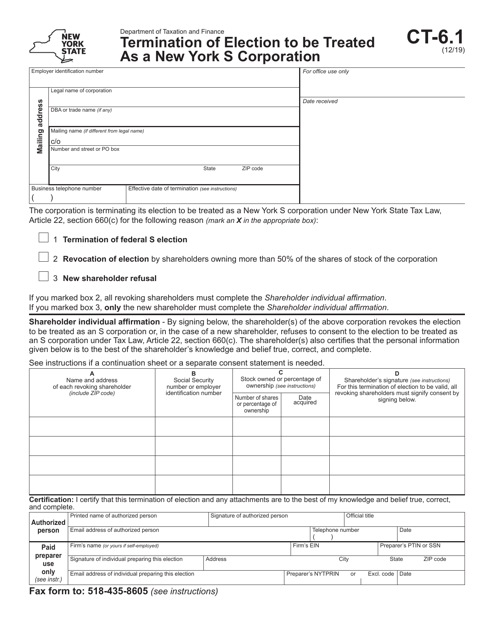

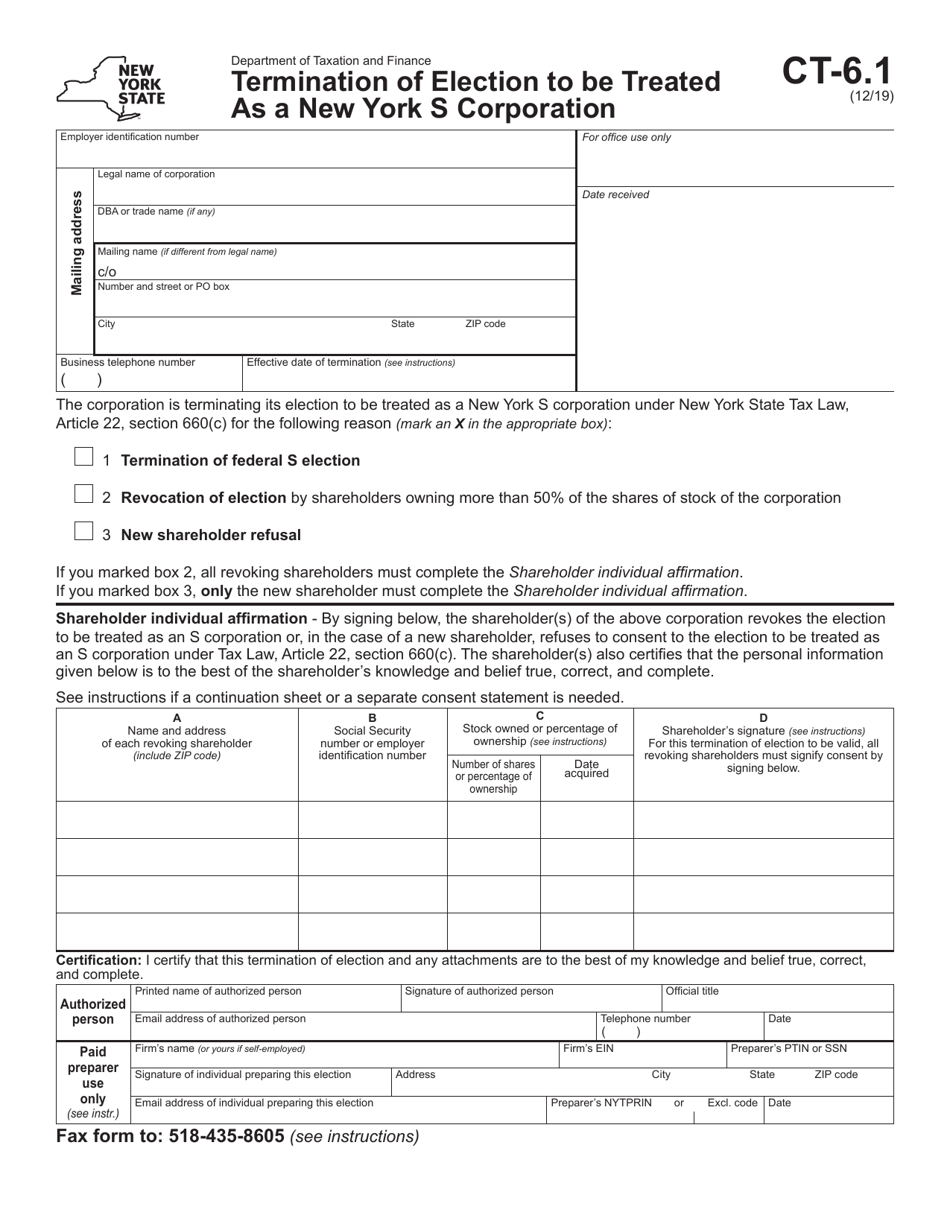

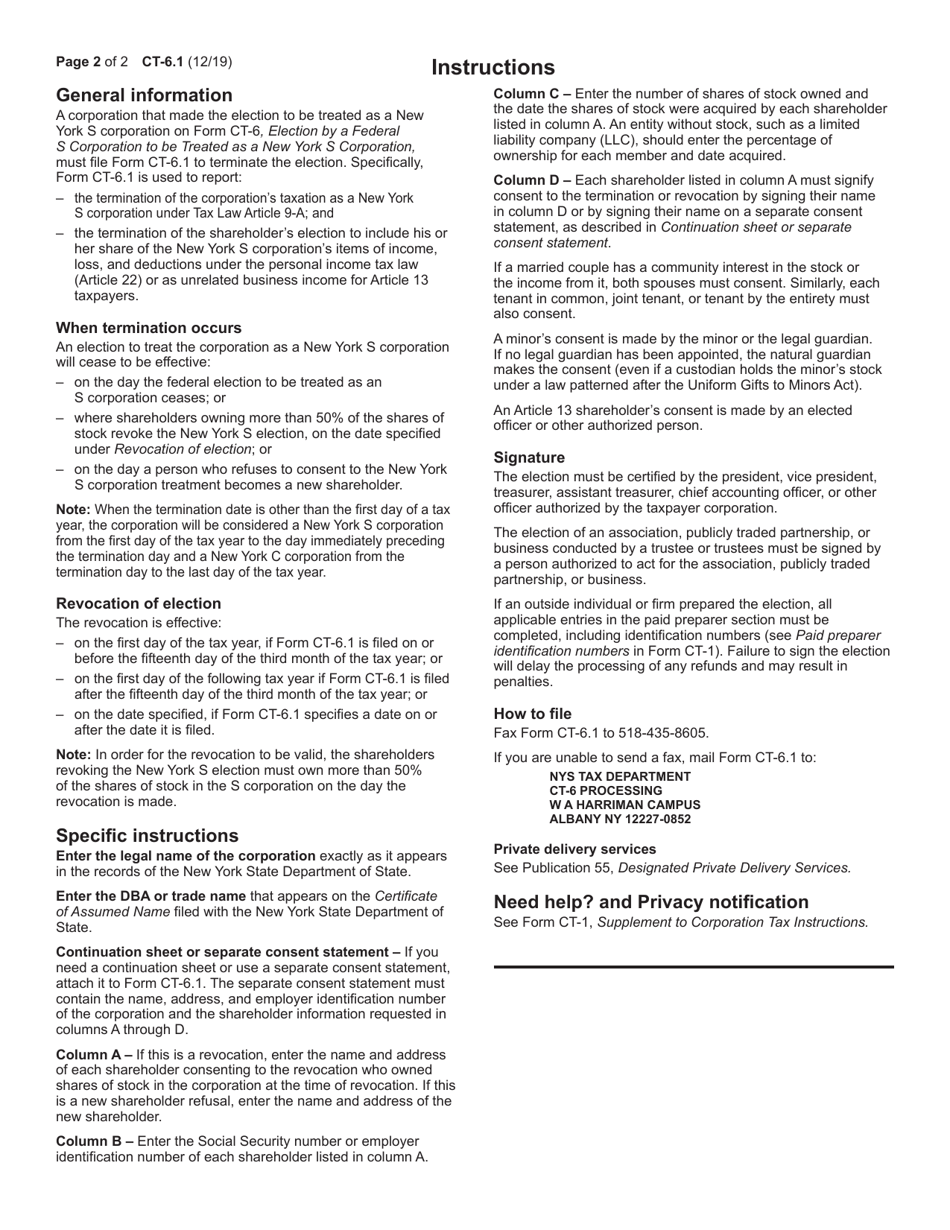

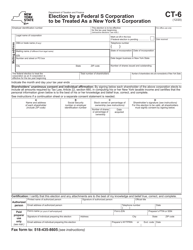

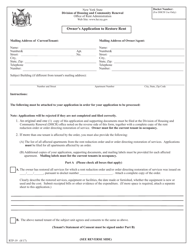

Form CT-6.1 Termination of Election to Be Treated as a New York S Corporation - New York

What Is Form CT-6.1?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-6.1?

A: Form CT-6.1 is the Termination of Election to Be Treated as a New York S Corporation in New York.

Q: When do you use Form CT-6.1?

A: You use Form CT-6.1 when you want to terminate your election to be treated as a New York S Corporation in New York.

Q: What is a New York S Corporation?

A: A New York S Corporation is a corporation that has elected to be treated as a small business corporation for federal income tax purposes.

Q: How do I fill out Form CT-6.1?

A: To fill out Form CT-6.1, you will need to provide information about your corporation and the termination of the S Corporation election.

Q: Are there any fees to file Form CT-6.1?

A: There are no fees to file Form CT-6.1.

Q: Is Form CT-6.1 for individuals or businesses?

A: Form CT-6.1 is for businesses, specifically corporations.

Q: What is the deadline to file Form CT-6.1?

A: The deadline to file Form CT-6.1 is generally on or before the 15th day of the third month following the close of the corporation's tax year.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-6.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.