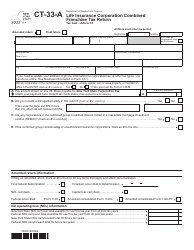

This version of the form is not currently in use and is provided for reference only. Download this version of

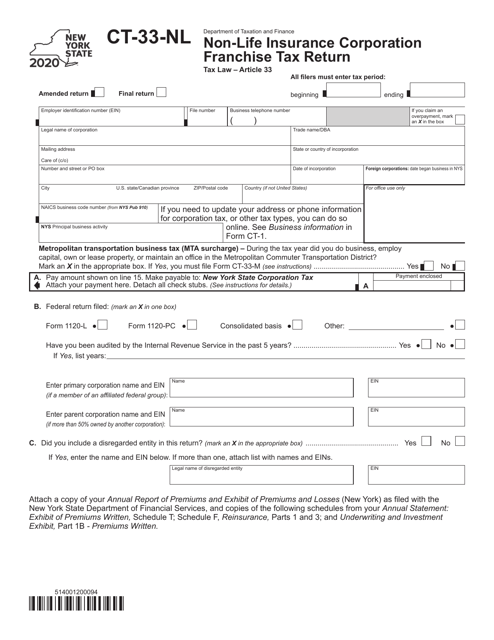

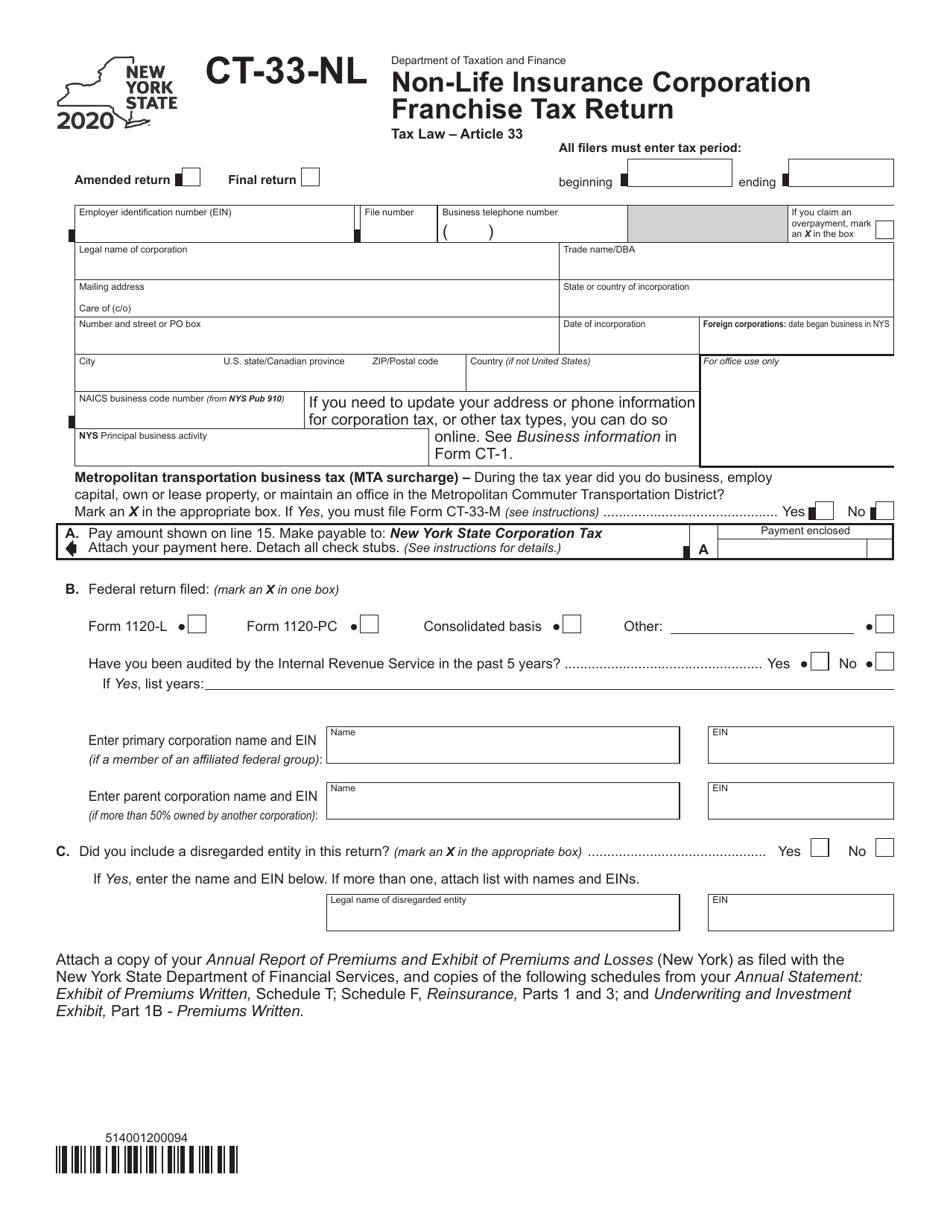

Form CT-33-NL

for the current year.

