This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

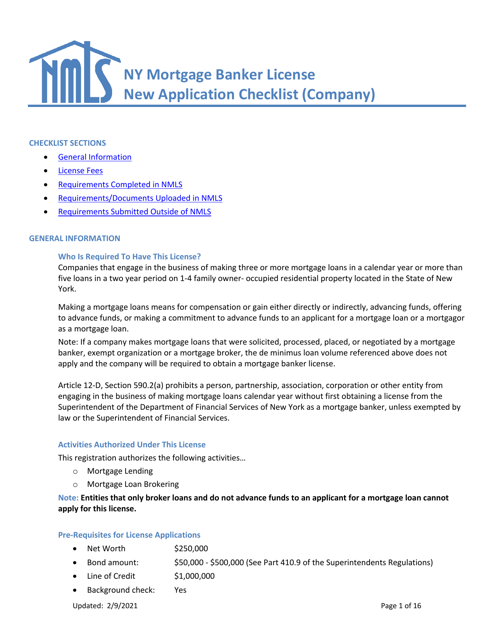

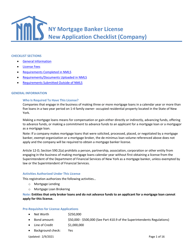

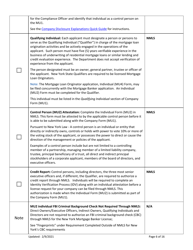

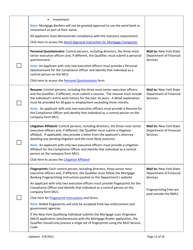

