This version of the form is not currently in use and is provided for reference only. Download this version of

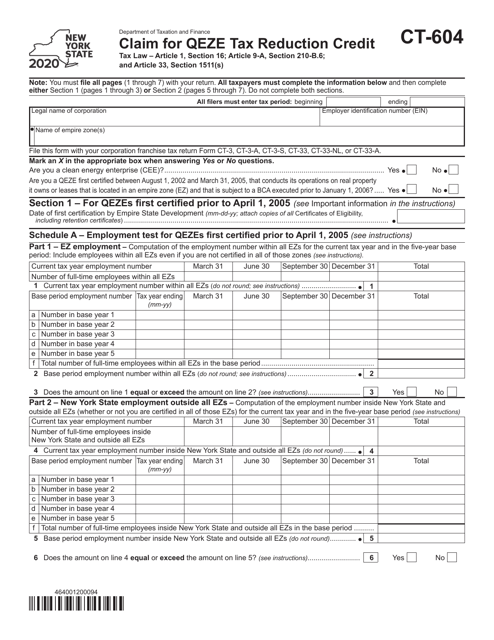

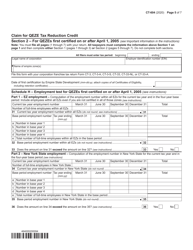

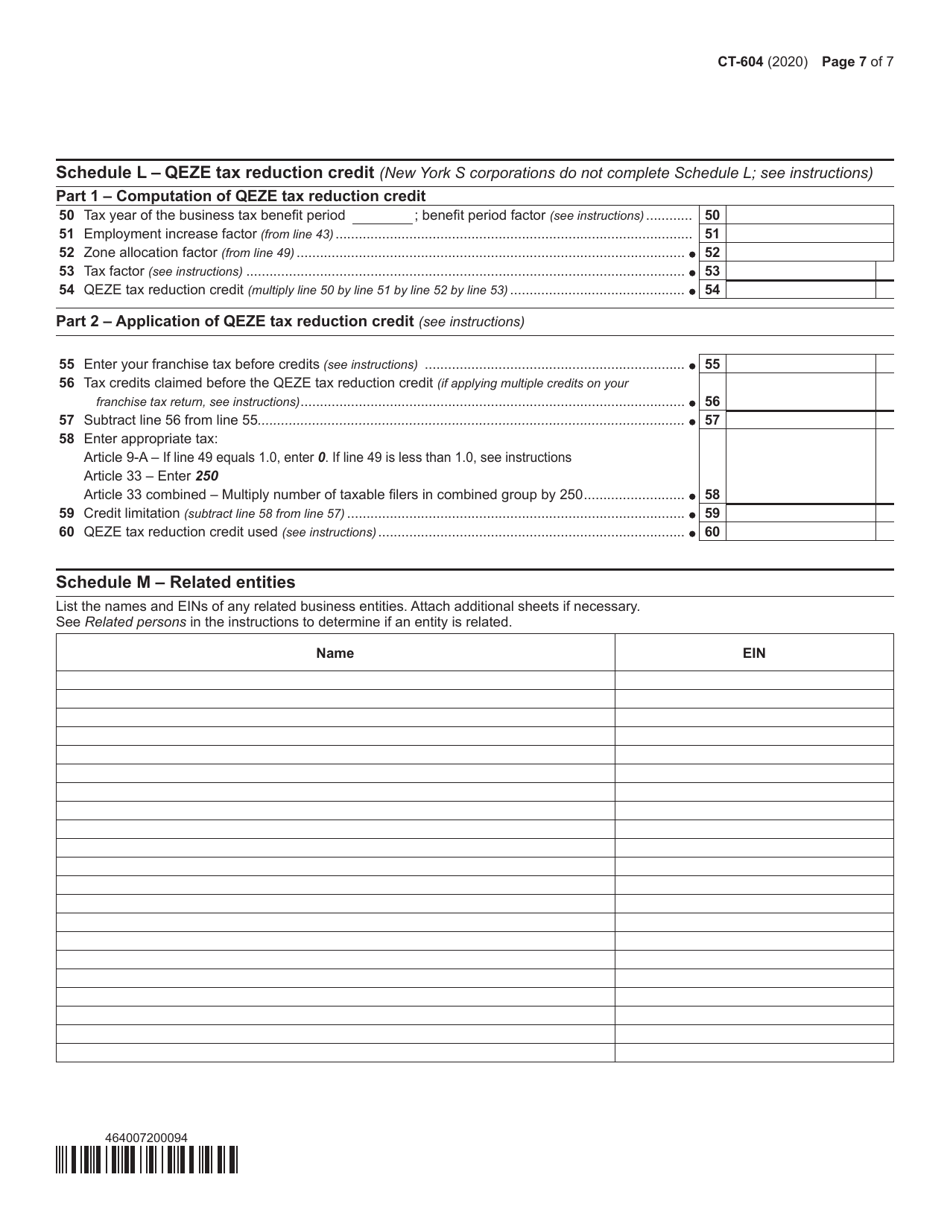

Form CT-604

for the current year.

