This version of the form is not currently in use and is provided for reference only. Download this version of

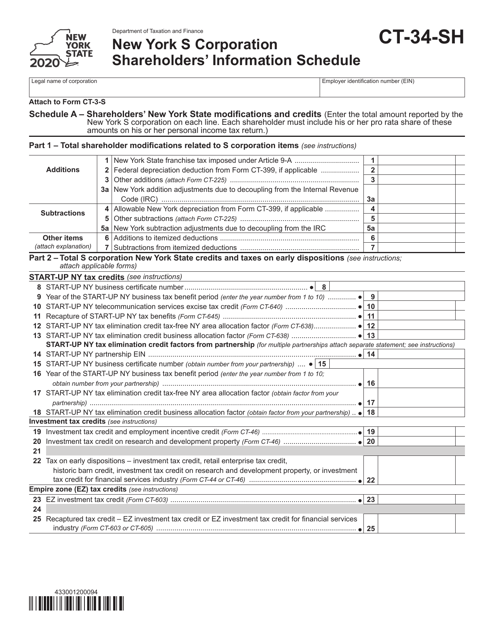

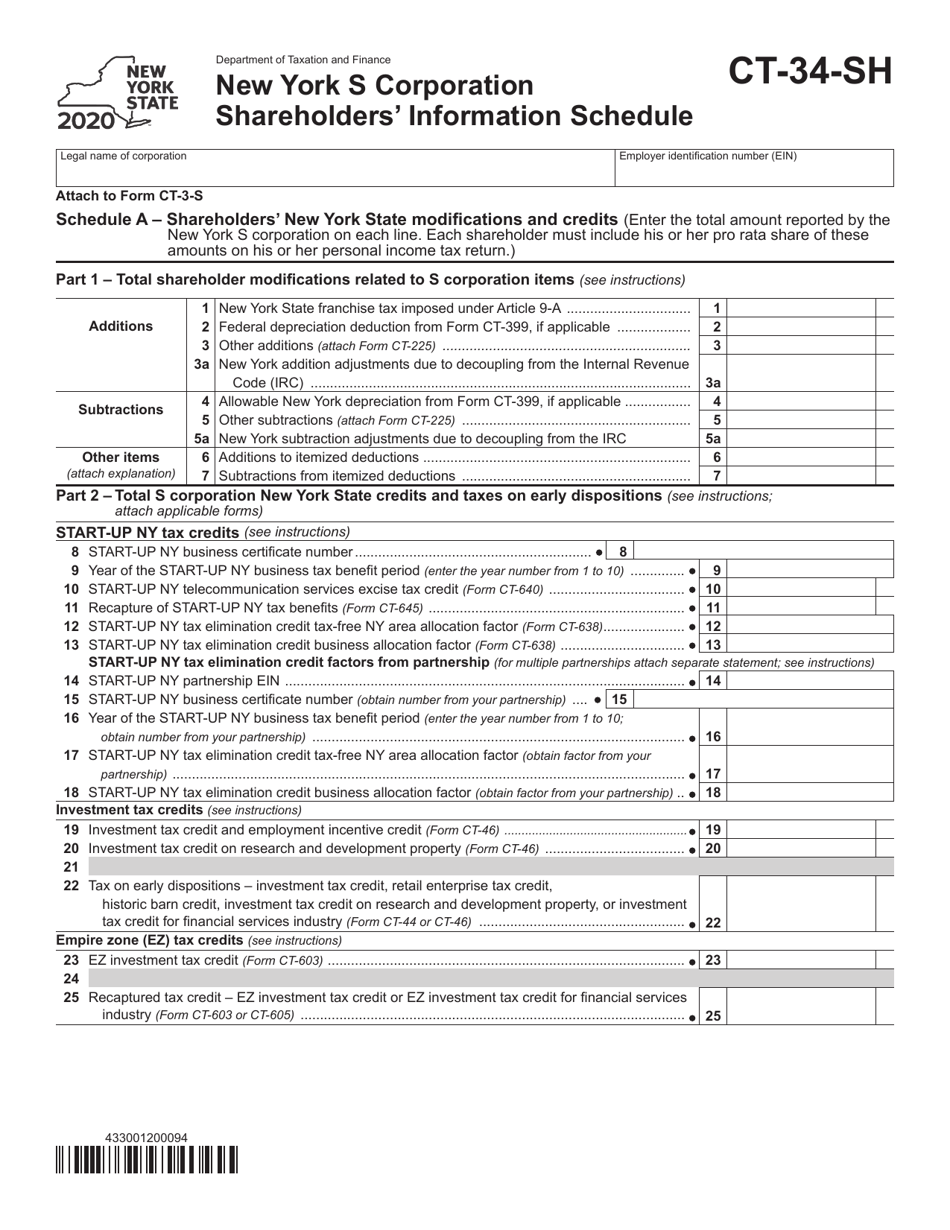

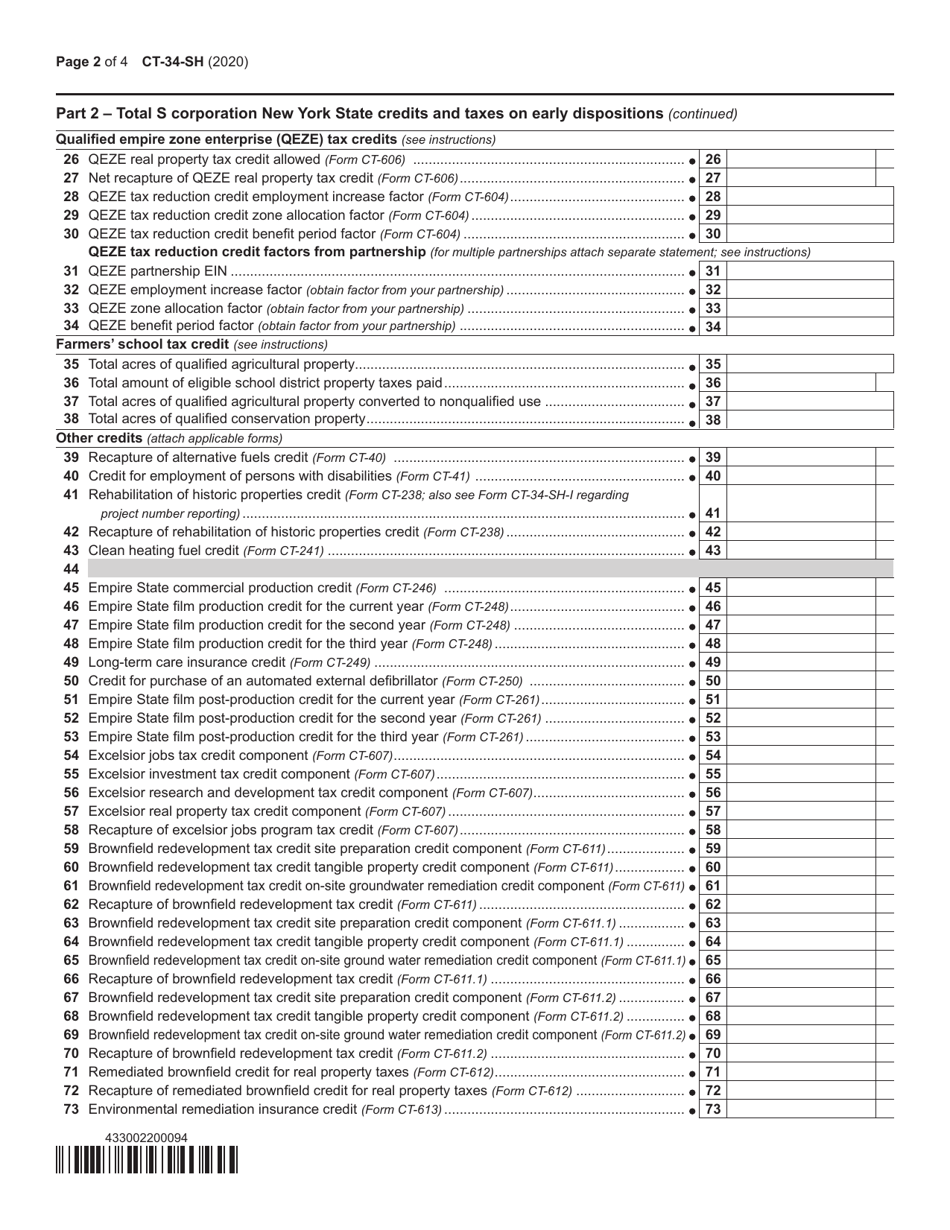

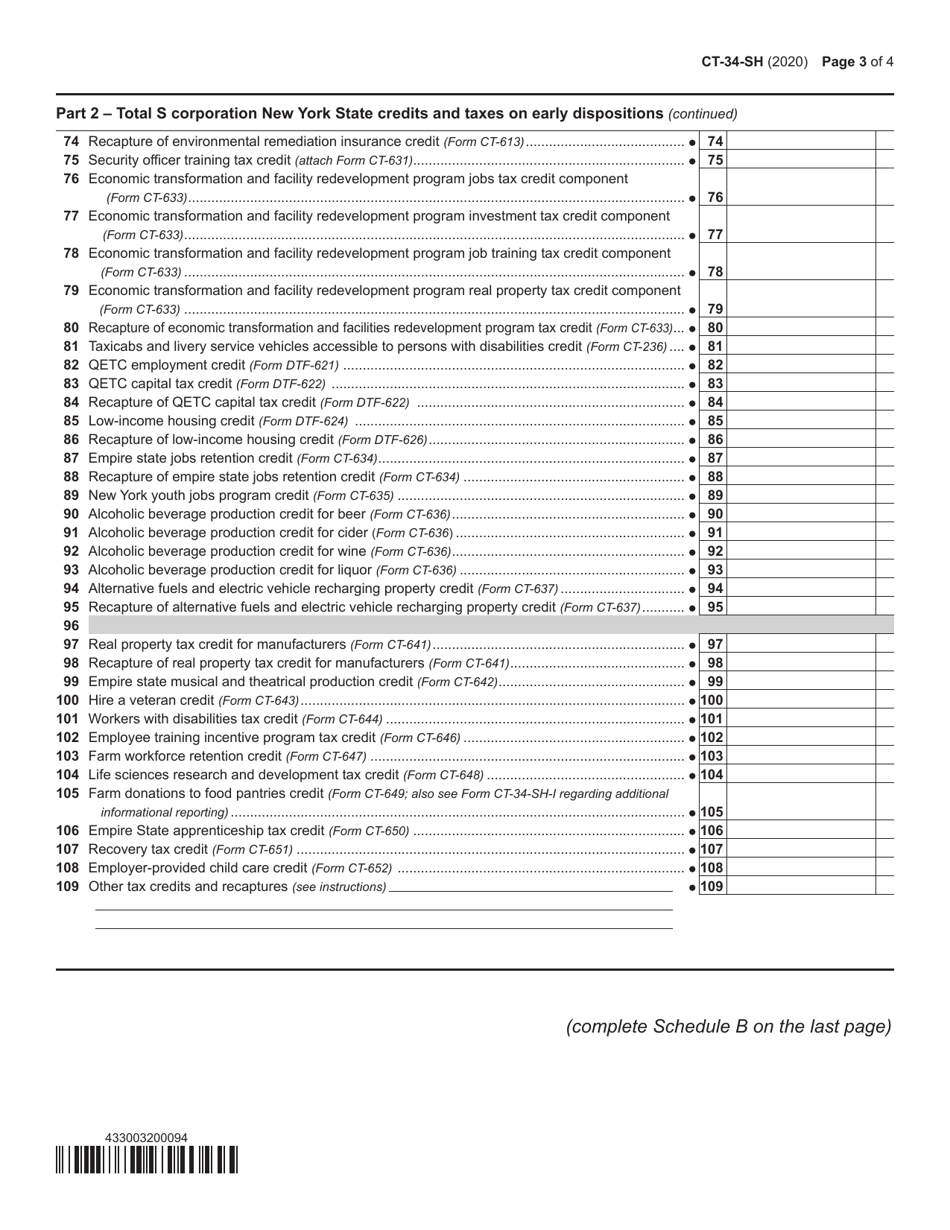

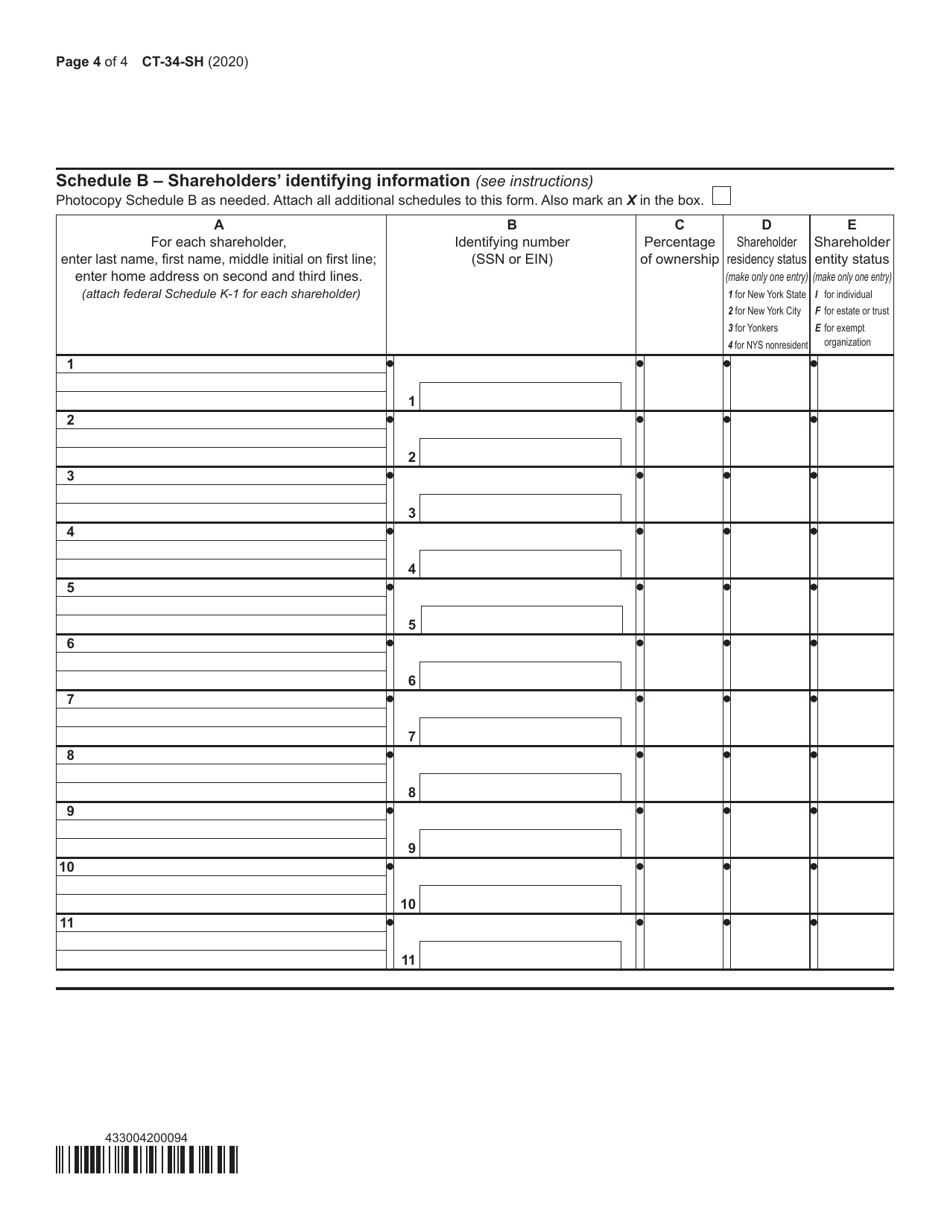

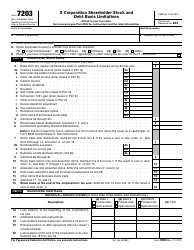

Form CT-34-SH

for the current year.

Form CT-34-SH New York S Corporation Shareholders' Information Schedule - New York

