This version of the form is not currently in use and is provided for reference only. Download this version of

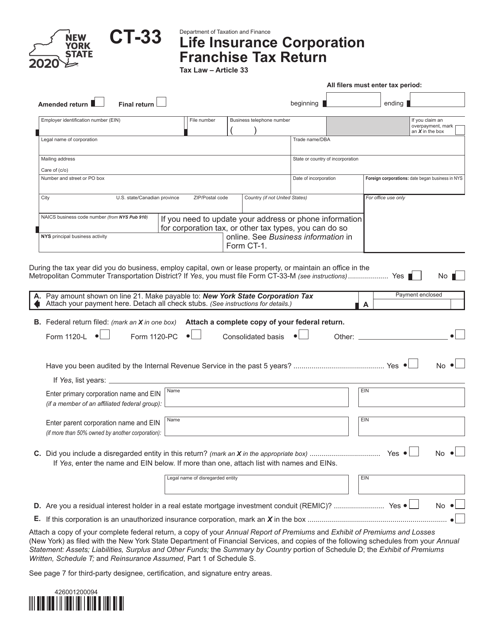

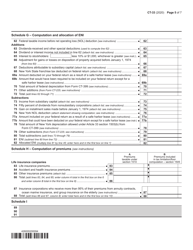

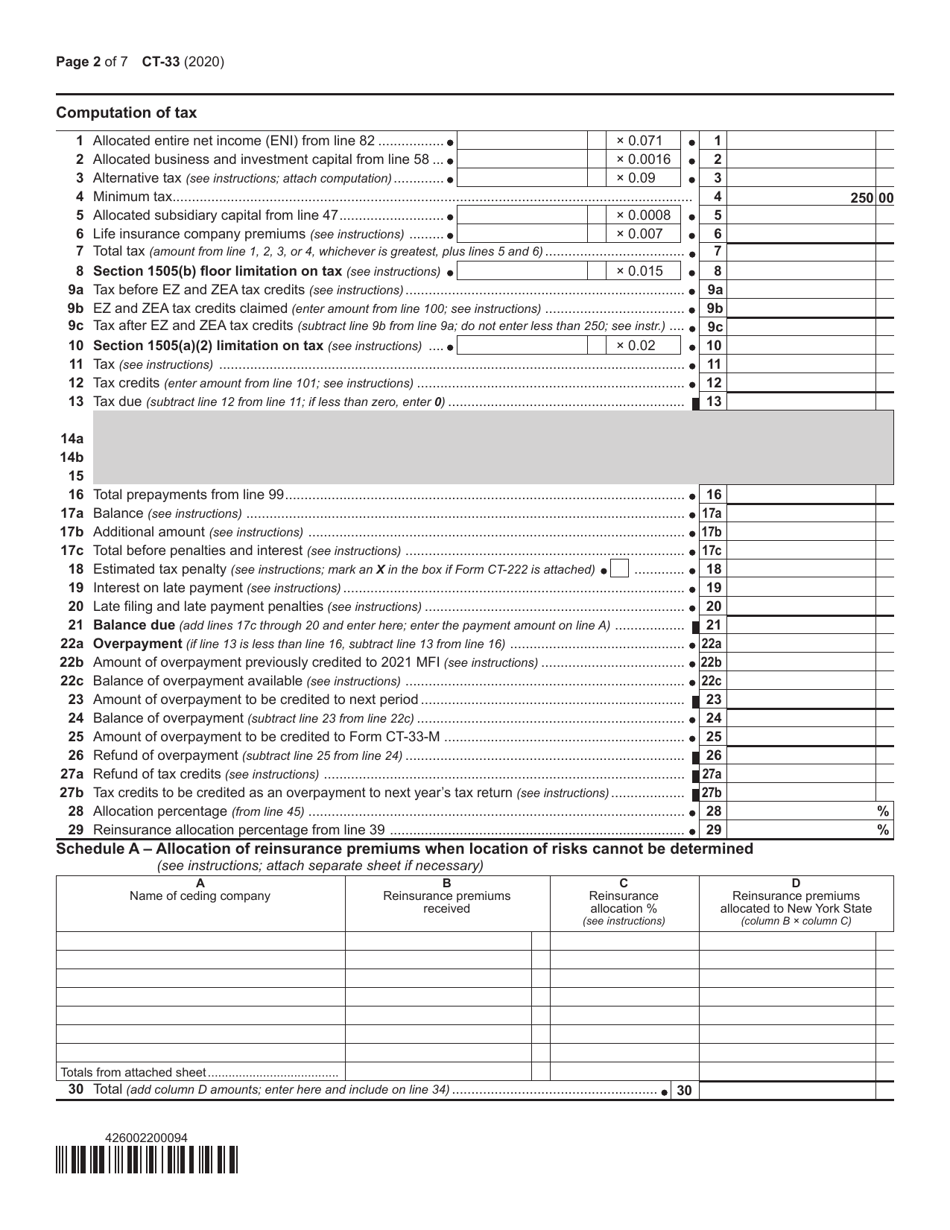

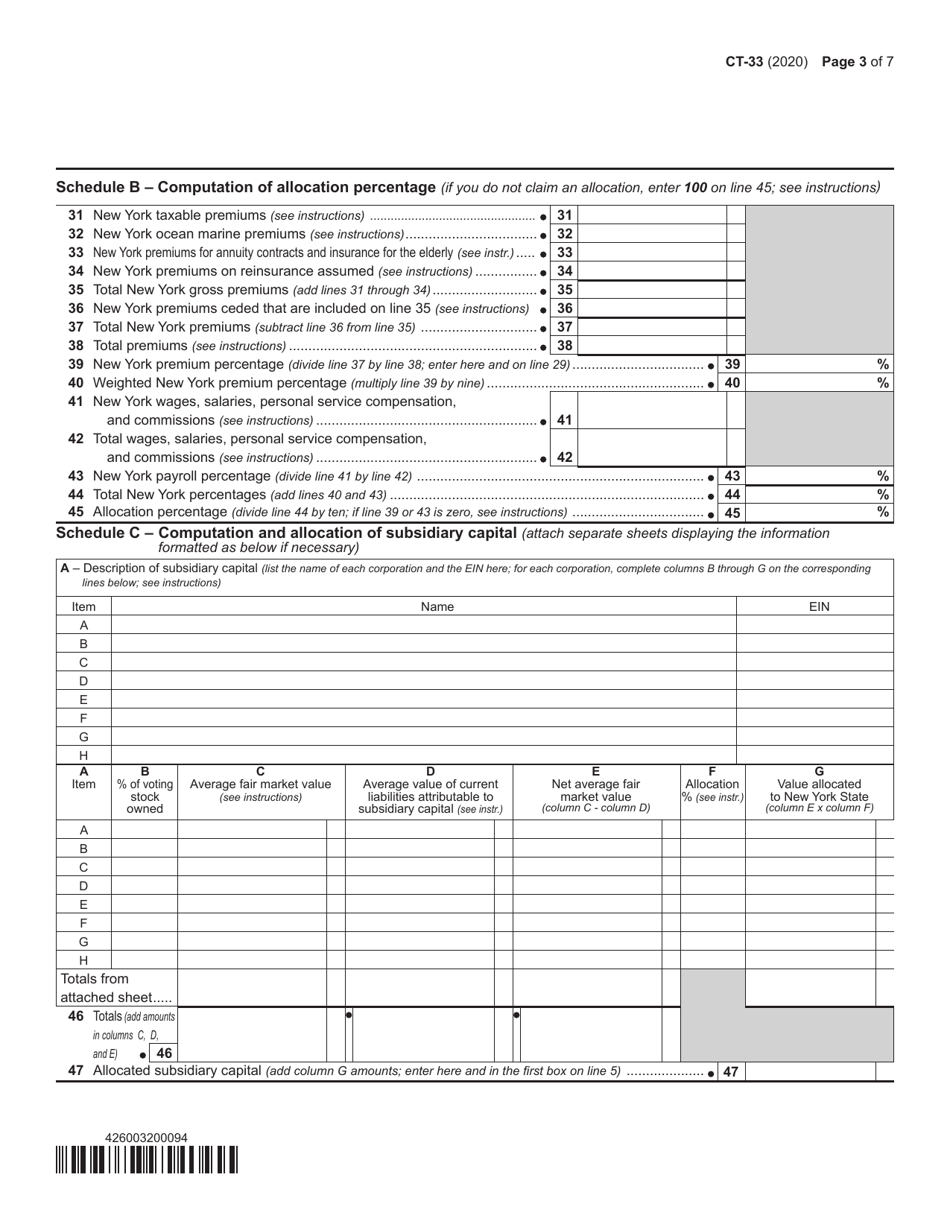

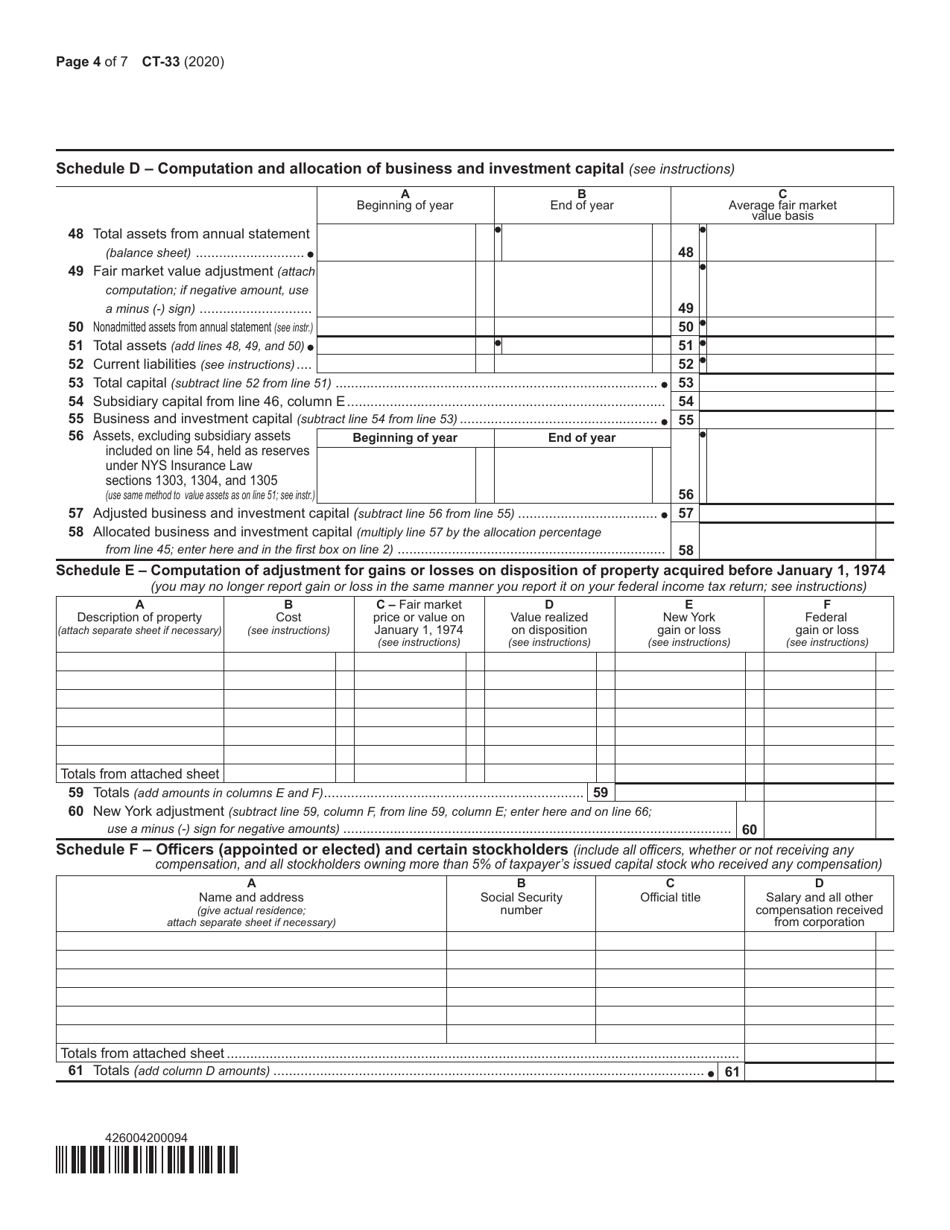

