This version of the form is not currently in use and is provided for reference only. Download this version of

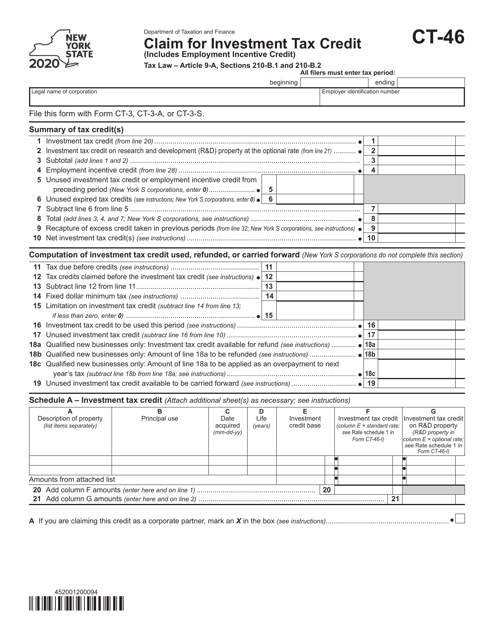

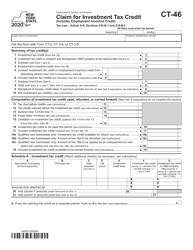

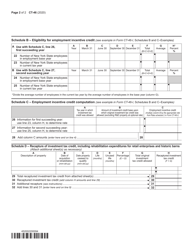

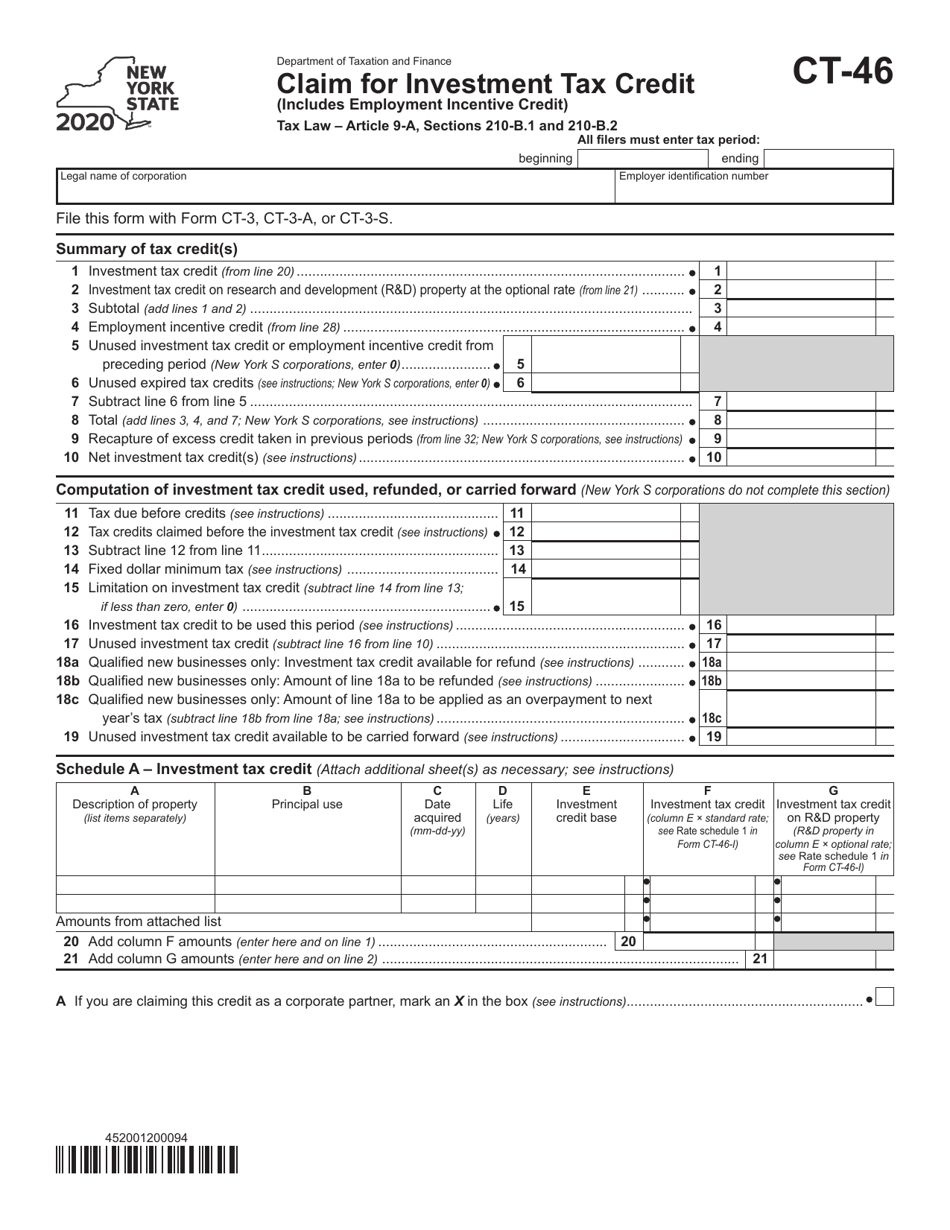

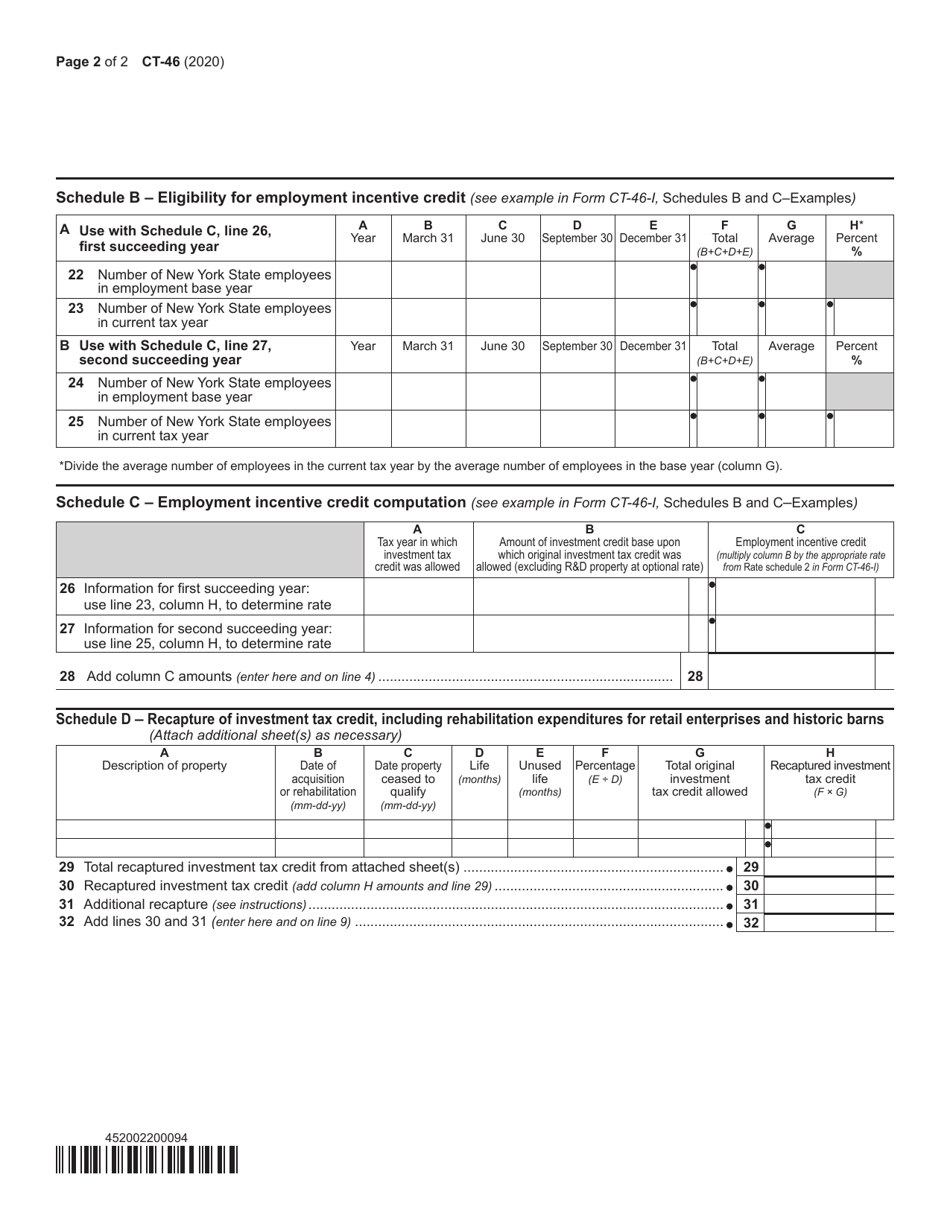

Form CT-46

for the current year.

Form CT-46 Claim for Investment Tax Credit (Includes Employment Incentive Credit) - New York

What Is Form CT-46?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-46?

A: Form CT-46 is a document used to claim the Investment Tax Credit in New York, which includes the Employment Incentive Credit.

Q: What is the Investment Tax Credit?

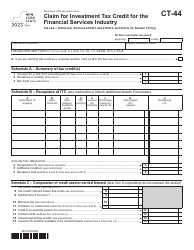

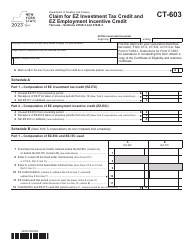

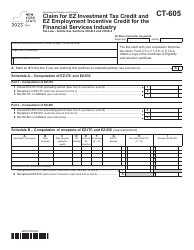

A: The Investment Tax Credit is a credit that provides tax incentives for certain businesses that make qualifying investments.

Q: What is the Employment Incentive Credit?

A: The Employment Incentive Credit is a credit that encourages job creation and retention in certain industries in New York.

Q: Who can use Form CT-46?

A: Businesses that are eligible for the Investment Tax Credit and/or the Employment Incentive Credit in New York can use Form CT-46.

Q: Are there any deadlines for filing Form CT-46?

A: Yes, the deadline for filing Form CT-46 depends on the specific tax year and is usually included in the instructions provided with the form.

Q: What information is required to complete Form CT-46?

A: To complete Form CT-46, you will need to provide information about your business, the qualifying investments made, and the number of eligible employees.

Q: What should I do after completing Form CT-46?

A: After completing Form CT-46, you should follow the instructions provided with the form to submit it to the New York State Department of Taxation and Finance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-46 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.