Form CT-33-NL Non-life Insurance Corporation Franchise Tax Return - New York

What Is Form CT-33-NL?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33-NL?

A: Form CT-33-NL is the Non-life Insurance CorporationFranchise Tax Return form for companies operating in New York.

Q: Who needs to file Form CT-33-NL?

A: Non-life insurance corporations conducting business in New York need to file Form CT-33-NL.

Q: What is the purpose of Form CT-33-NL?

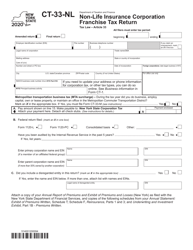

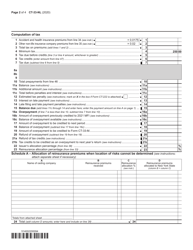

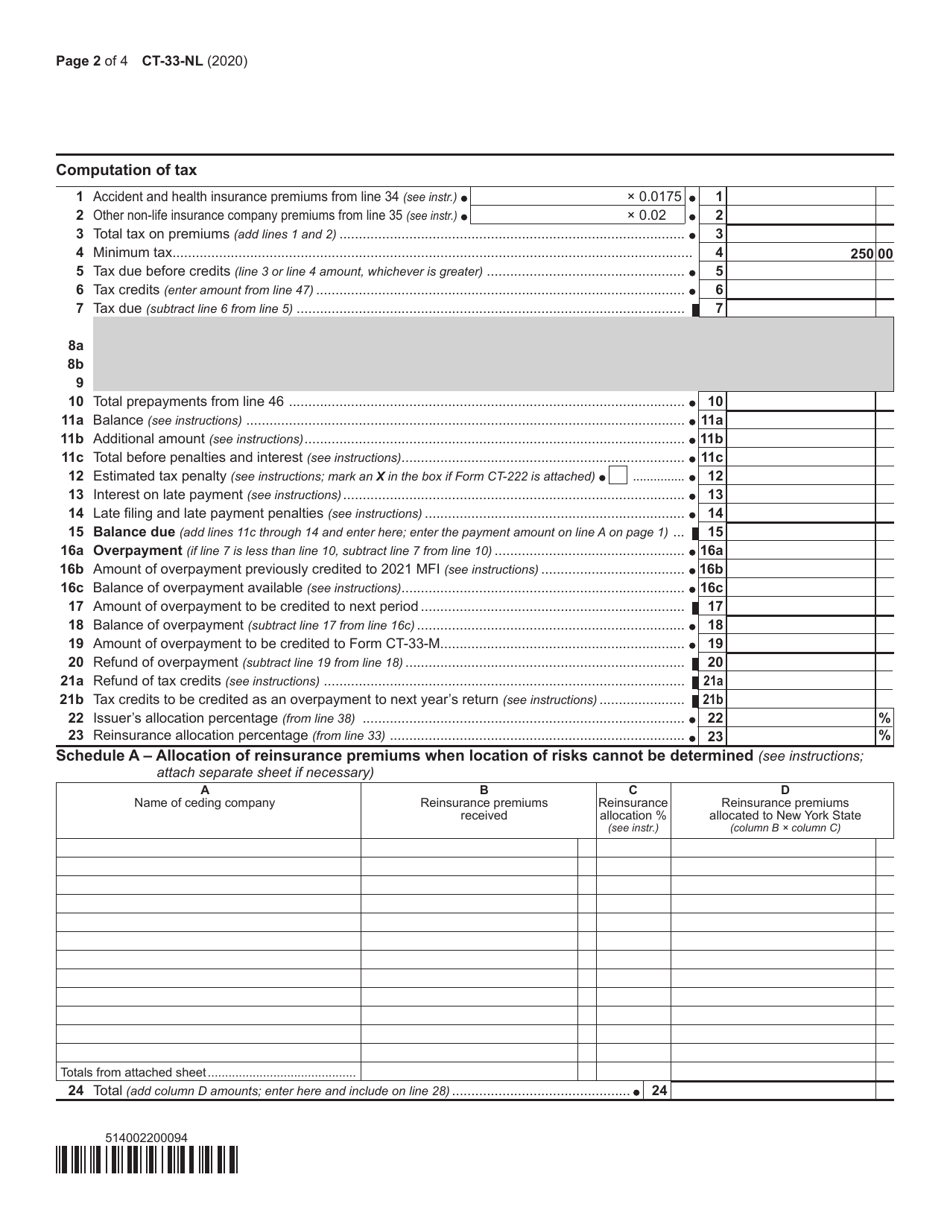

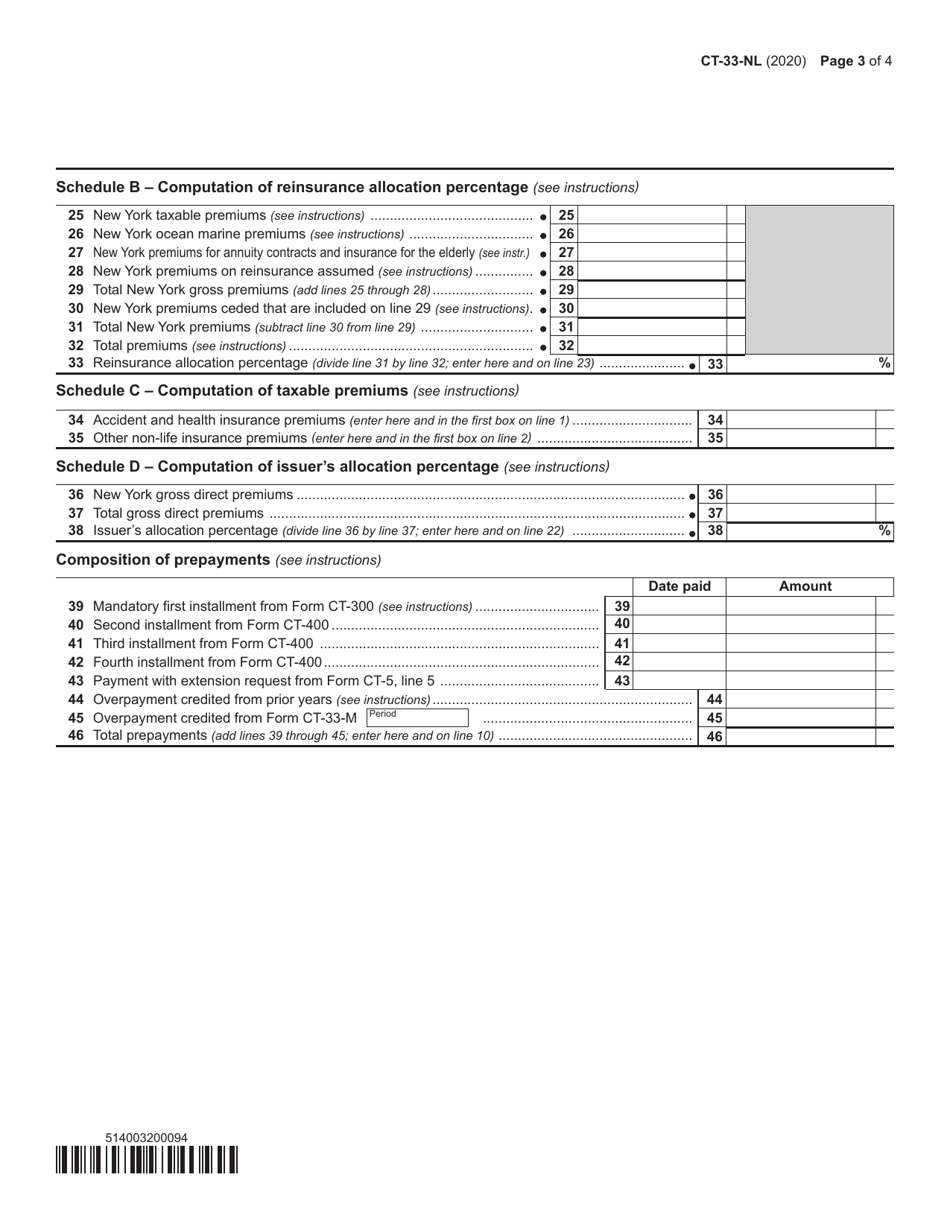

A: Form CT-33-NL is used to calculate and report the franchise tax liability for non-life insurance corporations in New York.

Q: When is Form CT-33-NL due?

A: Form CT-33-NL is due on or before March 15th following the close of the tax year.

Q: Are there any penalties for late filing?

A: Yes, there are penalties for late filing or failure to file Form CT-33-NL.

