This version of the form is not currently in use and is provided for reference only. Download this version of

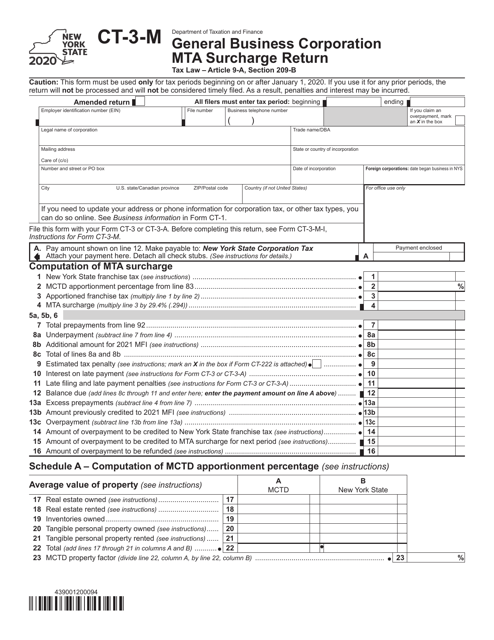

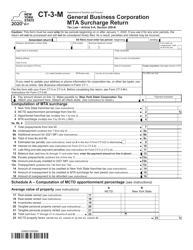

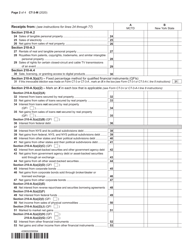

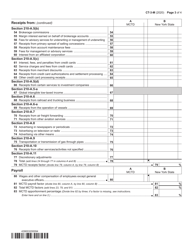

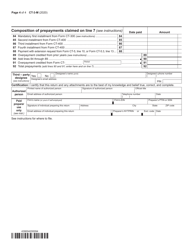

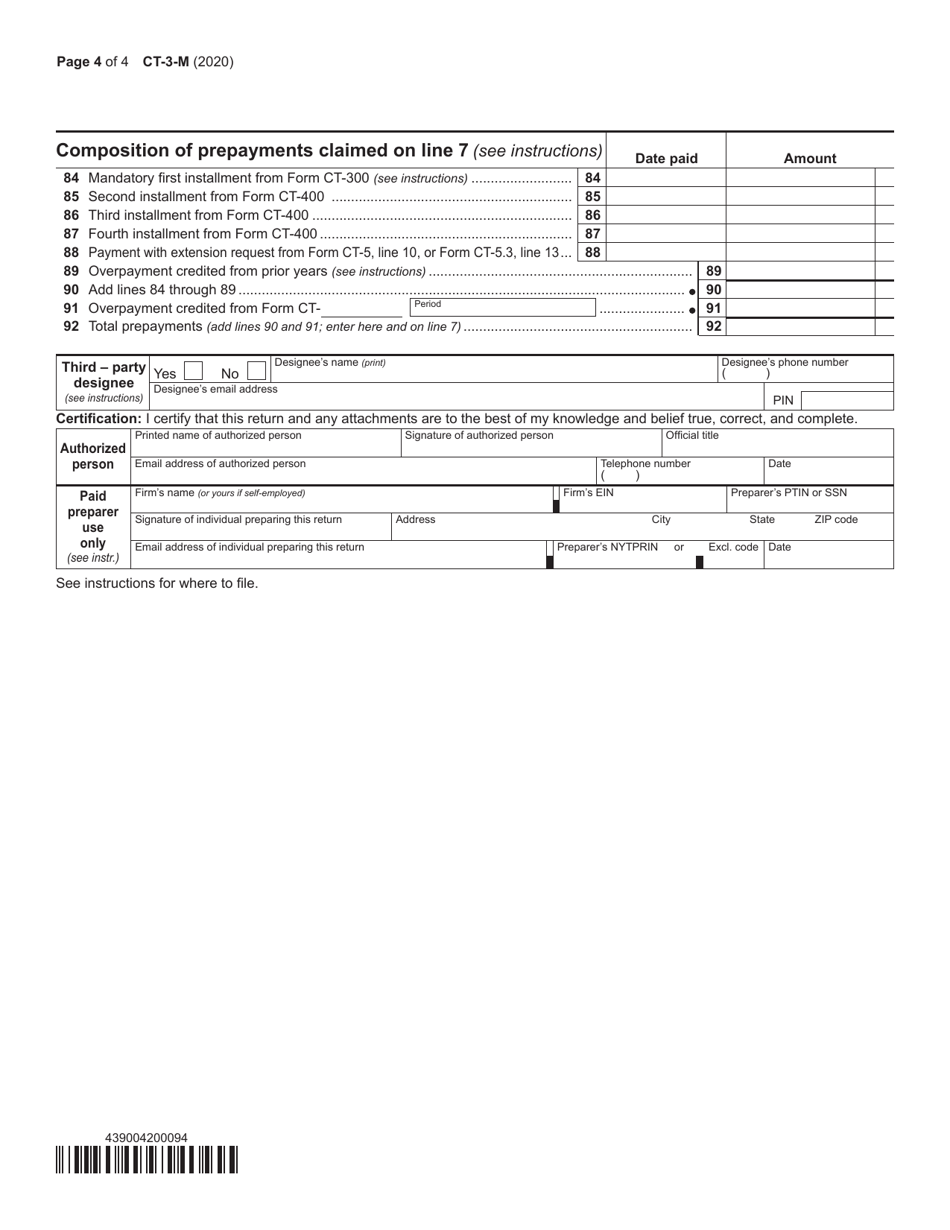

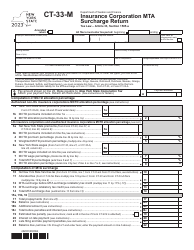

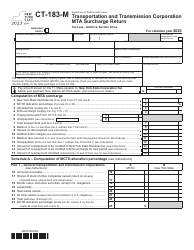

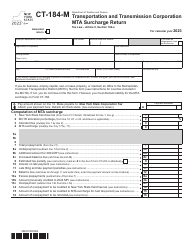

Form CT-3-M

for the current year.

Form CT-3-M General Business Corporation Mta Surcharge Return - New York

What Is Form CT-3-M?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3-M?

A: Form CT-3-M is the General Business Corporation MTA Surcharge Return in New York.

Q: Who needs to file Form CT-3-M?

A: General business corporations in New York need to file Form CT-3-M if they are subject to the Metropolitan Transportation Authority (MTA) surcharge.

Q: What is the MTA surcharge?

A: The MTA surcharge is a tax imposed on certain businesses in New York to help fund the Metropolitan Transportation Authority.

Q: When is Form CT-3-M due?

A: Form CT-3-M is generally due on or before the 15th day of the 4th month following the end of the tax year.

Q: Is Form CT-3-M the only form I need to file?

A: No, in addition to Form CT-3-M, you may need to file other New York State tax forms depending on your specific business activities and circumstances.

Q: Can I file Form CT-3-M electronically?

A: Yes, you can file Form CT-3-M electronically through the New York State electronic filing system.

Q: What happens if I don't file Form CT-3-M?

A: If you're required to file Form CT-3-M and fail to do so, you may be subject to penalties and interest.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3-M by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.