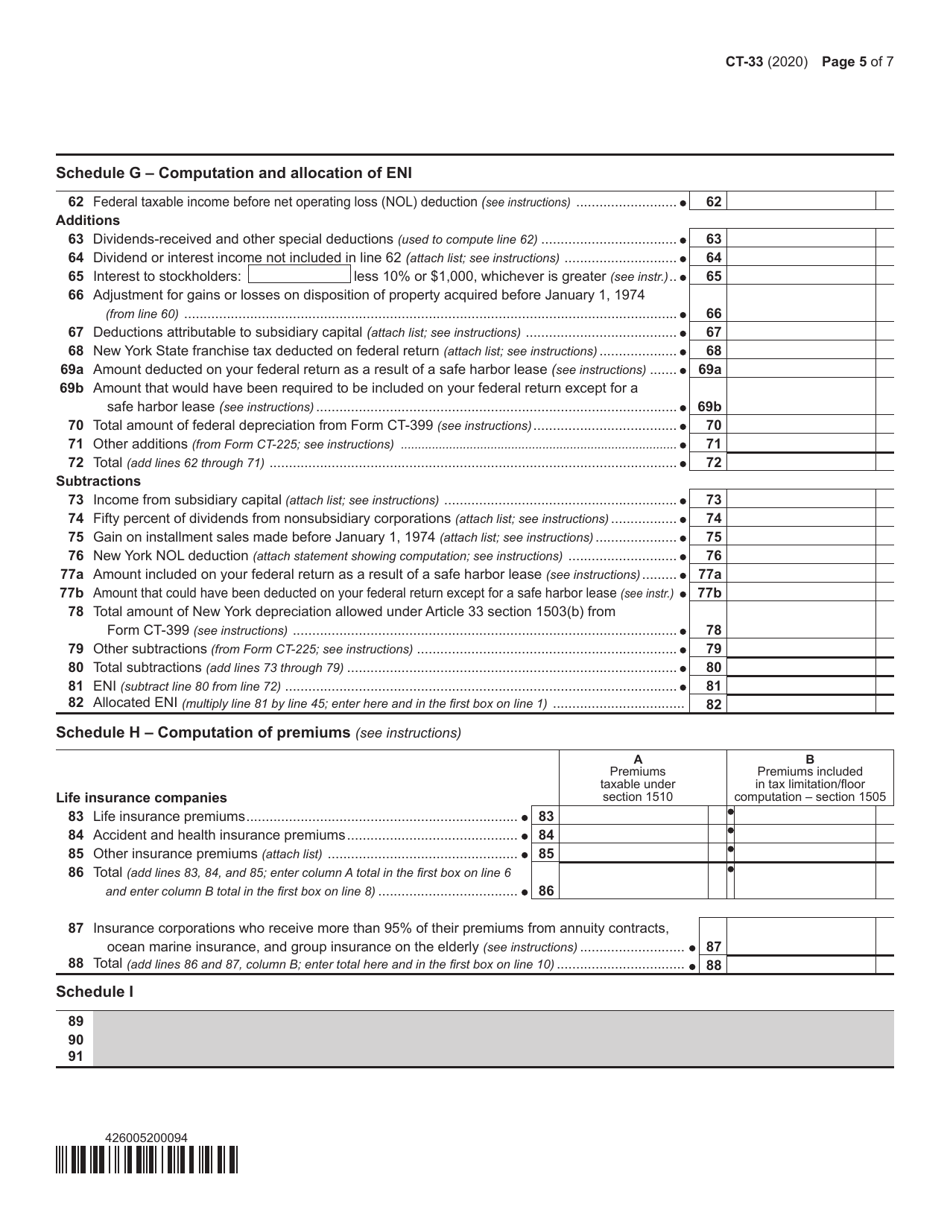

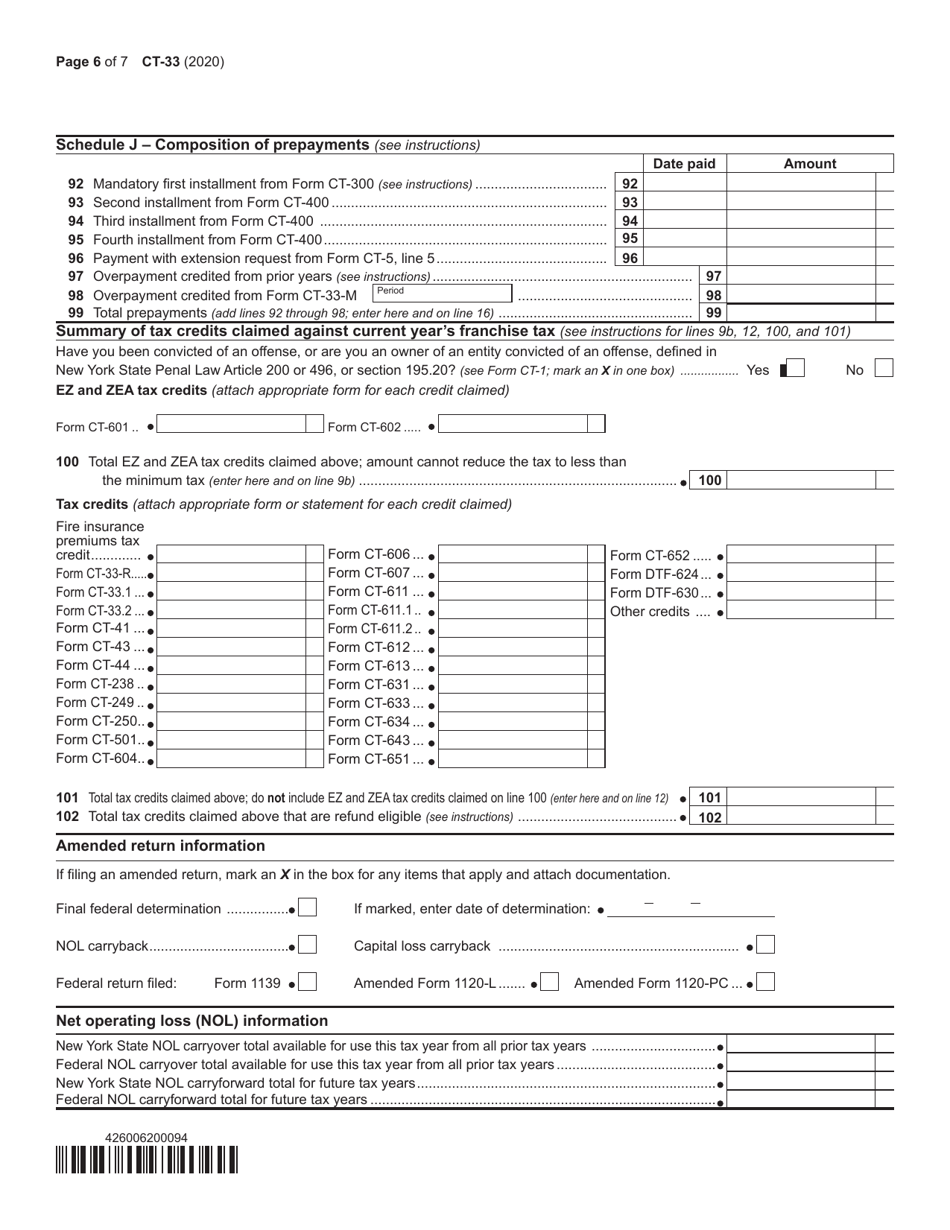

