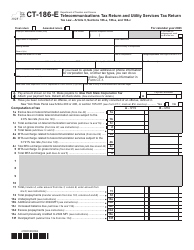

This version of the form is not currently in use and is provided for reference only. Download this version of

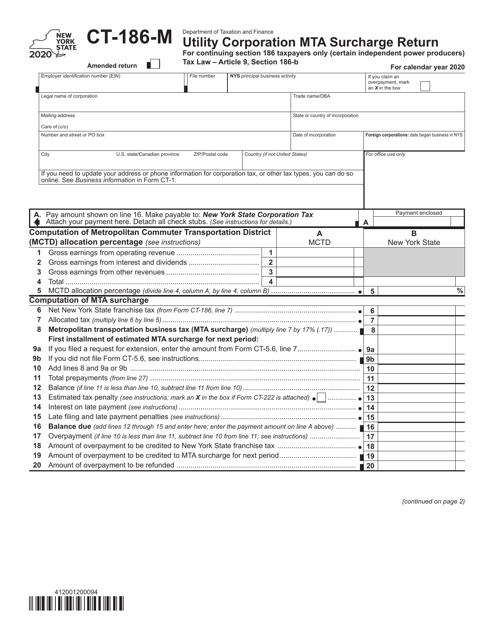

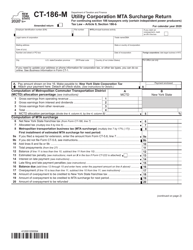

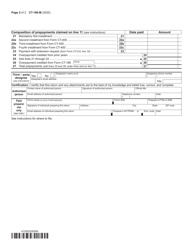

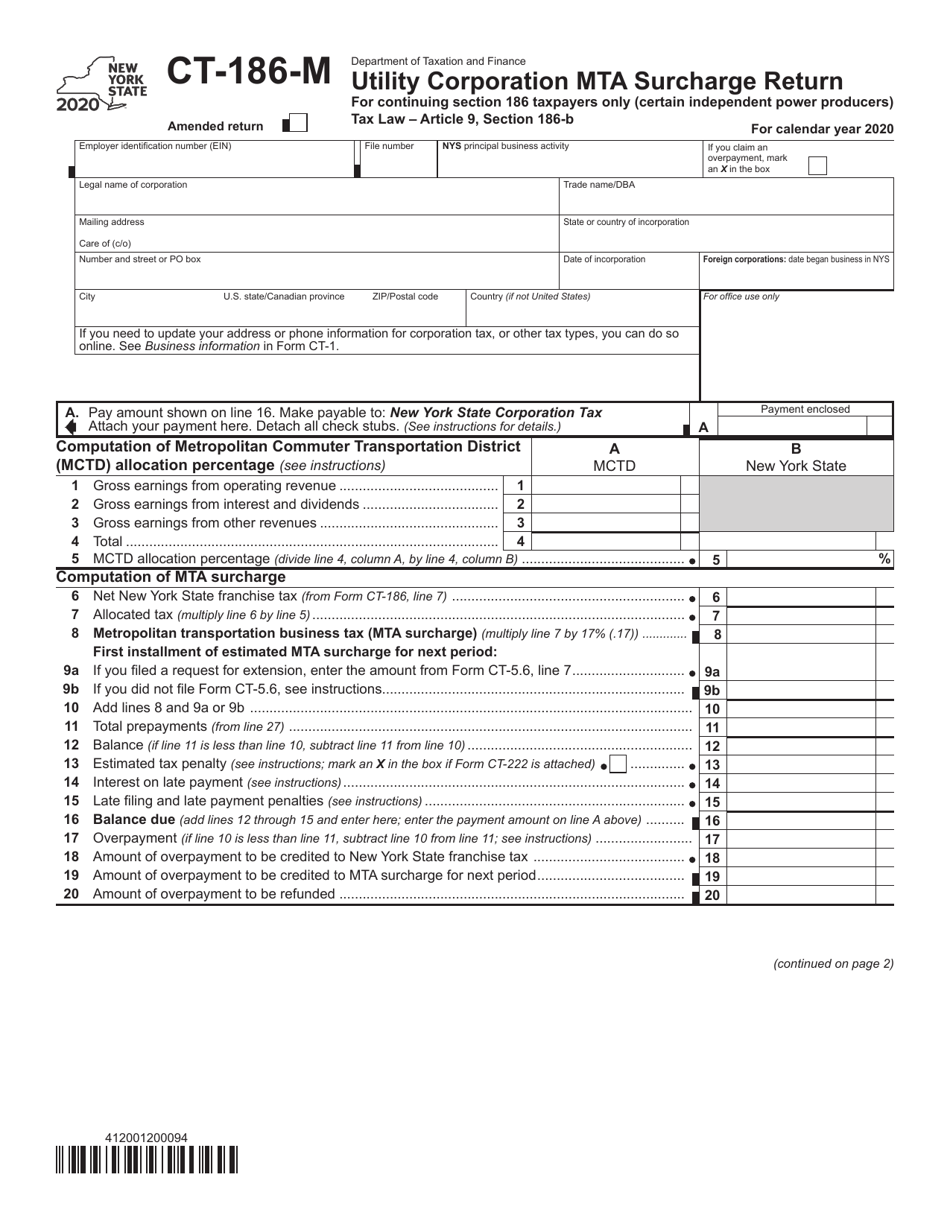

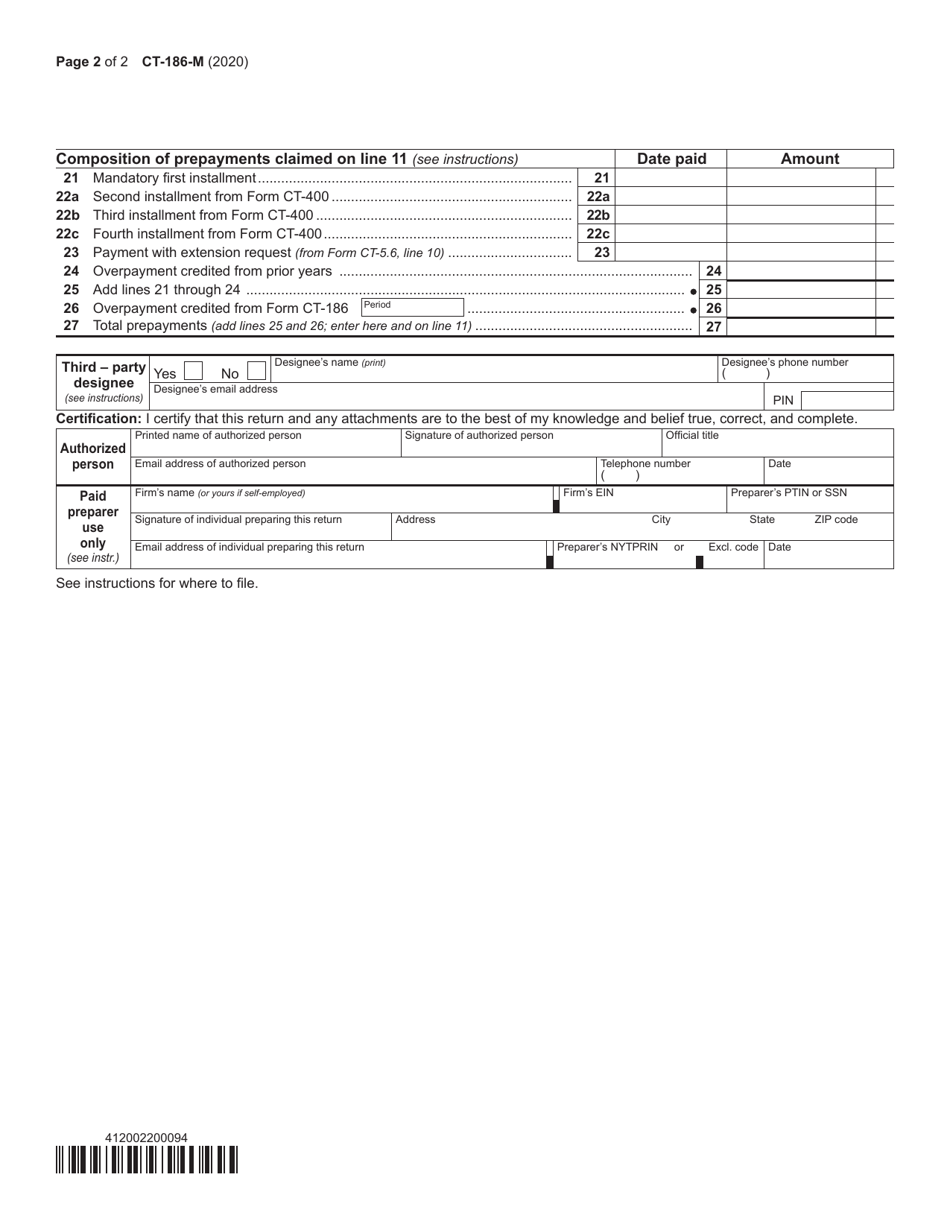

Form CT-186-M

for the current year.

Form CT-186-M Utility Corporation Mta Surcharge Return - New York

What Is Form CT-186-M?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

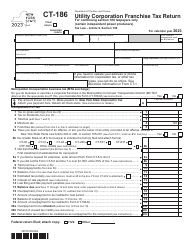

Q: What is Form CT-186-M?

A: Form CT-186-M is a tax return form for utility corporations in New York.

Q: Who needs to file Form CT-186-M?

A: Utility corporations in New York need to file Form CT-186-M.

Q: What is the purpose of Form CT-186-M?

A: Form CT-186-M is used to report and pay the MTA Surcharge by utility corporations in New York.

Q: What is the MTA Surcharge?

A: The MTA Surcharge is a tax imposed on utility corporations in New York to fund the Metropolitan Transportation Authority.

Q: When is Form CT-186-M due?

A: Form CT-186-M is generally due on a quarterly basis, with specific due dates provided by the New York State Department of Taxation and Finance.

Q: Are there any penalties for late filing of Form CT-186-M?

A: Yes, there are penalties for late filing of Form CT-186-M, including potential interest charges on the unpaid tax amount.

Q: Are utility corporations exempt from the MTA Surcharge?

A: No, utility corporations are not exempt from the MTA Surcharge in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-186-M by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.