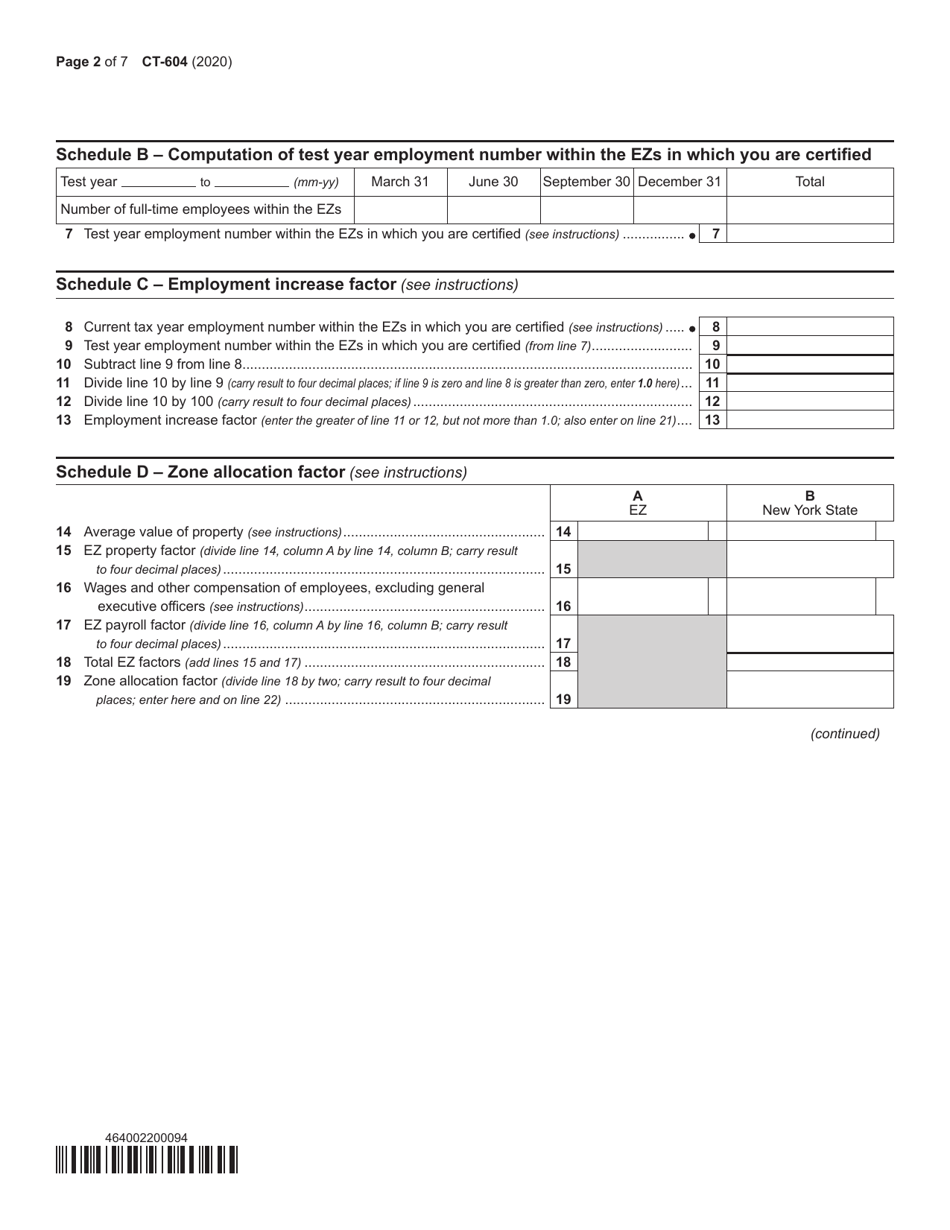

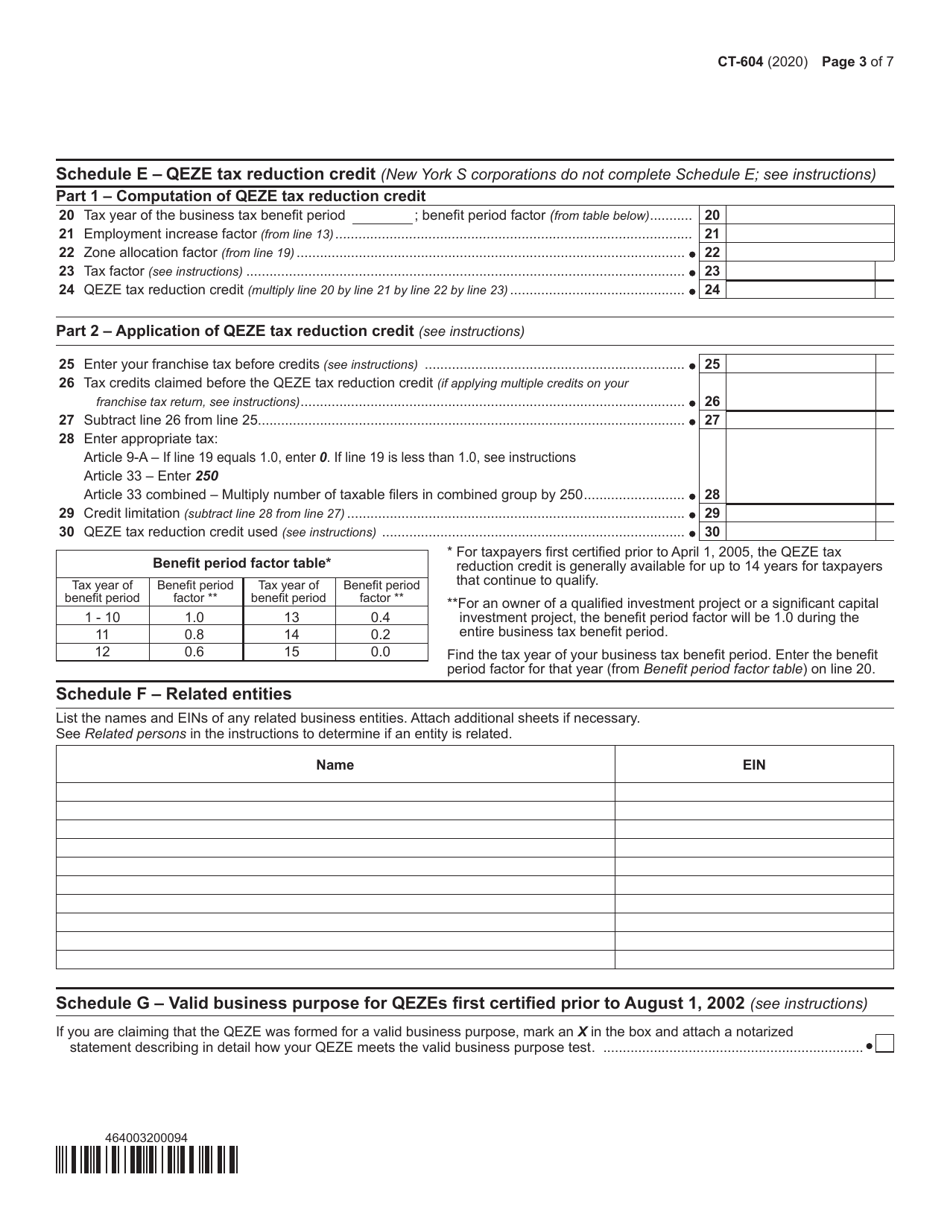

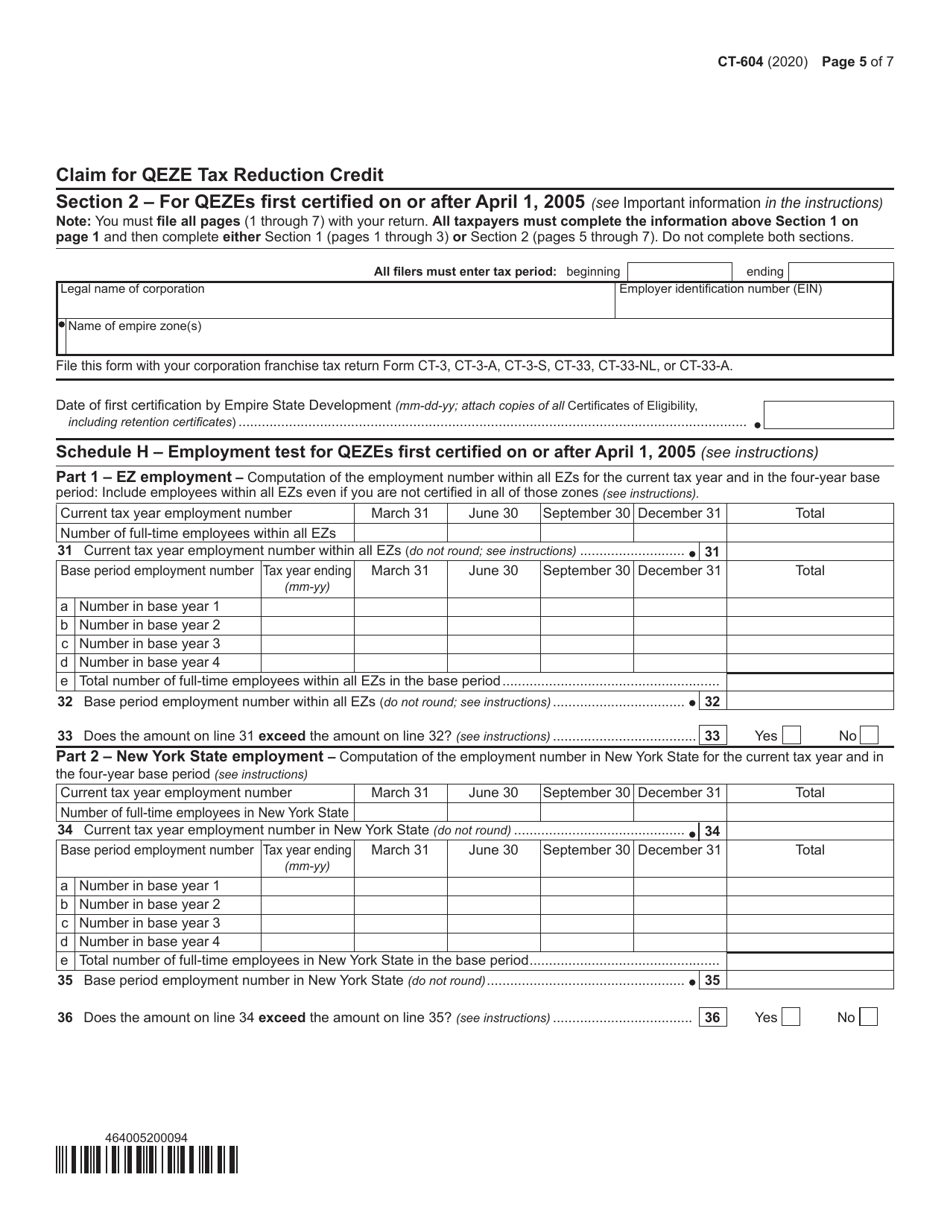

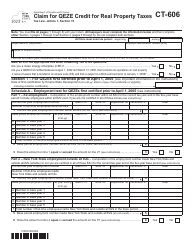

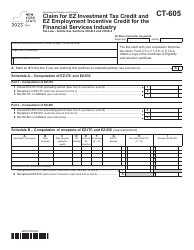

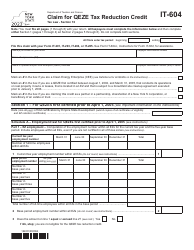

Form CT-604 Claim for Qeze Tax Reduction Credit - New York

What Is Form CT-604?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-604?

A: Form CT-604 is a form used to claim the Qeze Tax Reduction Credit in New York.

Q: What is the Qeze Tax Reduction Credit?

A: The Qeze Tax Reduction Credit is a credit available in New York to businesses that invest in Qualified Emerging Technology Companies.

Q: Who can file Form CT-604?

