This version of the form is not currently in use and is provided for reference only. Download this version of

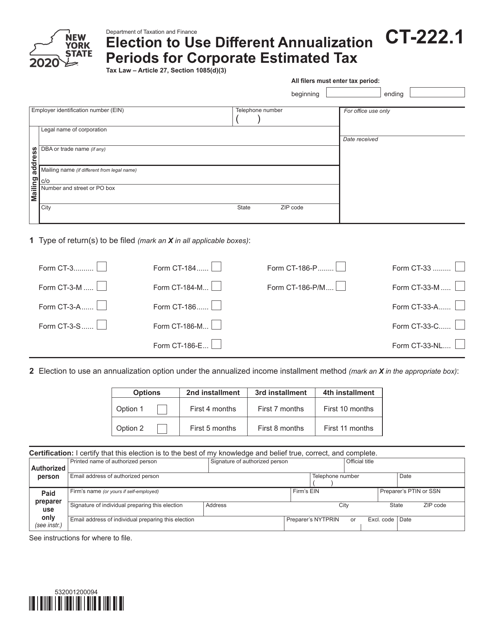

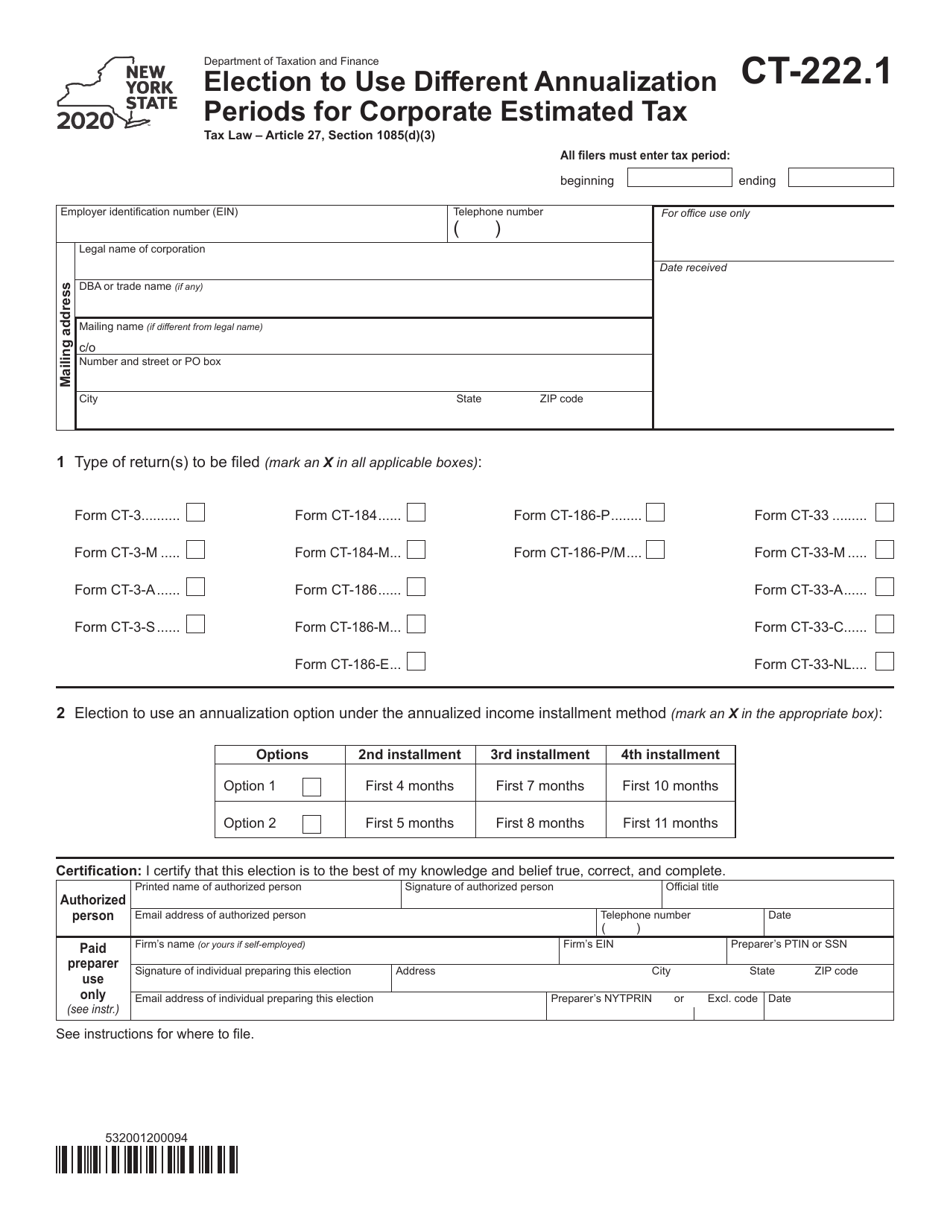

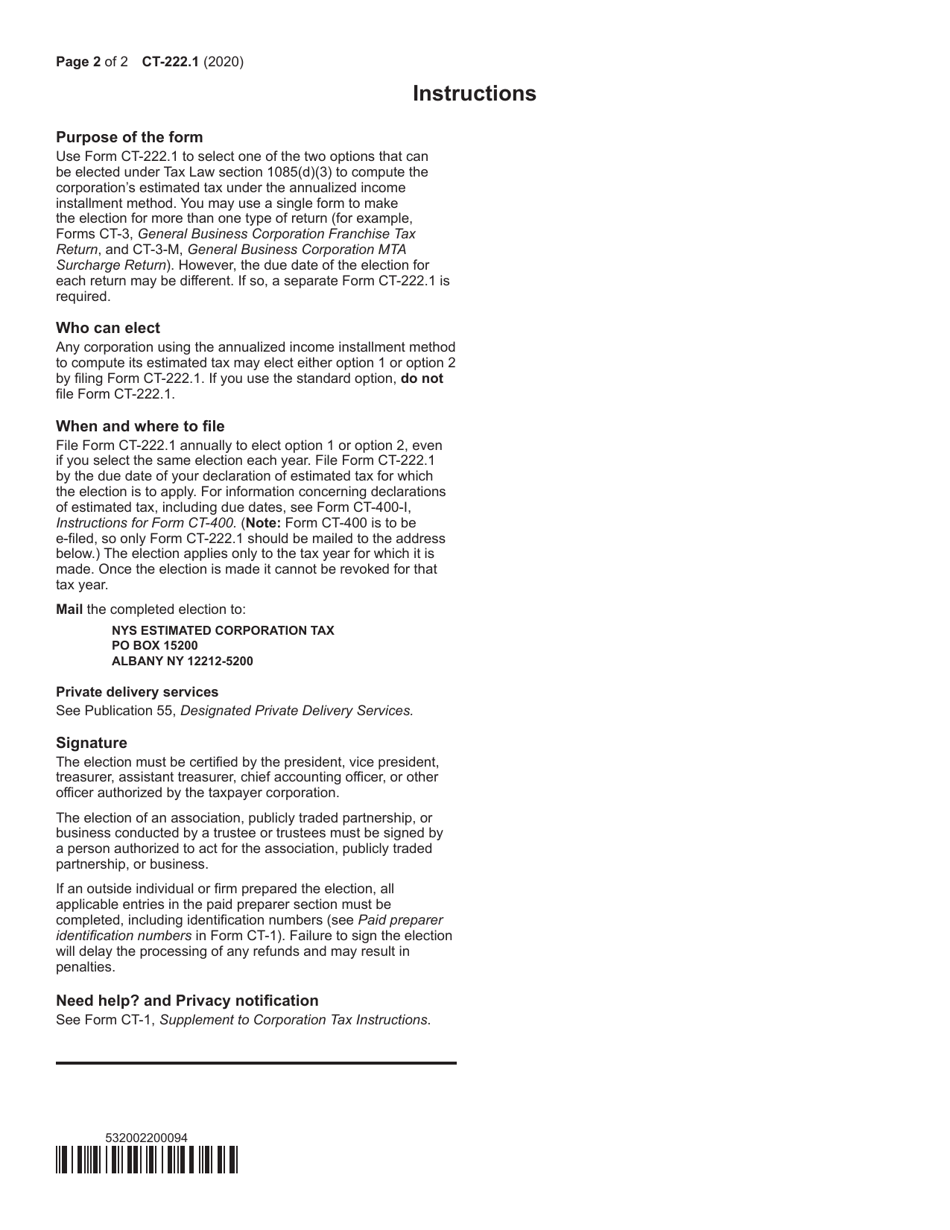

Form CT-222.1

for the current year.

Form CT-222.1 Election to Use Different Annualization Periods for Corporate Estimated Tax - New York

What Is Form CT-222.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-222.1?

A: Form CT-222.1 is a form used in New York to elect different annualization periods for corporate estimated tax.

Q: What is the purpose of Form CT-222.1?

A: The purpose of Form CT-222.1 is to allow corporations to choose different annualization periods for calculating estimated tax payments.

Q: Who needs to file Form CT-222.1?

A: Corporations in New York who want to use different annualization periods for their corporate estimated tax need to file Form CT-222.1.

Q: When should Form CT-222.1 be filed?

A: Form CT-222.1 should be filed by the due date of the first estimated tax installment for the tax year in question.

Q: Is there a fee to file Form CT-222.1?

A: No, there is no fee required to file Form CT-222.1 in New York.

Q: What should I do if I make a mistake on Form CT-222.1?

A: If you make a mistake on Form CT-222.1, you should correct it as soon as possible by filing an amended form.

Q: Can I use different annualization periods for my estimated tax payments without filing Form CT-222.1?

A: No, you need to file Form CT-222.1 in order to use different annualization periods for your corporate estimated tax payments in New York.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-222.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.