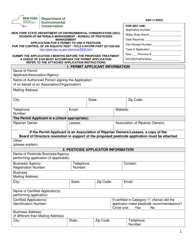

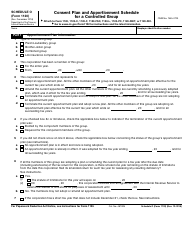

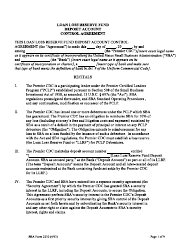

Control Agreement - New York

Control Agreement is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is a Control Agreement?

A: A Control Agreement is a legal document that establishes the rights and responsibilities of a lender in relation to collateral that is held by a third-party custodian.

Q: What is the purpose of a Control Agreement?

A: The purpose of a Control Agreement is to provide the lender with certain rights and protections in the event that the borrower defaults on their loan or otherwise fails to meet their obligations.

Q: Who are the parties involved in a Control Agreement?

A: The parties involved in a Control Agreement typically include the lender, the borrower, and the third-party custodian who holds the collateral.

Q: What rights does a lender have under a Control Agreement?

A: Under a Control Agreement, a lender typically has the right to take possession or control of the collateral in the event of default, as well as the right to sell or otherwise dispose of the collateral to repay the loan.

Q: What are the benefits of a Control Agreement for the lender?

A: Some benefits of a Control Agreement for the lender include enhanced security for their loan, increased certainty of repayment, and protection against the borrower's insolvency or misuse of the collateral.

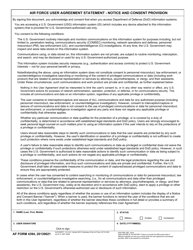

Form Details:

- Released on April 1, 2019;

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.