This version of the form is not currently in use and is provided for reference only. Download this version of

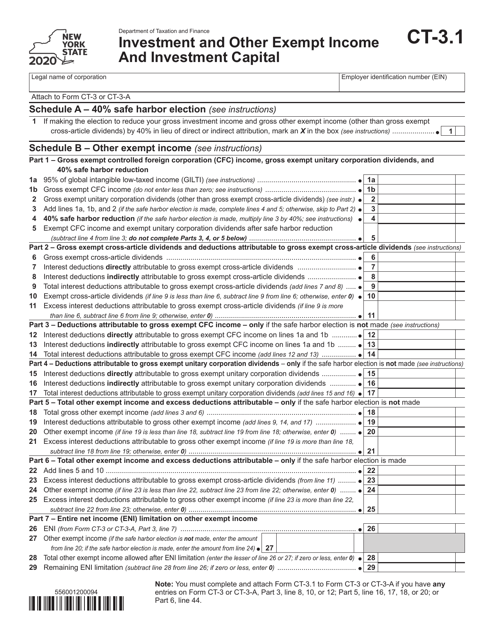

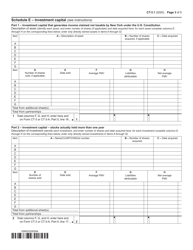

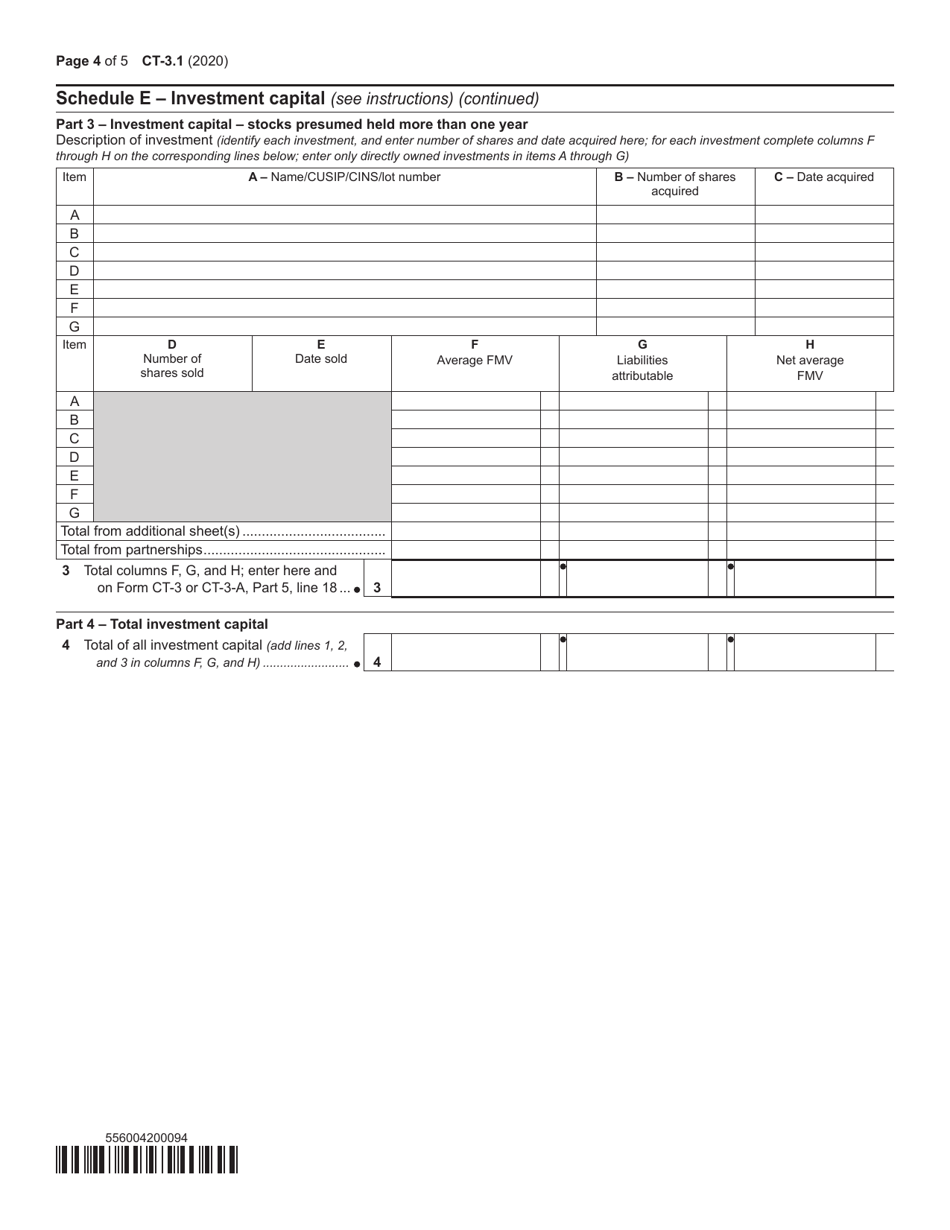

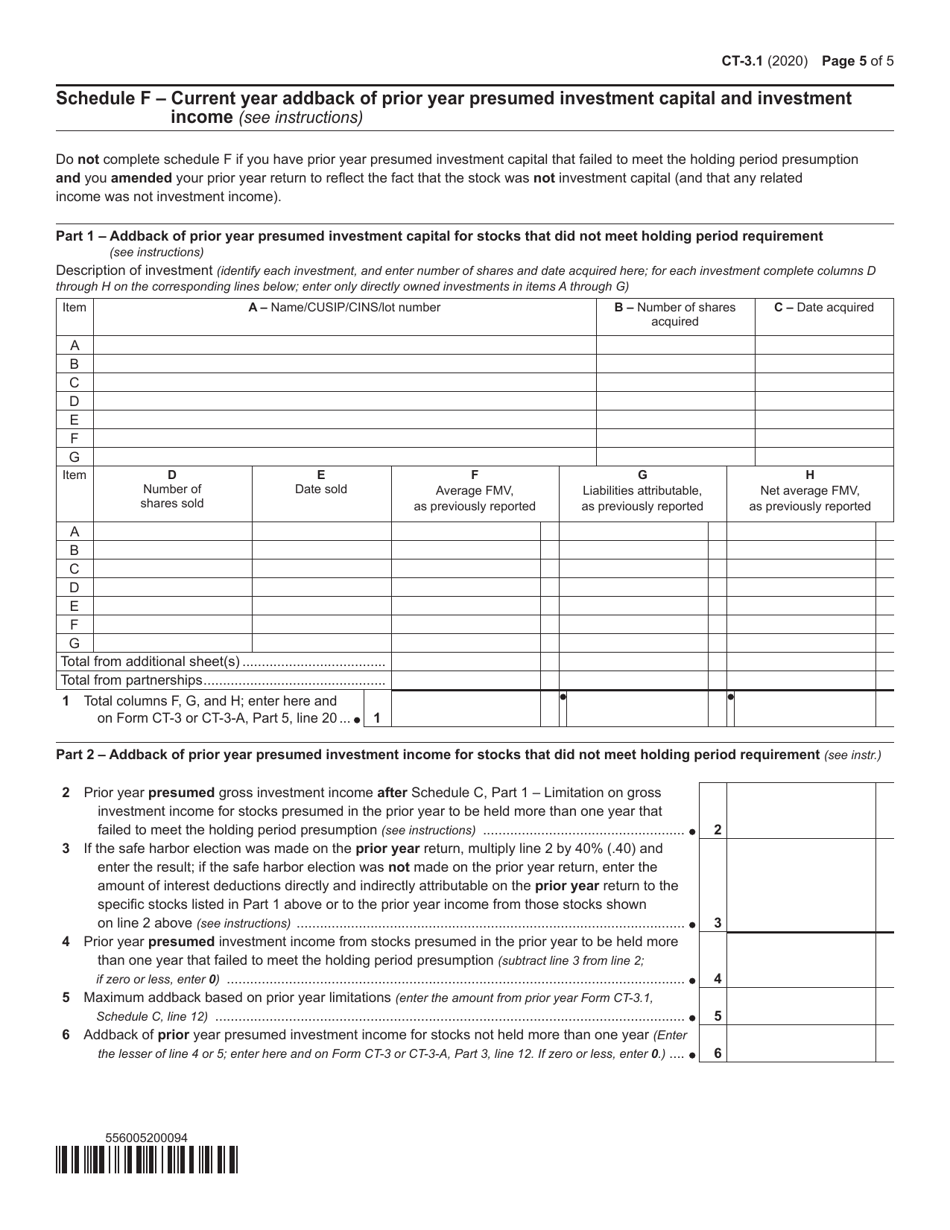

Form CT-3.1

for the current year.

