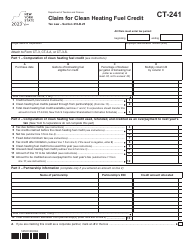

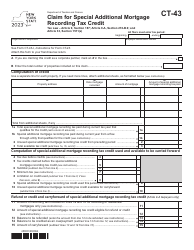

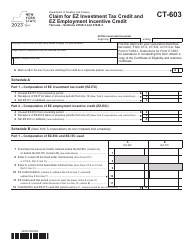

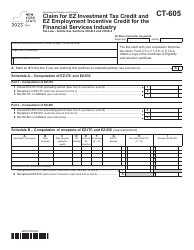

This version of the form is not currently in use and is provided for reference only. Download this version of

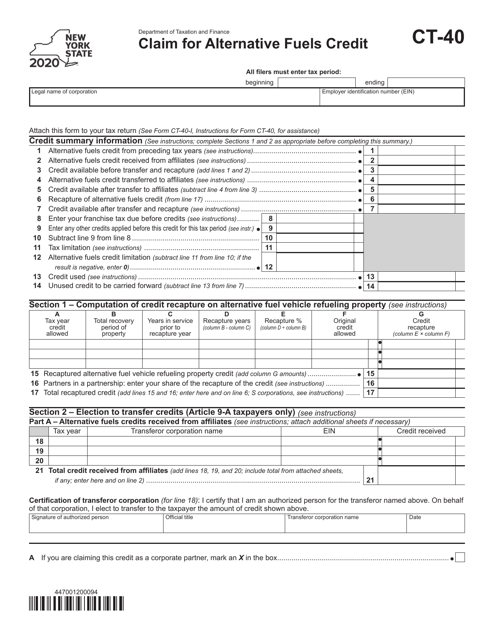

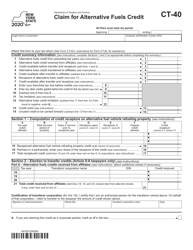

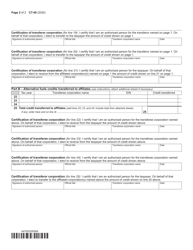

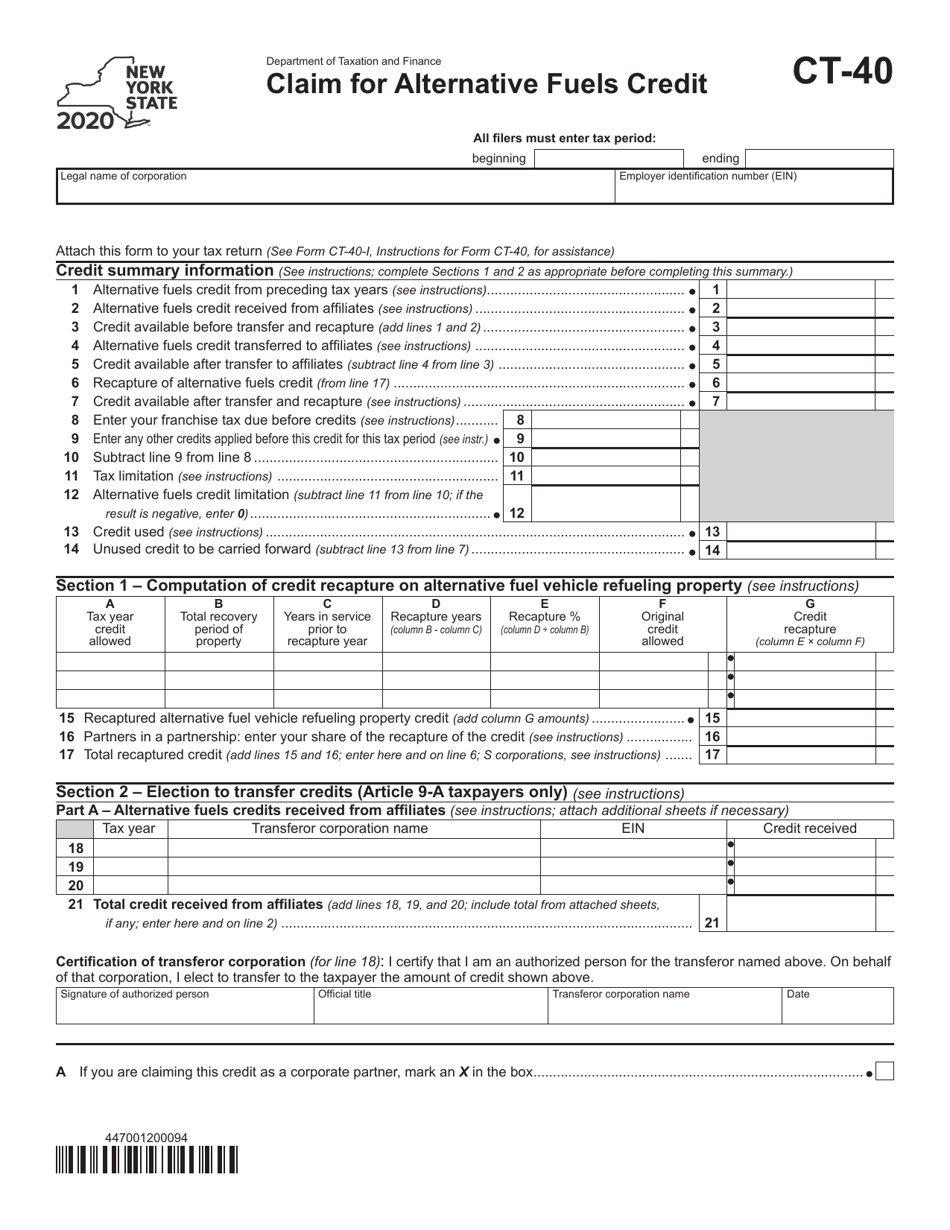

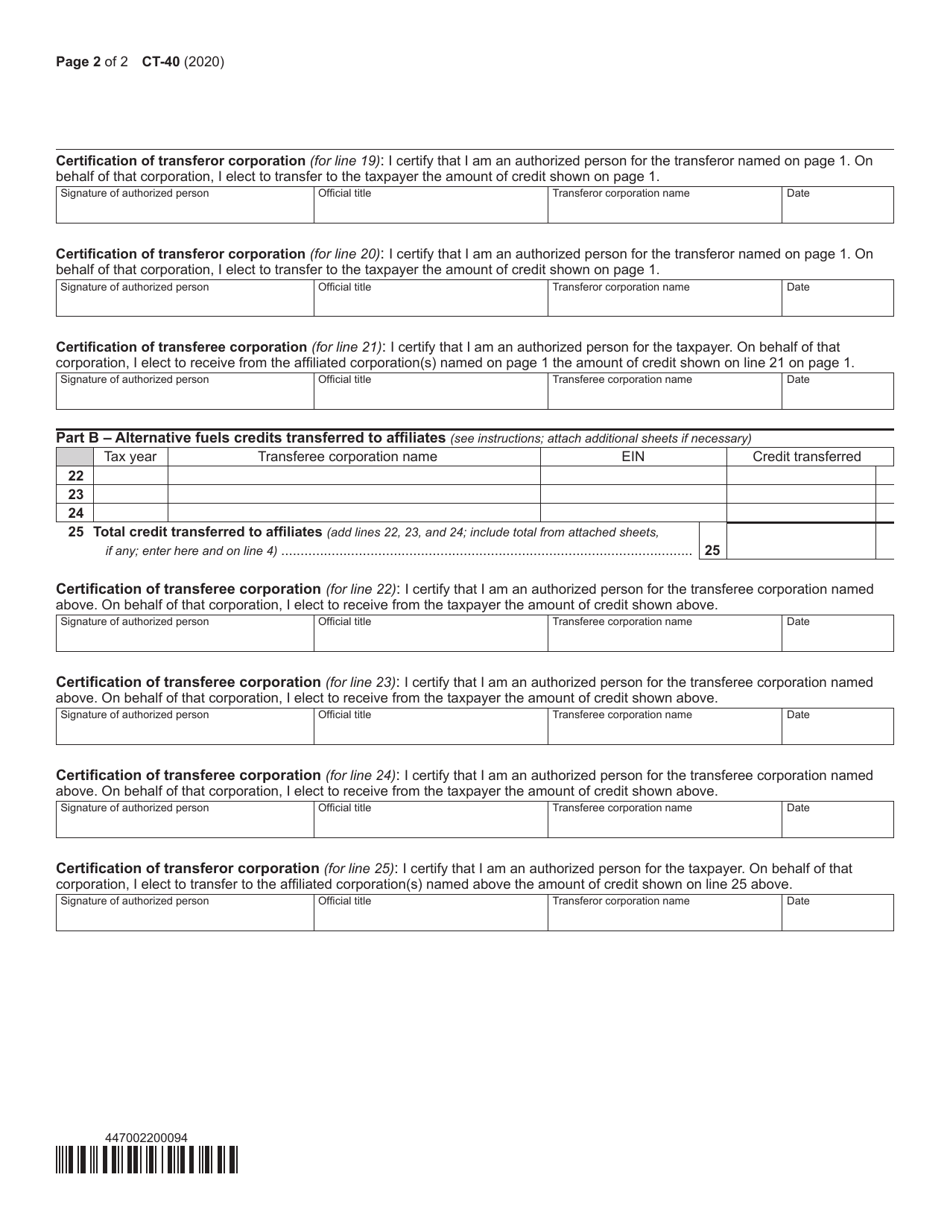

Form CT-40

for the current year.

Form CT-40 Claim for Alternative Fuels Credit - New York

What Is Form CT-40?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-40?

A: Form CT-40 is the claim form for the Alternative Fuels Credit in New York.

Q: What is the Alternative Fuels Credit?

A: The Alternative Fuels Credit is a tax credit in New York that provides incentives for using alternative fuels.

Q: Who can file Form CT-40?

A: Individuals, corporations, partnerships, and other entities that use alternative fuels in New York may file Form CT-40.

Q: What information is required on Form CT-40?

A: Form CT-40 requires information on the type and amount of alternative fuel used, as well as supporting documentation.

Q: When is Form CT-40 due?

A: Form CT-40 is due on or before the due date of your New York state tax return.

Q: Are there any limitations or restrictions for claiming the Alternative Fuels Credit?

A: Yes, there are limitations and restrictions for claiming the Alternative Fuels Credit, such as a cap on the credit amount and requirements for qualifying alternative fuels.

Q: Can I claim the Alternative Fuels Credit if I use alternative fuels in a vehicle or equipment that is not registered in New York?

A: No, the Alternative Fuels Credit is only available for vehicles or equipment that are registered and operated in New York.

Q: Is the Alternative Fuels Credit refundable?

A: No, the Alternative Fuels Credit is not refundable, but any excess credit can be carried forward to future tax years.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-40 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.