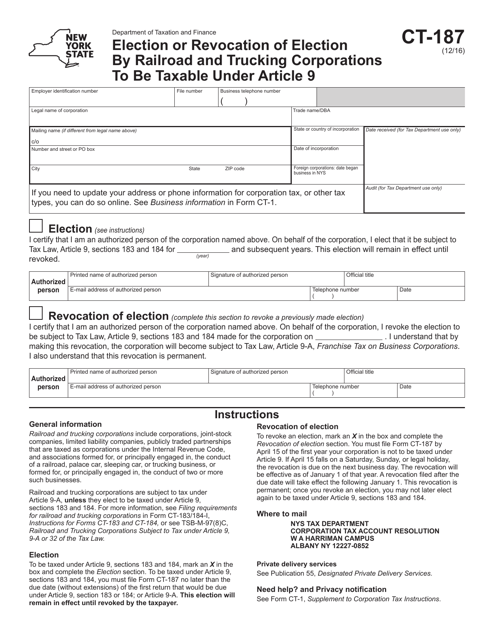

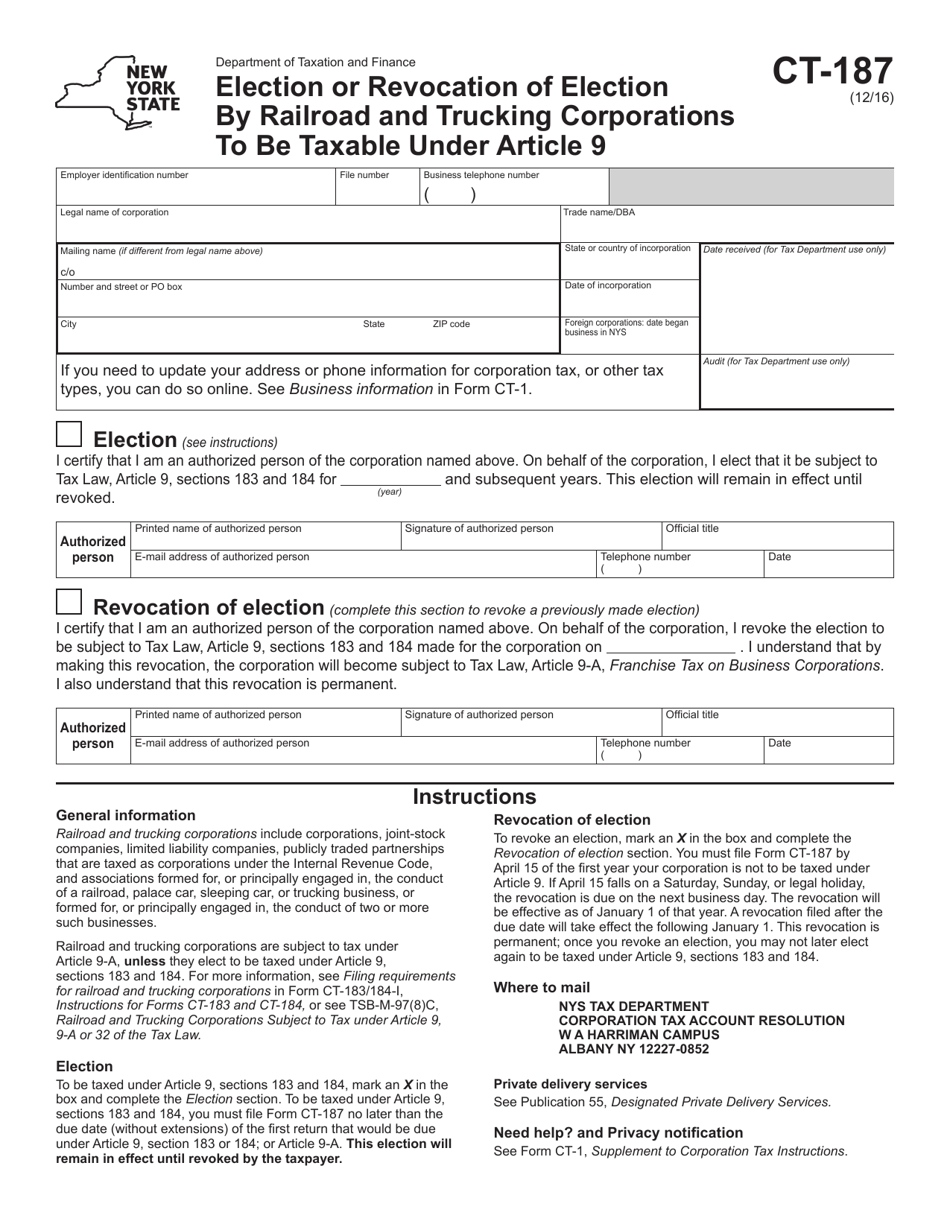

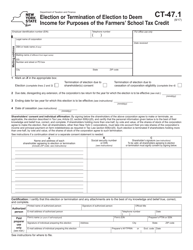

Form CT-187 Election or Revocation of Election by Railroad and Trucking Corporations to Be Taxable Under Article 9 - New York

What Is Form CT-187?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-187?

A: Form CT-187 is a form used for the election or revocation of election by railroad and trucking corporations to be taxable under Article 9 in New York.

Q: Who uses Form CT-187?

A: Railroad and trucking corporations use Form CT-187.

Q: What is the purpose of Form CT-187?

A: The purpose of Form CT-187 is to elect or revoke the election to be taxable under Article 9 in New York.

Q: What does Article 9 refer to?

A: Article 9 refers to the tax law in New York.

Q: Are railroad and trucking corporations automatically taxable under Article 9?

A: No, railroad and trucking corporations must elect to be taxable under Article 9. Form CT-187 is used to make this election.

Q: Can a railroad or trucking corporation revoke its election to be taxable under Article 9?

A: Yes, a railroad or trucking corporation can revoke its election by using Form CT-187.

Q: Is there a deadline for filing Form CT-187?

A: Yes, Form CT-187 must be filed by the due date of the corporation's return for the tax year in which the election or revocation is to be effective.

Form Details:

- Released on December 1, 2016;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-187 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.