Form CT-3.1 Investment and Other Exempt Income and Investment Capital - New York

What Is Form CT-3.1?

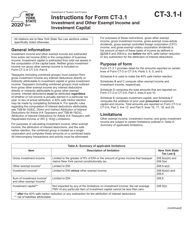

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form CT-3.1?

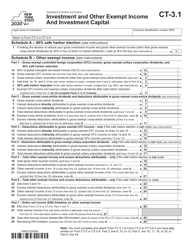

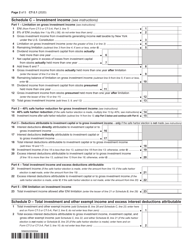

A: Form CT-3.1 is a New York state tax form used to report investment and other exempt income and investment capital.

Q: Who needs to file Form CT-3.1?

A: Businesses in New York that have investment income or investment capital that is exempt from tax may need to file Form CT-3.1.

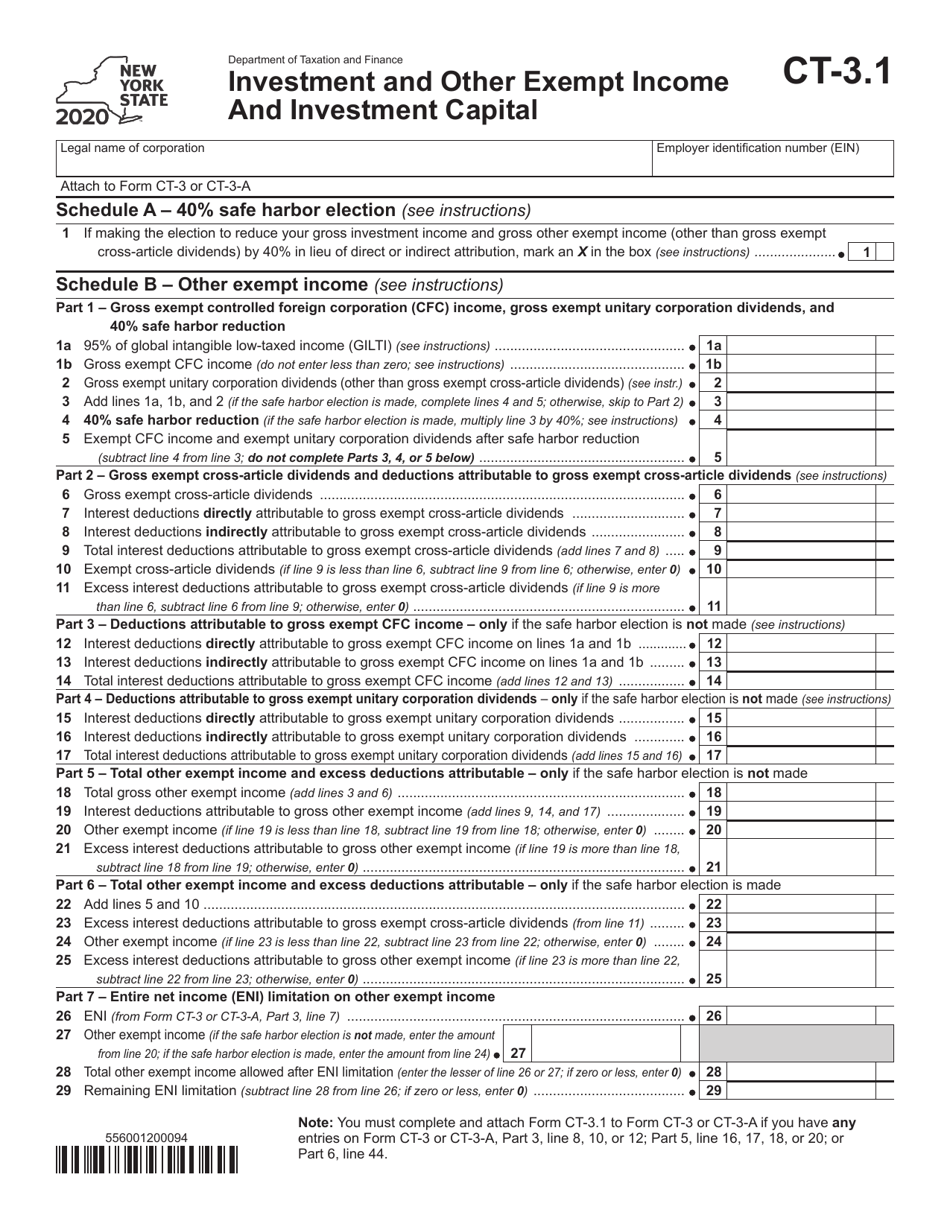