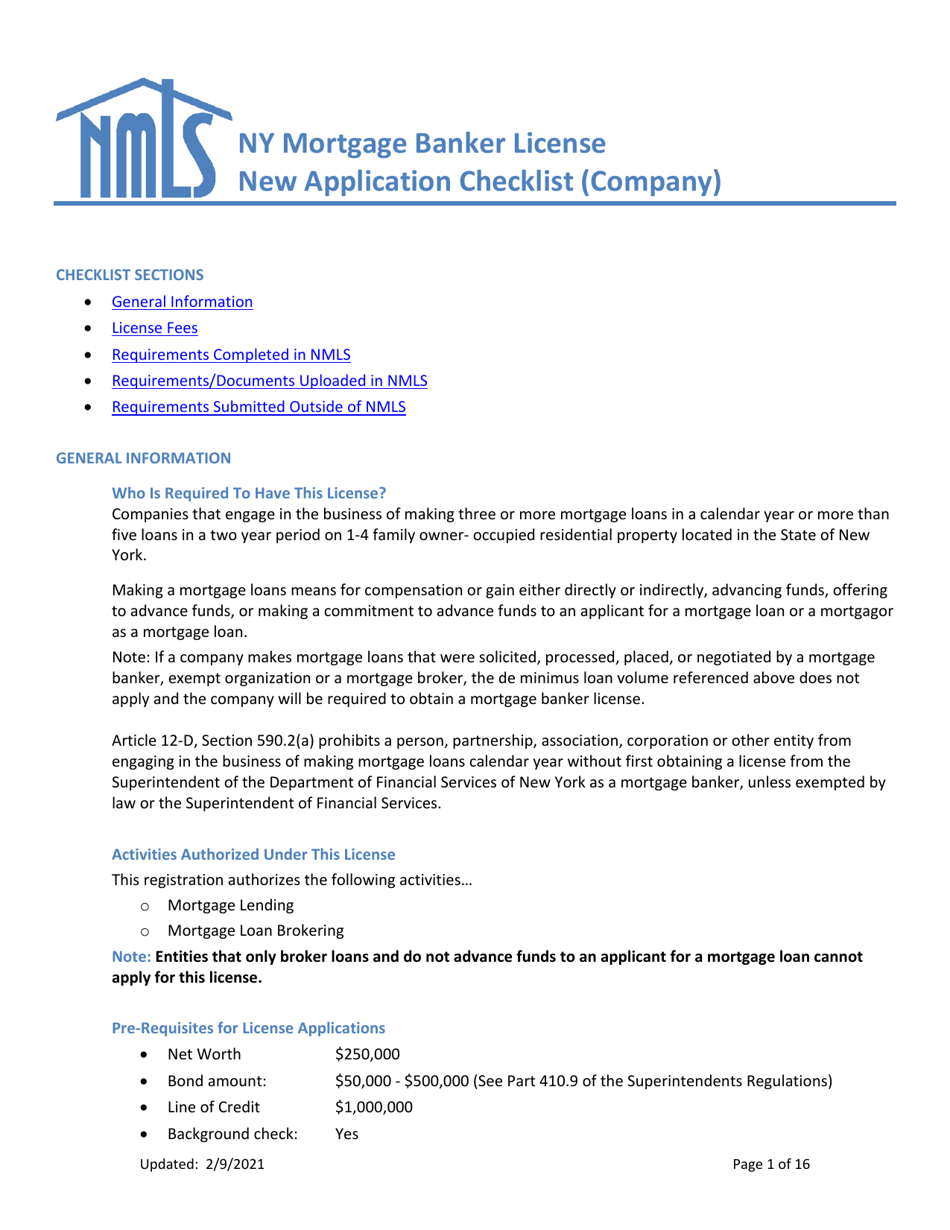

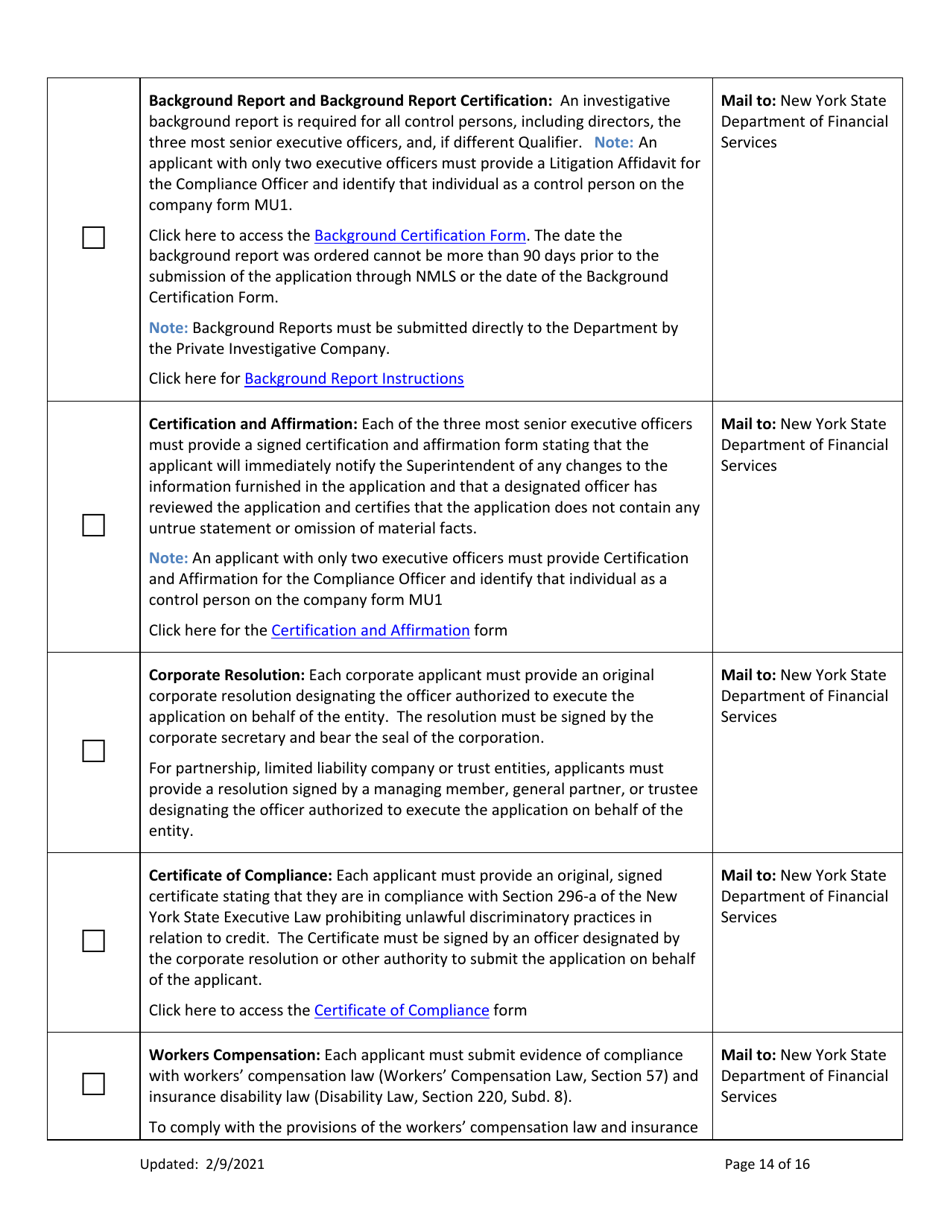

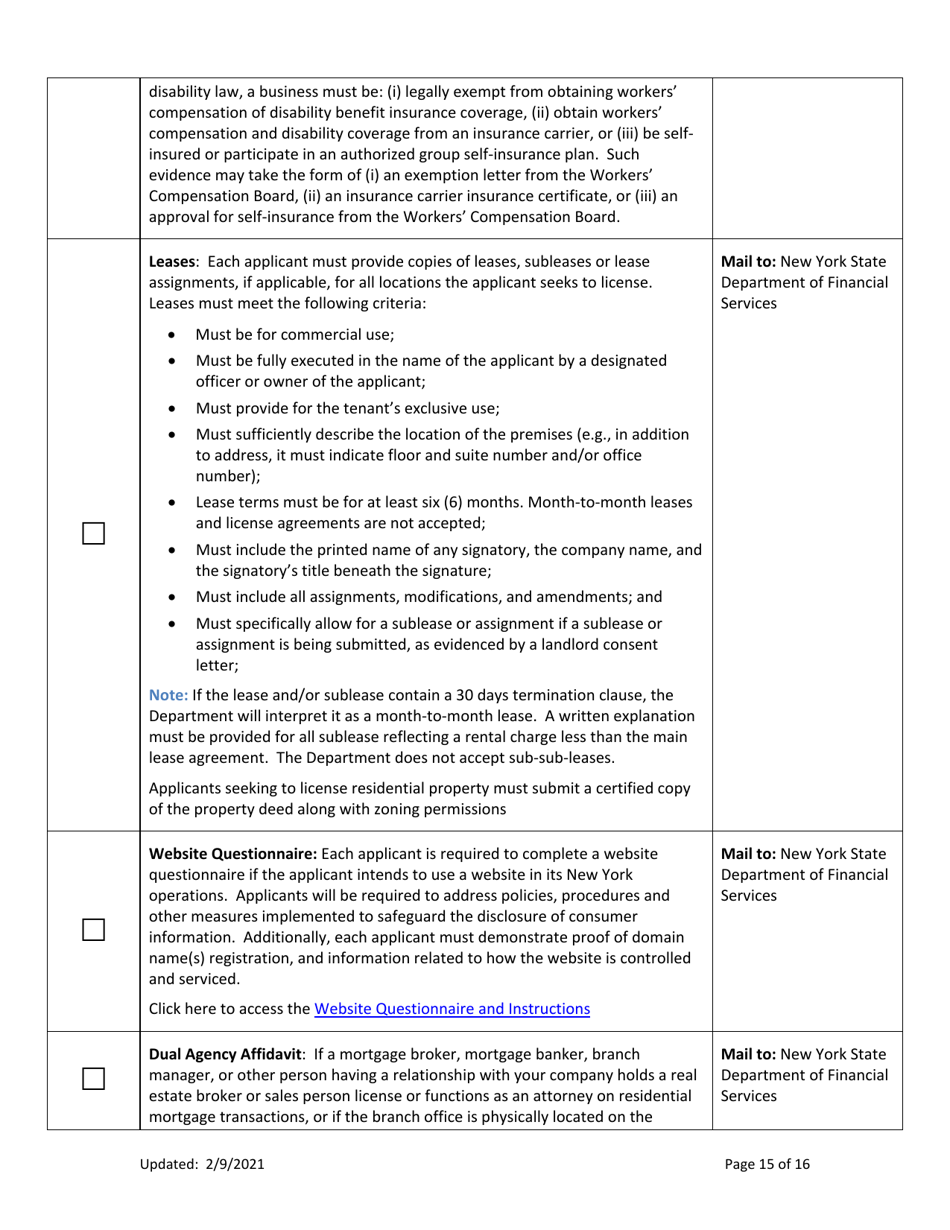

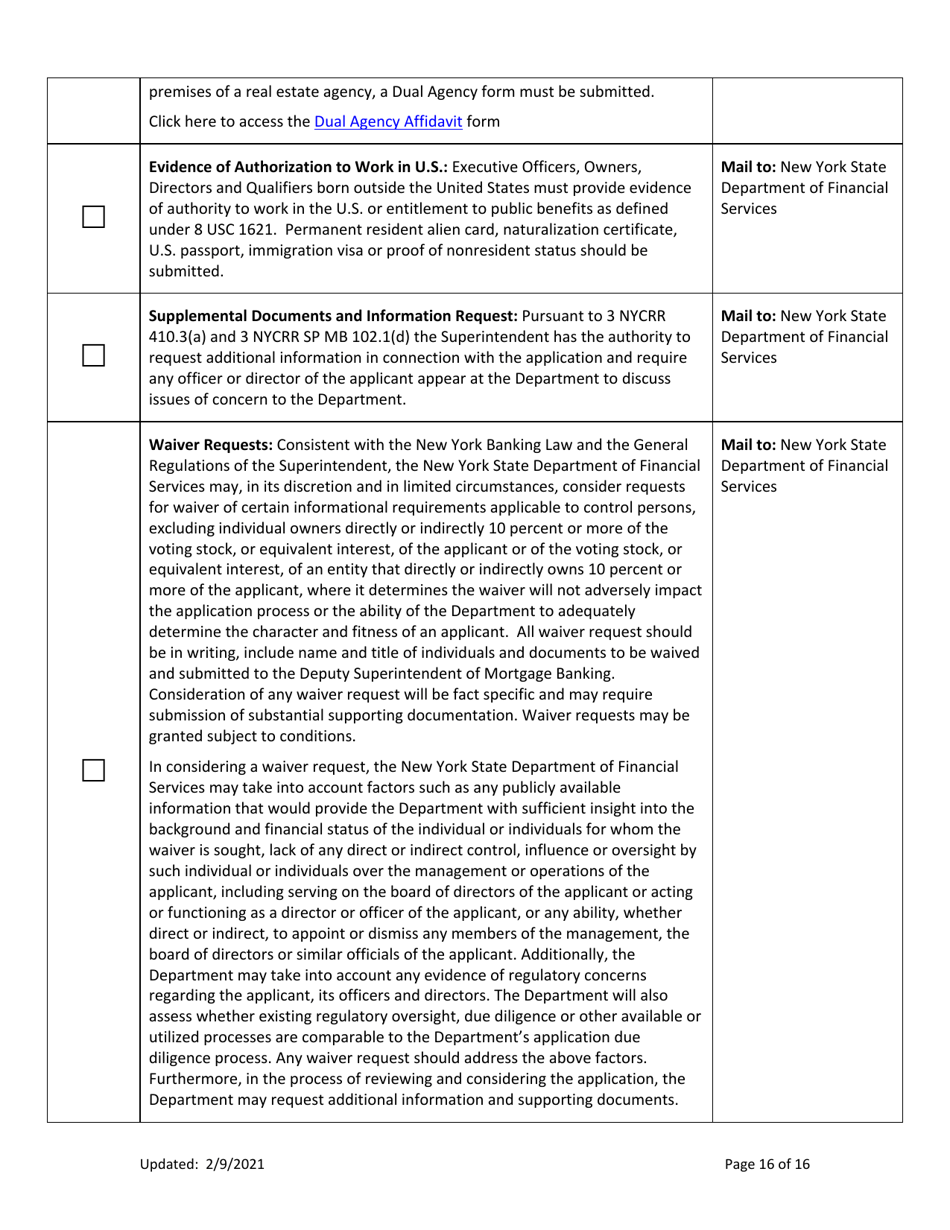

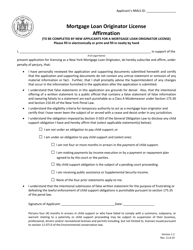

Ny Mortgage Banker License New Application Checklist (Company) - New York

Ny Mortgage Banker License New Application Checklist (Company) is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