A: Businesses that have invested in Qualified Emerging Technology Companies in New York can file Form CT-604.

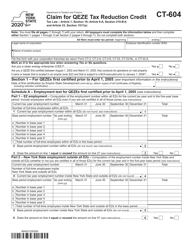

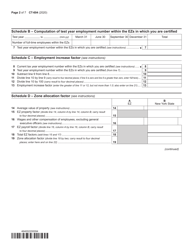

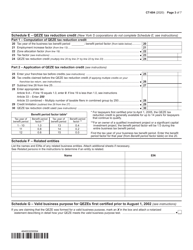

Q: What information is required on Form CT-604?

A: Form CT-604 requires information about the business, the Qualified Emerging Technology Companies invested in, and the amount of the investment.

Q: When is the deadline for filing Form CT-604?

A: The deadline for filing Form CT-604 is generally the same as the deadline for filing the business's tax return in New York.

Q: Is the Qeze Tax Reduction Credit refundable?

A: No, the Qeze Tax Reduction Credit is not refundable.

Q: Can I claim the Qeze Tax Reduction Credit for investments outside of New York?

A: No, the Qeze Tax Reduction Credit can only be claimed for investments in Qualified Emerging Technology Companies in New York.

Q: Are there any limitations on the amount of the Qeze Tax Reduction Credit?

A: Yes, there are limitations on the amount of the Qeze Tax Reduction Credit that can be claimed based on the business's annual investment and taxable income.

Q: Is professional assistance recommended for filing Form CT-604?

A: Yes, it is recommended to seek professional assistance when filing Form CT-604 to ensure compliance with all requirements and maximize the credit.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-604 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.