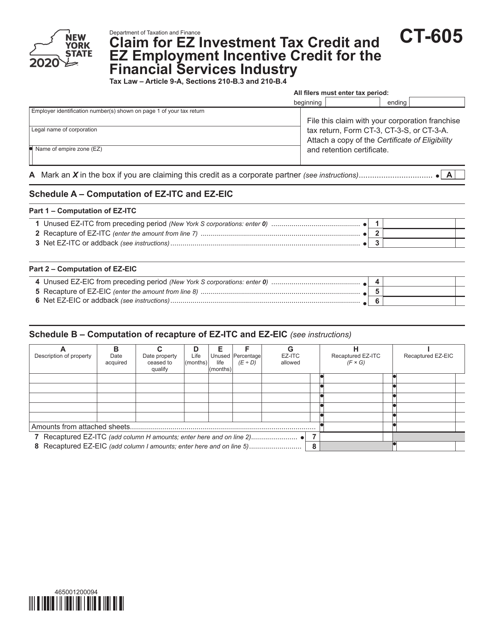

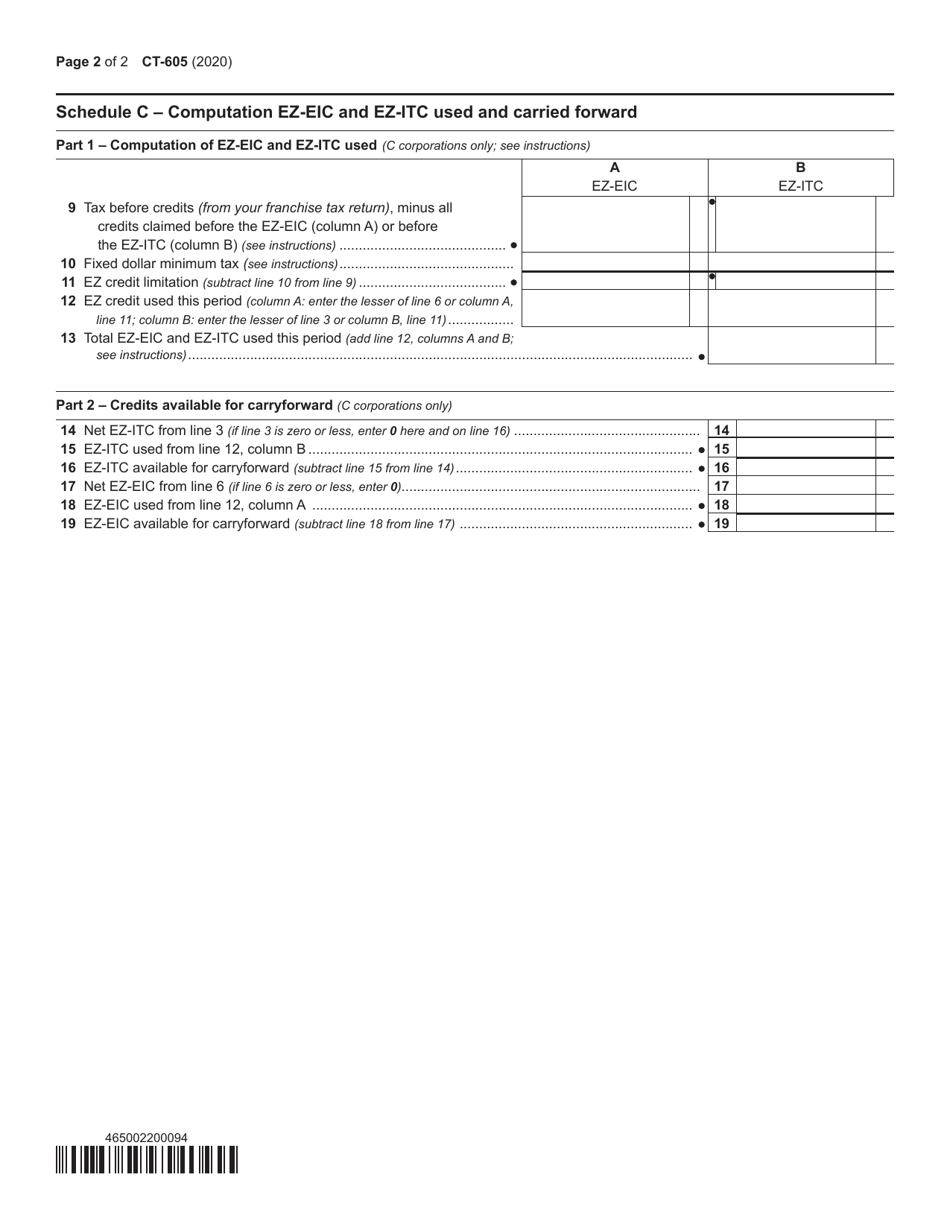

Form CT-605

for the current year.

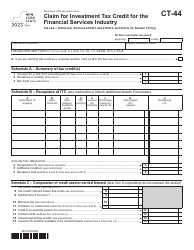

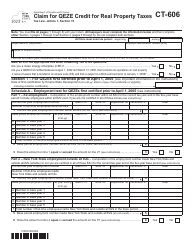

Form CT-605 Claim for Ez Investment Tax Credit and Ez Employment Incentive Credit for the Financial Services Industry - New York

What Is Form CT-605?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-605?

