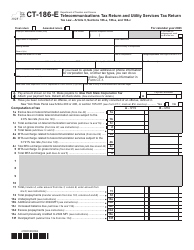

This version of the form is not currently in use and is provided for reference only. Download this version of

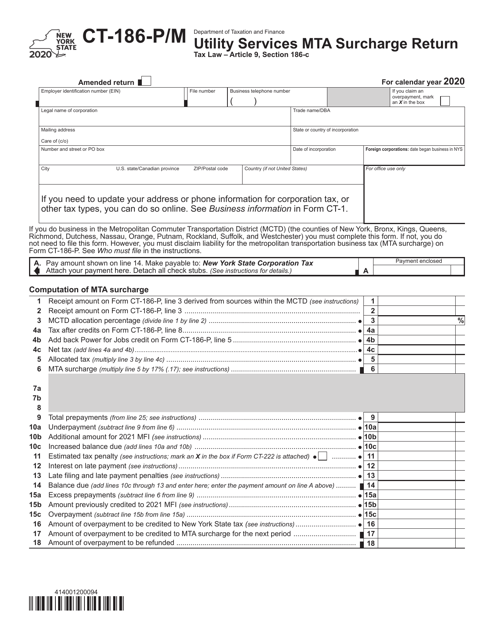

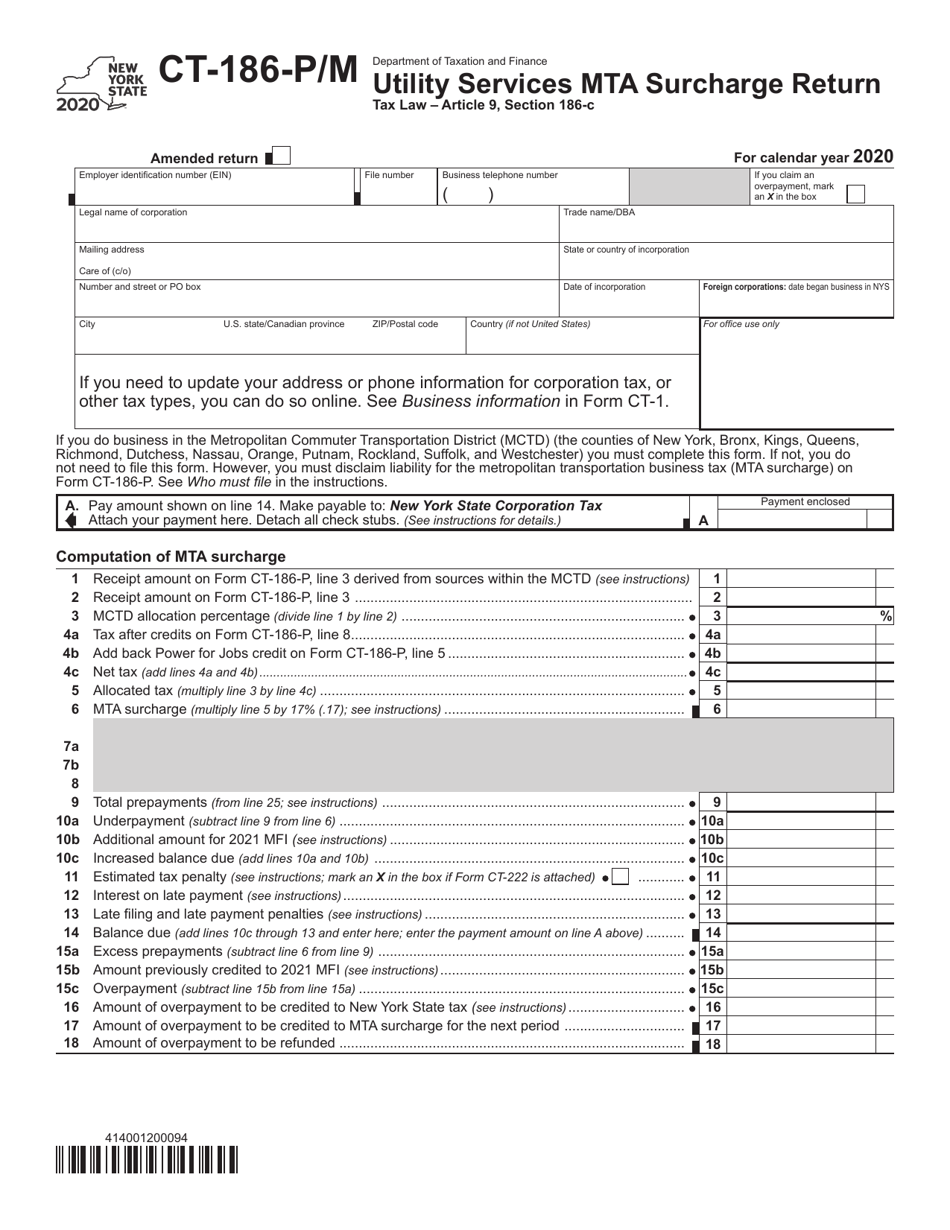

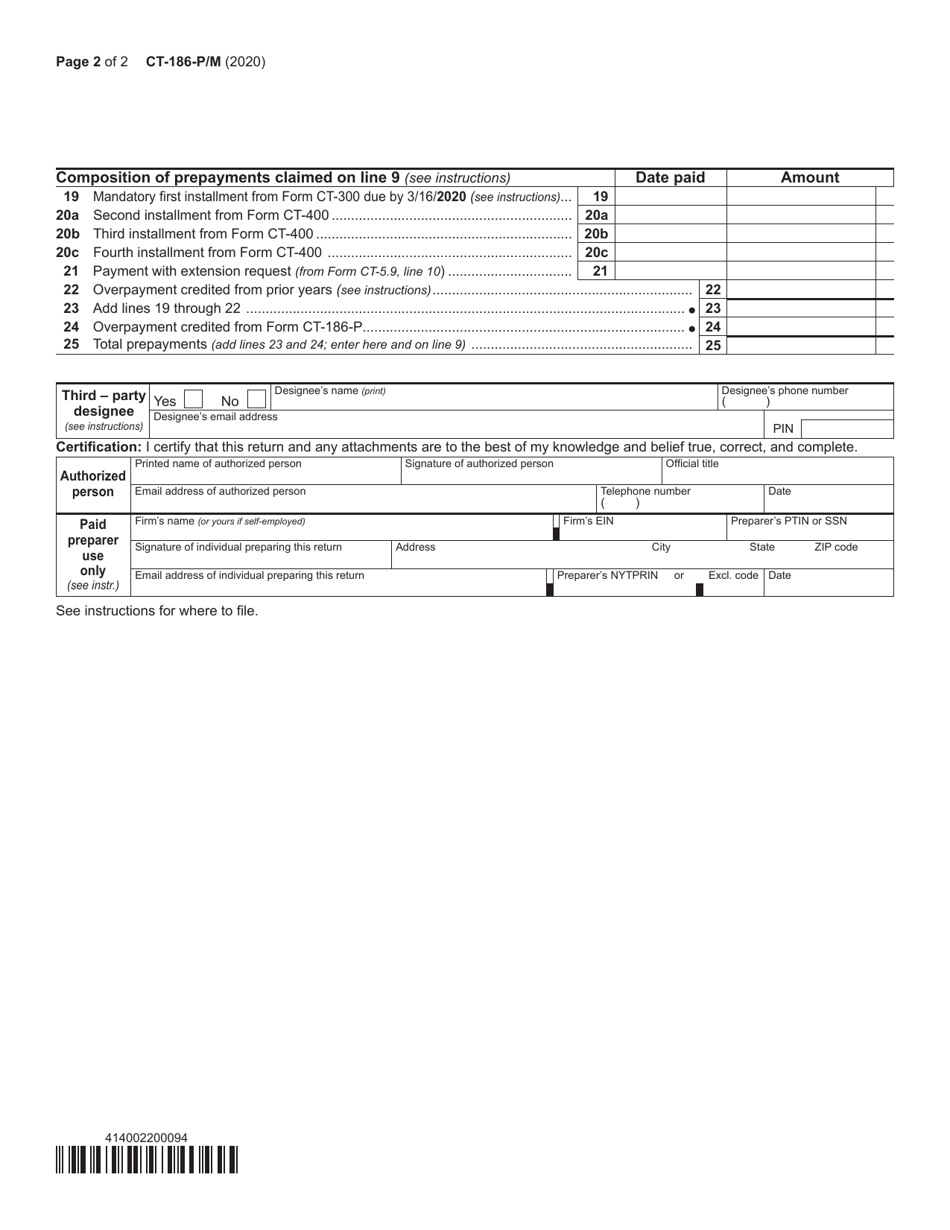

Form CT-186-P/M

for the current year.

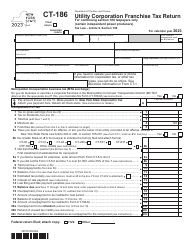

Form CT-186-P / M Utility Services Mta Surcharge Return - New York

What Is Form CT-186-P/M?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-186-P/M?

A: Form CT-186-P/M is the Utility Services MTA Surcharge Return for the state of New York.

Q: What is the purpose of Form CT-186-P/M?

A: The purpose of Form CT-186-P/M is to report and pay the MTA surcharge on utility services in New York.

Q: Who needs to file Form CT-186-P/M?

A: Any person, corporation, partnership, or other entity that is subject to the MTA surcharge on utility services in New York needs to file this form.

Q: When is Form CT-186-P/M due?

A: Form CT-186-P/M is due on a quarterly basis. The due dates are April 20, July 20, October 20, and January 20.

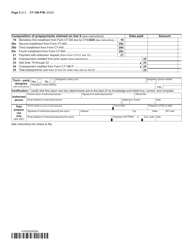

Q: How do I complete Form CT-186-P/M?

A: You will need to provide information about your business, total utility services charges subject to the MTA surcharge, and calculate the amount of surcharge due.

Q: Is there a penalty for late filing of Form CT-186-P/M?

A: Yes, there is a penalty for late filing of Form CT-186-P/M. The penalty is based on the amount of surcharge due and the number of days the return is late.

Q: Are there any exemptions or deductions available for the MTA surcharge?

A: No, there are no exemptions or deductions available for the MTA surcharge on utility services in New York.

Q: Who should I contact for further assistance with Form CT-186-P/M?

A: If you need further assistance with Form CT-186-P/M, you can contact the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-186-P/M by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.