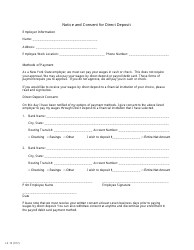

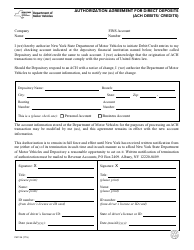

Deposit Agreement - New York

Deposit Agreement is a legal document that was released by the New York State Department of Financial Services - a government authority operating within New York.

FAQ

Q: What is a deposit agreement?

A: A deposit agreement is a contract between a bank and a customer that governs the terms and conditions of deposits made into a bank account.

Q: What are the benefits of a deposit agreement?

A: A deposit agreement provides clarity and protection for both the bank and the customer. It outlines the rights and responsibilities of each party regarding deposits and helps prevent misunderstandings.

Q: What information is included in a deposit agreement?

A: A deposit agreement typically includes details such as the types of accounts offered, the minimum deposit requirements, interest rates, withdrawal terms, and any fees or penalties that may apply.

Q: What is the minimum deposit requirement for a bank account?

A: The minimum deposit requirement for a bank account can vary from bank to bank. It is important to check with your specific bank to determine the minimum deposit requirement.

Q: Can a deposit agreement be modified or terminated?

A: Yes, a deposit agreement can be modified or terminated by mutual agreement between the bank and the customer, or as specified in the terms and conditions of the agreement.

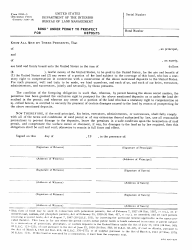

Q: Are deposits in a bank account insured?

A: Yes, deposits in a bank account are generally insured by the Federal Deposit Insurance Corporation (FDIC) up to $250,000 per depositor, per bank.

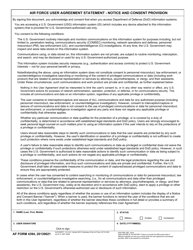

Q: What should I do if I have a complaint or issue related to a deposit agreement?

A: If you have a complaint or issue related to a deposit agreement, you should contact your bank's customer service department and follow their complaint resolution process.

Form Details:

- Released on October 3, 2011;

- The latest edition currently provided by the New York State Department of Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New York State Department of Financial Services.