This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-635

for the current year.

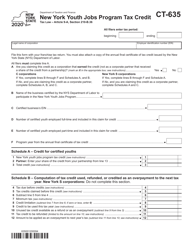

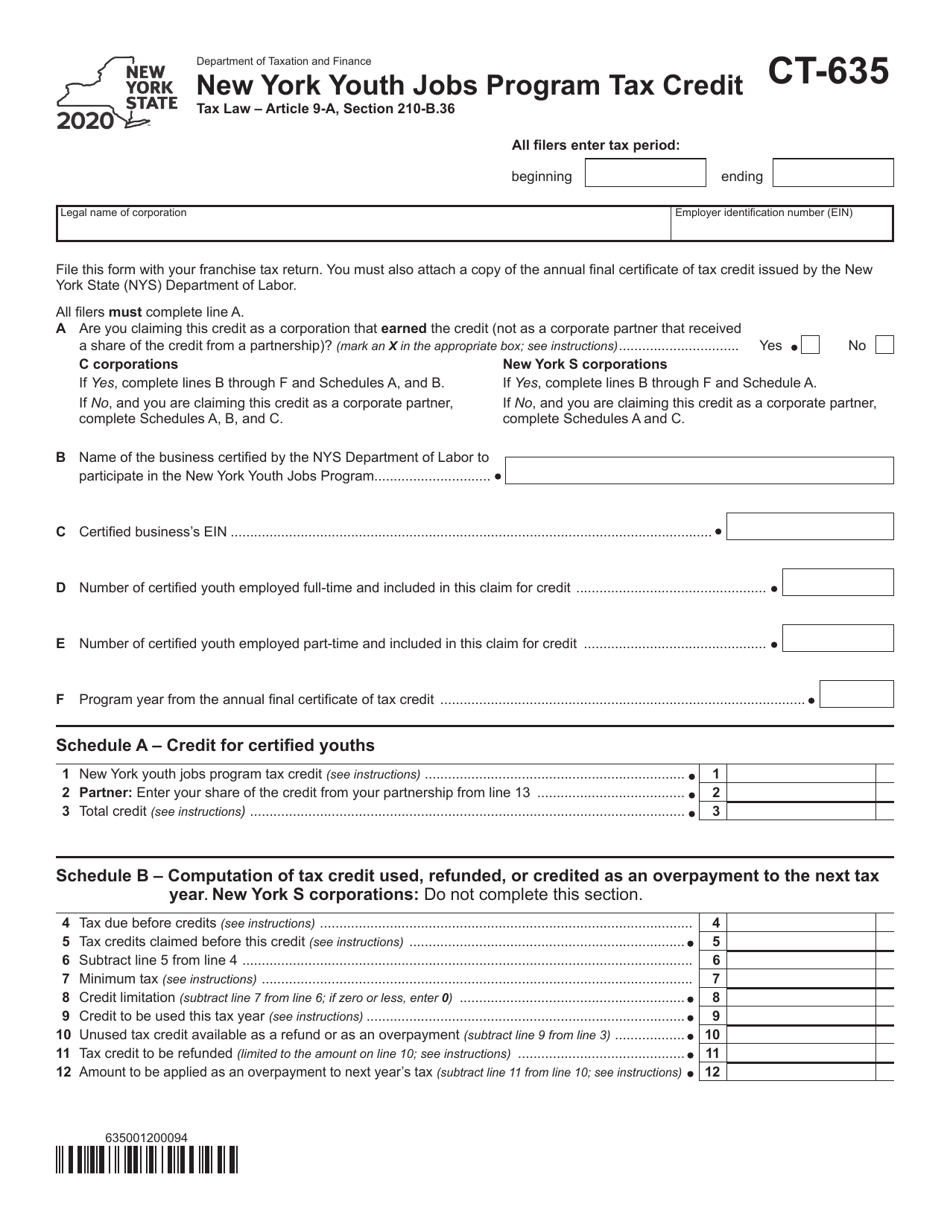

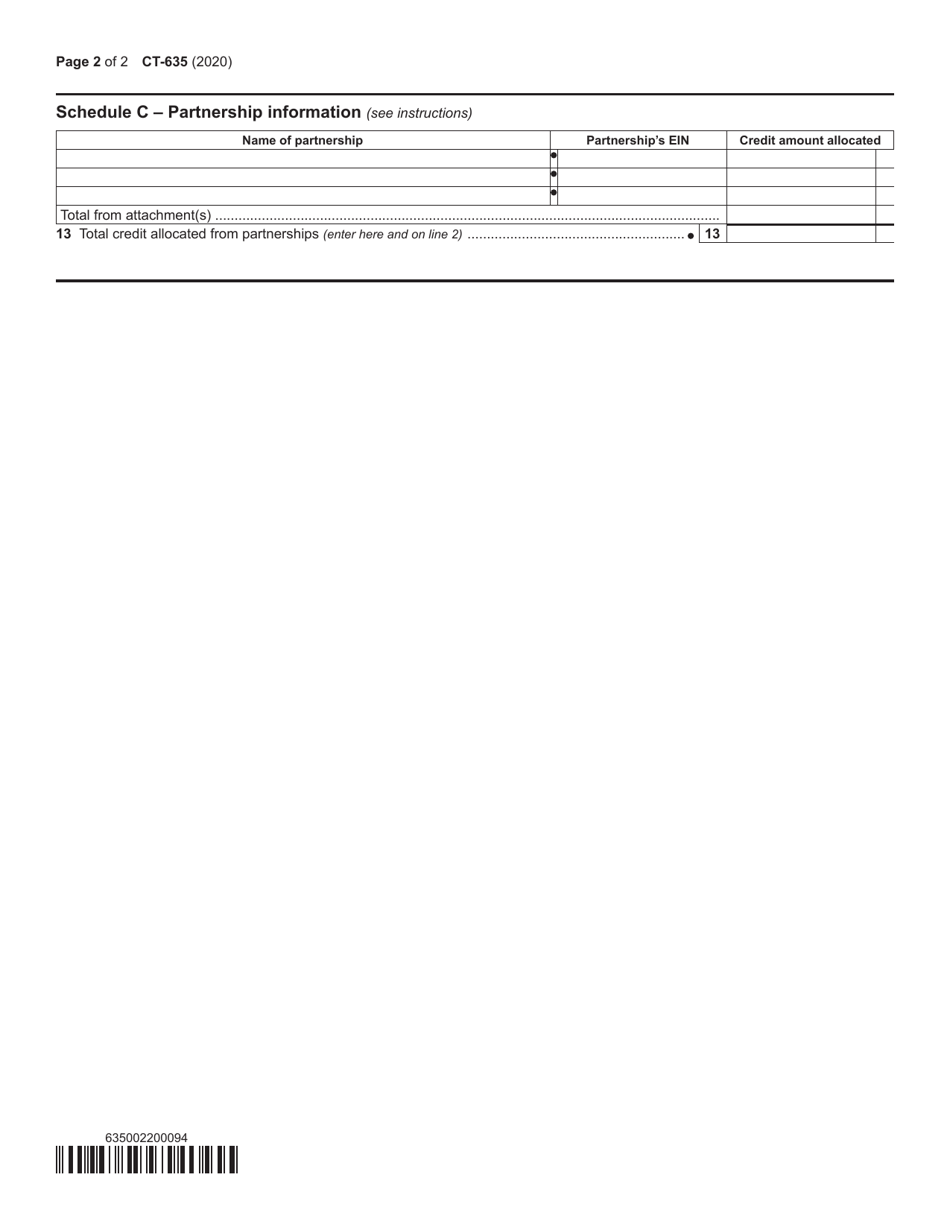

Form CT-635 New York Youth Jobs Program Tax Credit - New York

What Is Form CT-635?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-635?

A: Form CT-635 is the New York Youth Jobs ProgramTax Credit form.

Q: What is the New York Youth Jobs Program Tax Credit?

A: The New York Youth Jobs Program Tax Credit is a program designed to encourage employers to hire unemployed youth between the ages of 16 and 24.

Q: Who is eligible for the New York Youth Jobs Program Tax Credit?

A: Employers who hire eligible youth between the ages of 16 and 24 are eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit is equal to 15% of the gross wages paid to eligible youth during the tax year.

Q: How do employers claim the tax credit?

A: Employers must complete Form CT-635 and attach it to their New York state income tax return.

Q: Are there any limitations to the tax credit?

A: Yes, the tax credit is subject to various limitations, including a maximum credit of $5,000 per eligible youth and a cap on the total amount of credits available each year.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-635 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.