This version of the form is not currently in use and is provided for reference only. Download this version of

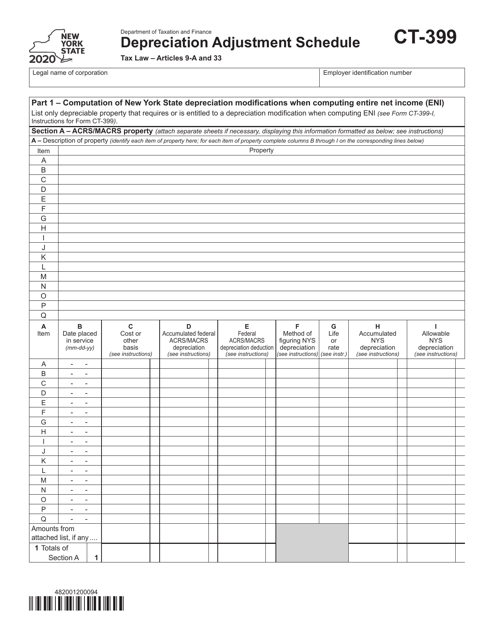

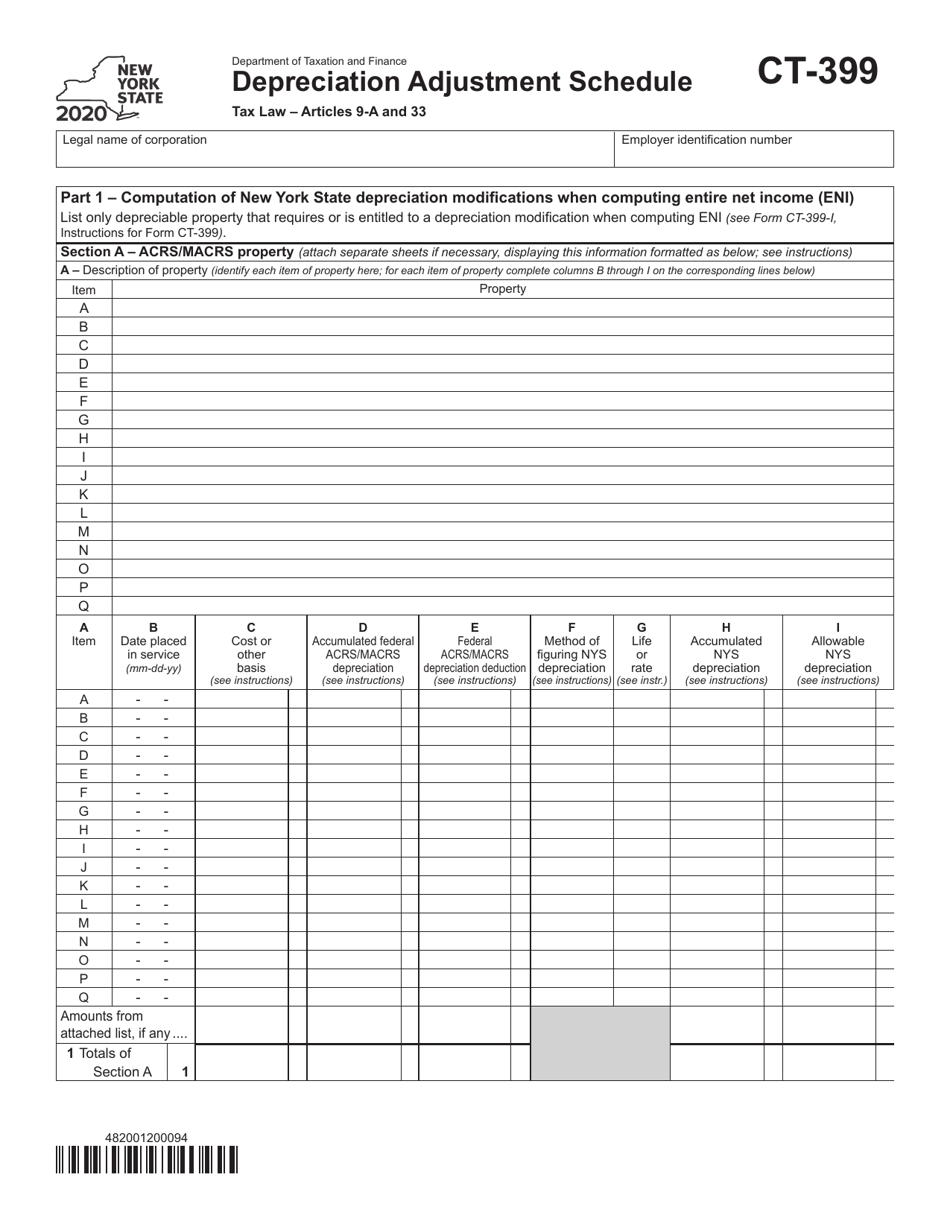

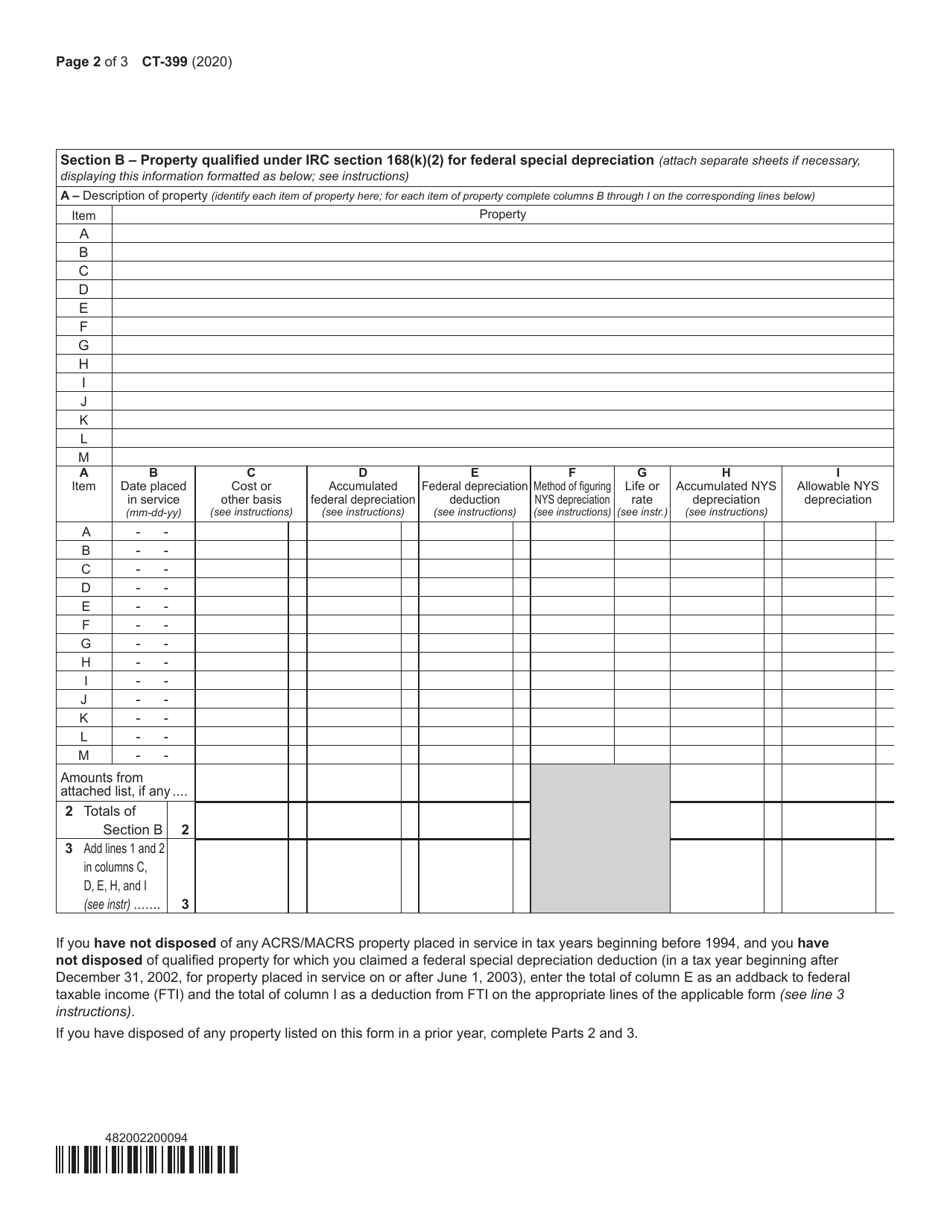

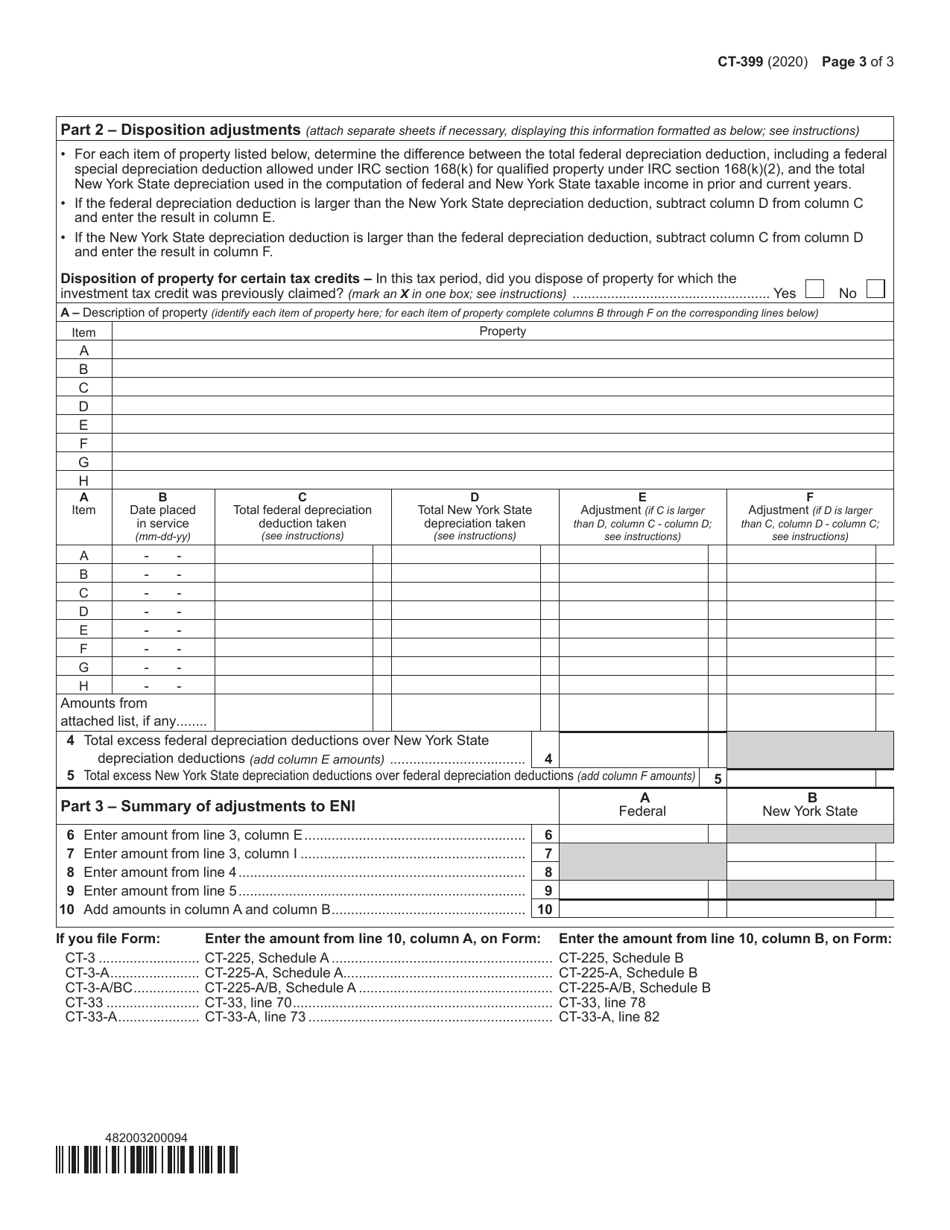

Form CT-399

for the current year.

Form CT-399 Depreciation Adjustment Schedule - New York

What Is Form CT-399?

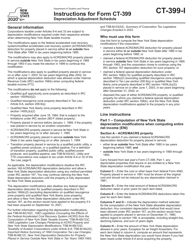

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-399?

A: Form CT-399 is the Depreciation Adjustment Schedule used in New York.

Q: What is the purpose of Form CT-399?

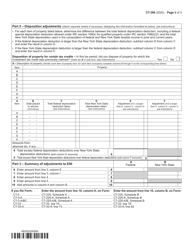

A: The purpose of Form CT-399 is to calculate and report the depreciation adjustment for tax purposes in New York.

Q: Who needs to file Form CT-399?

A: Businesses in New York that claim depreciation deductions on their tax returns may need to file Form CT-399.

Q: When is Form CT-399 due?

A: Form CT-399 is generally due at the same time as the New York state tax return, which is April 15th for calendar year taxpayers.

Q: Are there any penalties for not filing Form CT-399?

A: Yes, failure to file Form CT-399 or filing it late may result in penalties imposed by the New York State Department of Taxation and Finance.

Q: Can I e-file Form CT-399?

A: Yes, Form CT-399 can be e-filed using approved software or through a tax professional who offers e-filing services.

Q: Do I need to attach any documents with Form CT-399?

A: Yes, you may need to attach supporting documentation such as depreciation schedules and other relevant records to substantiate the depreciation adjustment claimed on Form CT-399.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-399 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.