This version of the form is not currently in use and is provided for reference only. Download this version of

Form CT-611.1

for the current year.

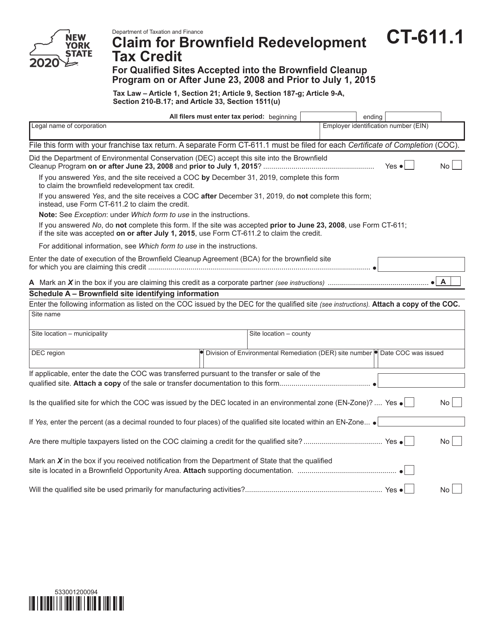

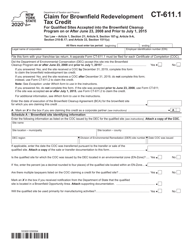

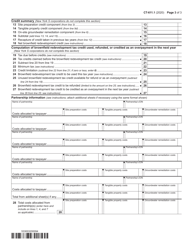

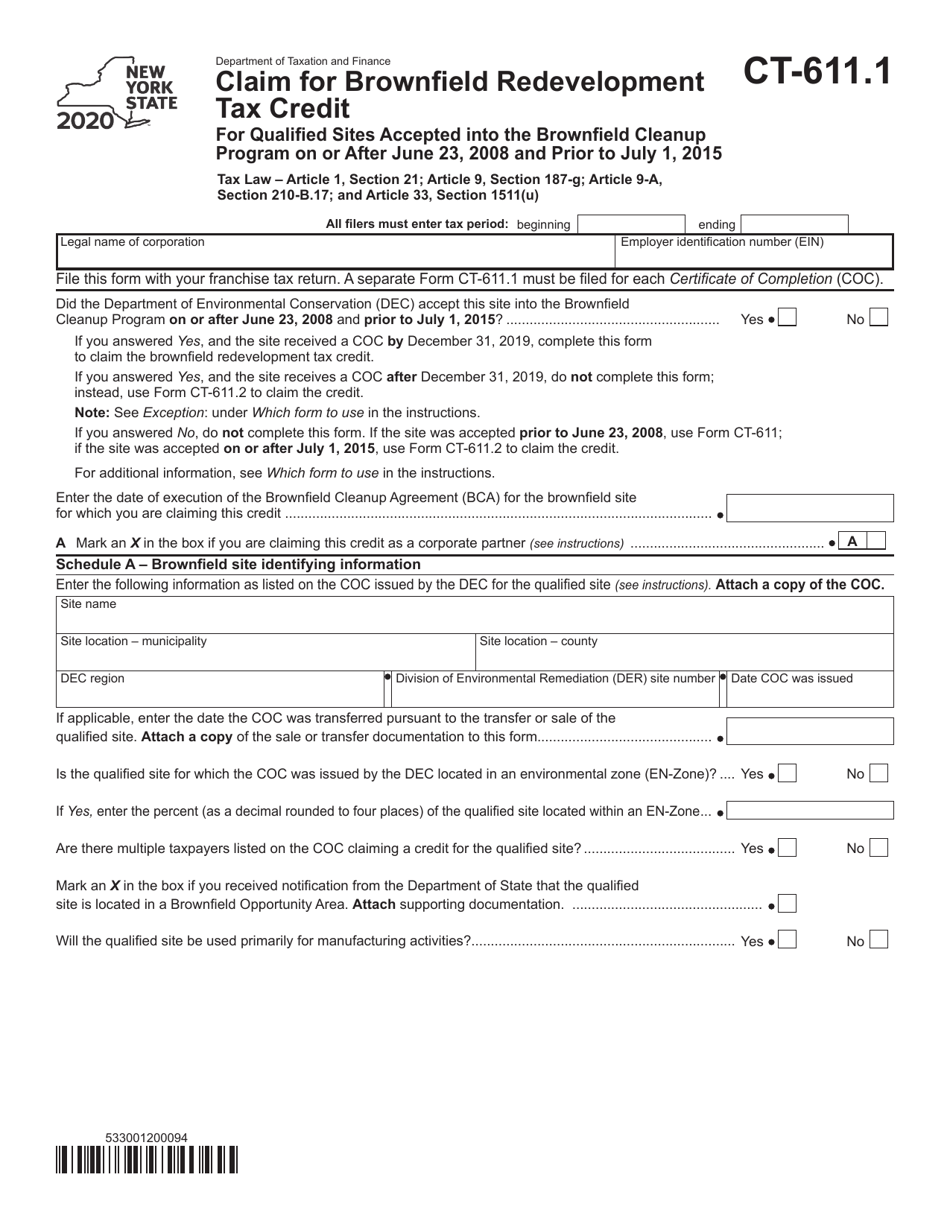

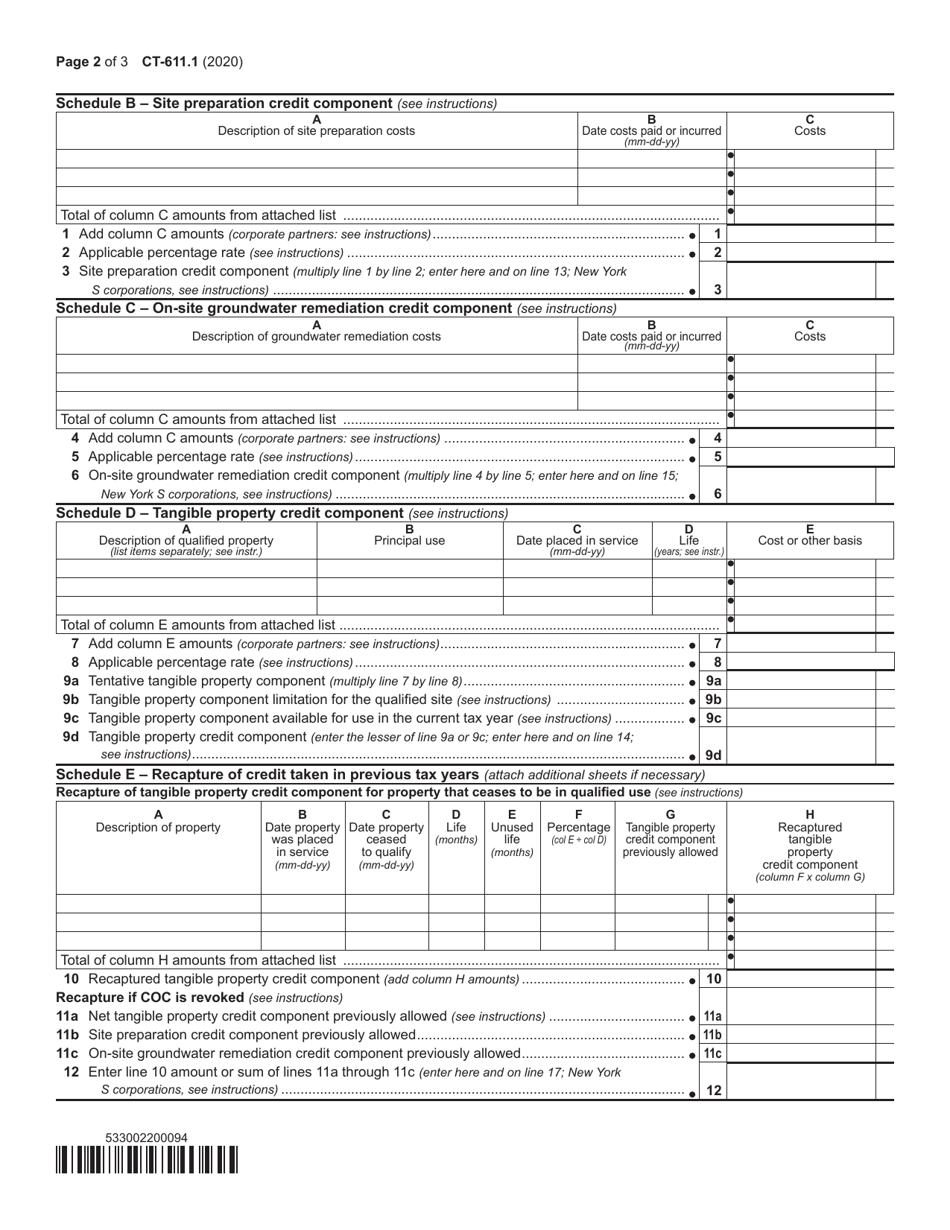

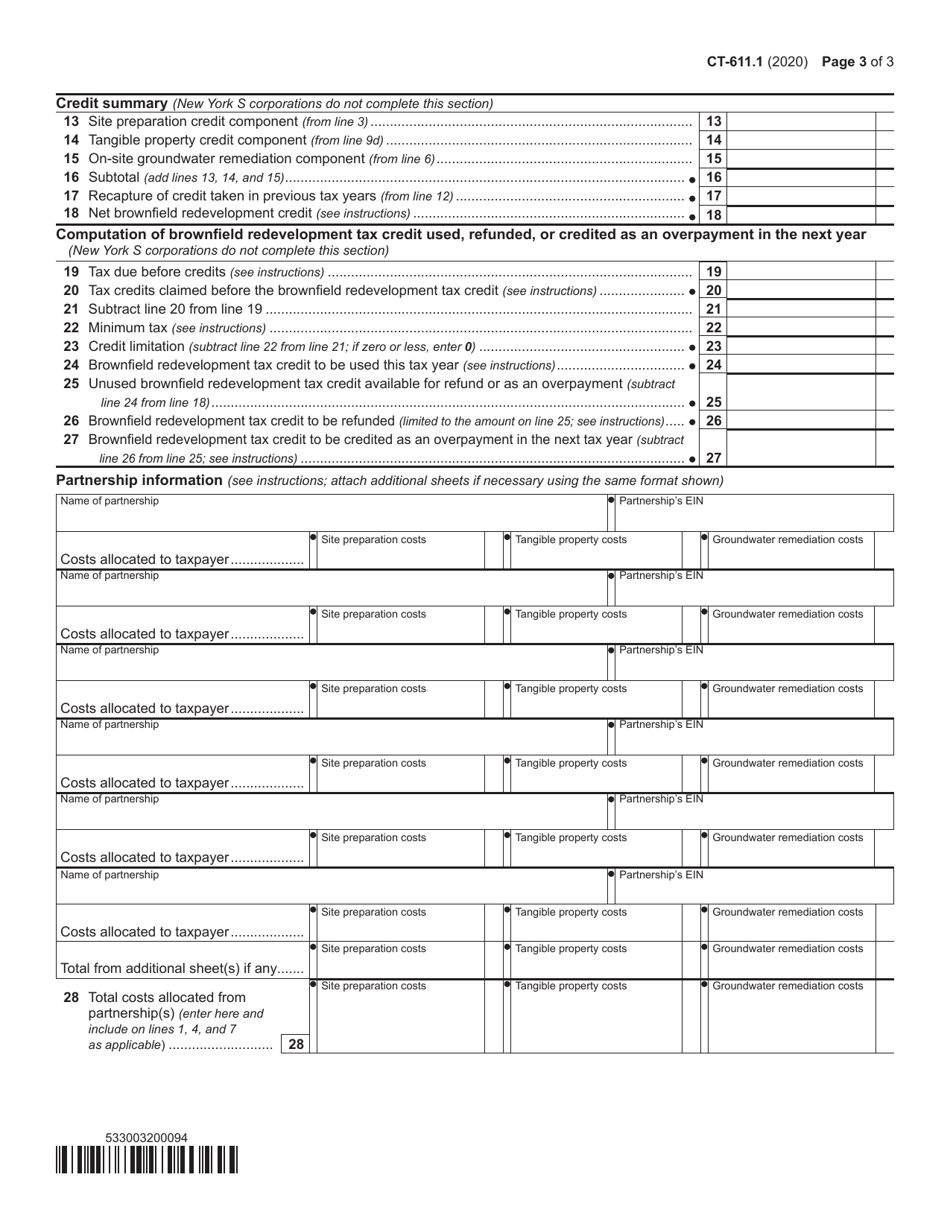

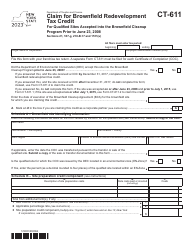

Form CT-611.1 Claim for Brownfield Redevelopment Tax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program on or After June 23, 2008 and Prior to July 1, 2015 - New York

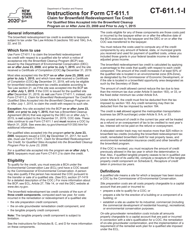

What Is Form CT-611.1?

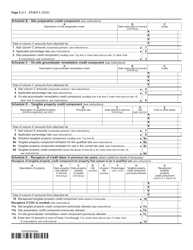

