This version of the form is not currently in use and is provided for reference only. Download this version of

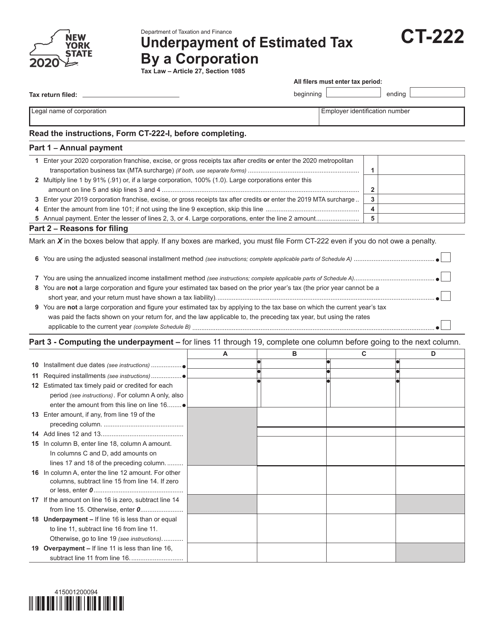

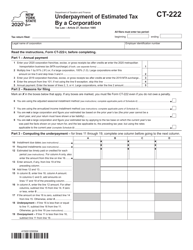

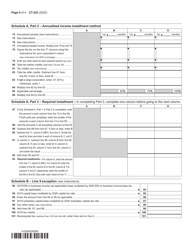

Form CT-222

for the current year.

Form CT-222 Underpayment of Estimated Tax by a Corporation - New York

What Is Form CT-222?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-222?

A: Form CT-222 is a tax form used in New York for corporations to report underpayment of estimated tax.

Q: When should Form CT-222 be filed?

A: Form CT-222 should be filed by a corporation if it underpaid estimated tax during the tax year.

