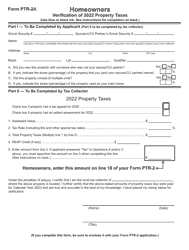

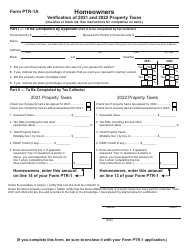

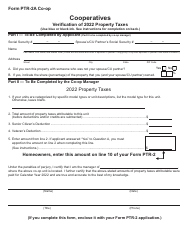

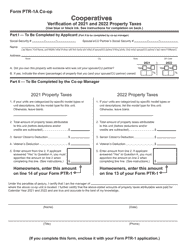

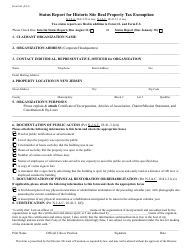

Form PTR-I Property Tax Reimbursement Income Report - New Jersey

What Is Form PTR-I?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

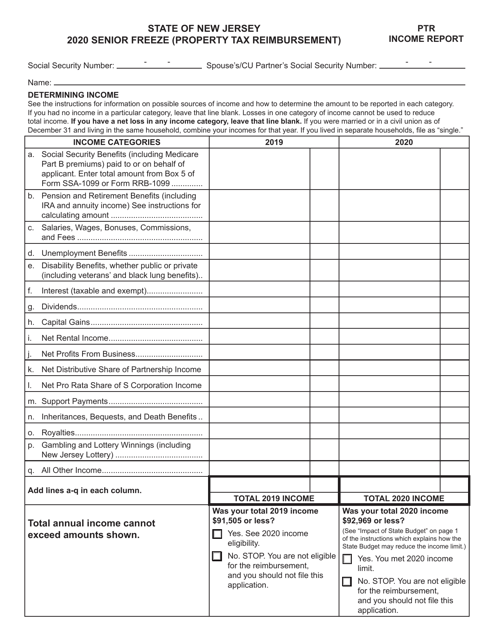

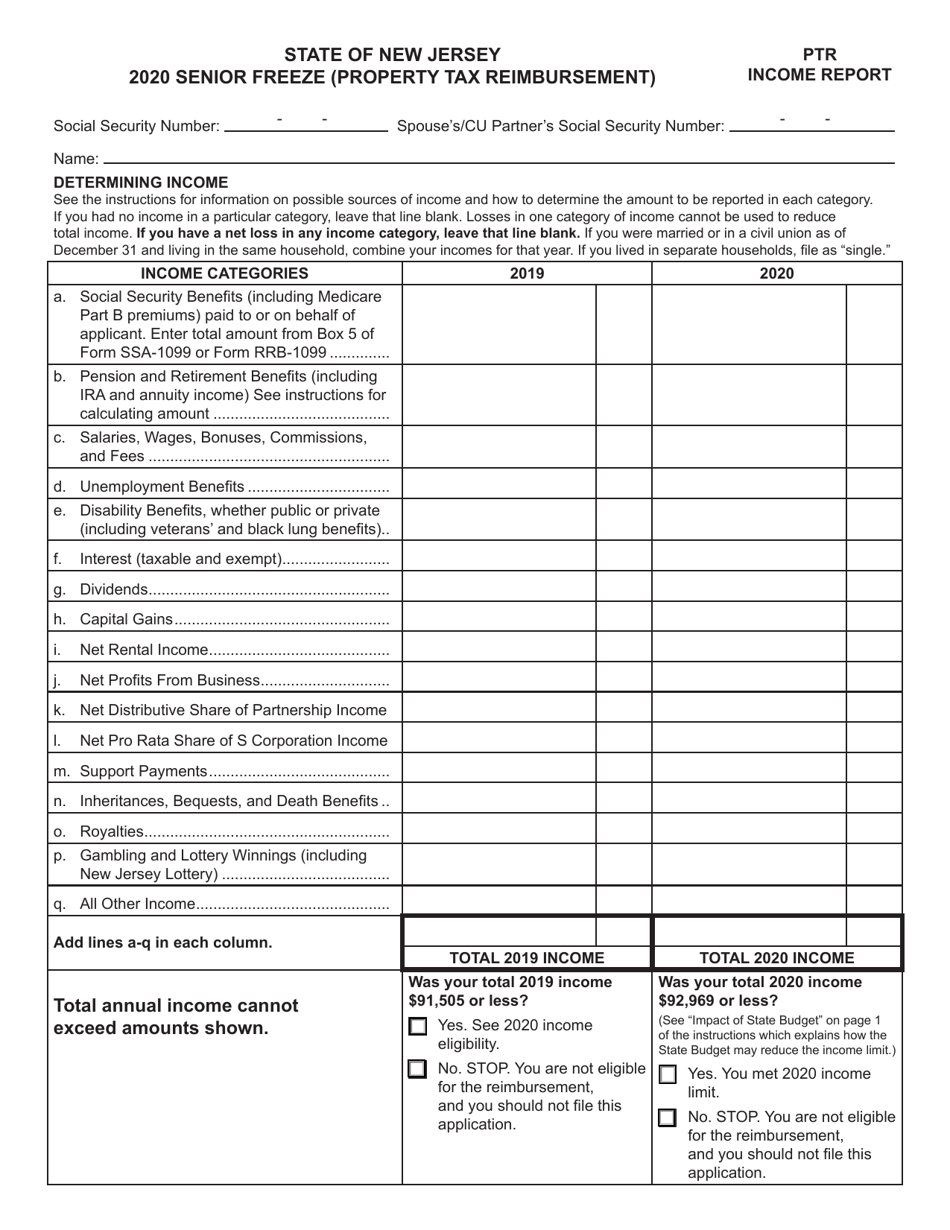

Q: What is the PTR-I Property Tax Reimbursement Income Report?

A: The PTR-I Property Tax ReimbursementIncome Report is a form used in New Jersey for reporting a homeowner's income that is used to determine eligibility for property tax reimbursement.

Q: Who is required to file the PTR-I form?

A: Homeowners in New Jersey who meet certain eligibility requirements must file the PTR-I form to determine if they qualify for property tax reimbursement.

Q: What is property tax reimbursement?

A: Property tax reimbursement is a program in New Jersey that provides financial assistance to eligible homeowners who are burdened by high property taxes.

Q: What information should I provide on the PTR-I form?

A: On the PTR-I form, you will need to provide information about your income, property taxes paid, and other relevant details as outlined in the instructions.

Q: When is the deadline to file the PTR-I form?

A: The deadline to file the PTR-I form is typically June 1st of the year following the tax year for which you are seeking reimbursement.

Q: How long does it take to process the PTR-I form?

A: Processing times for the PTR-I form vary, but you can generally expect a response from the New Jersey Division of Taxation within several months of filing.

Q: What happens after I file the PTR-I form?

A: After you file the PTR-I form, the Division of Taxation will review your application and determine if you qualify for property tax reimbursement based on the information you provided.

Q: How will I receive the property tax reimbursement?

A: If you qualify for property tax reimbursement, you will receive a check or direct deposit from the State of New Jersey.

Q: What if I have questions or need assistance with the PTR-I form?

A: If you have questions or need assistance with the PTR-I form, you can contact the New Jersey Division of Taxation or seek help from a qualified tax professional.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PTR-I by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.