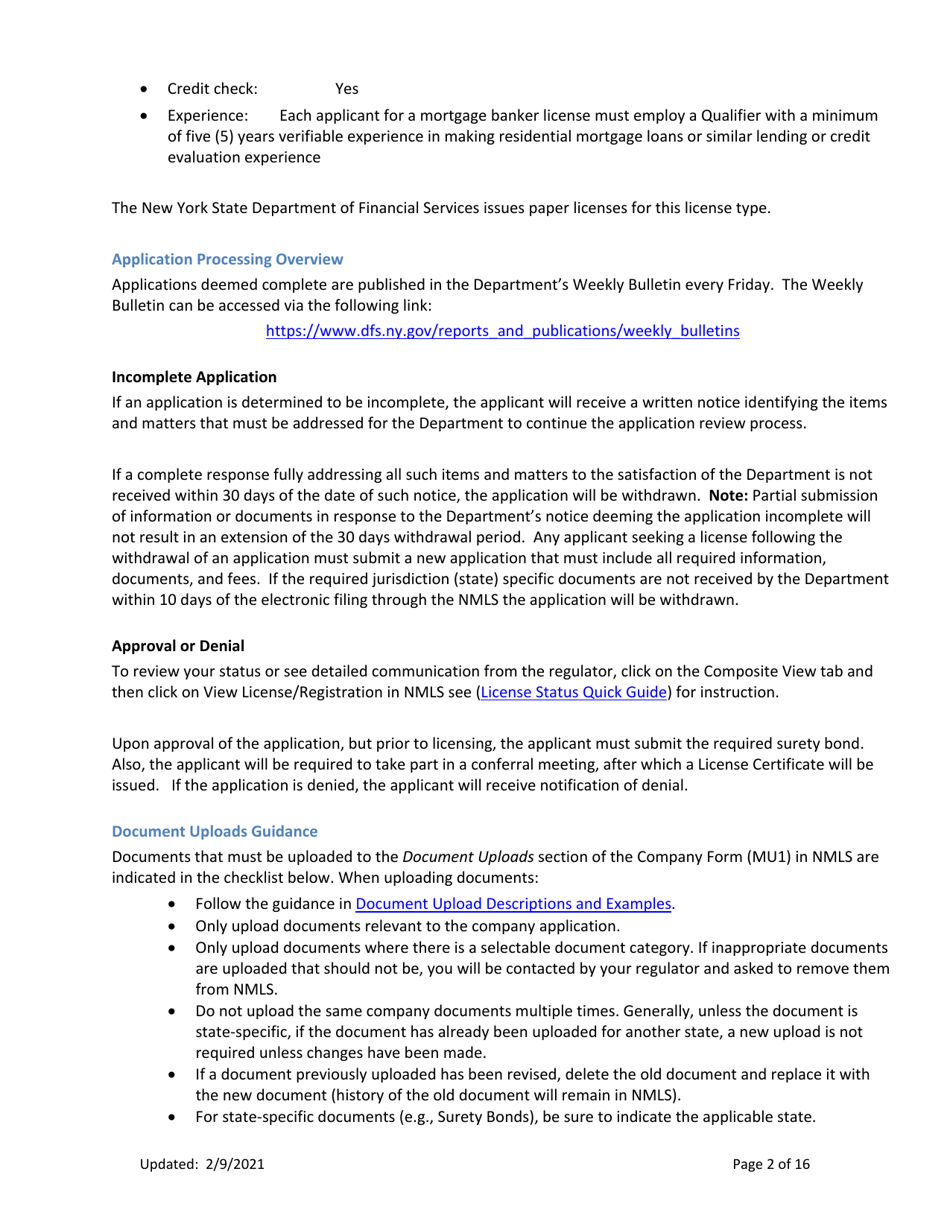

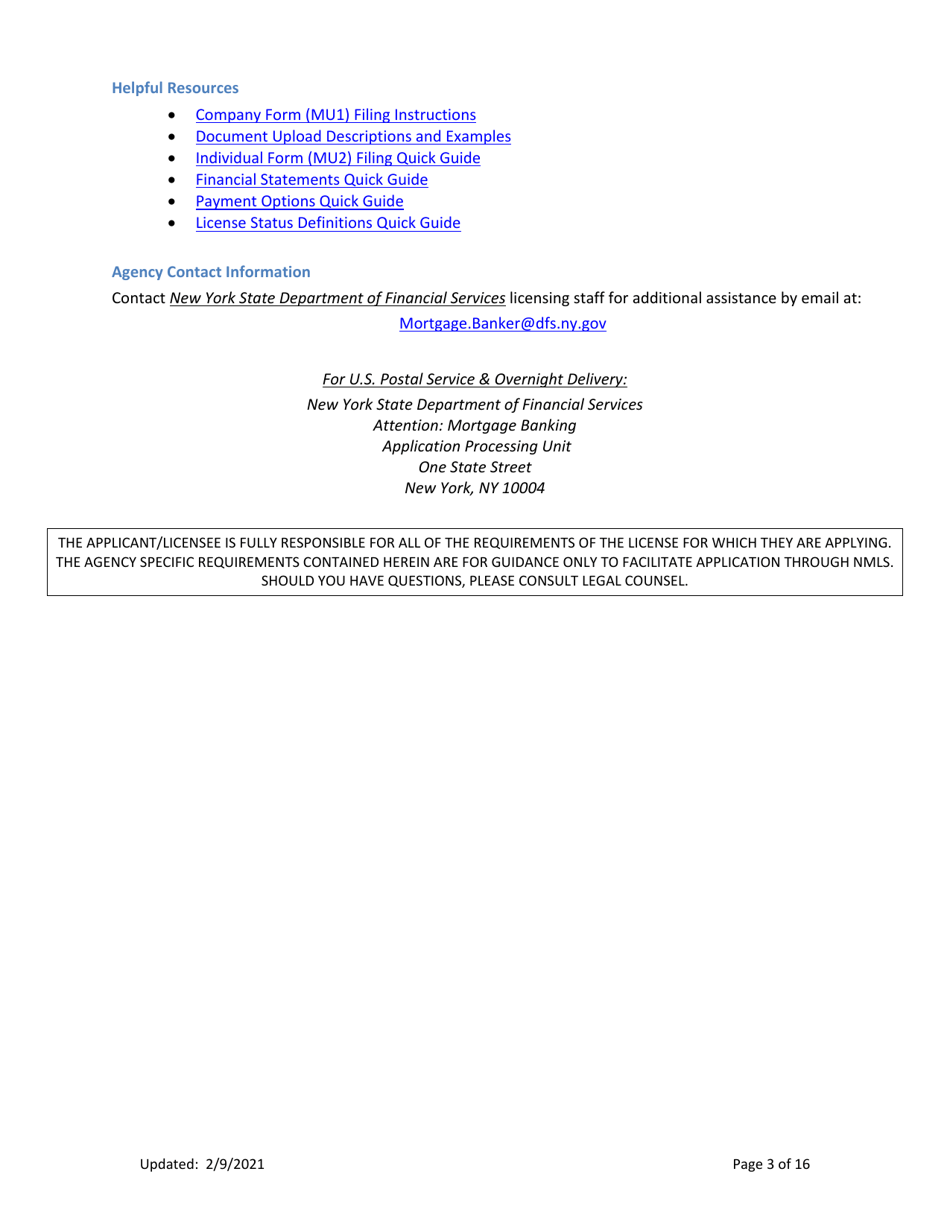

Q: What is the process for applying for a NY Mortgage Banker License?

A: To apply for a NY Mortgage Banker License, you first need to complete an application form and submit it along with the required documents.