Q: Are there any special instructions or requirements for completing Form CT-33-NL?

A: Yes, non-life insurance corporations should carefully review the instructions provided with the form to ensure accurate completion and calculation of the franchise tax liability.

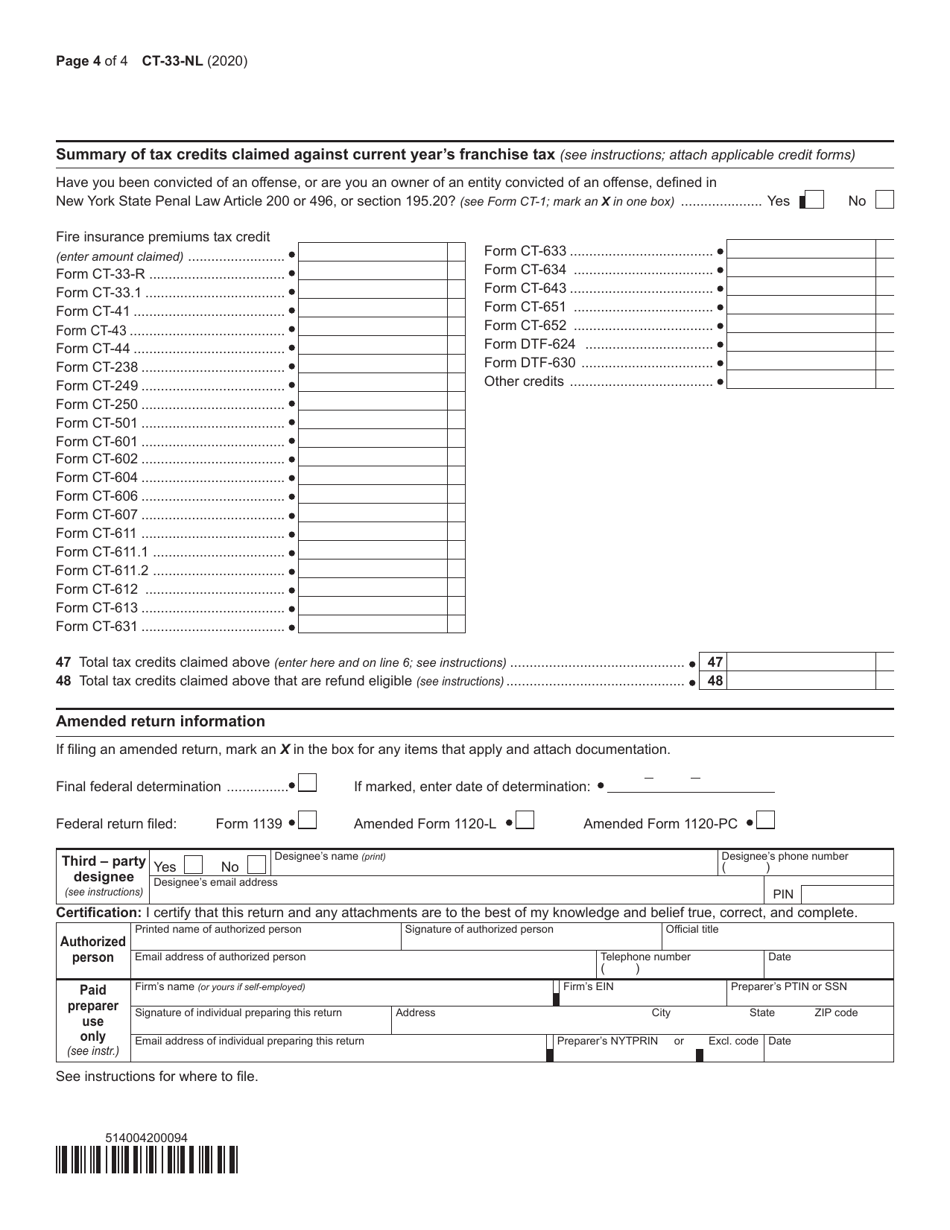

Q: Can I claim any deductions or credits on Form CT-33-NL?

A: Yes, non-life insurance corporations may be eligible for certain deductions and credits which can be claimed on Form CT-33-NL. The instructions provide details on available deductions and credits.

Q: What should I do if I have questions or need assistance with Form CT-33-NL?

A: For questions or assistance with Form CT-33-NL, you can contact the New York State Department of Taxation and Finance or consult a tax professional.

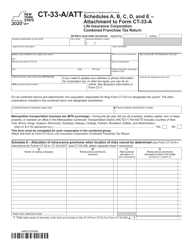

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33-NL by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.