This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-250

for the current year.

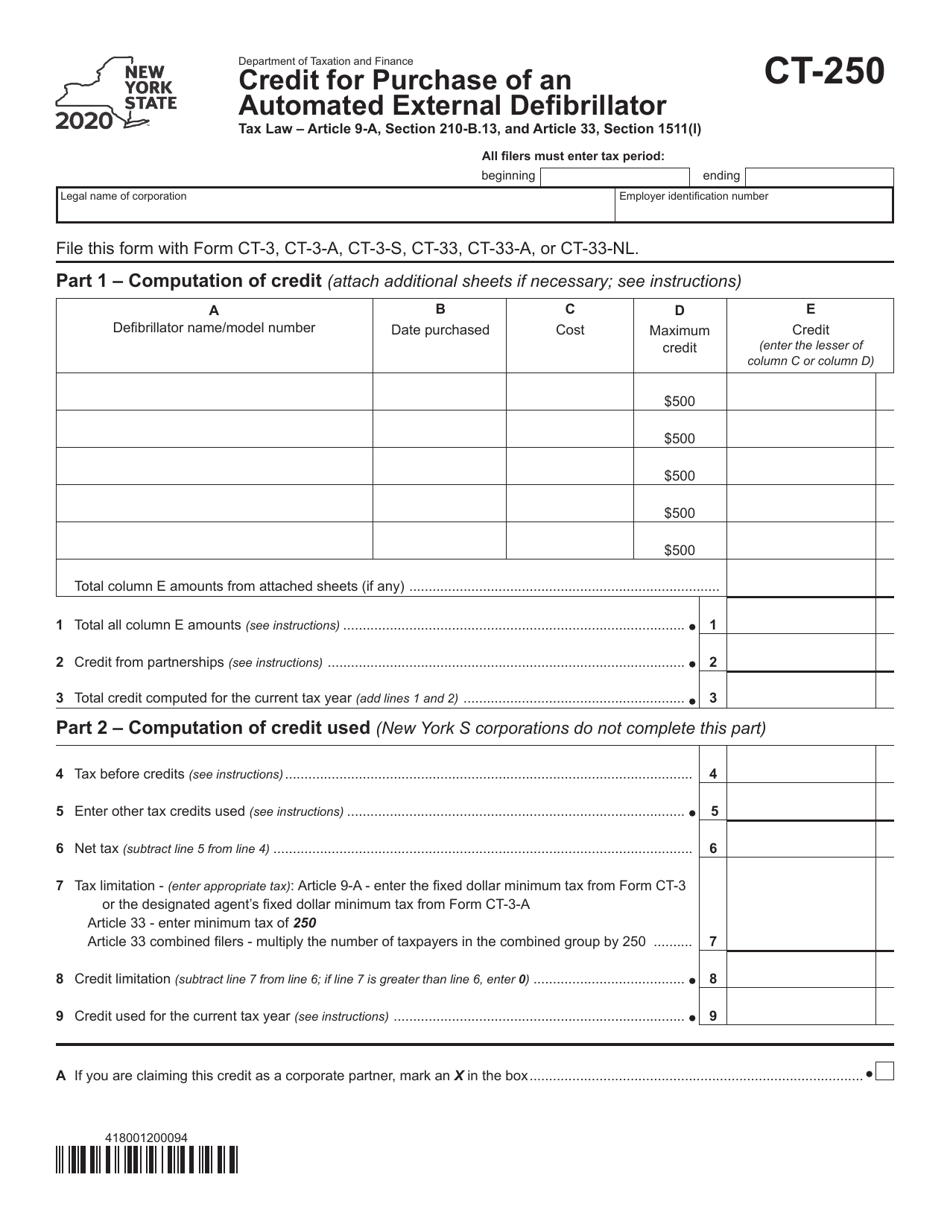

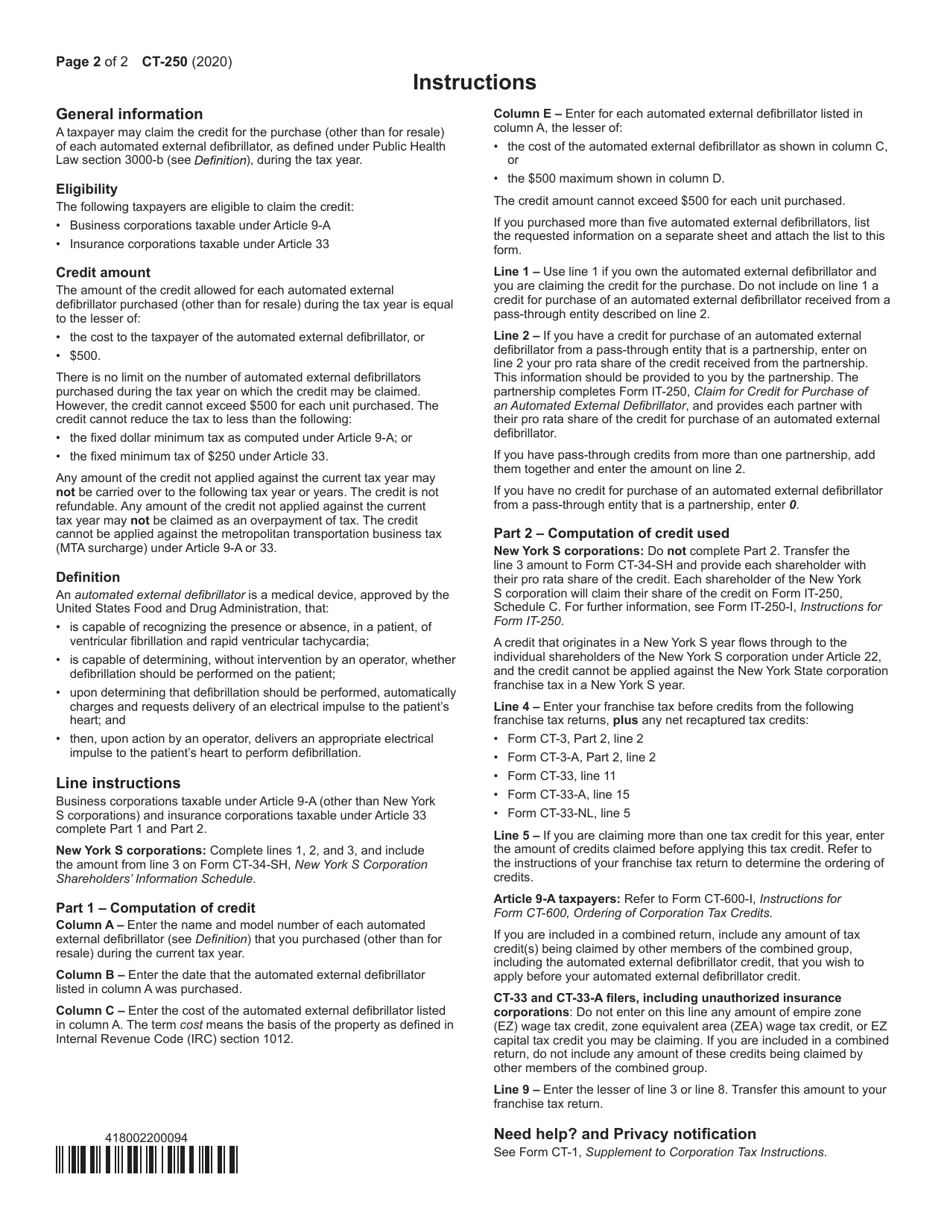

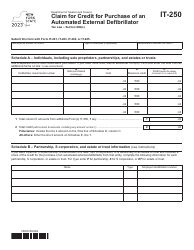

Form CT-250 Credit for Purchase of an Automated External Defibrillator - New York

What Is Form CT-250?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-250?

A: Form CT-250 is a document used in New York to claim the Credit for Purchase of an Automated External Defibrillator.

Q: Who is eligible to use Form CT-250?

A: Any taxpayer in New York who purchased an Automated External Defibrillator (AED) is eligible to use this form.

Q: What is the purpose of the Credit for Purchase of an Automated External Defibrillator?

A: The purpose of this credit is to incentivize individuals and businesses to purchase automated external defibrillators in order to be prepared for cardiac emergencies.

Q: How much is the credit?

A: The credit is equal to 50% of the cost of purchasing an AED, up to a maximum of $500.

Q: How do I claim the credit?

A: To claim the credit, you must complete and file Form CT-250 with the New York State Department of Taxation and Finance.

Q: Is there a deadline to file Form CT-250?

A: Yes, the form must be filed within 1 year from the last day of the taxable year in which the AED was purchased.

Q: Are there any additional requirements to claim the credit?

A: Yes, you must provide proof of purchase and certification that the AED meets the required standards.

Q: Can I claim this credit if I purchased an AED for personal use?

A: Yes, individuals as well as businesses can claim this credit.

Q: Can I claim this credit if I purchased an AED for my business?

A: Yes, if you are a business owner in New York and purchased an AED, you can claim this credit.

Q: Can I claim this credit if I purchased an AED for my non-profit organization?

A: Yes, non-profit organizations in New York are also eligible to claim this credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-250 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.