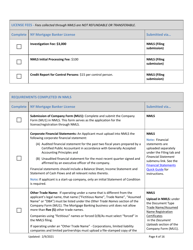

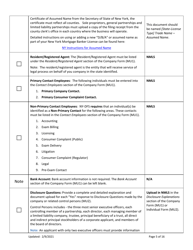

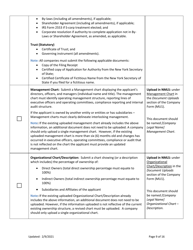

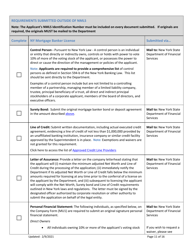

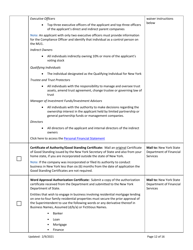

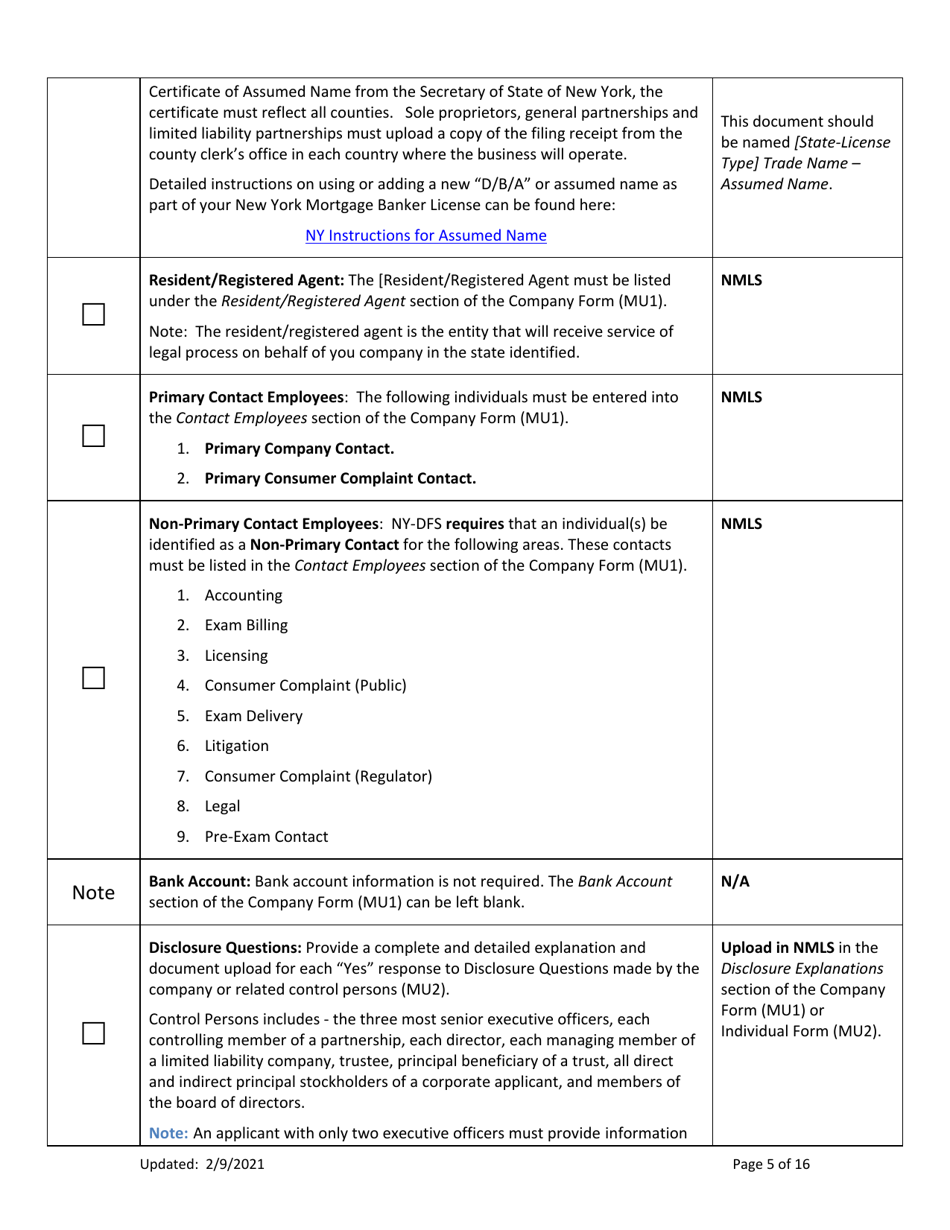

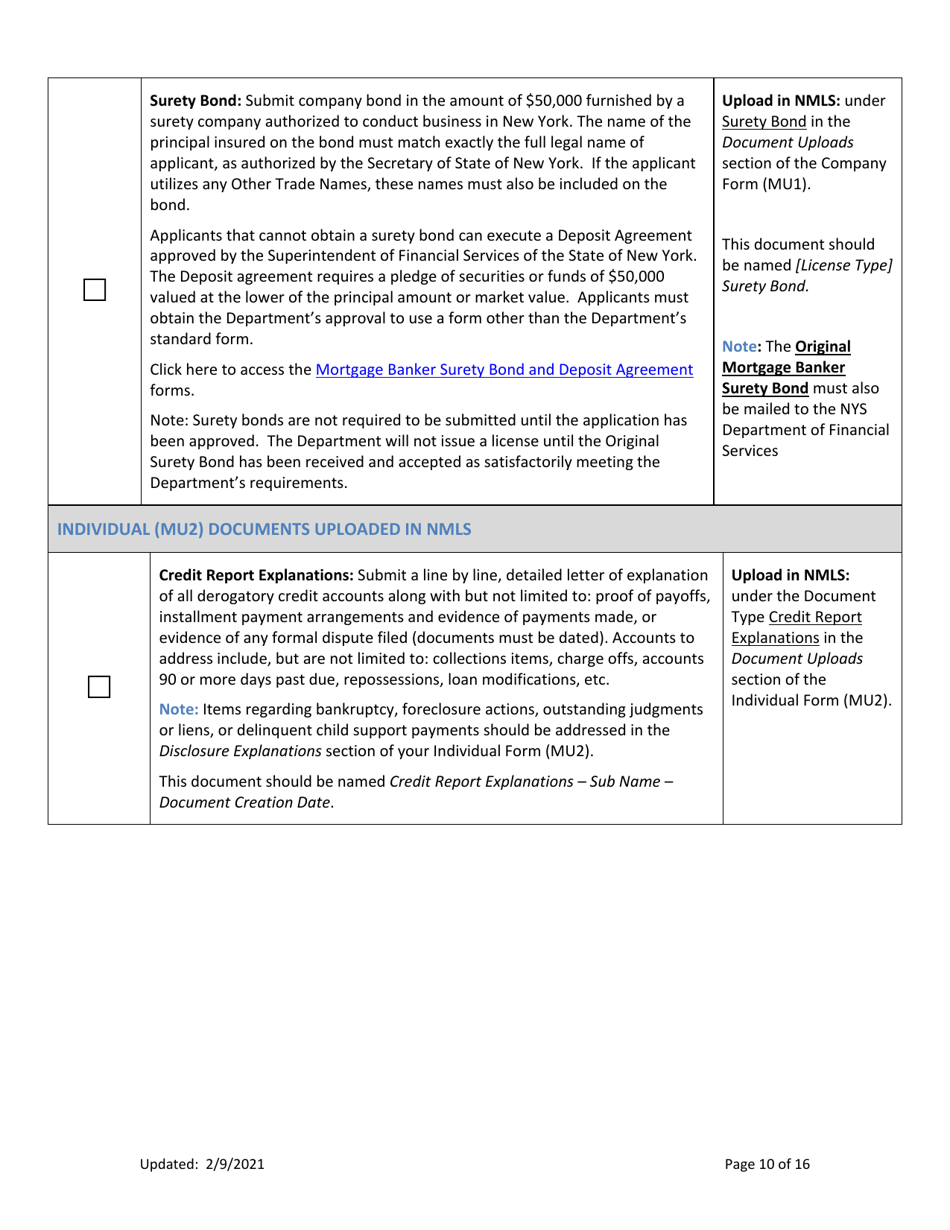

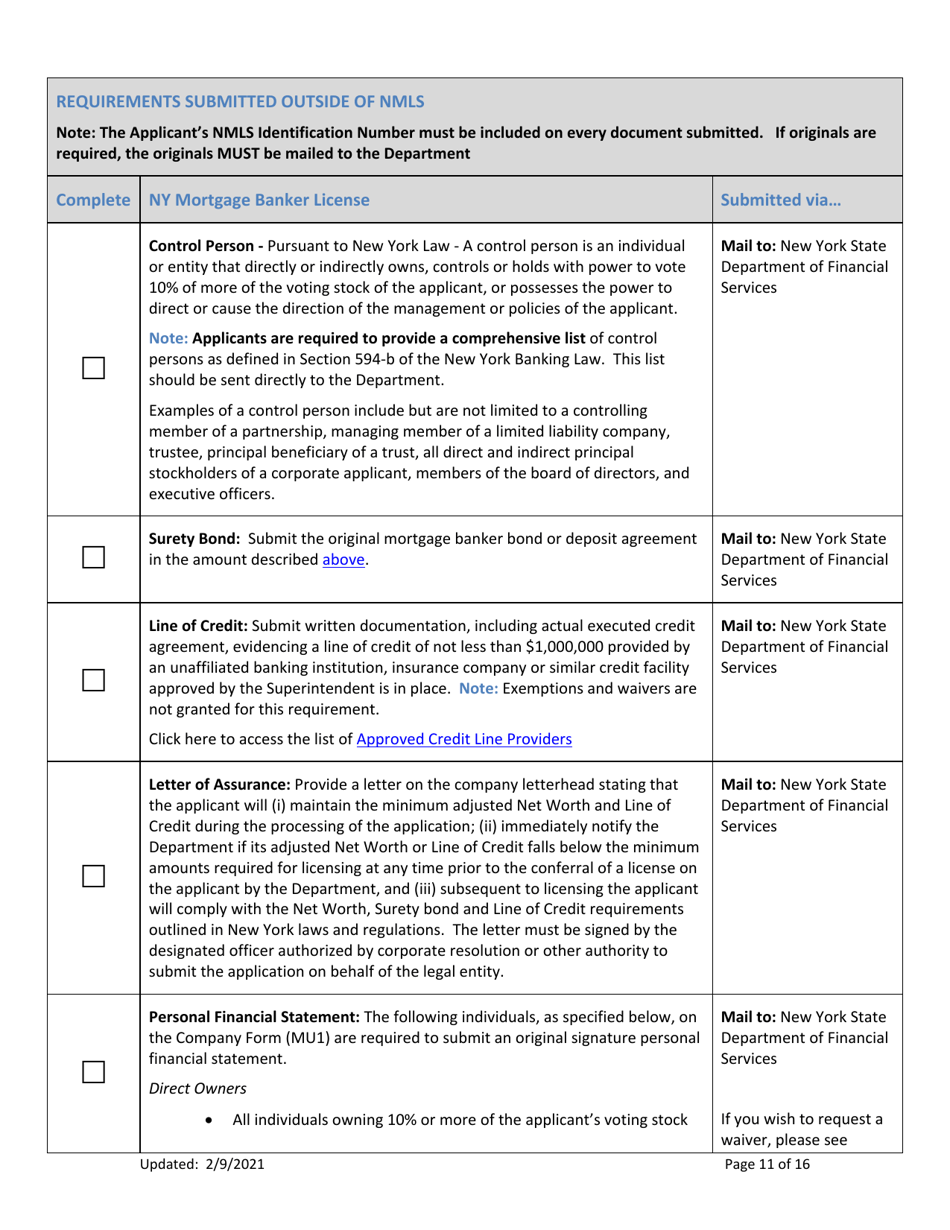

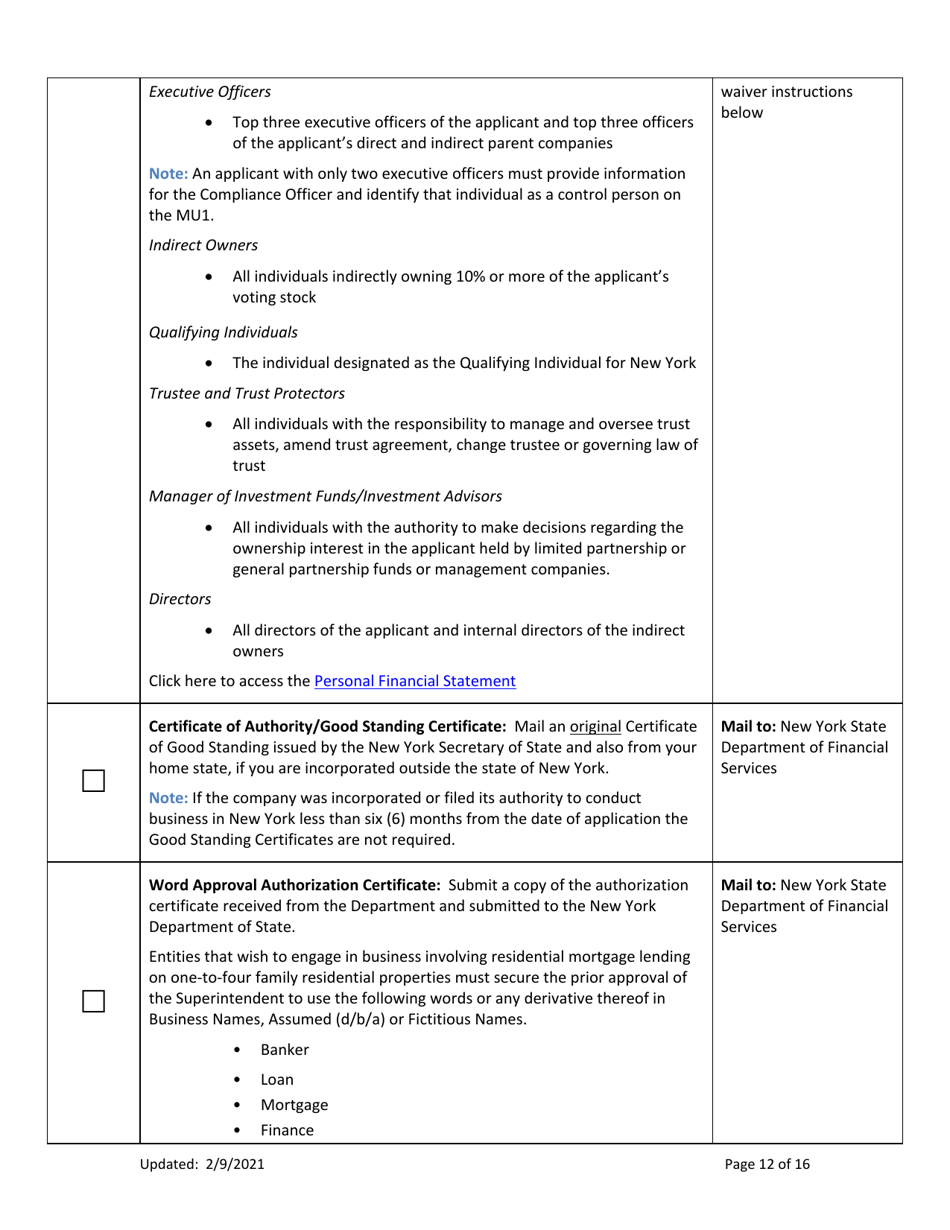

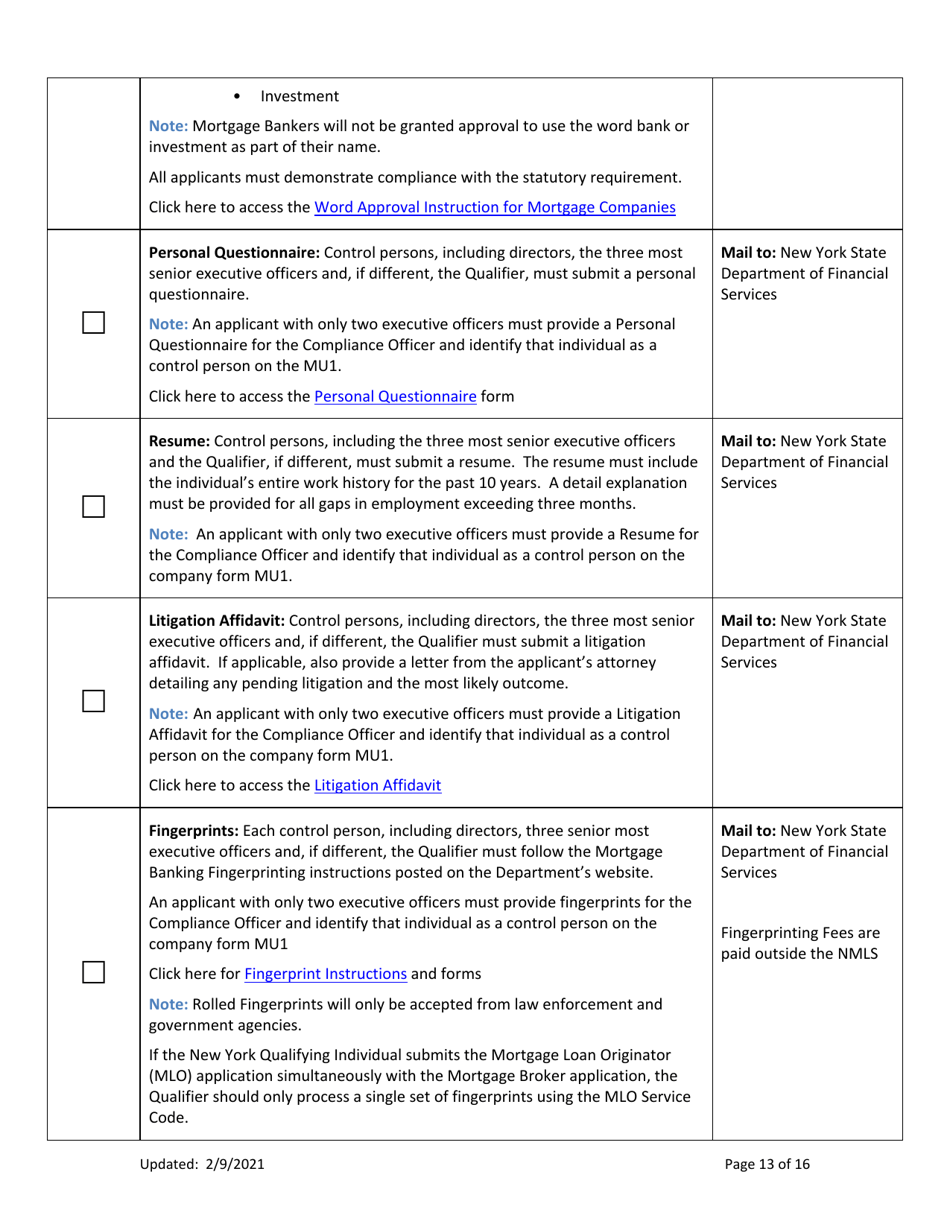

Q: What documents are required for a NY Mortgage Banker License application?

A: The required documents for a NY Mortgage Banker License application include a completed application