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form CT-611.1 for?

A: The Form CT-611.1 is for claiming Brownfield RedevelopmentTax Credit for Qualified Sites Accepted Into the Brownfield Cleanup Program.

Q: What is the Brownfield Cleanup Program?

A: The Brownfield Cleanup Program is a program in New York for the remediation and redevelopment of contaminated properties.

Q: When can this form be used?

A: This form can be used for sites accepted into the Brownfield Cleanup Program between June 23, 2008 and July 1, 2015.

Q: What is the purpose of the Brownfield Redevelopment Tax Credit?

A: The purpose of the Brownfield Redevelopment Tax Credit is to incentivize the cleanup and redevelopment of contaminated properties.

Q: Who is eligible to claim this tax credit?

A: The owner of a qualified site accepted into the Brownfield Cleanup Program is eligible to claim this tax credit.

Q: How can this tax credit be claimed?

A: This tax credit can be claimed by filing the Form CT-611.1 with the appropriate tax authorities.

Q: Is there a deadline for claiming this tax credit?

A: Yes, the deadline for claiming this tax credit is typically three years from the date the site is accepted into the Brownfield Cleanup Program.

Q: Can this tax credit be carried forward?

A: Yes, any unused portion of the tax credit can be carried forward for up to 15 years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-611.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.