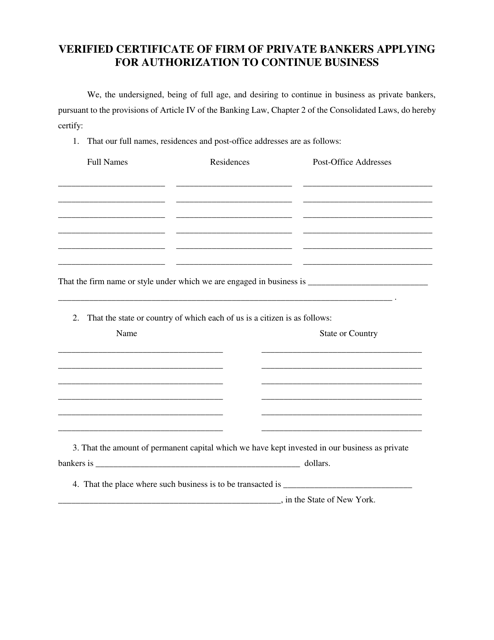

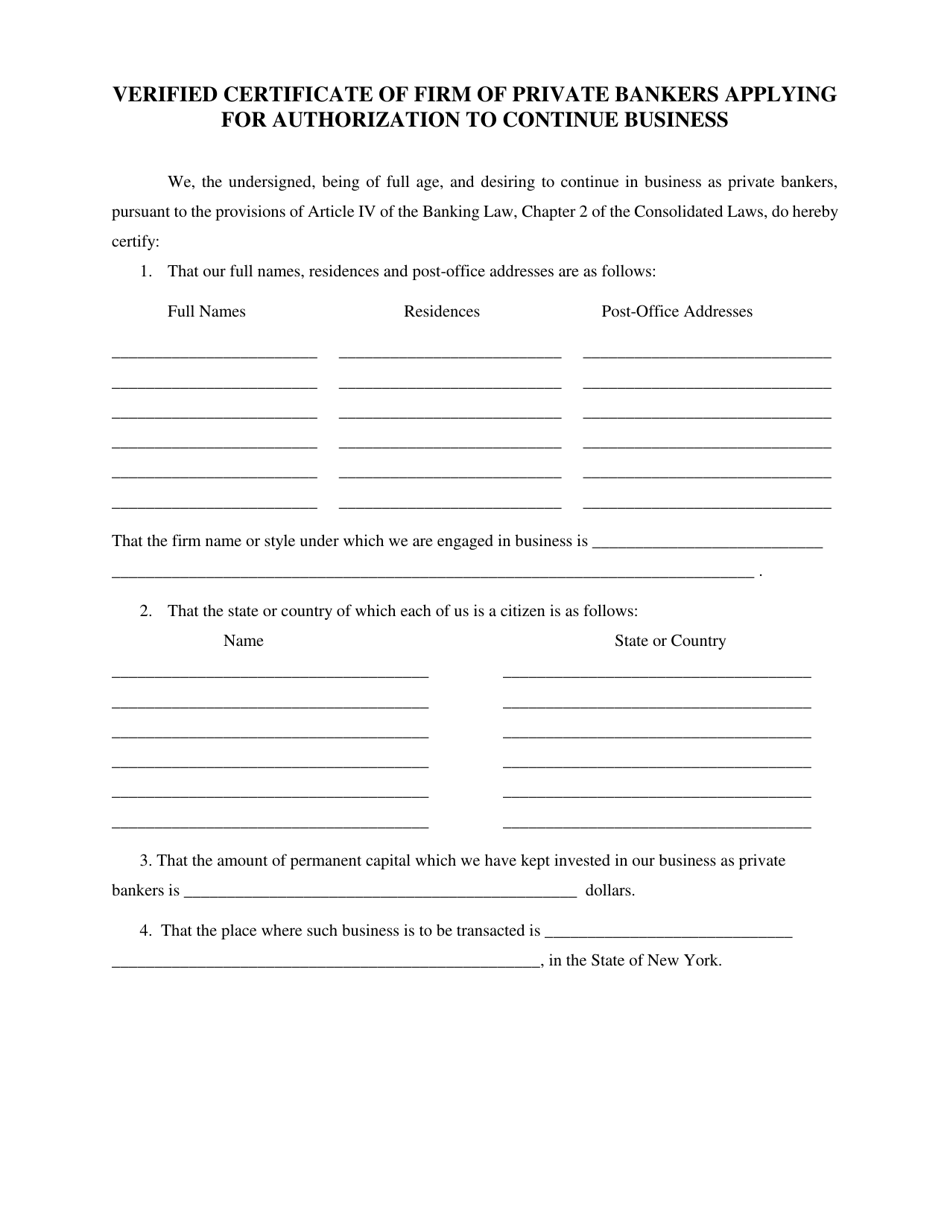

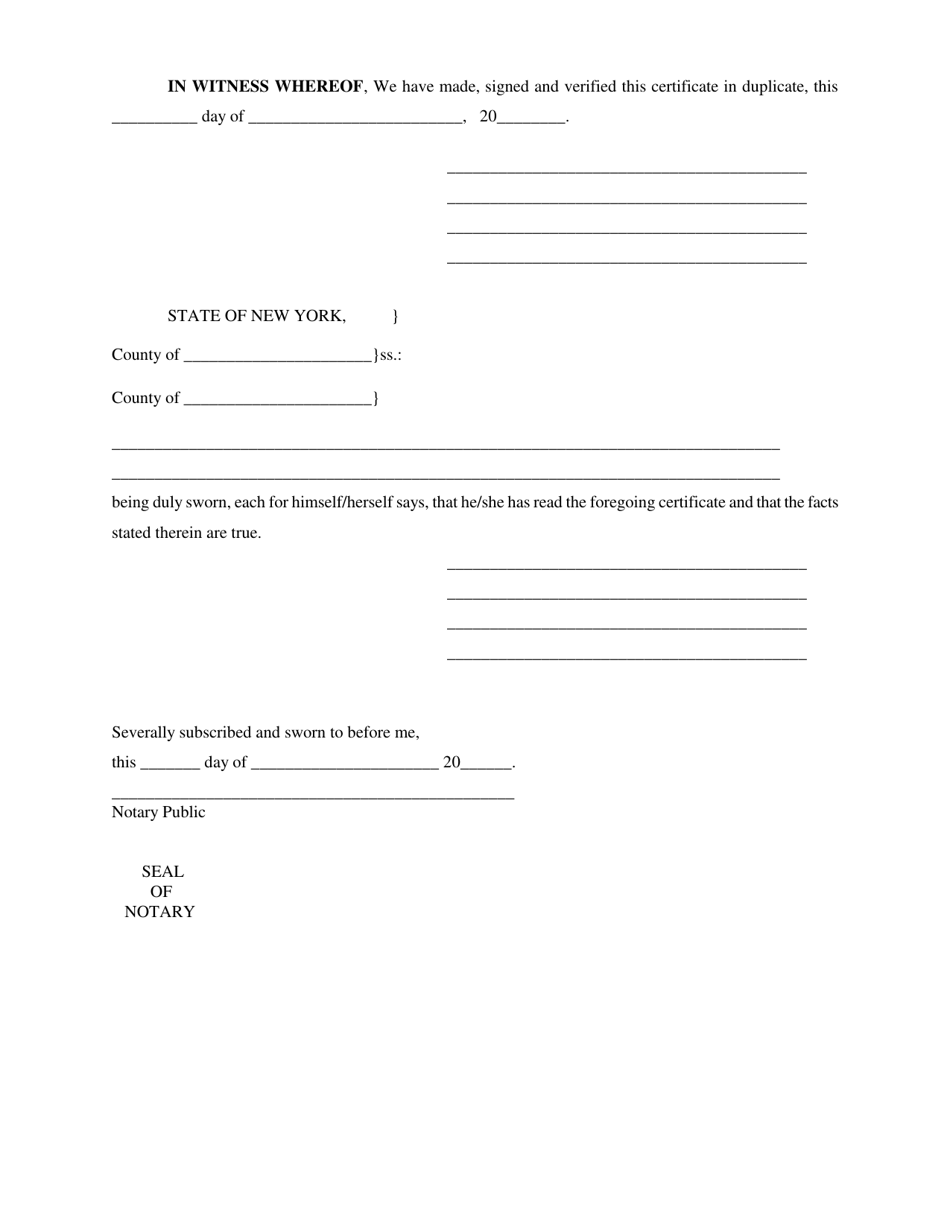

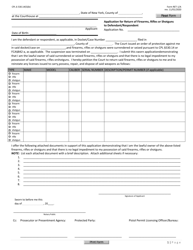

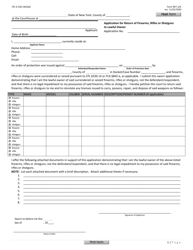

Verified Certificate of Firm of Private Bankers Applying for Authorization to Continue Business - New York

Verified Certificate of Firm of Private Bankers Applying for Authorization to Continue Business is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is a Verified Certificate of Firm?

A: A Verified Certificate of Firm is a document that certifies a private bank as a legitimate and authorized business.

Q: What does it mean to apply for authorization to continue business?

A: Applying for authorization to continue business means that the private bank is seeking permission to operate as an ongoing entity in New York.

Q: Why would a private bank need to apply for authorization to continue business?

A: Private banks need to apply for authorization to continue business to ensure that they are operating within the legal framework and meeting the regulatory requirements set by the authorities.

Q: Who issues the Verified Certificate of Firm?

A: The Verified Certificate of Firm is typically issued by the regulatory authority responsible for overseeing private banks in New York.

Q: What information is included in the Verified Certificate of Firm?

A: The Verified Certificate of Firm includes details about the private bank, such as its name, address, and legal status, as well as any conditions or restrictions associated with its authorization.

Q: What is the purpose of the Verified Certificate of Firm?

A: The purpose of the Verified Certificate of Firm is to provide evidence that the private bank is authorized to continue its business operations and is compliant with relevant laws and regulations.

Q: Is the Verified Certificate of Firm transferable?

A: No, the Verified Certificate of Firm is not transferable. It is specific to the private bank for which it is issued.

Q: What happens if a private bank operates without a Verified Certificate of Firm?

A: Operating without a Verified Certificate of Firm is illegal and can result in penalties, fines, or even the closure of the bank.

Q: How long does it take to obtain a Verified Certificate of Firm?

A: The time taken to obtain a Verified Certificate of Firm may vary depending on the specific circumstances and the regulatory process in New York.

Q: Can a private bank continue to operate if its application for authorization is rejected?

A: If a private bank's application for authorization is rejected, it may not be able to continue its operations legally and may need to take corrective actions or appeal the decision, if possible.

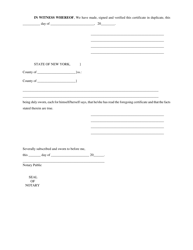

Form Details:

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.