A: Form CT-605 is a claim form for the Ez Investment Tax Credit and Ez Employment Incentive Credit for the Financial Services Industry in New York.

Q: What is the Ez Investment Tax Credit?

A: The Ez Investment Tax Credit is a tax credit available for eligible investment in qualified tangible property in certain designated areas of New York.

Q: What is the Ez Employment Incentive Credit?

A: The Ez Employment Incentive Credit is a tax credit available for eligible businesses in the financial services industry that create new jobs or increase wages in certain designated areas of New York.

Q: Who can file Form CT-605?

A: Businesses in the financial services industry that meet the eligibility requirements can file Form CT-605 to claim the Ez Investment Tax Credit and Ez Employment Incentive Credit.

Q: What documentation is required to file Form CT-605?

A: You will need to provide documentation such as investment records, employment records, and wage records to support your claim on Form CT-605.

Q: What are the designated areas for the credits?

A: The designated areas for the Ez Investment Tax Credit and Ez Employment Incentive Credit are specified by the New York State Department of Economic Development.

Q: Is there a deadline for filing Form CT-605?

A: Yes, Form CT-605 must be filed on or before the due date of the business's tax return for the tax year in which the credit is being claimed.

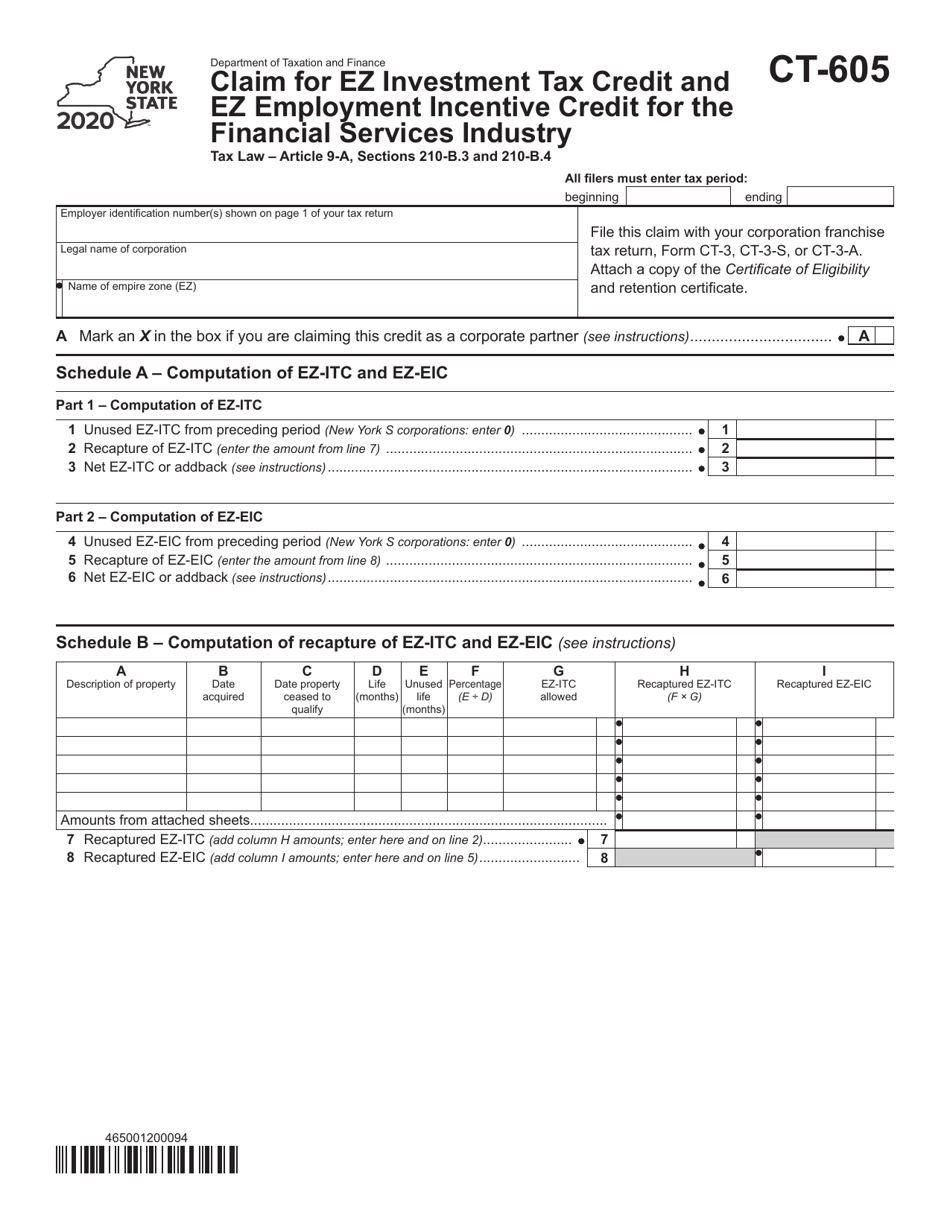

Q: Can I claim both the Ez Investment Tax Credit and the Ez Employment Incentive Credit?

A: Yes, eligible businesses can claim both credits on Form CT-605 if they meet the requirements for each credit.

Q: Are there any limitations or restrictions on the credits?

A: Yes, there are limitations and restrictions on the Ez Investment Tax Credit and Ez Employment Incentive Credit, such as the amount of credit that can be claimed and the eligibility criteria for businesses and investments.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-605 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.