This version of the form is not currently in use and is provided for reference only. Download this version of

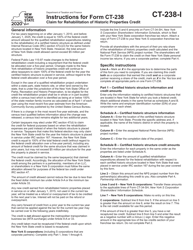

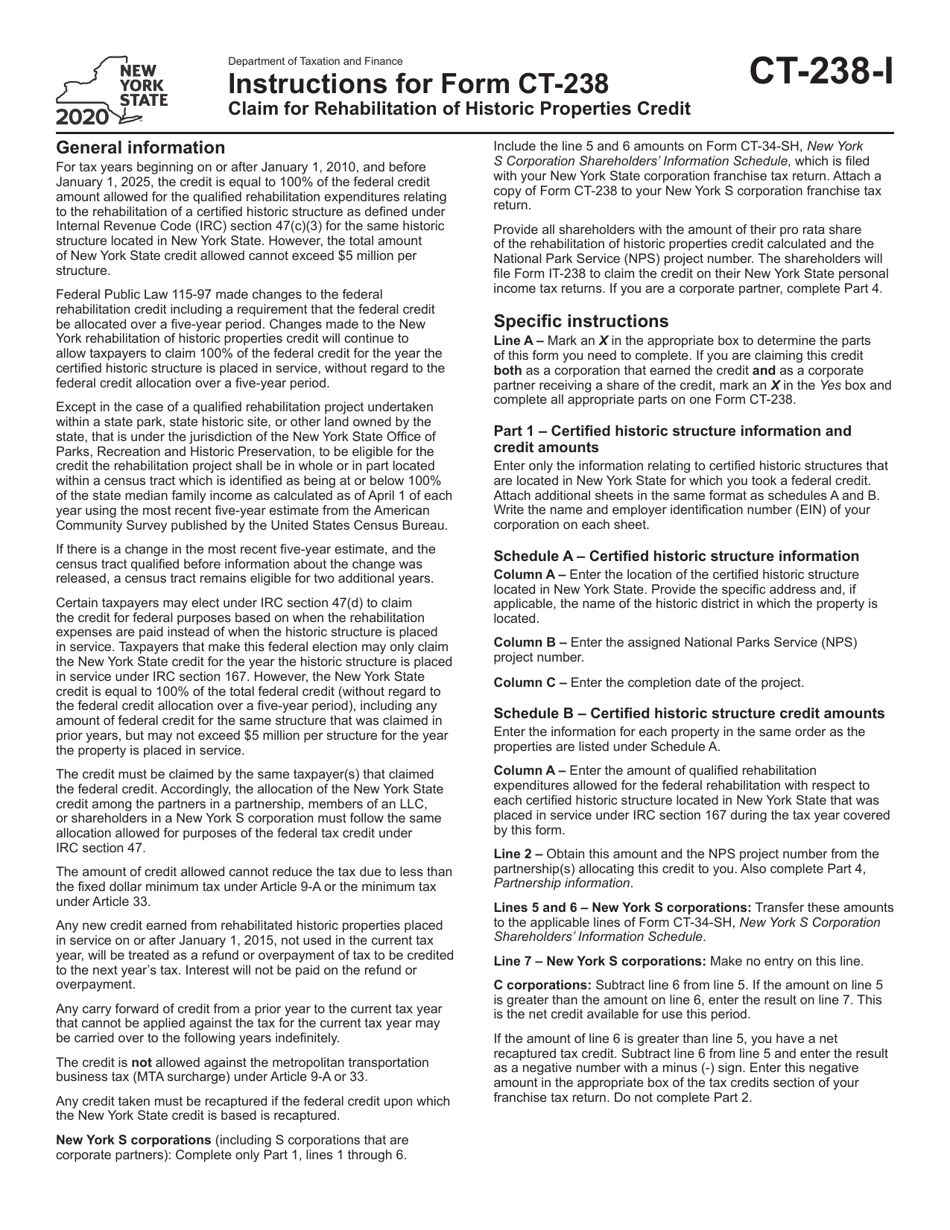

Instructions for Form CT-238

for the current year.