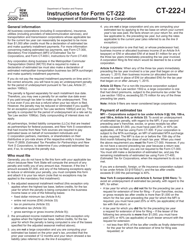

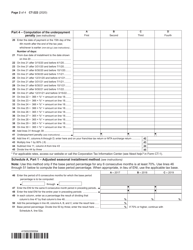

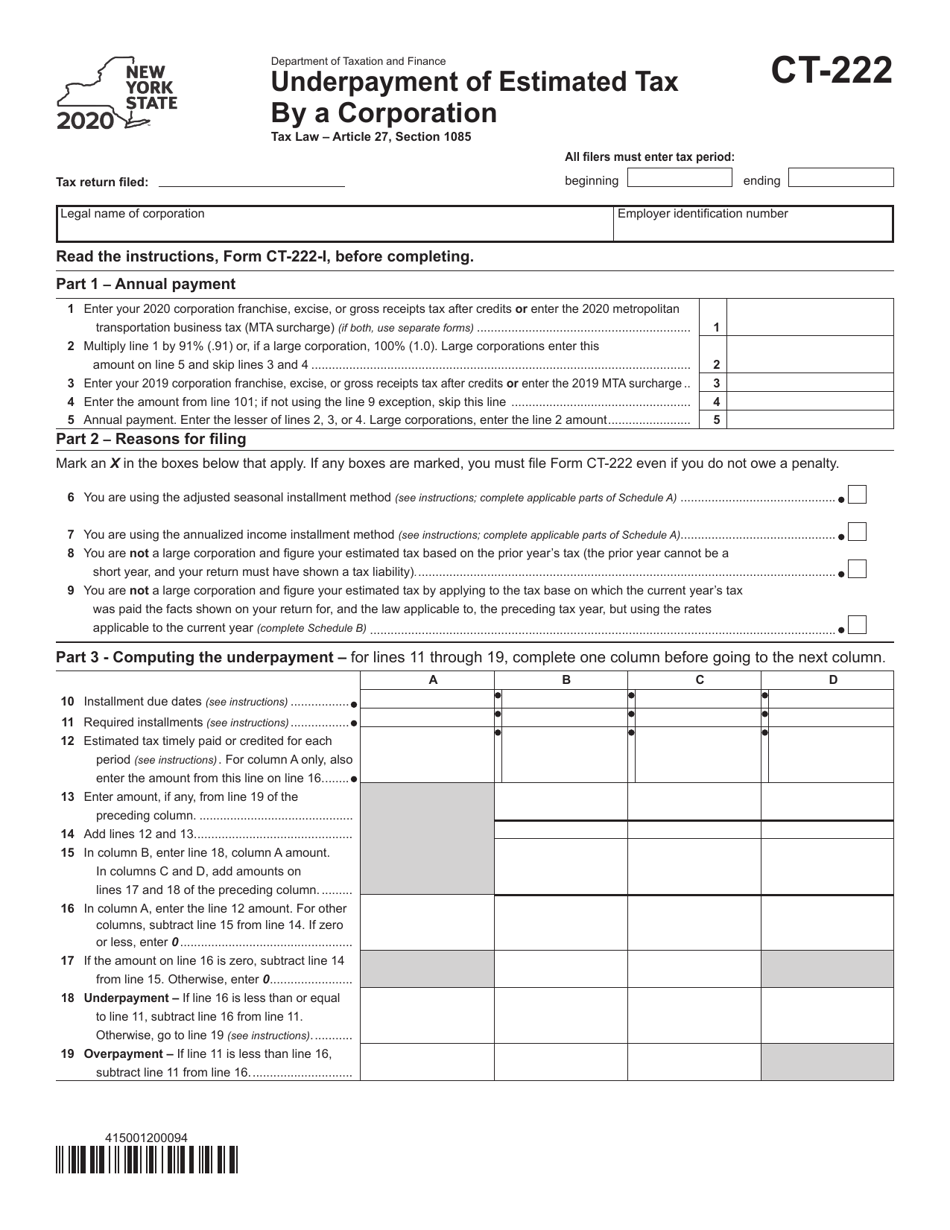

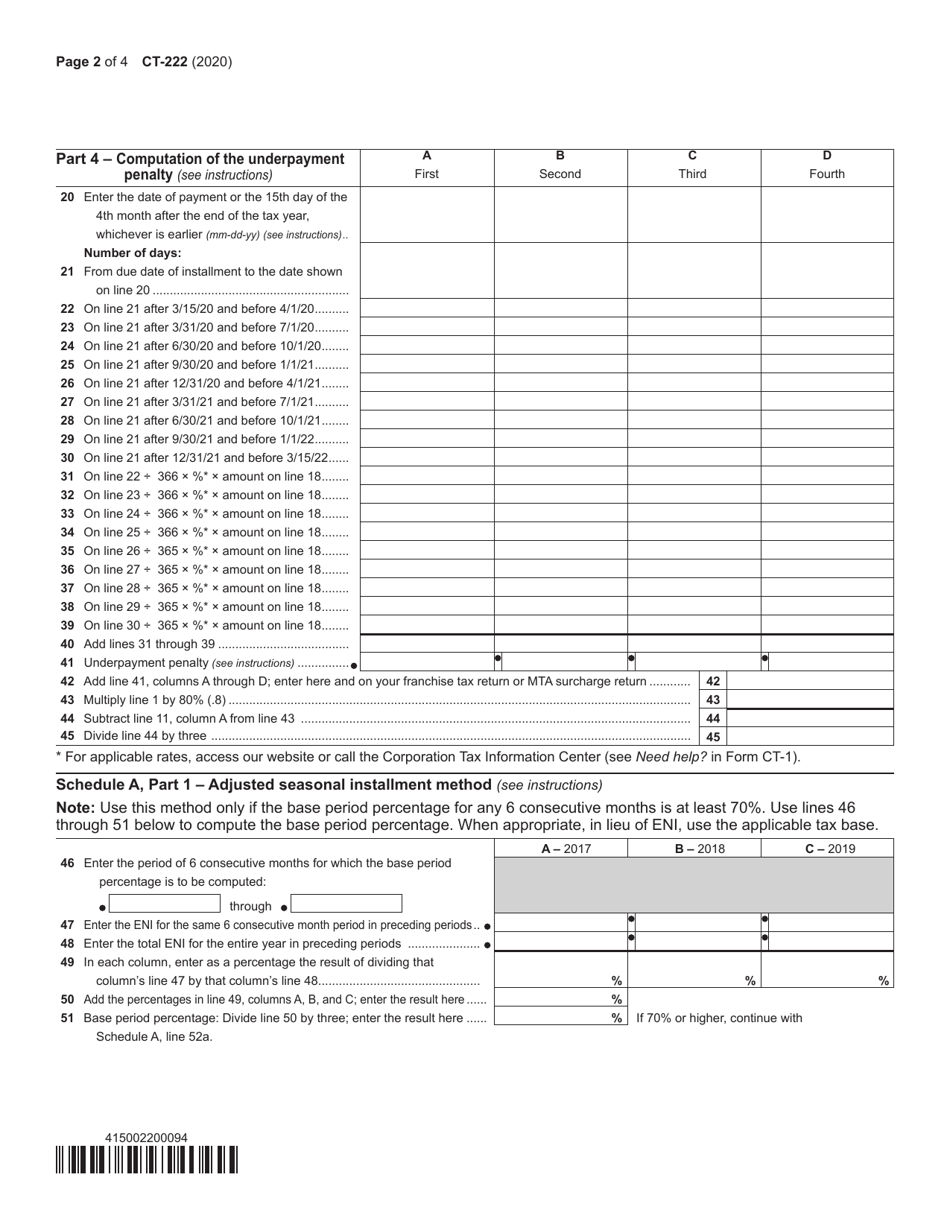

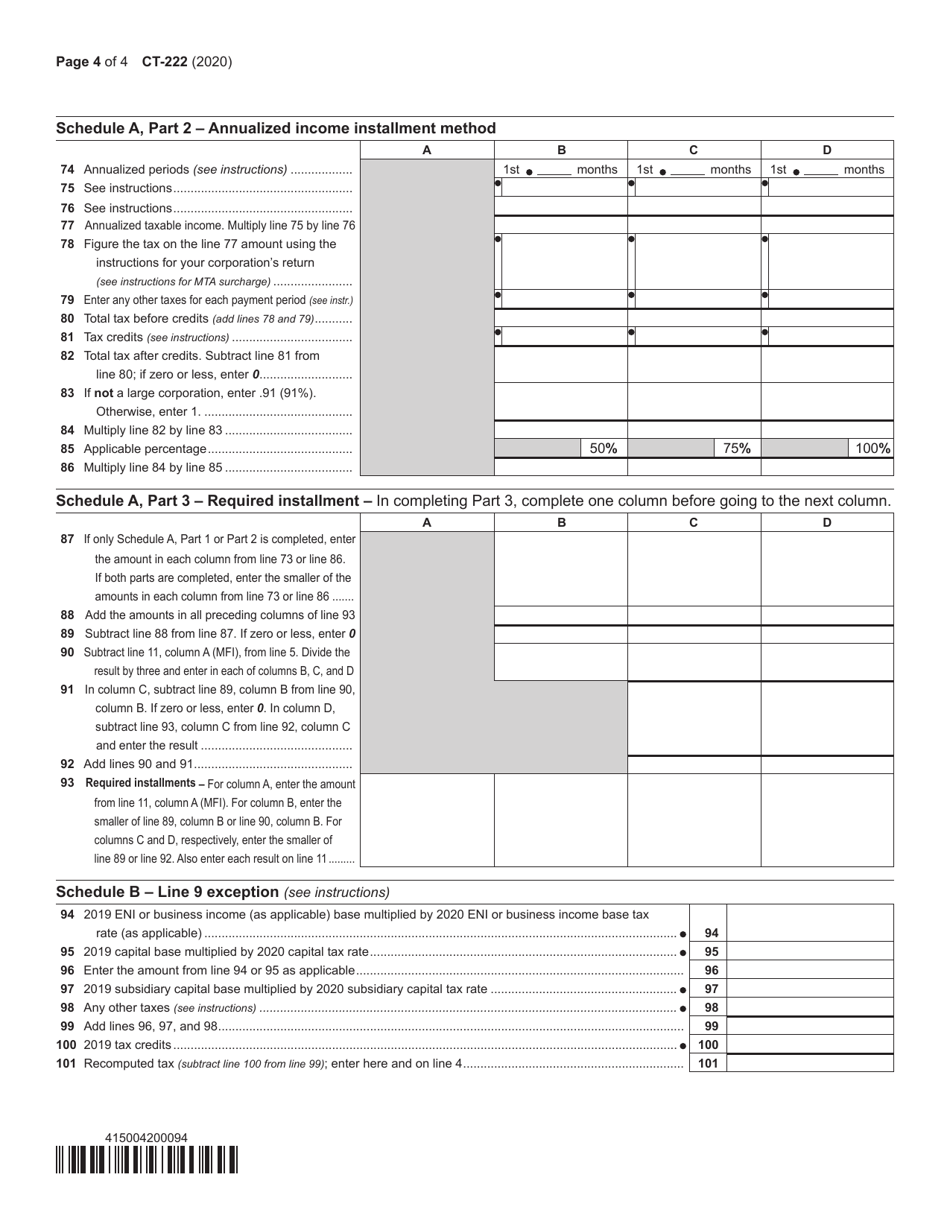

Q: How do I fill out Form CT-222?

A: Form CT-222 requires you to provide information about your corporation, calculate the underpayment amount, and include any necessary documentation.

Q: What happens if I don't file Form CT-222?

A: If you don't file Form CT-222 or if you underpay estimated tax, you may be subject to penalties and interest.

Q: Is Form CT-222 specific to corporations in New York?

A: Yes, Form CT-222 is specific to corporations in New York that need to report underpayment of estimated tax.

Q: Are there any deadlines for filing Form CT-222?

A: Yes, Form CT-222 should generally be filed by the due date of the corporation's tax return, which is usually March 15th for calendar year filers.

Q: What type of information should I have available when filling out Form CT-222?

A: When filling out Form CT-222, you should have information about your corporation's estimated tax payments, tax year, and any relevant documentation.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-222 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.