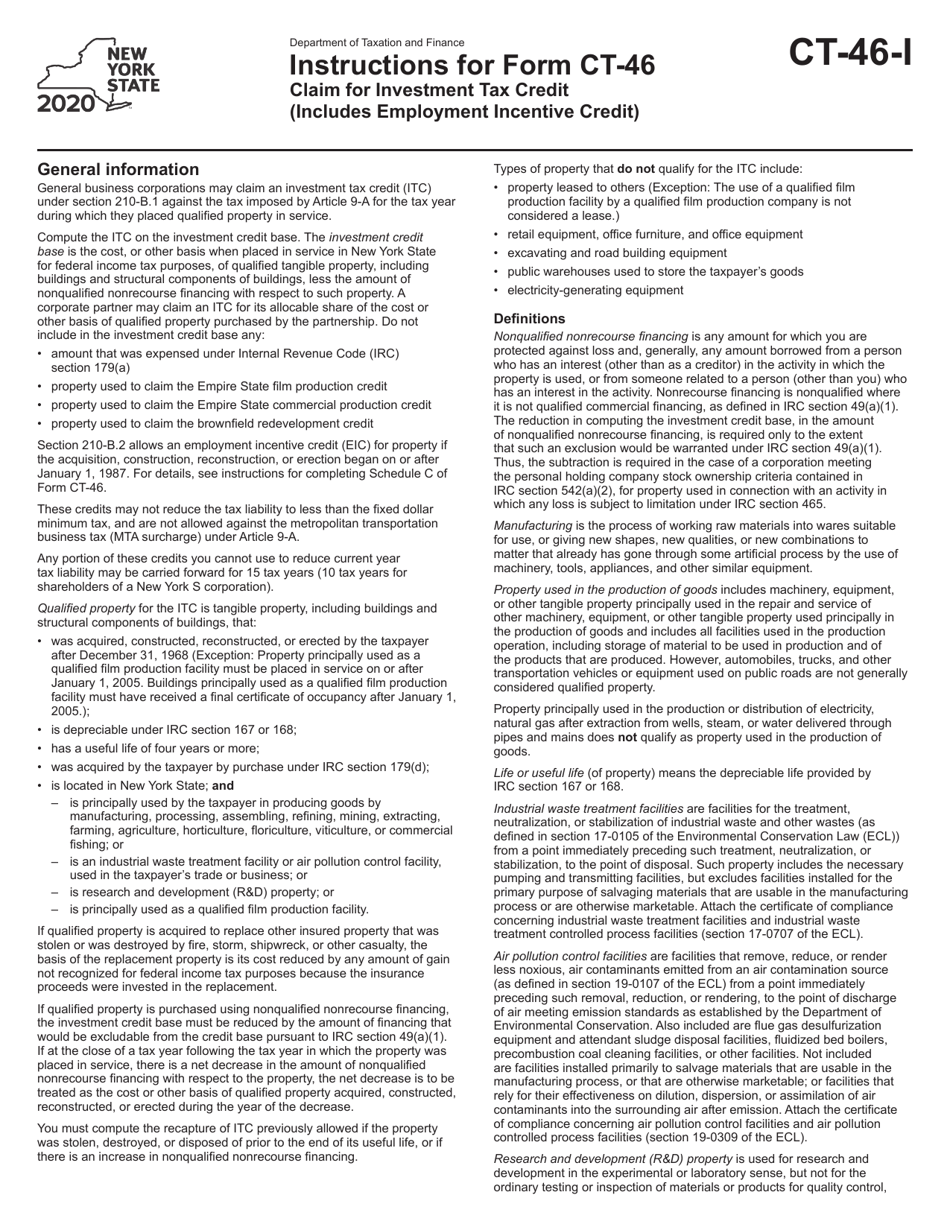

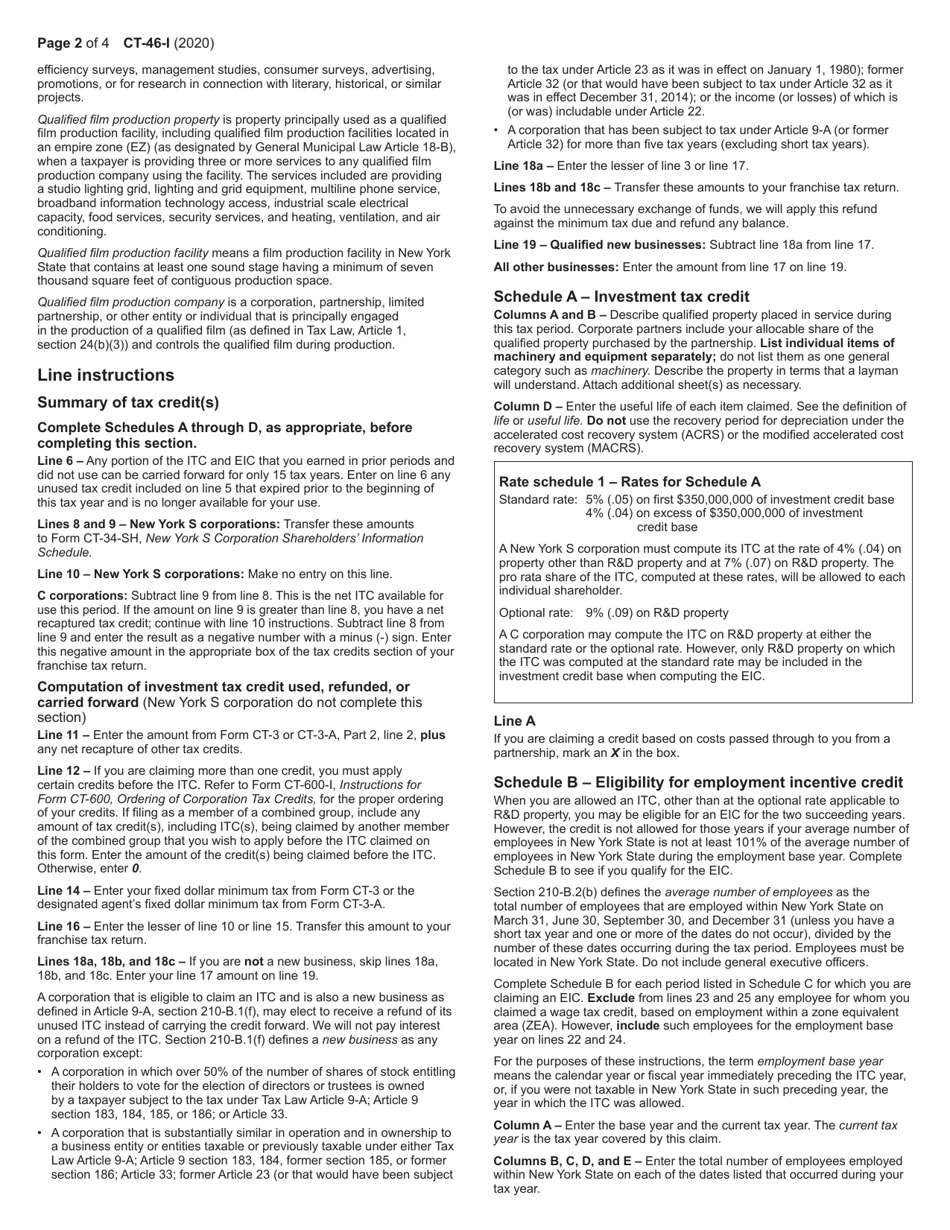

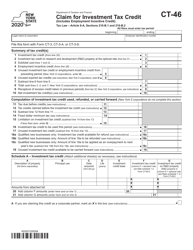

Instructions for Form CT-46 Claim for Investment Tax Credit (Includes Employment Incentive Credit) - New York

This document contains official instructions for Form CT-46 , Claim for Employment Incentive Credit) - a form released and collected by the New York State Department of Financial Services.

FAQ

Q: What is Form CT-46?

A: Form CT-46 is a claim form for the Investment Tax Credit (Includes Employment Incentive Credit) in New York.

Q: What is the purpose of the Investment Tax Credit?

A: The purpose of the Investment Tax Credit is to provide a credit against New York state tax liability for qualified investments made by businesses.

Q: What is the Employment Incentive Credit?

A: The Employment Incentive Credit is a subset of the Investment Tax Credit that provides additional tax credits for job creation and retention.

Q: Who is eligible to claim the Investment Tax Credit?

A: Businesses that make qualified investments in certain eligible property located in New York may be eligible to claim the Investment Tax Credit.

Q: What documentation do I need to submit with Form CT-46?

A: You may need to submit documentation such as invoices, purchase orders, and other supporting documents that demonstrate your qualified investments.

Q: Is there a deadline for filing Form CT-46?

A: Yes, Form CT-46 must be filed within three years from the due date of the tax return for the taxable year in which the investment was made.

Q: What happens after I file Form CT-46?

A: After you file Form CT-46, the New York State Department of Taxation and Finance will review your claim and notify you of any adjustments or additional information required.

Q: Can I claim the Investment Tax Credit for investments made in previous years?

A: Yes, you may be able to claim the Investment Tax Credit for qualified investments made in previous years, as long as you meet the eligibility requirements.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New York State Department of Financial Services.