What Is Form CT-34-SH?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-34-SH?

A: Form CT-34-SH is the New York S Corporation Shareholders' Information Schedule.

Q: What is the purpose of Form CT-34-SH?

A: The purpose of Form CT-34-SH is to provide information about the shareholders of a New York S Corporation.

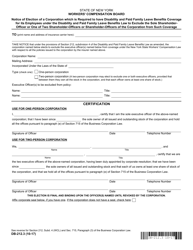

Q: Who needs to file Form CT-34-SH?

A: Any New York S Corporation is required to file Form CT-34-SH.

Q: When is Form CT-34-SH due?

A: Form CT-34-SH is due on March 15th following the end of the tax year for which it is being filed.

Q: Is there a penalty for not filing Form CT-34-SH?

A: Yes, there is a penalty for not filing Form CT-34-SH in a timely manner.

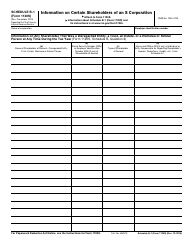

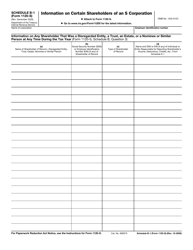

Q: What information is required on Form CT-34-SH?

A: Form CT-34-SH requires information about the shareholders' names, addresses, social security numbers, and percentage of ownership.

Q: Can Form CT-34-SH be filed electronically?

A: Yes, Form CT-34-SH can be filed electronically through the New York State Department of Taxation and Finance's e-filing system.

Q: Do I need to include Form CT-34-SH with my tax return?

A: Yes, Form CT-34-SH should be included with your New York S Corporation tax return.

Q: Can I amend my Form CT-34-SH if I made a mistake?

A: Yes, you can amend your Form CT-34-SH if you made a mistake or need to update the information provided.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-34-SH by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.