This version of the form is not currently in use and is provided for reference only. Download this version of

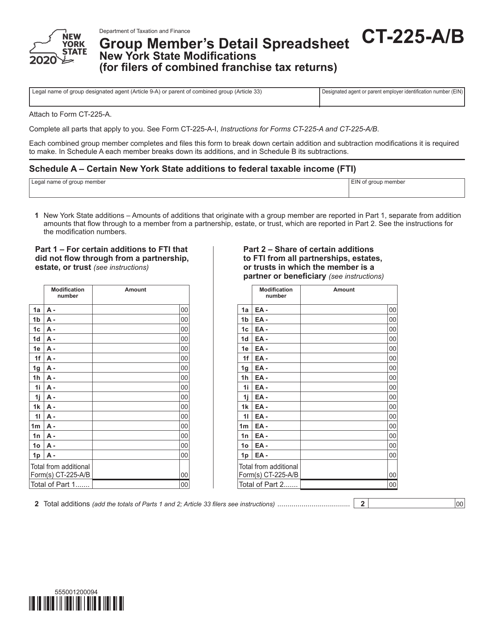

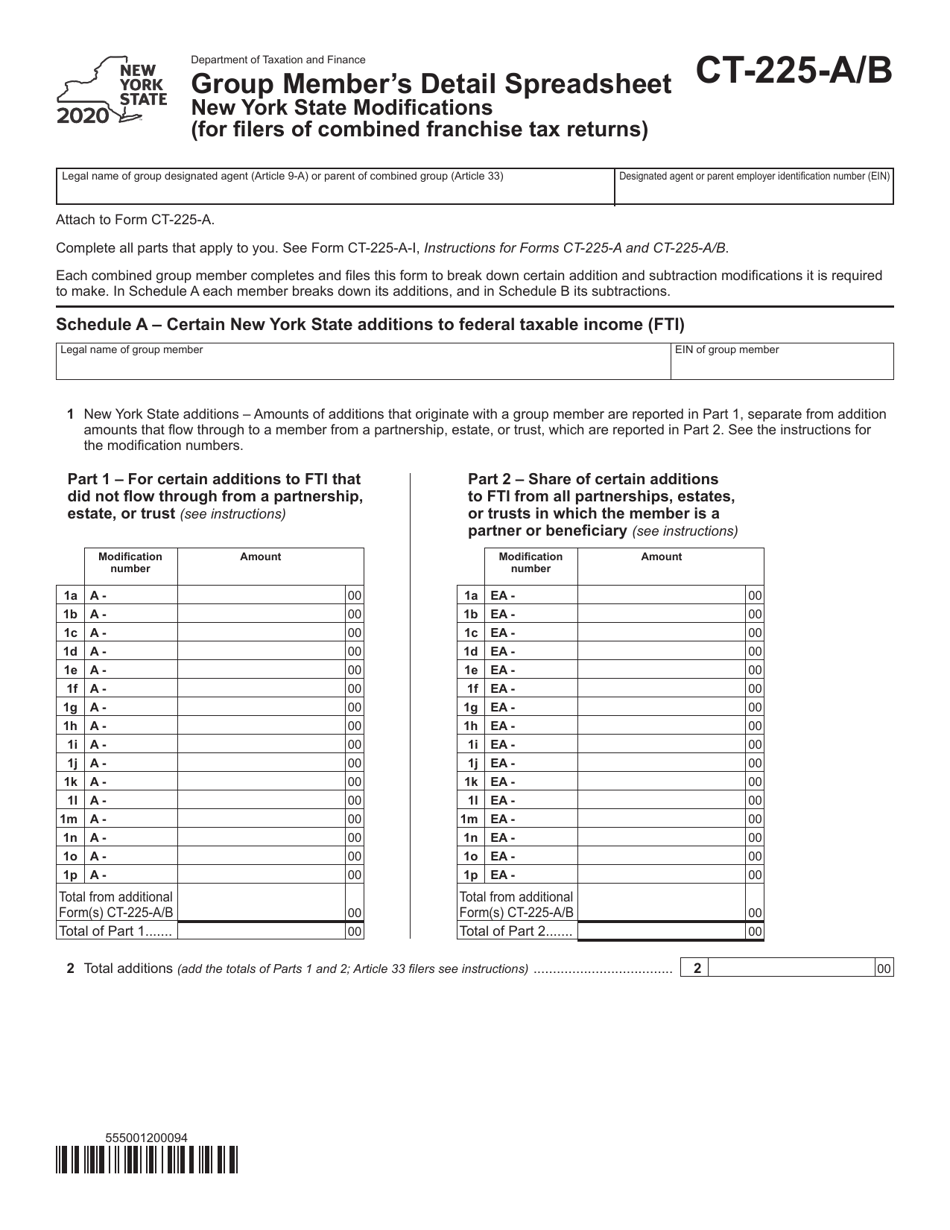

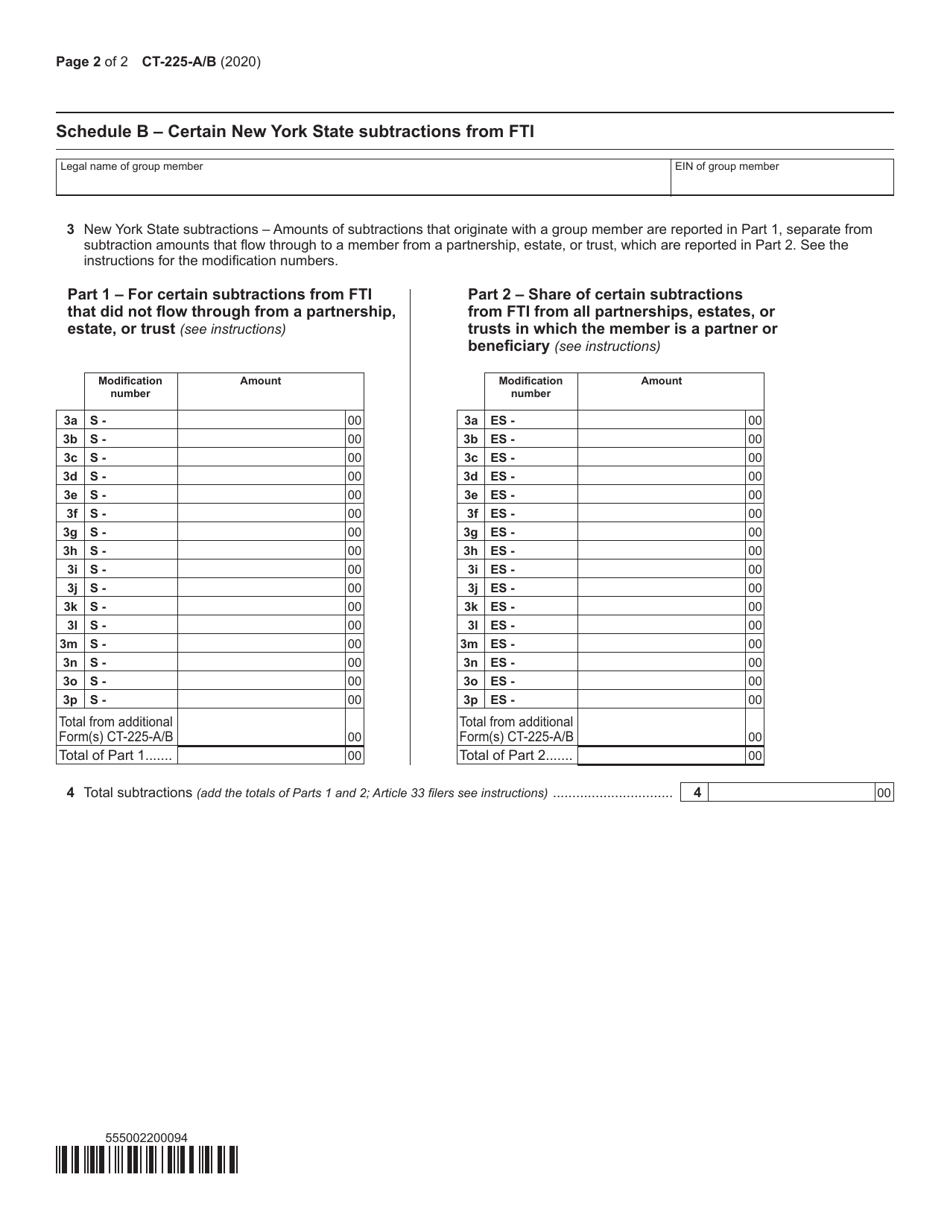

Form CT-225-A/B

for the current year.

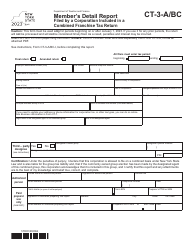

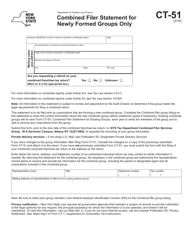

Form CT-225-A / B Group Member's Detail Spreadsheet New York State Modifications (For Filers of Combined Franchise Tax Returns) - New York

What Is Form CT-225-A/B?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-225-A/B?

A: Form CT-225-A/B is a spreadsheet used by filers of combined franchise tax returns in New York State to report the details of group members.

Q: What are New York State Modifications?

A: New York State Modifications are adjustments made to the federal taxable income on the combined franchise tax return in order to calculate the New York State taxable income.

Q: Who is required to use Form CT-225-A/B?

A: Filers of combined franchise tax returns in New York State are required to use Form CT-225-A/B to report the details of group members.

Q: What information is reported on Form CT-225-A/B?

A: Form CT-225-A/B requires the reporting of various details about each group member, such as federal taxable income, New York State additions, subtractions, and modifications.

Q: Is Form CT-225-A/B only for residents of New York State?

A: No, Form CT-225-A/B is used by filers of combined franchise tax returns in New York State, regardless of their residency.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-225-A/B by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.