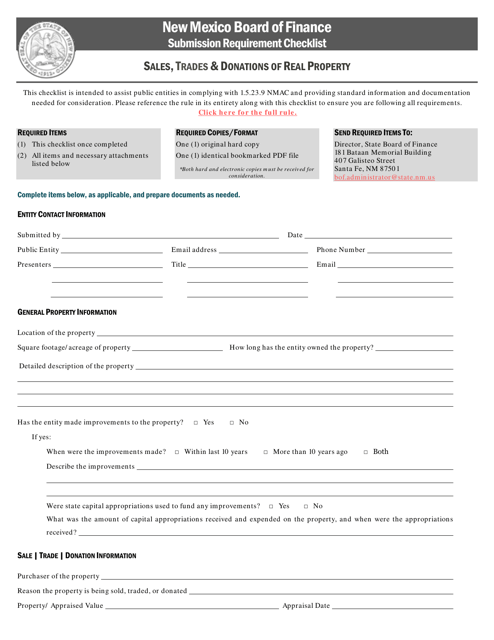

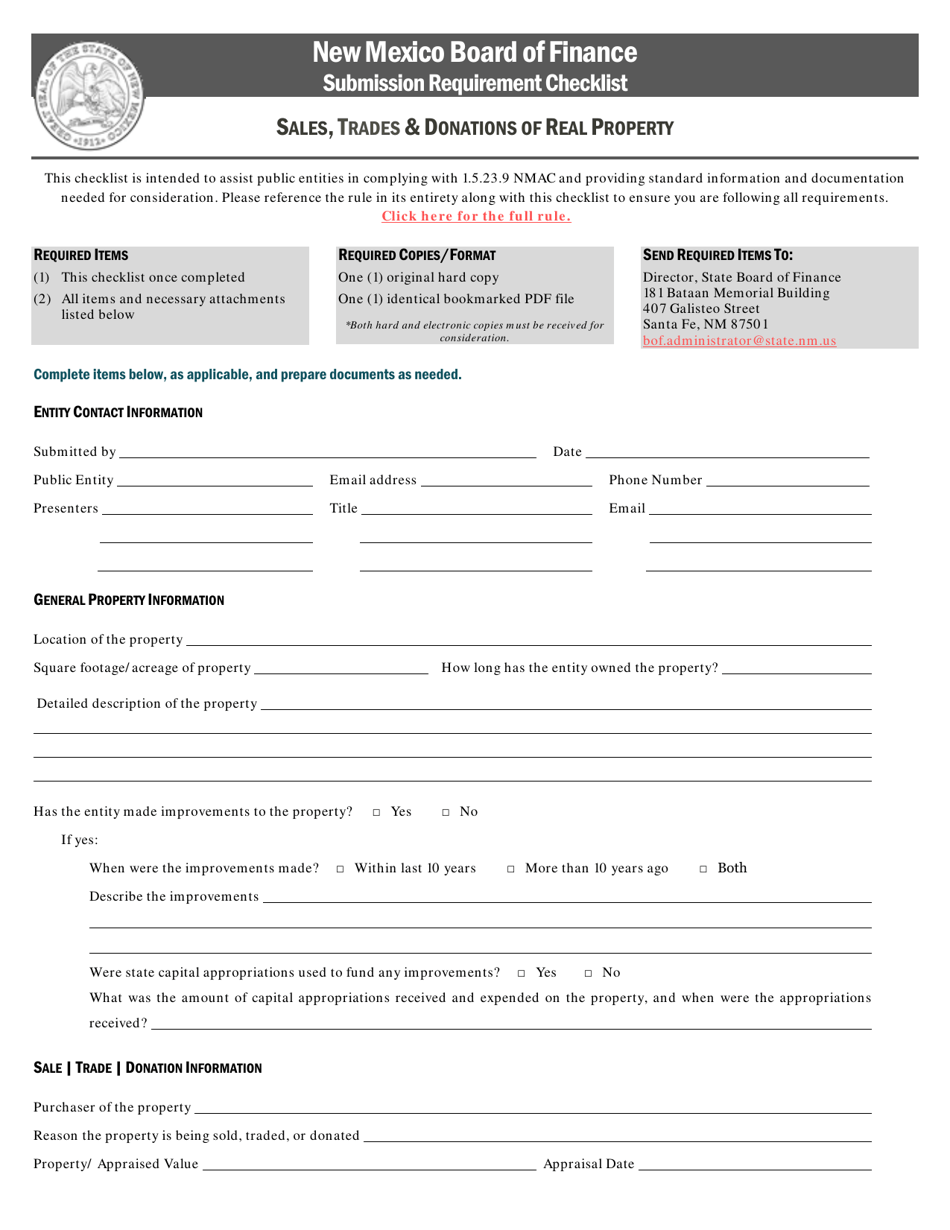

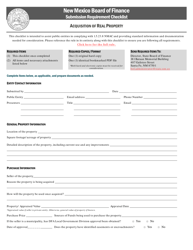

Sales,trades & Donations of Real Property Submission Requirement Checklist - New Mexico

Sales,trades & Donations of Submission Requirement Checklist is a legal document that was released by the New Mexico Department of Finance and Administration - a government authority operating within New Mexico.