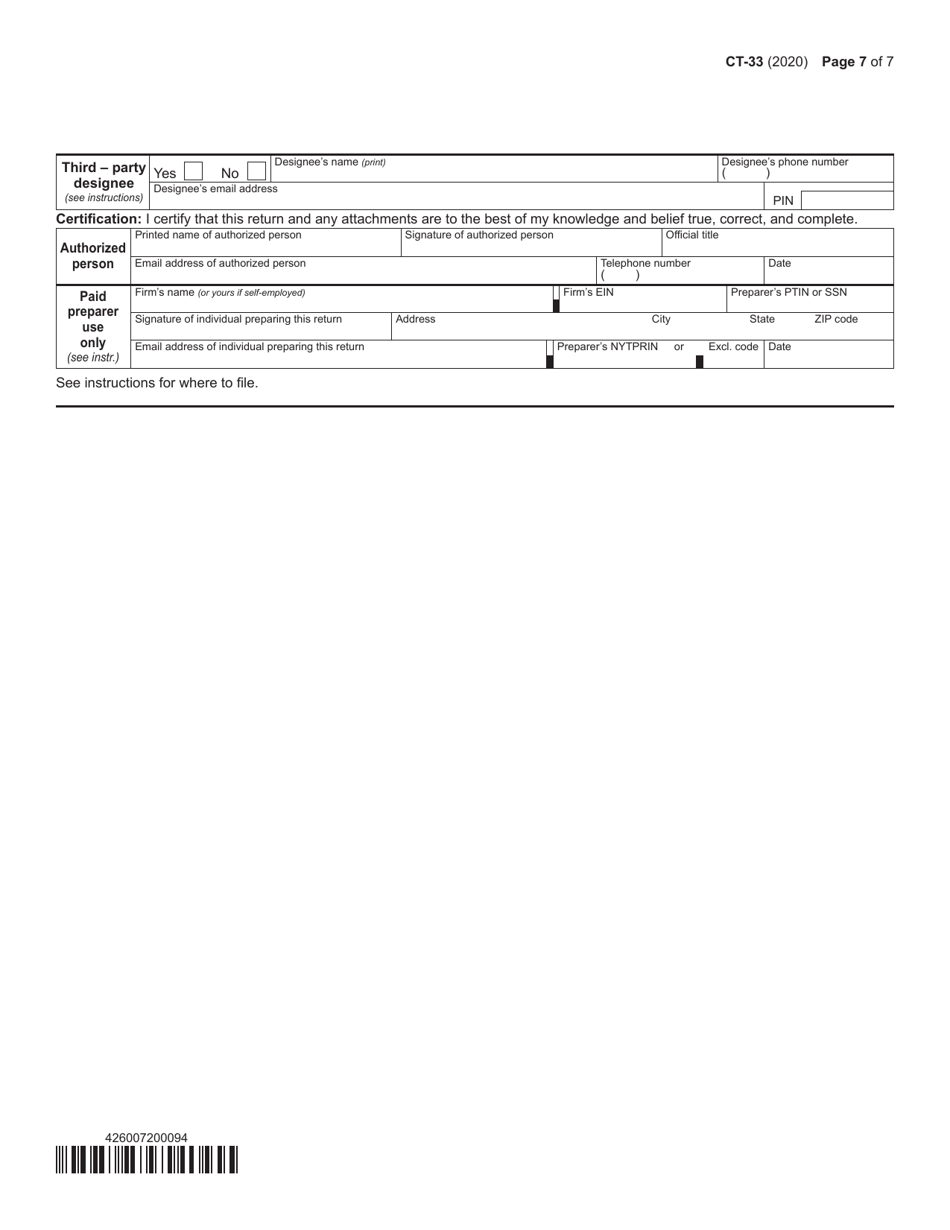

Form CT-33

for the current year.

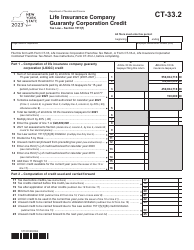

Form CT-33 Life Insurance Corporation Franchise Tax Return - New York

What Is Form CT-33?

