This version of the form is not currently in use and is provided for reference only. Download this version of

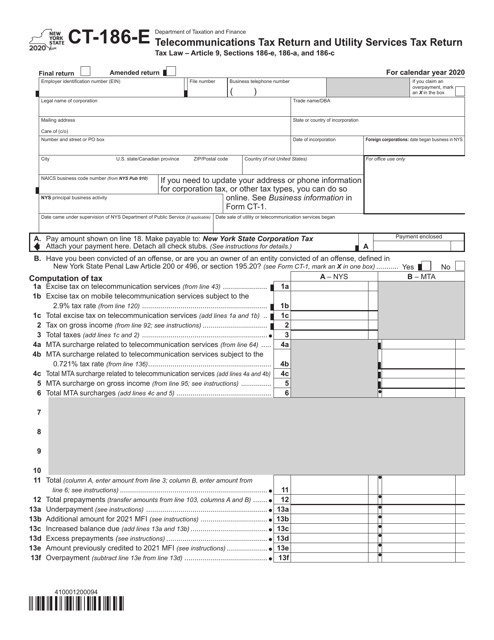

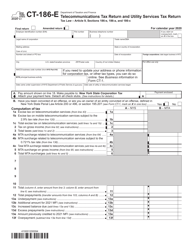

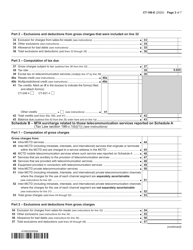

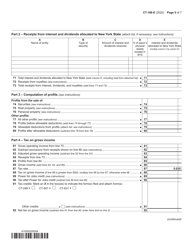

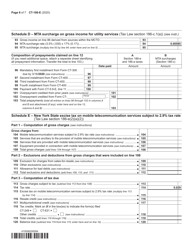

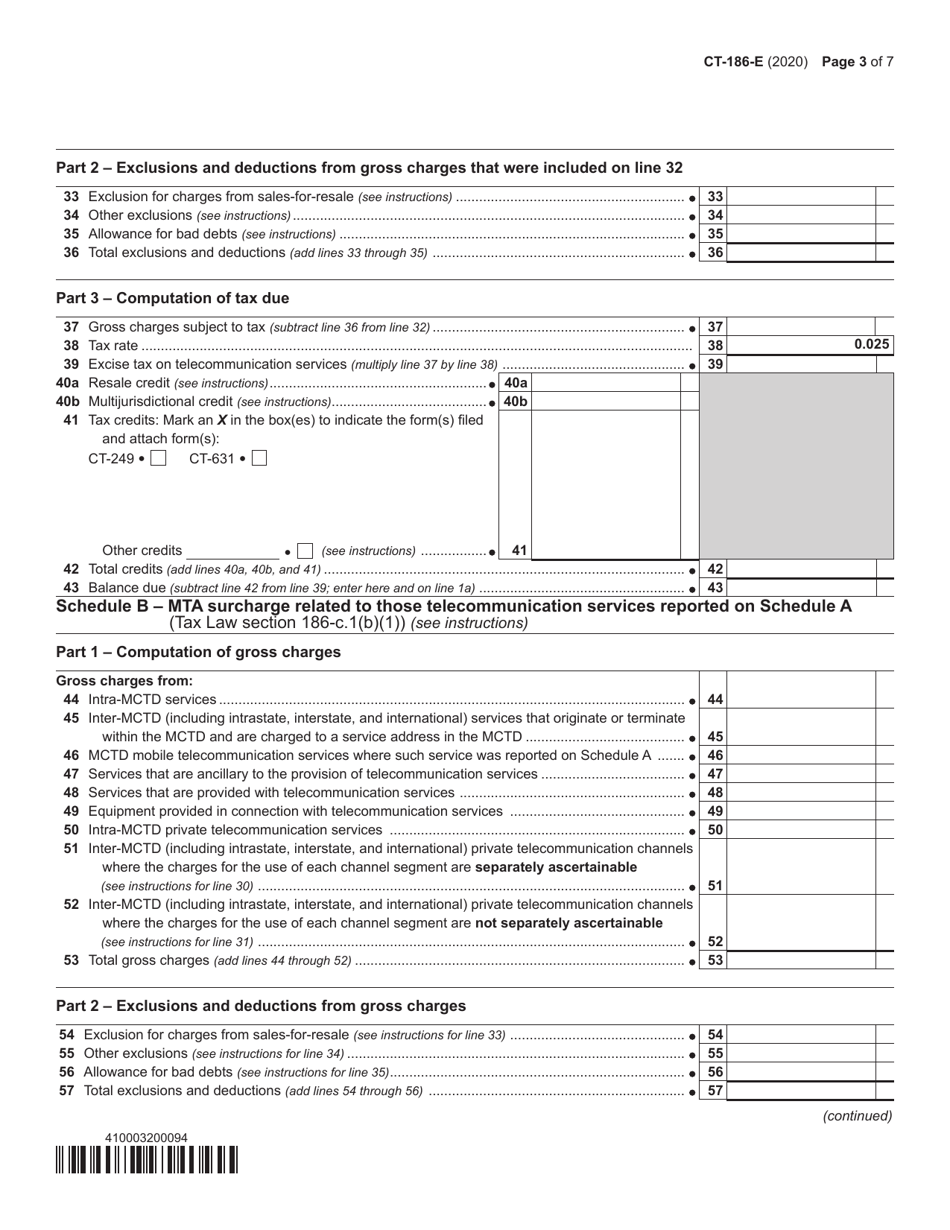

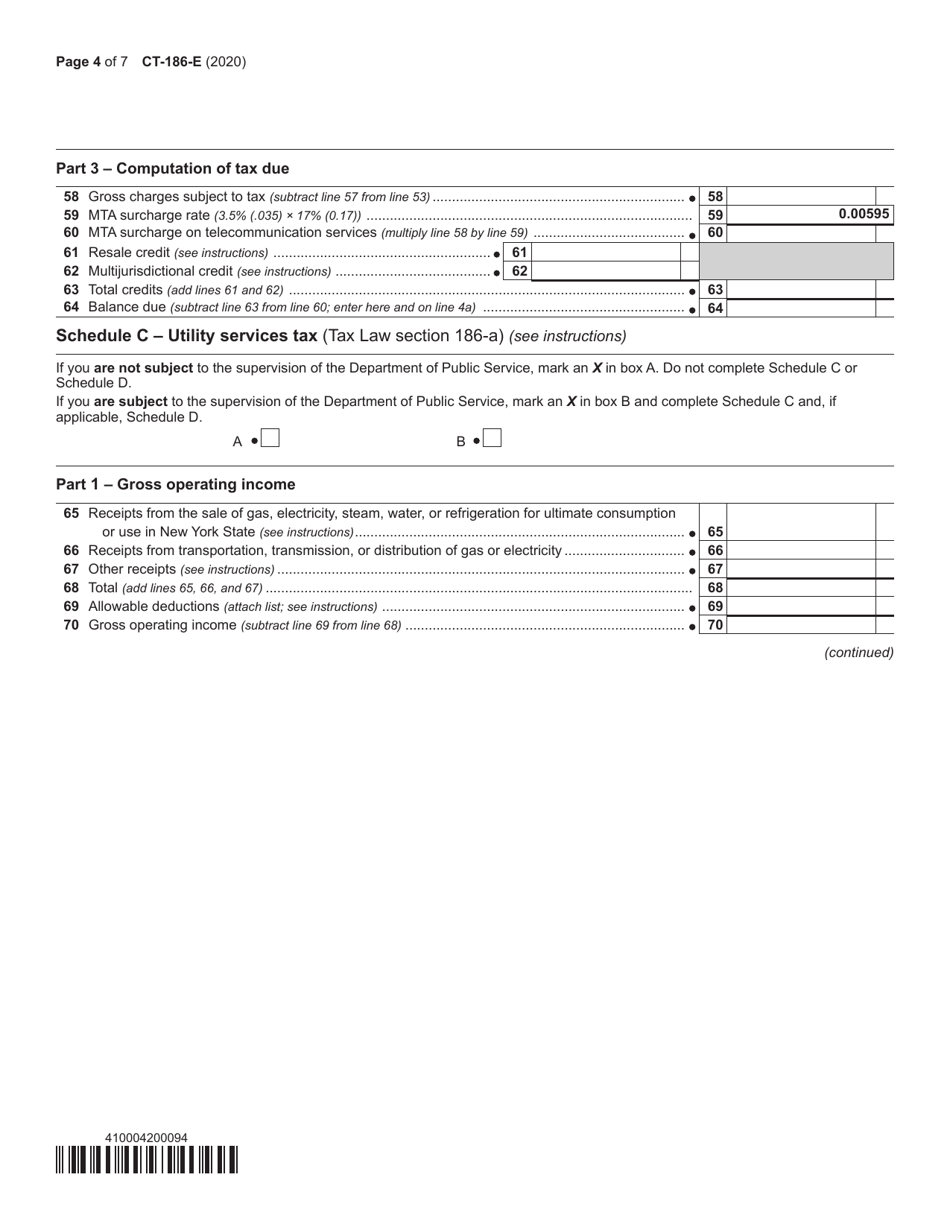

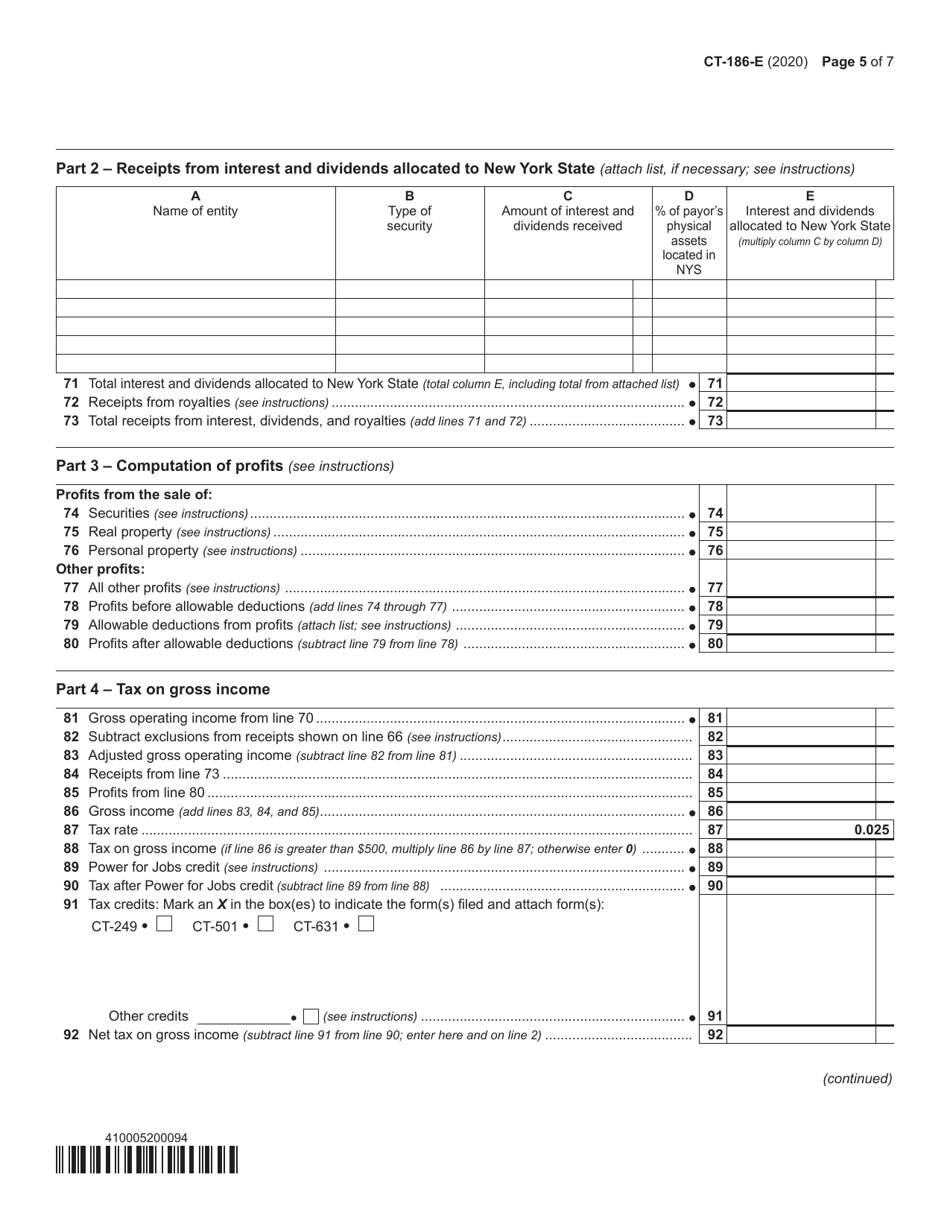

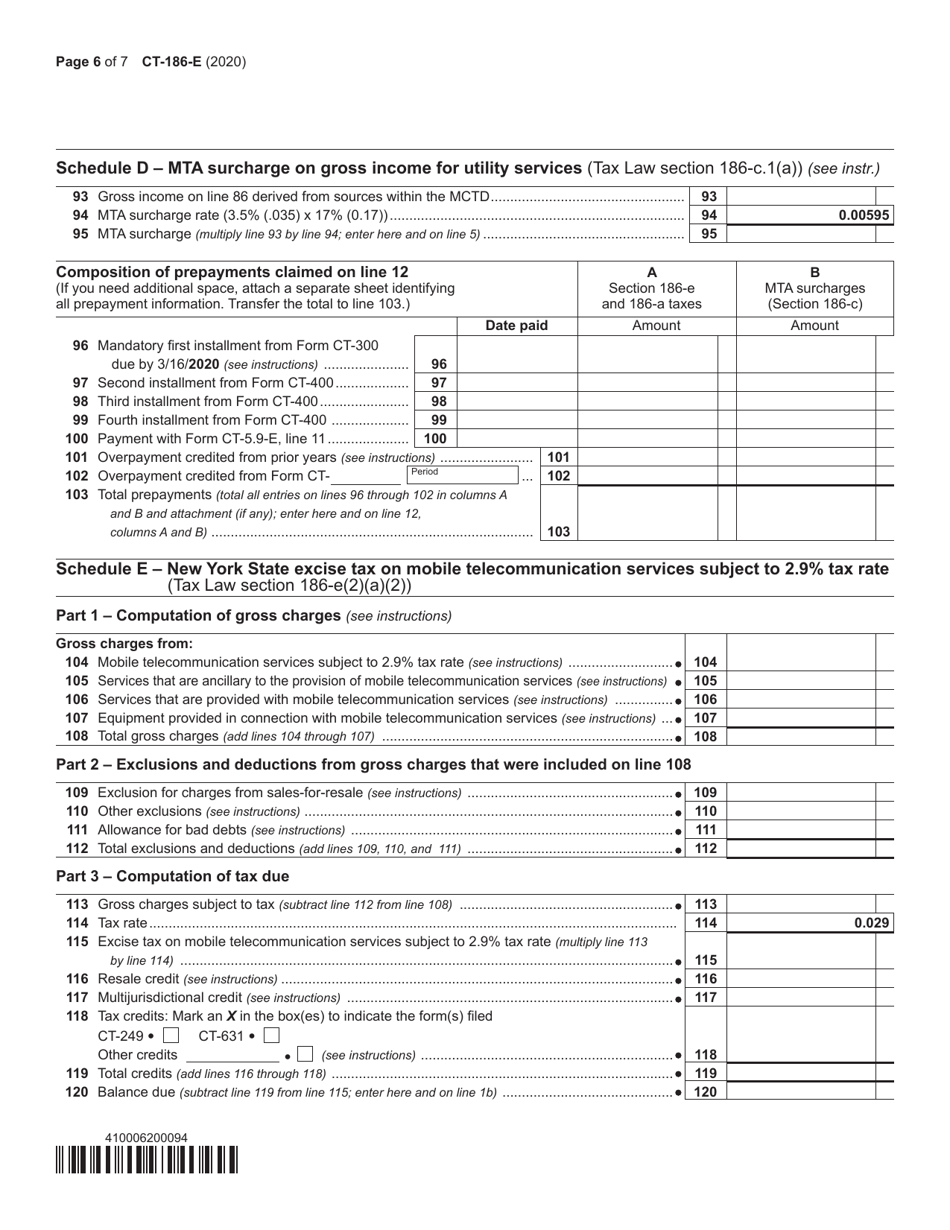

