This version of the form is not currently in use and is provided for reference only. Download this version of

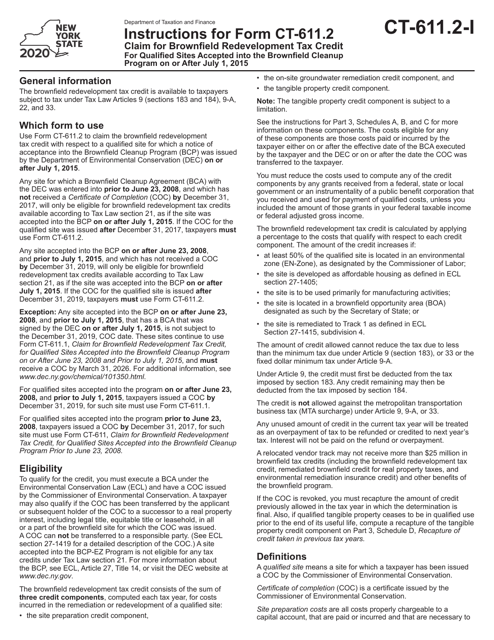

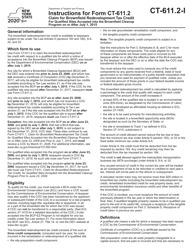

Instructions for Form CT-611.2

for the current year.

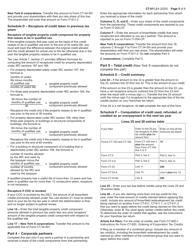

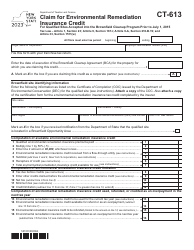

Instructions for Form CT-611.2 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After July 1, 2015 - New York

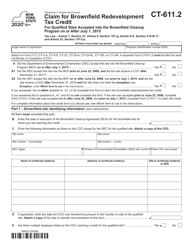

This document contains official instructions for Form CT-611.2 , Claim for Brownfield Cleanup Program on or After July 1, 2015 - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-611.2 is available for download through this link.

FAQ

Q: What is Form CT-611.2?

A: Form CT-611.2 is a form used to claim the Brownfield Redevelopment Tax Credit for qualified sites accepted into the Brownfield Cleanup Program on or after July 1, 2015 in the state of New York.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York that provides tax incentives to encourage the cleanup and redevelopment of contaminated sites.

Q: Who is eligible to claim the Brownfield Redevelopment Tax Credit?

A: The owner or developer of a qualified site accepted into the Brownfield Cleanup Program on or after July 1, 2015 may be eligible to claim the tax credit.

Q: What is the purpose of the Brownfield Redevelopment Tax Credit?

A: The purpose of the tax credit is to provide financial assistance to encourage the redevelopment of contaminated sites, known as brownfields, in New York.

Q: When is Form CT-611.2 due?

A: The due date for Form CT-611.2 varies depending on the taxpayer's filing status and other factors. It is recommended to refer to the instructions provided with the form for specific due dates.

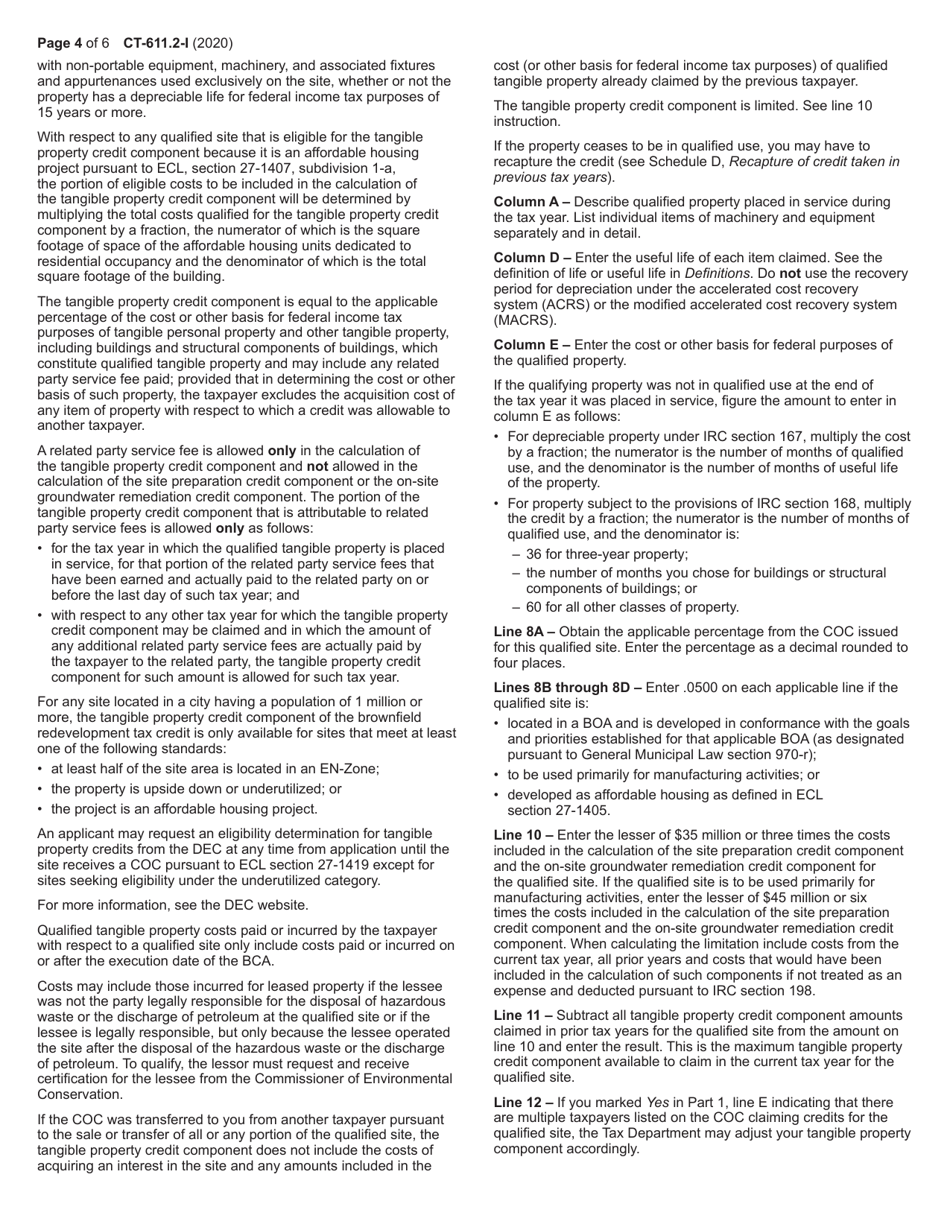

Instruction Details:

- This 6-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.