form, a surety bond, proof of financial responsibility, and various other supporting documents.

Q: What is a surety bond in the context of a NY Mortgage Banker License?

A: A surety bond is a form of financial guarantee that ensures the mortgage banker will adhere to all applicable laws and regulations.

Q: What is proof of financial responsibility?

A: Proof of financial responsibility is documentation that demonstrates a mortgage banker's ability to fulfill their financial obligations and responsibilities.

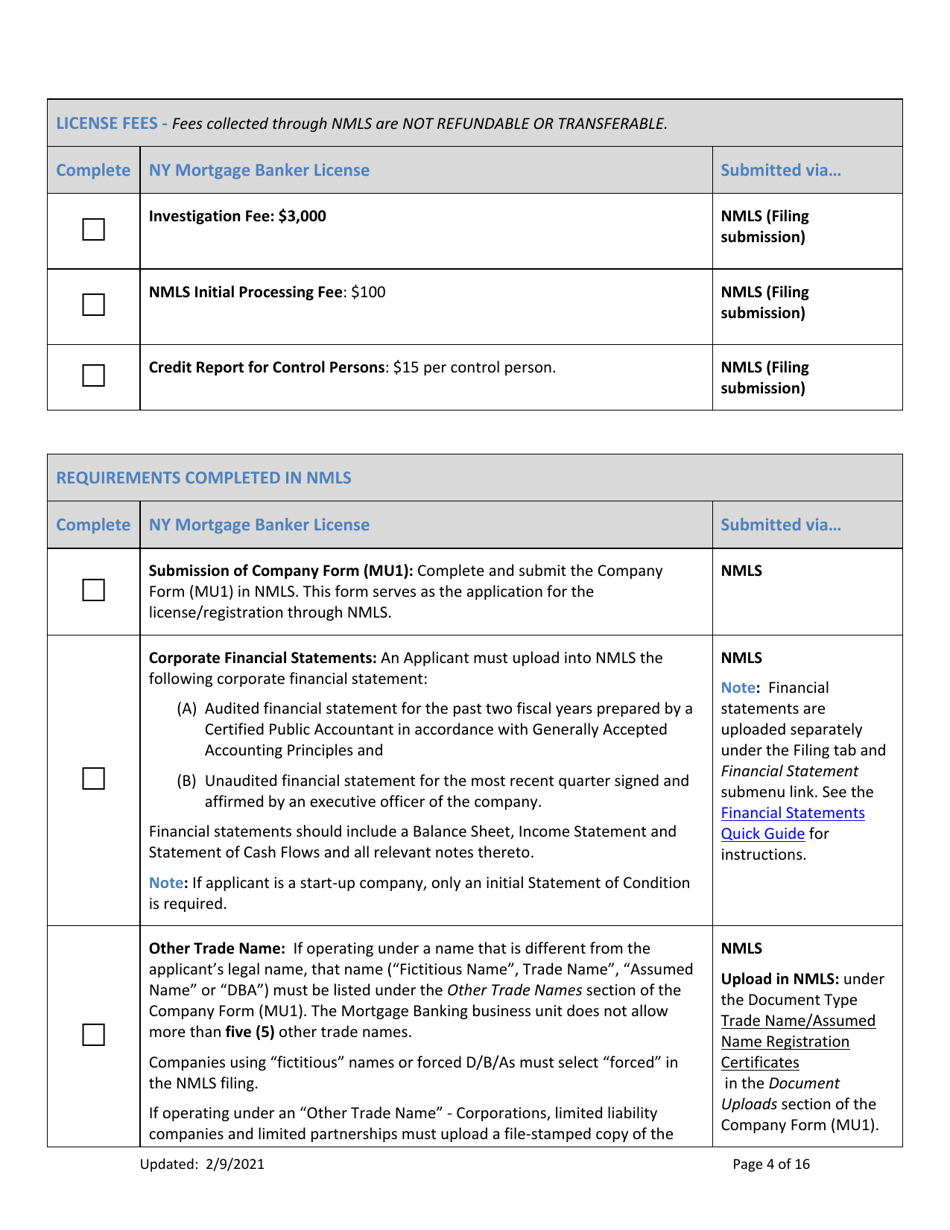

Q: Are there any fees associated with applying for a NY Mortgage Banker License?

A: Yes, there are fees associated with the application process, including a licensing fee and an investigation fee.

Q: How long does it take to process a NY Mortgage Banker License application?

A: The processing time for a NY Mortgage Banker License application can vary, but it is typically several months.

Q: What happens after my NY Mortgage Banker License application is approved?

A: After your NY Mortgage Banker License application is approved, you will receive your license and be able to legally operate as a mortgage banker in New York.

Q: Is there a renewal process for a NY Mortgage Banker License?

A: Yes, NY Mortgage Banker Licenses must be renewed periodically, and the renewal process involves submitting updated documentation and paying renewal fees.

Q: What happens if my NY Mortgage Banker License application is denied?

A: If your NY Mortgage Banker License application is denied, you will receive a notice from the DFS explaining the reasons for the denial. You may have the opportunity to appeal the decision.

Form Details:

- Released on February 9, 2021;

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.