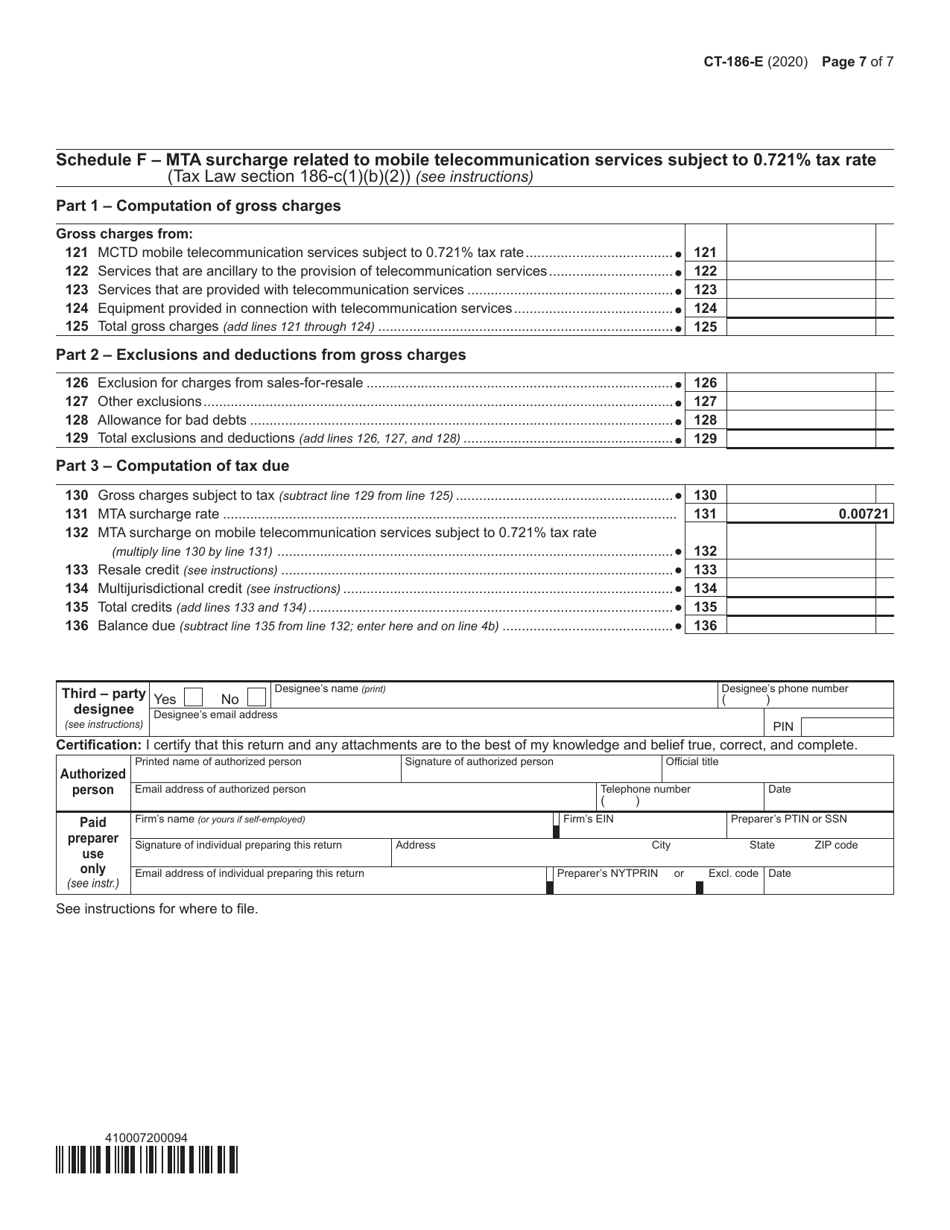

Form CT-186-E

for the current year.

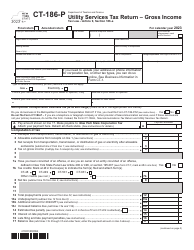

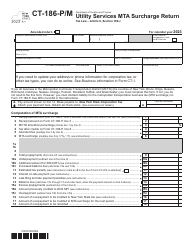

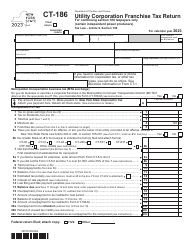

Form CT-186-E Telecommunications Tax Return and Utility Services Tax Return - New York

What Is Form CT-186-E?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-186-E?

A: Form CT-186-E is the Telecommunications Tax Return and Utility Services Tax Return for the state of New York.

