This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CT-242

for the current year.

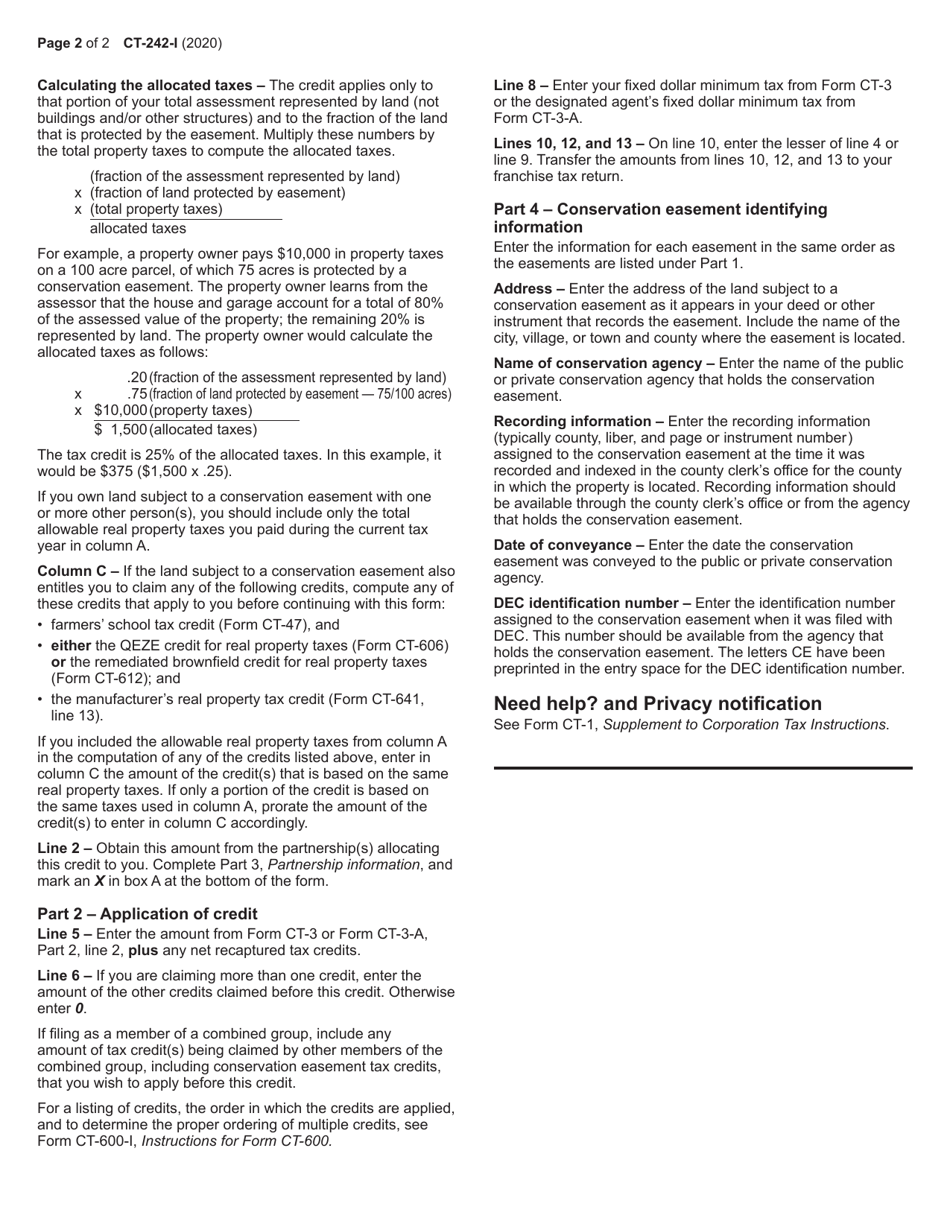

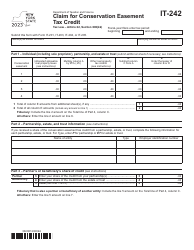

Instructions for Form CT-242 Claim for Conservation Easement Tax Credit - New York

This document contains official instructions for Form CT-242 , Claim for Conservation Easement Tax Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-242 is available for download through this link.

FAQ

Q: What is Form CT-242?

A: Form CT-242 is a form specific to New York State that is used to claim a conservation easement tax credit.

