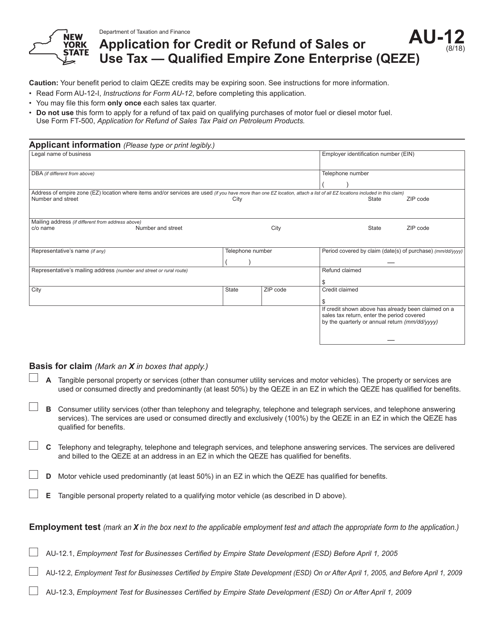

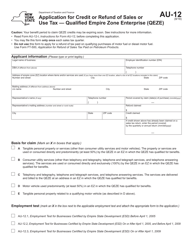

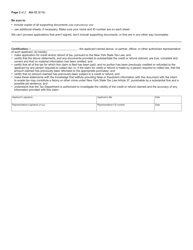

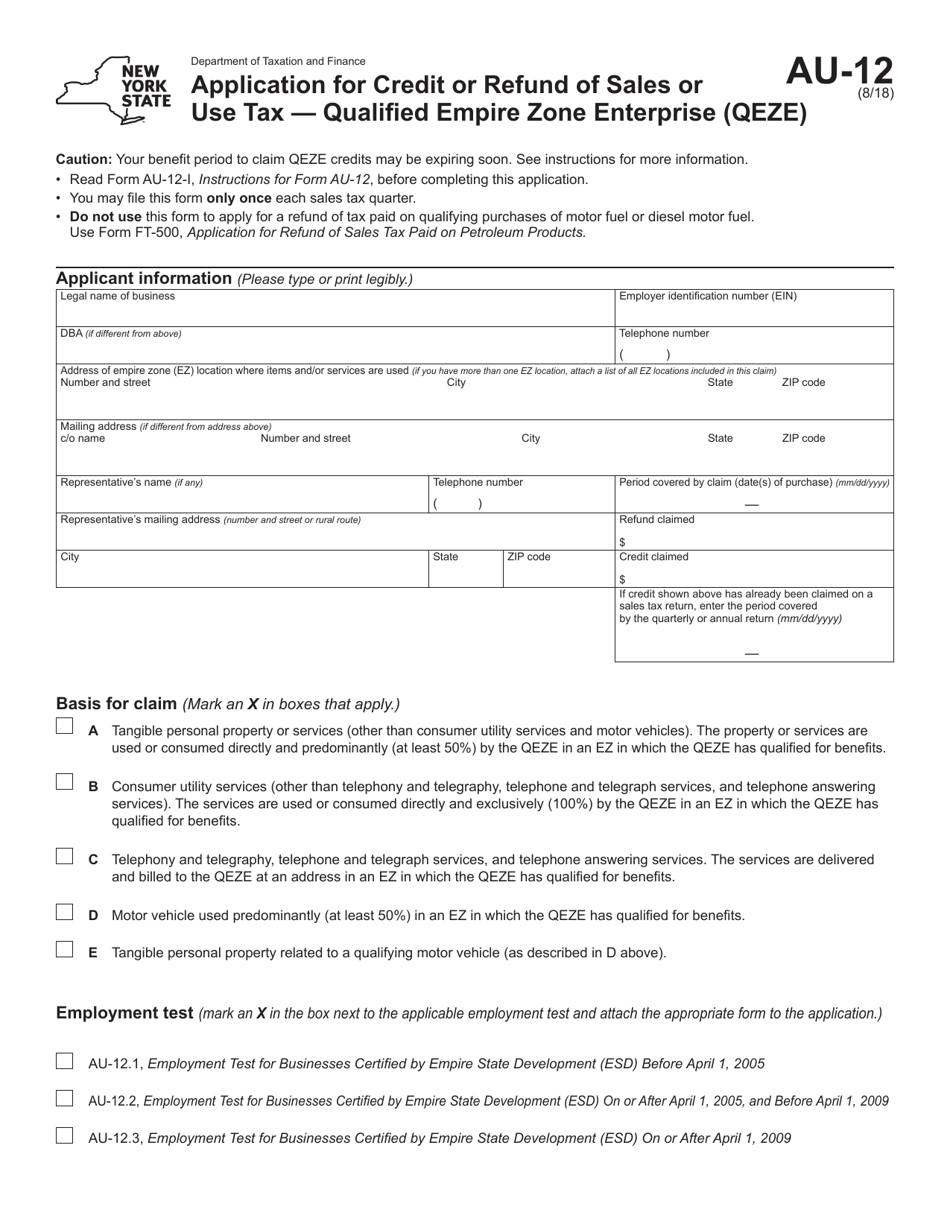

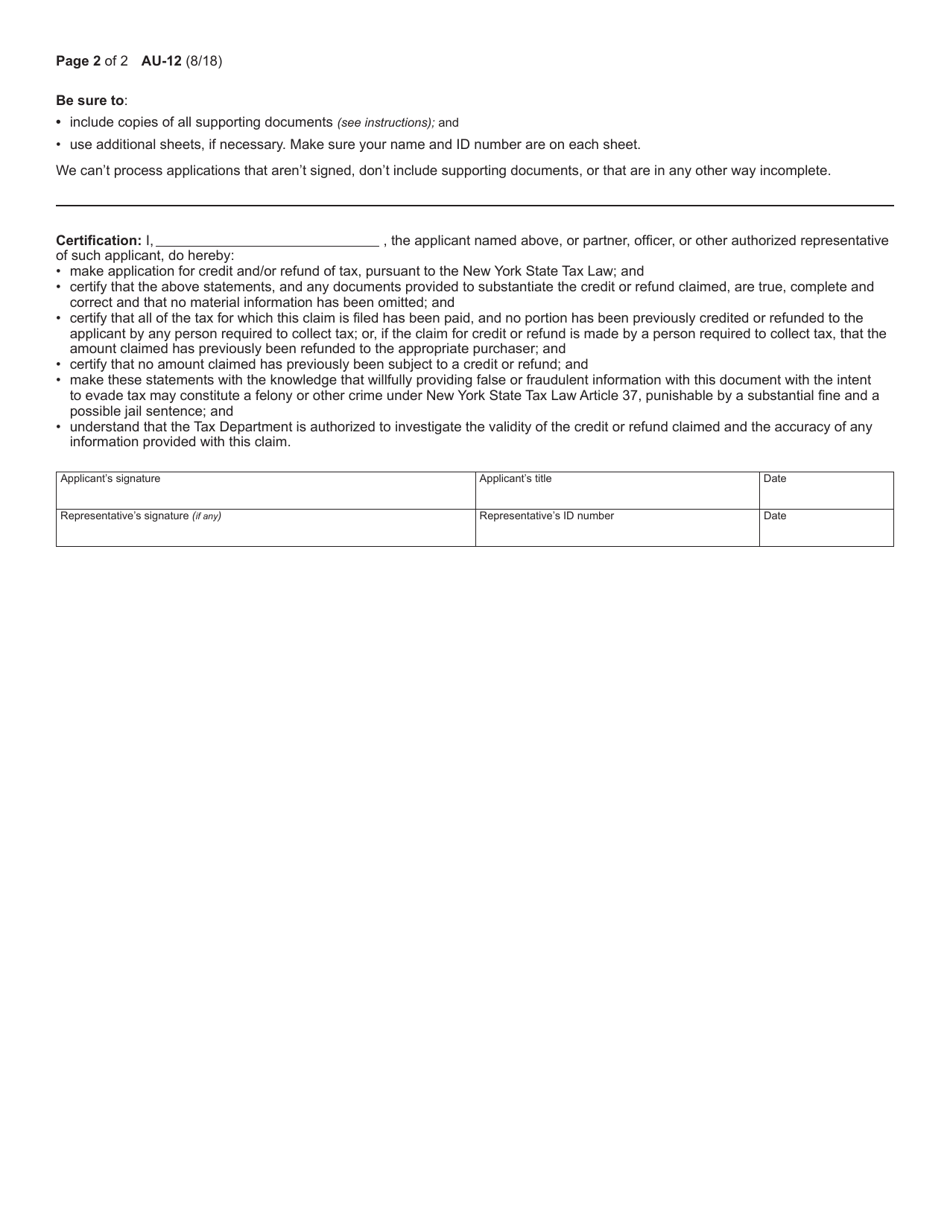

Form AU-12 Application for Credit or Refund of Sales or Use Tax - Qualified Empire Zone Enterprise (Qeze) - New York

What Is Form AU-12?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form AU-12?

A: Form AU-12 is an application used to request credit or refund of sales or use tax.

Q: Who can use Form AU-12?

A: Form AU-12 is specifically for Qualified Empire Zone Enterprises (QEZE) in New York.

Q: What is a Qualified Empire Zone Enterprise (QEZE)?

A: A QEZE is a business located in a designated Empire Zone that meets certain criteria.

Q: What is the purpose of Form AU-12?

A: The purpose of Form AU-12 is to claim a credit or refund of sales or use tax paid by a QEZE.

Q: What information is required on Form AU-12?

A: Form AU-12 requires information about the QEZE, including its name, address, and certification number, as well as details about the sales or use tax paid.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form AU-12 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.