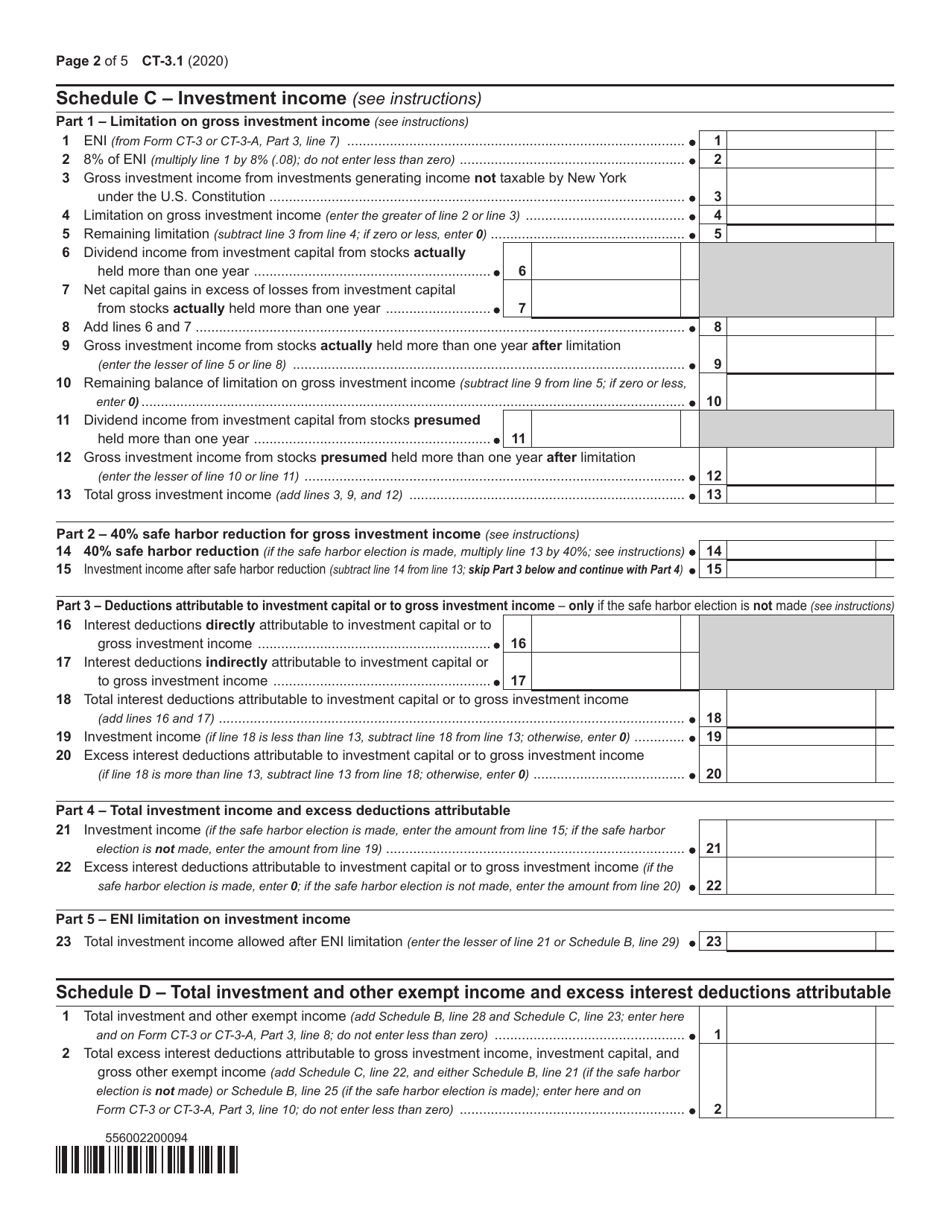

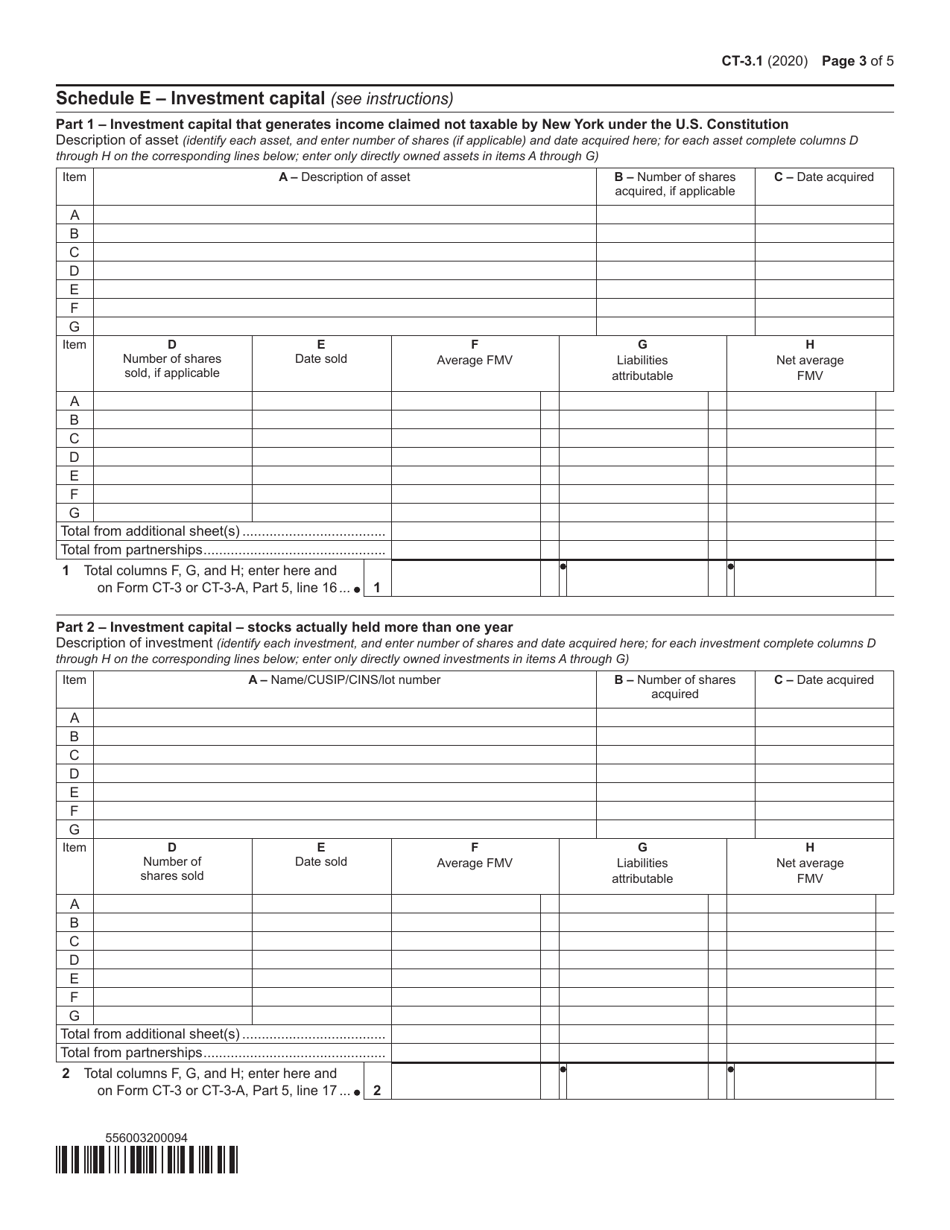

Q: What types of income and capital are reported on Form CT-3.1?

A: Form CT-3.1 is used to report income and capital from investments that are exempt from tax, such as certain dividends, interest, and capital gains.

Q: When is the deadline to file Form CT-3.1?

A: The deadline to file Form CT-3.1 is usually the same as the deadline for filing your New York state tax return, which is generally April 15th.

Q: Is there a fee to file Form CT-3.1?

A: No, there is no fee to file Form CT-3.1.

Q: What if I made a mistake on Form CT-3.1?

A: If you made a mistake on Form CT-3.1, you can file an amended return to correct the error.

Q: Can I file Form CT-3.1 electronically?

A: Yes, you can file Form CT-3.1 electronically using the New York State Department of Taxation and Finance's e-file system.

Q: Do I need to include any supporting documents with Form CT-3.1?

A: Yes, you may need to include supporting documents, such as schedules and statements, that support the income and capital reported on Form CT-3.1.

Form Details:

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-3.1 by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.