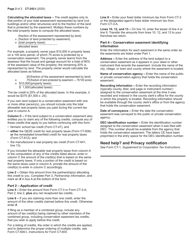

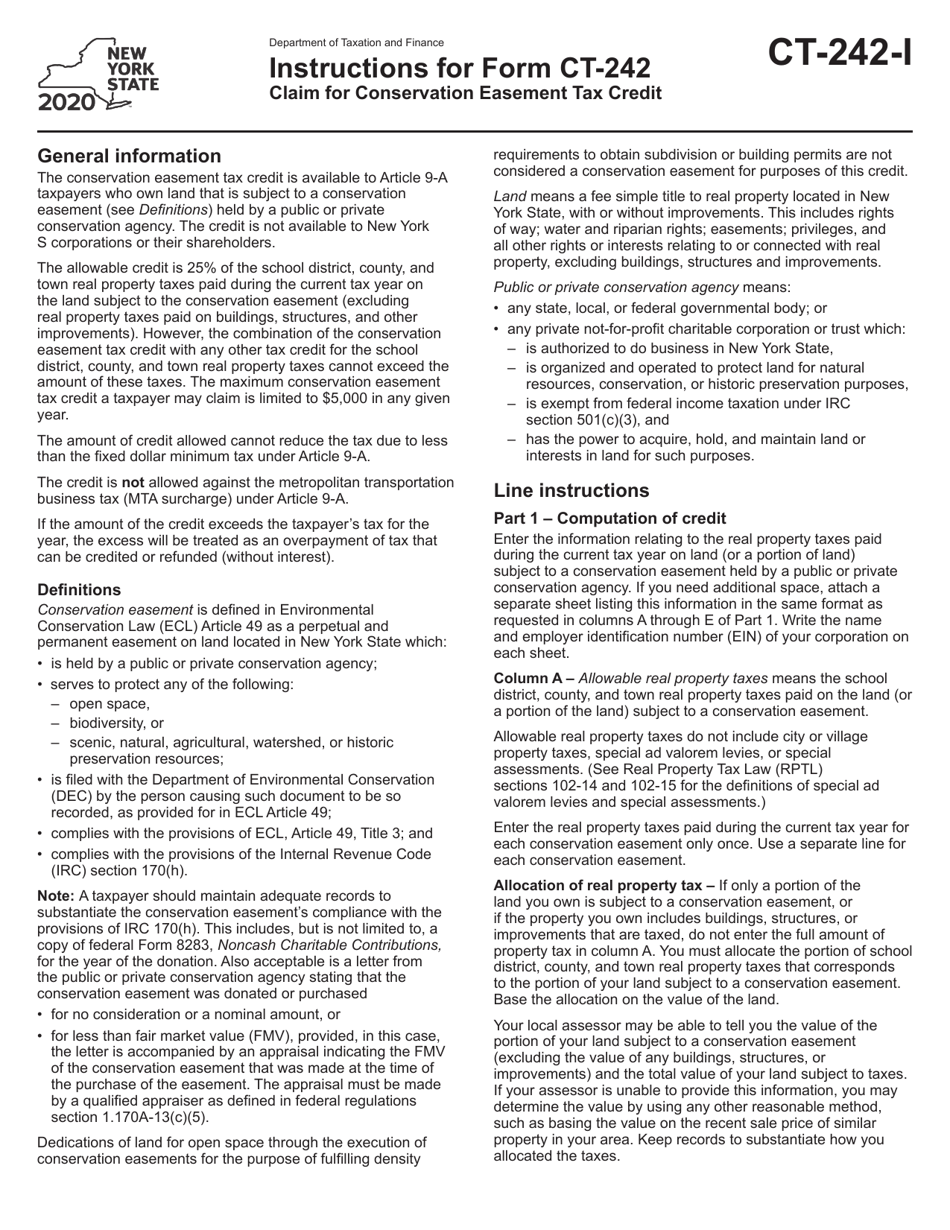

Q: What is a conservation easement?

A: A conservation easement is a legal agreement where a landowner agrees to restrict development on their property in order to protect its natural resources or cultural heritage.

Q: Who can claim the conservation easement tax credit?

A: Individuals, estates, trusts, and corporations who own land with a qualifying conservation easement in New York State can claim the tax credit.

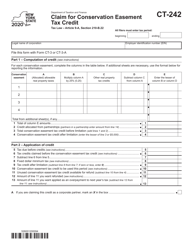

Q: How is the conservation easement tax credit calculated?

A: The tax credit is generally equal to 25% of the fair market value of the easement, up to a maximum credit of $5 million.

Q: What documentation is required to claim the tax credit?

A: The claimant must provide a copy of the conservation easement, an appraisal report, and a completed Form CT-242.

Q: What is the deadline to file Form CT-242?

A: The form must be filed within 3 years from the original due date of the tax return for the year the credit is claimed.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.