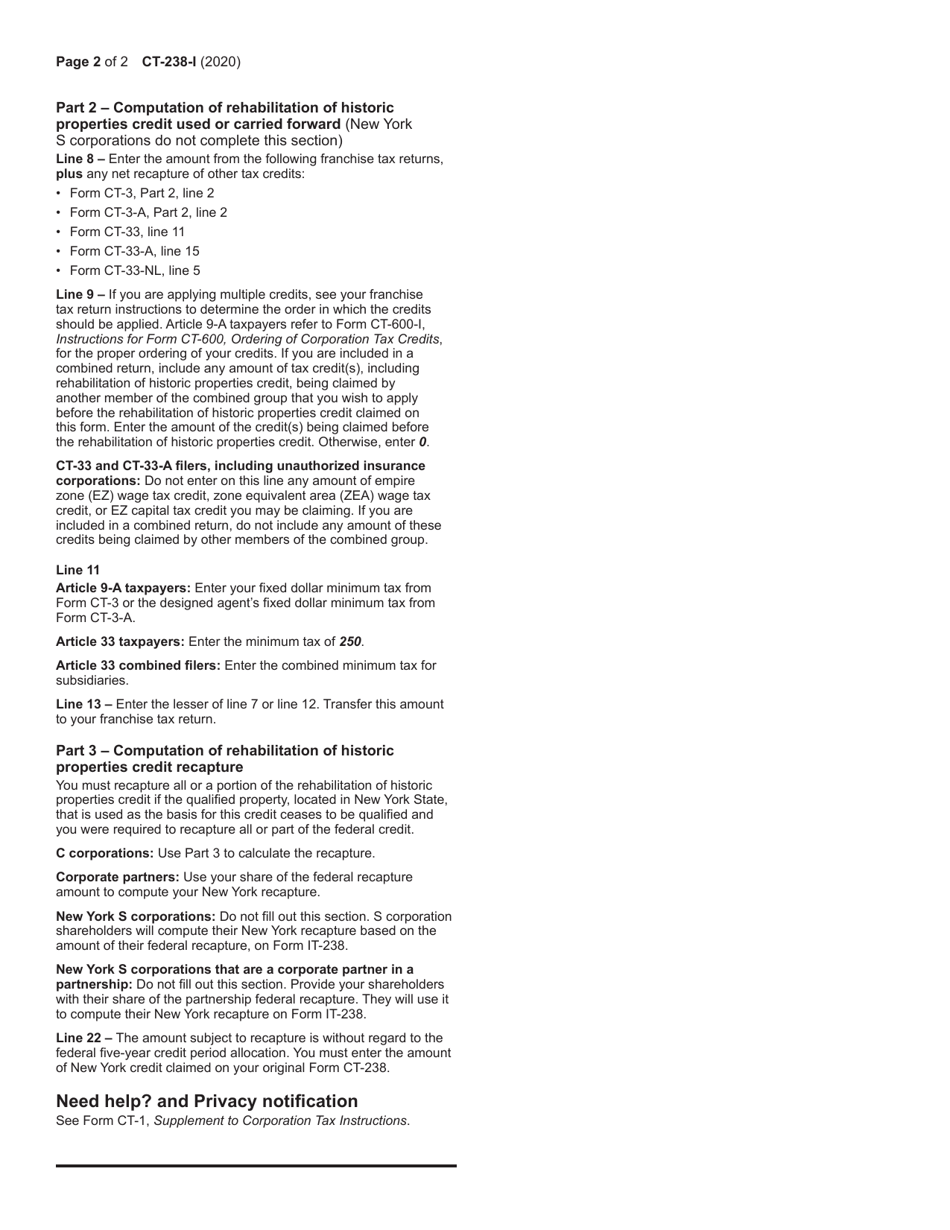

Instructions for Form CT-238 Claim for Rehabilitation of Historic Properties Credit - New York

This document contains official instructions for Form CT-238 , Claim for Rehabilitation of Historic Properties Credit - a form released and collected by the New York State Department of Taxation and Finance. An up-to-date fillable Form CT-238 is available for download through this link.

FAQ

Q: What is Form CT-238?

A: Form CT-238 is a tax form used to claim the Rehabilitation of Historic Properties Credit in New York.

Q: What is the Rehabilitation of Historic Properties Credit?

A: The Rehabilitation of Historic Properties Credit is a tax credit given to individuals or companies who have made qualifying expenses for rehabilitating historic properties in New York.

Q: Who can claim the Rehabilitation of Historic Properties Credit?

A: Individuals or companies who have made qualifying expenses for rehabilitating historic properties in New York can claim this credit.

Q: What are qualifying expenses for the Rehabilitation of Historic Properties Credit?

A: Qualifying expenses include costs for the rehabilitation or reconstruction of a certified historic structure, as well as certain ancillary costs.

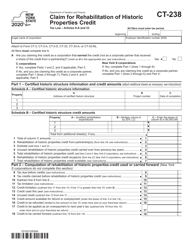

Q: How do I complete Form CT-238?

A: The form requires information about the taxpayer, the historic property, and the qualifying expenses. It also requires documentation to support the credit claim.

Q: Is there a deadline for filing Form CT-238?

A: Yes, Form CT-238 must be filed by the due date of the taxpayer's return, including extensions.

Q: Can I claim the Rehabilitation of Historic Properties Credit if I am not a New York resident?

A: No, only individuals or companies who have made qualifying expenses for rehabilitating historic properties in New York are eligible for this credit.

Q: What documentation do I need to support my claim for the Rehabilitation of Historic Properties Credit?

A: You will need to provide documentation such as receipts, invoices, and other records that substantiate your qualifying expenses.

Q: Can I claim the Rehabilitation of Historic Properties Credit for expenses that were reimbursed by insurance or other sources?

A: No, you can only claim the credit for expenses that were not reimbursed by insurance or other sources.

Instruction Details:

- This 2-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Taxation and Finance.