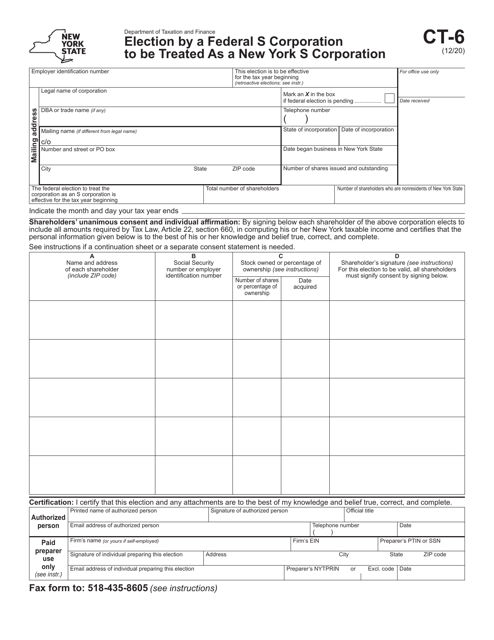

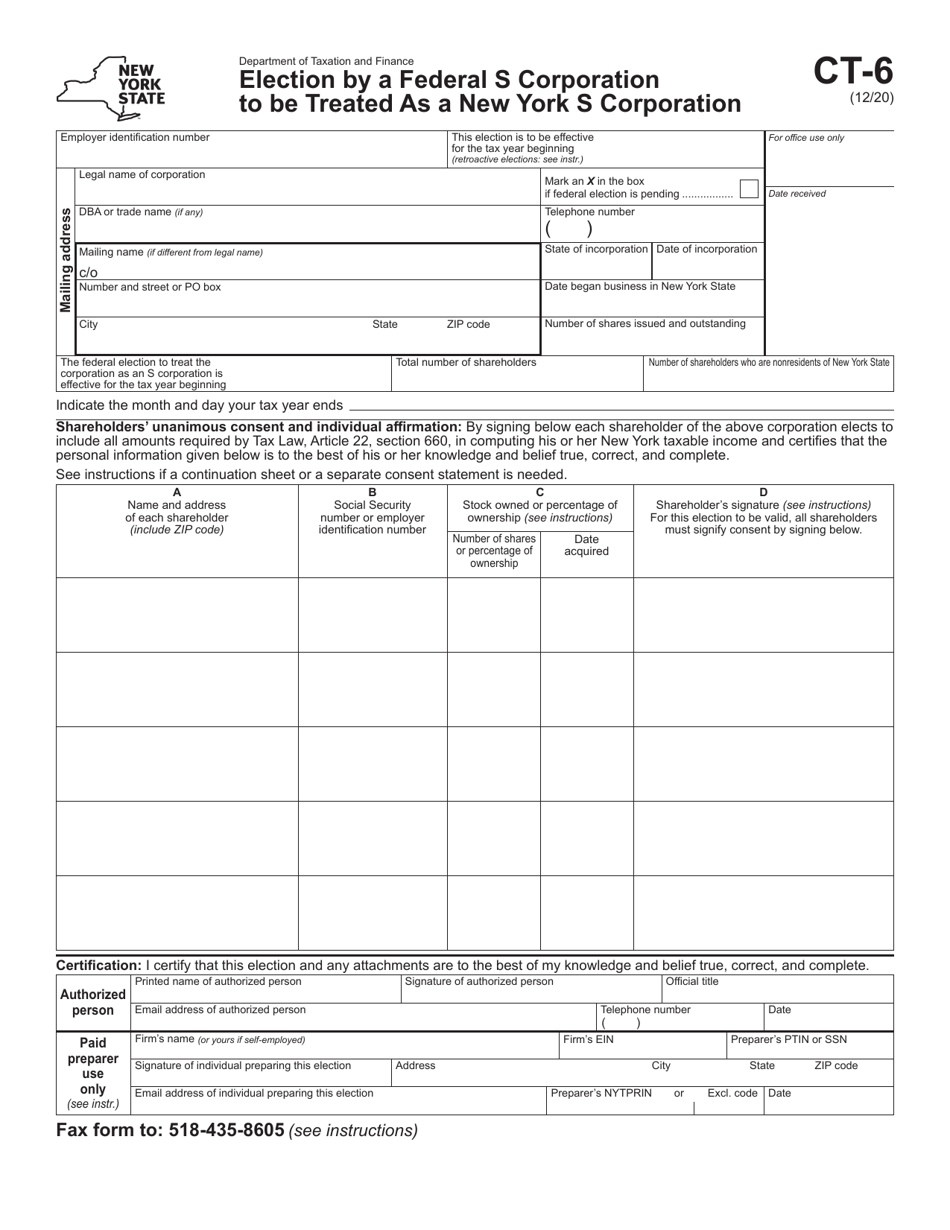

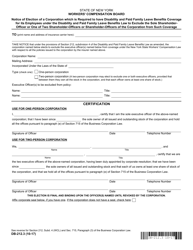

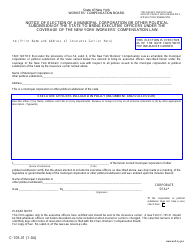

Form CT-6 Election by a Federal S Corporation to Be Treated as a New York S Corporation - New York

What Is Form CT-6?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-6?

A: Form CT-6 is a form used by a federal S Corporation to elect to be treated as a New York S Corporation.

Q: What is an S Corporation?

A: An S Corporation is a type of corporation that can pass-through its income, losses, deductions, and credits to its shareholders for federal tax purposes.

Q: Why would a federal S Corporation want to be treated as a New York S Corporation?

A: By electing to be treated as a New York S Corporation, the corporation can take advantage of the more favorable tax treatment for New York state tax purposes.

Q: How can a federal S Corporation elect to be treated as a New York S Corporation?

A: The corporation must file Form CT-6 with the New York State Department of Taxation and Finance.

Q: Are there any specific requirements or qualifications for electing to be a New York S Corporation?

A: Yes, the corporation must meet certain eligibility criteria and comply with all applicable rules and regulations.

Q: Is there a deadline for filing Form CT-6?

A: Yes, the form must be filed by the due date of the corporation's New York state tax return for the first taxable year in which it wants to be treated as a New York S Corporation.

Q: Is there a fee for filing Form CT-6?

A: No, there is no fee for filing Form CT-6.

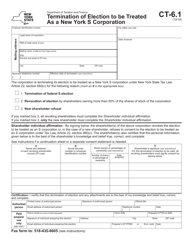

Q: Can a federal S Corporation change its election to be treated as a New York S Corporation?

A: Yes, a federal S Corporation can revoke or modify its election by filing Form CT-5 with the New York State Department of Taxation and Finance.

Form Details:

- Released on December 1, 2020;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CT-6 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.