This version of the form is not currently in use and is provided for reference only. Download this version of

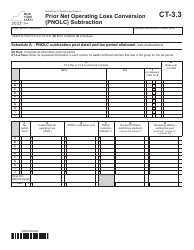

Form CT-3.2

for the current year.

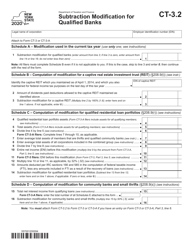

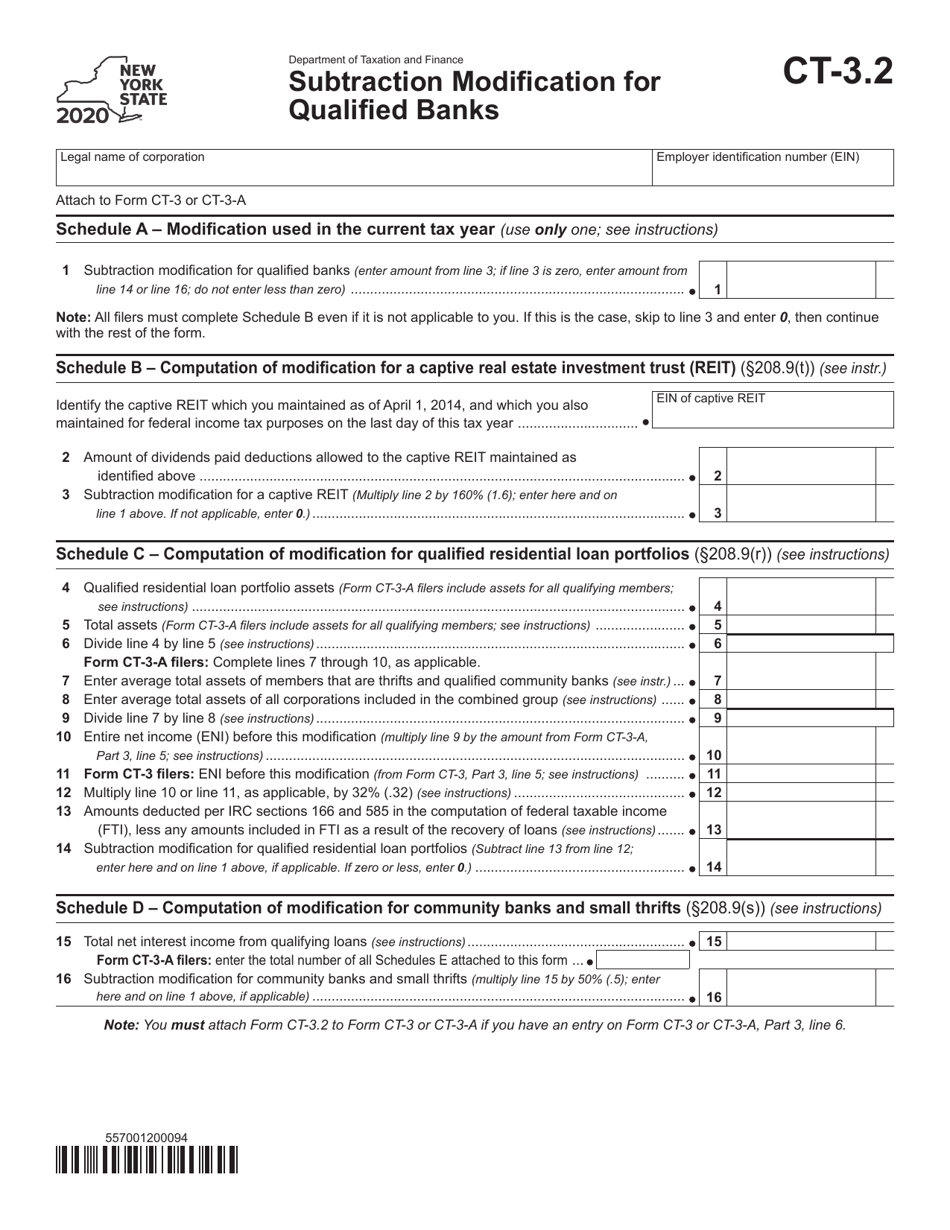

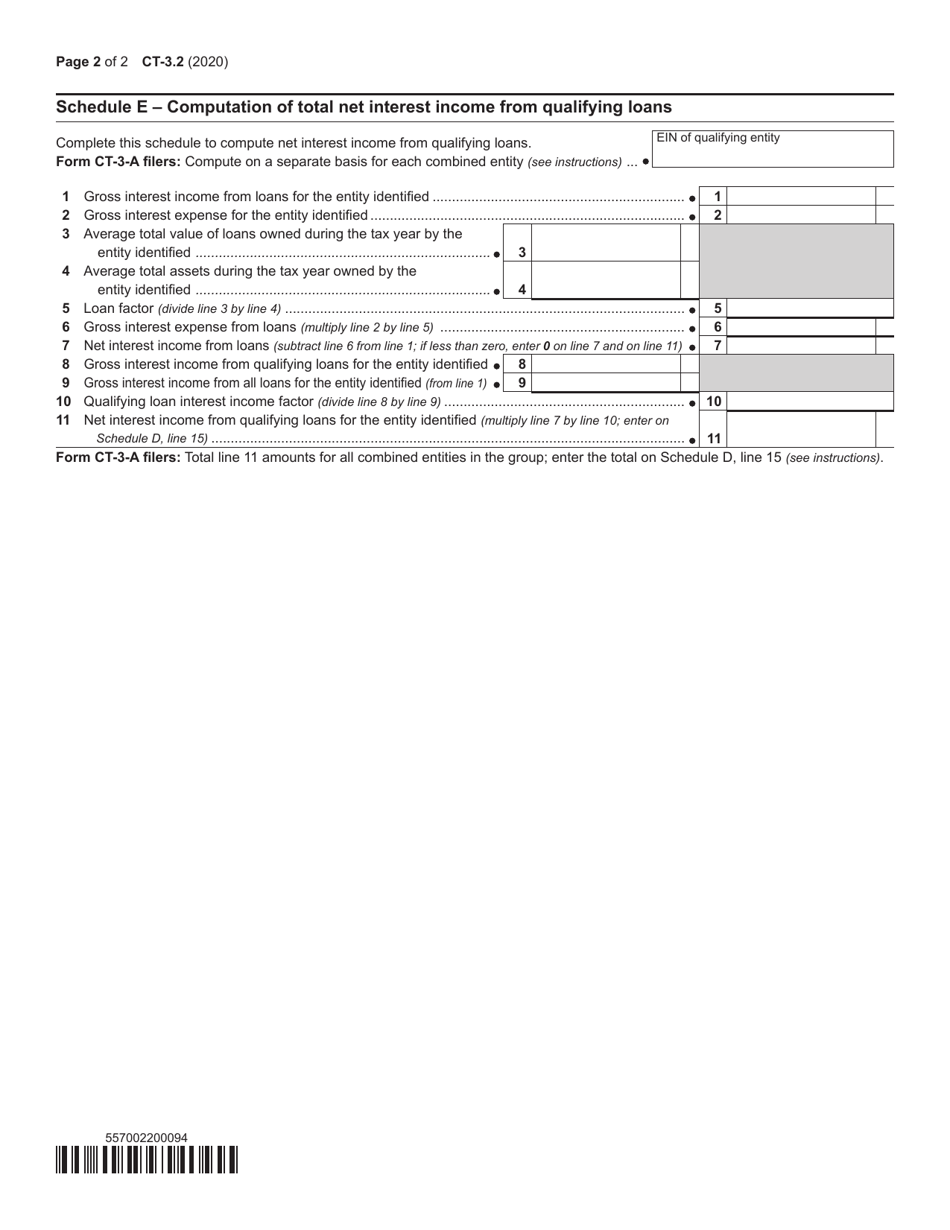

Form CT-3.2 Subtraction Modification for Qualified Banks - New York

What Is Form CT-3.2?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.2?

A: Form CT-3.2 is a tax form used for a subtraction modification for qualified banks in New York.

Q: Who needs to file Form CT-3.2?

A: Qualified banks in New York need to file Form CT-3.2.

Q: What is a subtraction modification?

A: A subtraction modification is an adjustment made to taxable income, reducing the amount of income subject to tax.

Q: What qualifies a bank for the subtraction modification?

A: Banks that meet certain criteria, such as being subject to the tax on banking corporations and meeting specific criteria related to capital, assets, liabilities, and other factors, may qualify for the subtraction modification.

Q: When is the deadline to file Form CT-3.2?

A: The deadline to file Form CT-3.2 is the same as the deadline for filing the corporation tax return, which is generally March 15th for calendar year taxpayers.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing of Form CT-3.2, including interest charges and penalties for failure to file or pay on time.

Q: Can Form CT-3.2 be filed electronically?

A: Yes, Form CT-3.2 can be filed electronically through the New York State Tax Department's e-file system.

Q: Are there any additional forms or documentation needed to file Form CT-3.2?

A: Banks filing Form CT-3.2 may need to include additional forms or documentation, such as supporting schedules or financial statements.

Q: What should I do if I have questions or need assistance with Form CT-3.2?

A: If you have questions or need assistance with Form CT-3.2, you can contact the New York State Tax Department for guidance and support.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.2 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.