Q: Who needs to file Form CT-186-E?

A: Telecommunications service providers and utility service providers in New York need to file Form CT-186-E.

Q: What is the purpose of Form CT-186-E?

A: The purpose of Form CT-186-E is to report and pay the telecommunications and utility servicestax owed to the state of New York.

Q: When is Form CT-186-E due?

A: Form CT-186-E is due on a quarterly basis, with the due dates falling on the 20th day of the month following the end of each calendar quarter.

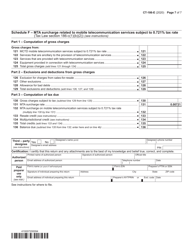

Q: Are there any penalties for late filing of Form CT-186-E?

A: Yes, there may be penalties for late filing or failure to file Form CT-186-E, including additional interest charges on the amount owed.

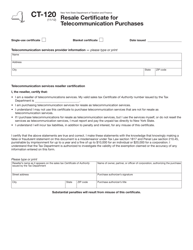

Q: What should I include with Form CT-186-E?

A: You should include any required supporting documentation, such as schedules and worksheets, along with Form CT-186-E.

Q: How can I pay the tax owed on Form CT-186-E?

A: You can pay the tax owed on Form CT-186-E using electronic funds transfer (EFT), credit card, or by mailing a check or money order.

Q: What if I have questions or need assistance with Form CT-186-E?

A: If you have questions or need assistance with Form CT-186-E, you can contact the New York State Department of Taxation and Finance for guidance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-186-E by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.