FAQ

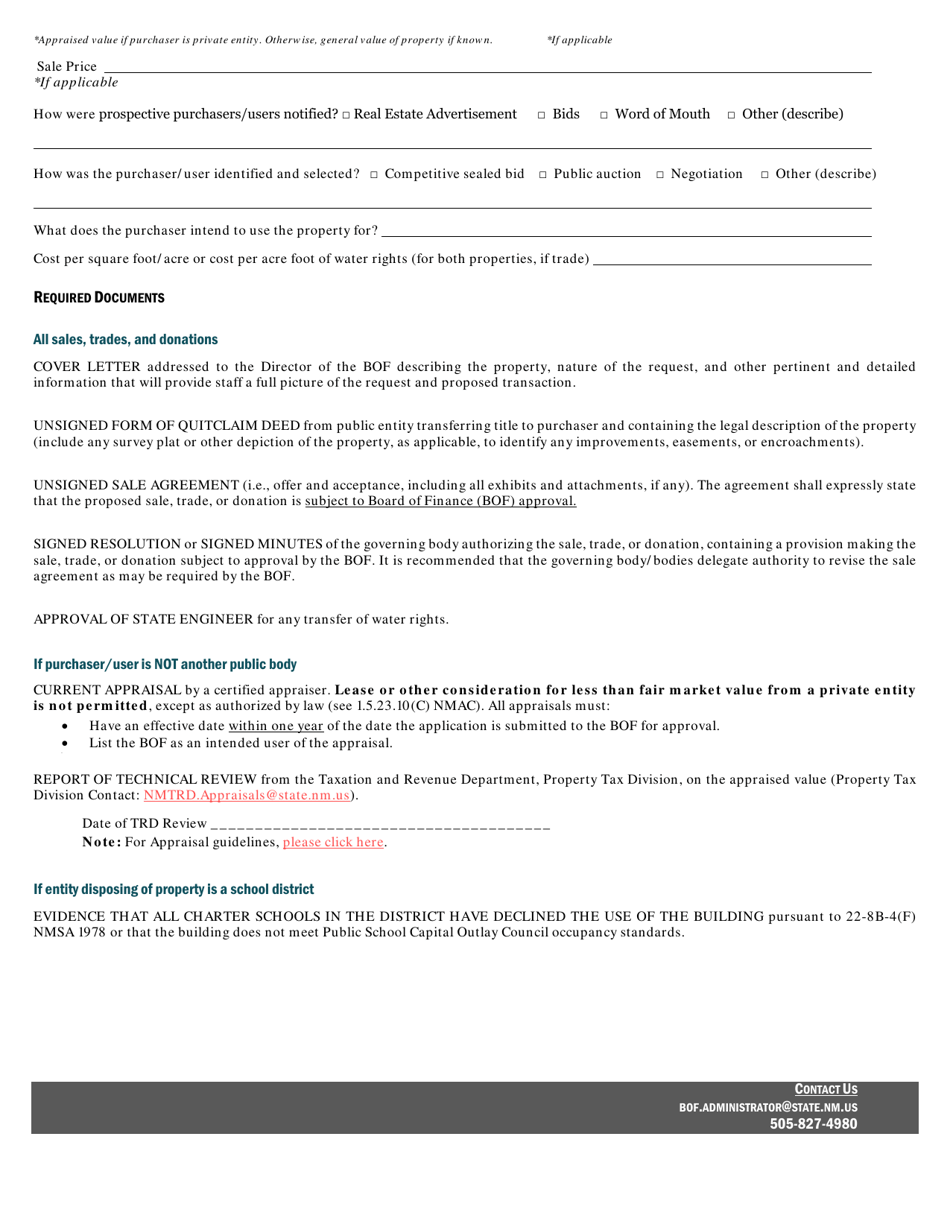

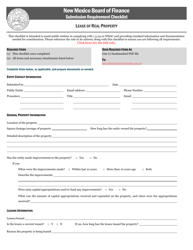

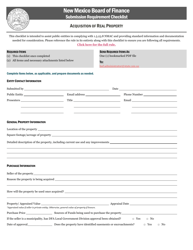

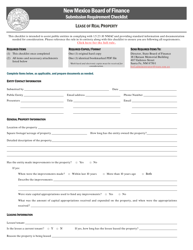

Q: What are the submission requirements for sales, trades, and donations of real property in New Mexico?

A: The submission requirements for sales, trades, and donations of real property in New Mexico include filing the Real Property Transfer Declaration (RPTD) and paying any applicable taxes.

Q: What is the Real Property Transfer Declaration (RPTD)?

A: The Real Property Transfer Declaration (RPTD) is a form that must be filed when there is a sale, trade, or donation of real property in New Mexico.

Q: Are there any taxes associated with sales, trades, and donations of real property in New Mexico?

A: Yes, there are taxes associated with sales, trades, and donations of real property in New Mexico. These taxes include the Gross Receipts Tax, the Real Property Transfer Tax, and the Real Property Conveyance Tax.

Q: Who is responsible for filing the Real Property Transfer Declaration?

A: The person or entity transferring the real property is generally responsible for filing the Real Property Transfer Declaration.

Form Details:

- The latest edition currently provided by the New Mexico Department of Finance and Administration;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Mexico Department of Finance and Administration.