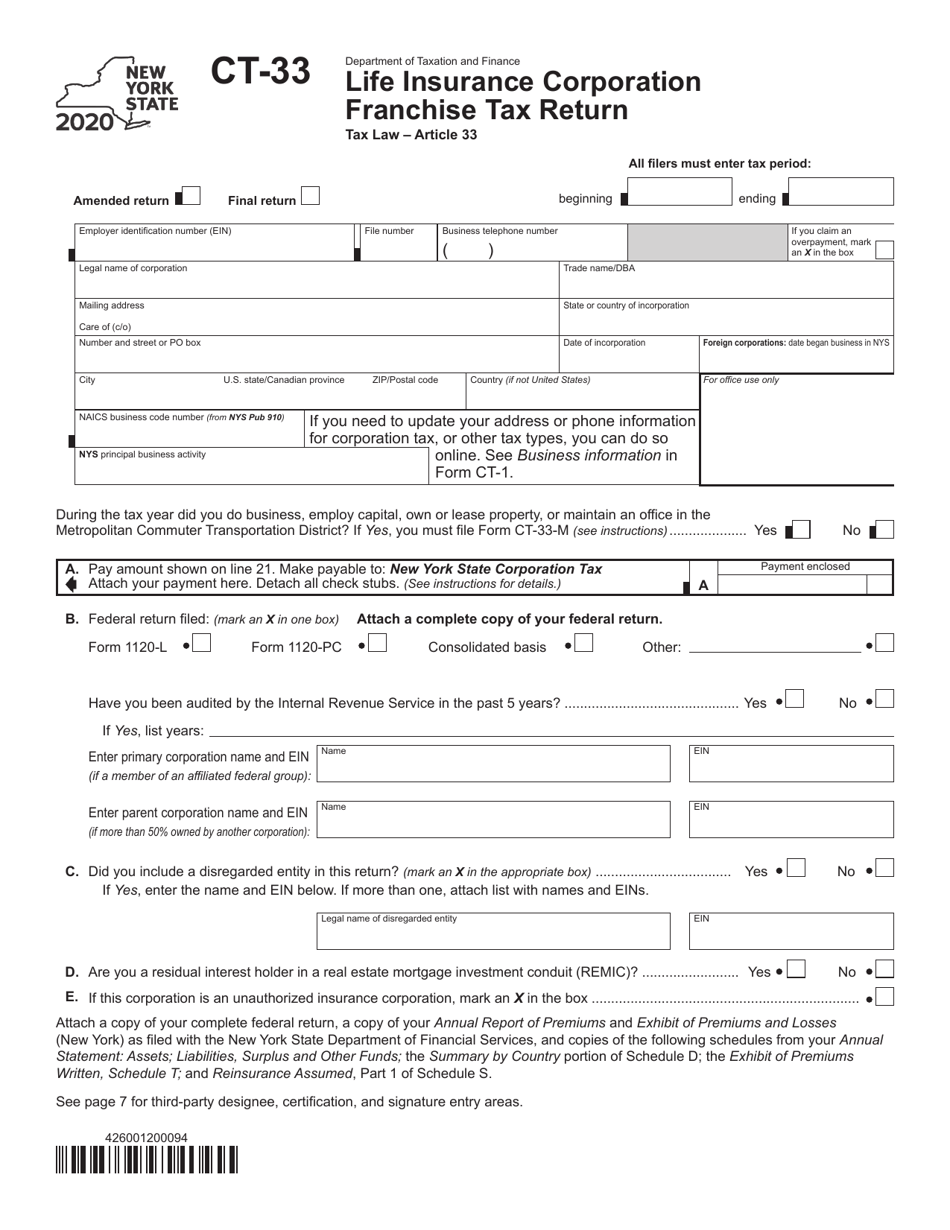

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-33?

A: Form CT-33 is the Life Insurance CorporationFranchise Tax Return for New York.

Q: Who needs to file Form CT-33?

A: Life Insurance Corporations in New York need to file Form CT-33.

Q: What is the purpose of Form CT-33?

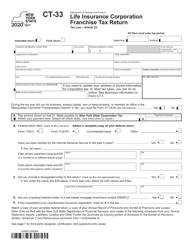

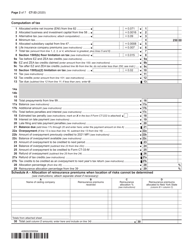

A: Form CT-33 is used to report and calculate the franchise tax owed by Life Insurance Corporations in New York.

Q: How often do I need to file Form CT-33?

A: Form CT-33 is an annual tax return and needs to be filed every year.

Q: When is the deadline to file Form CT-33?

A: The deadline to file Form CT-33 is generally March 15th of the following year for calendar year taxpayers.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing, depending on the circumstances. It is important to file the return on time to avoid penalties.

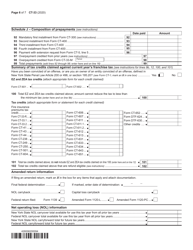

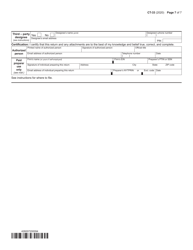

Q: Are there any deductions or credits available for Life Insurance Corporations?

A: Yes, there may be deductions and credits available. It is advisable to consult a tax professional or refer to the instructions for Form CT-33 for more information.

Q: What should I do if I have questions or need assistance with Form CT-33?

A: If you have questions or need assistance with Form CT-33, you can contact the New York State Department of Taxation and Finance for guidance.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-33 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.