This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-612

for the current year.

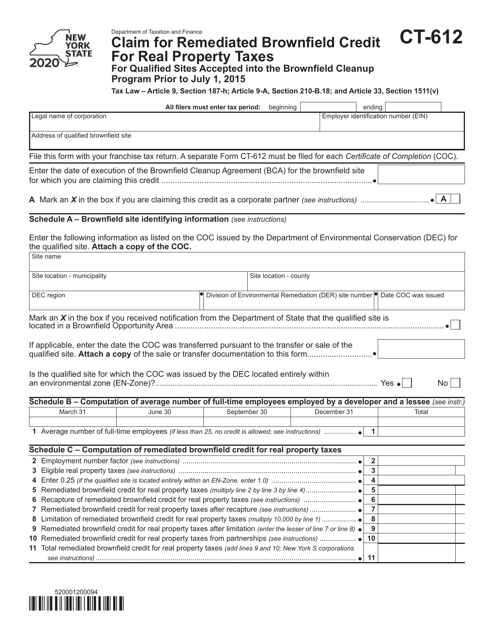

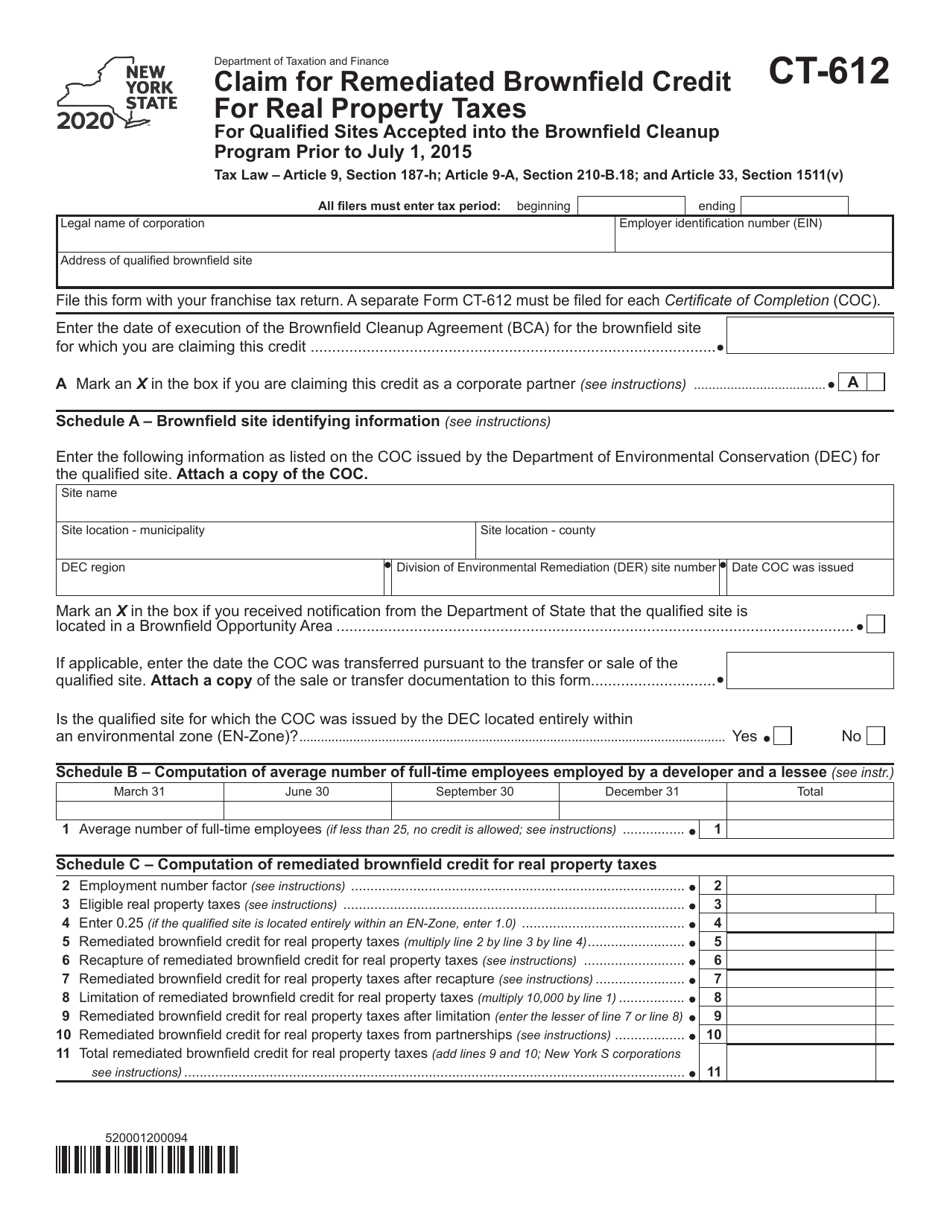

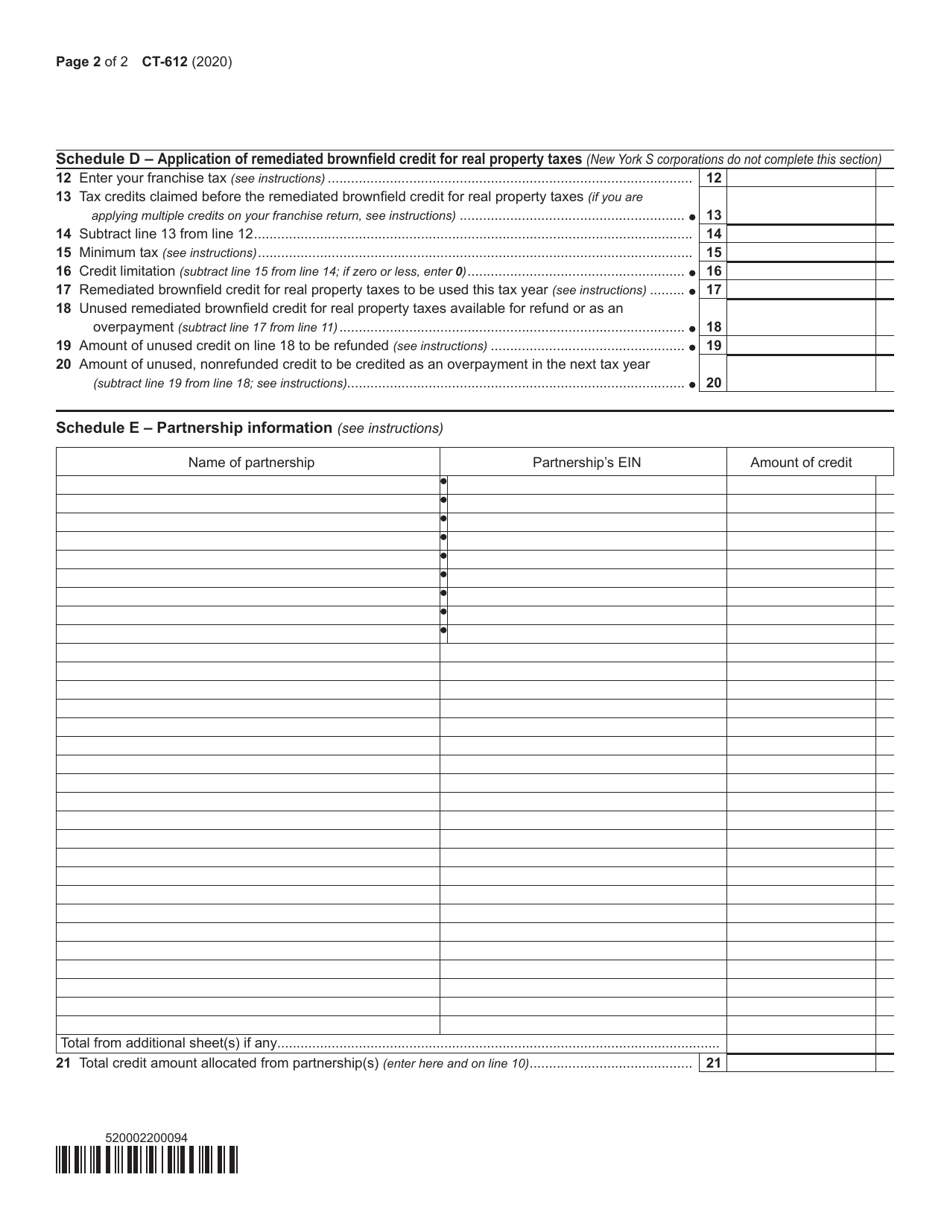

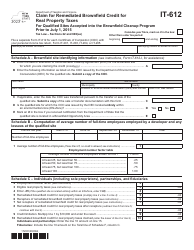

Form CT-612 Claim for Remediated Brownfield Credit for Real Property Taxes for Qualified Sites Accepted Into the Brownfield Cleanup Program Prior to July 1, 2015 - New York

What Is Form CT-612?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-612?

A: Form CT-612 is a claim for remediated brownfield credit for real property taxes for qualified sites accepted into the Brownfield Cleanup Program prior to July 1, 2015 in New York.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a New York State program that provides tax incentives for the cleanup and redevelopment of contaminated properties.

Q: What is the purpose of Form CT-612?

A: The purpose of Form CT-612 is to claim a credit for real property taxes paid on qualified sites that have undergone remediation under the Brownfield Cleanup Program.

Q: Who is eligible to file Form CT-612?

A: Property owners or developers who have had their sites accepted into the Brownfield Cleanup Program prior to July 1, 2015 in New York are eligible to file Form CT-612.

Q: What is the deadline for filing Form CT-612?

A: The deadline for filing Form CT-612 is generally March 15th of the year following the tax year for which the credit is being claimed.

Q: What documentation is required to file Form CT-612?

A: Documentation that may be required to file Form CT-612 includes proof of payment of real property taxes, evidence of acceptance into the Brownfield Cleanup Program, and any other relevant supporting documentation.

Q: How long does it take to receive the credit after filing Form CT-612?

A: The processing time for Form CT-612 varies, but it typically takes several weeks to several months to receive the credit.

Q: Are there any restrictions on the use of the credit received through Form CT-612?

A: Yes, there may be restrictions on the use of the credit received through Form CT-612. It is important to consult the instructions and guidelines provided with the form for specific details.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-612 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.