This version of the form is not currently in use and is provided for reference only. Download this version of

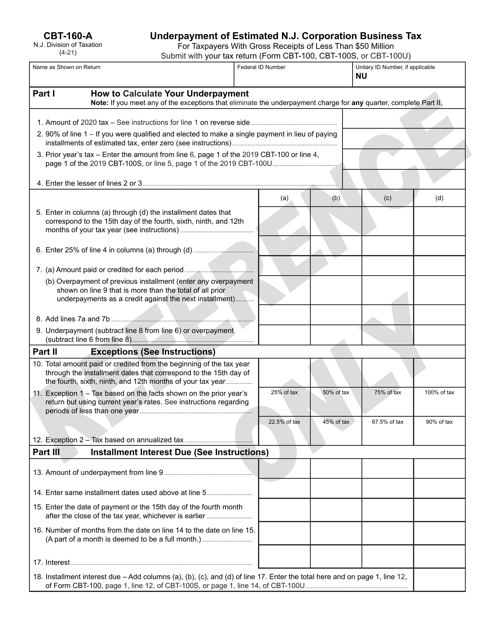

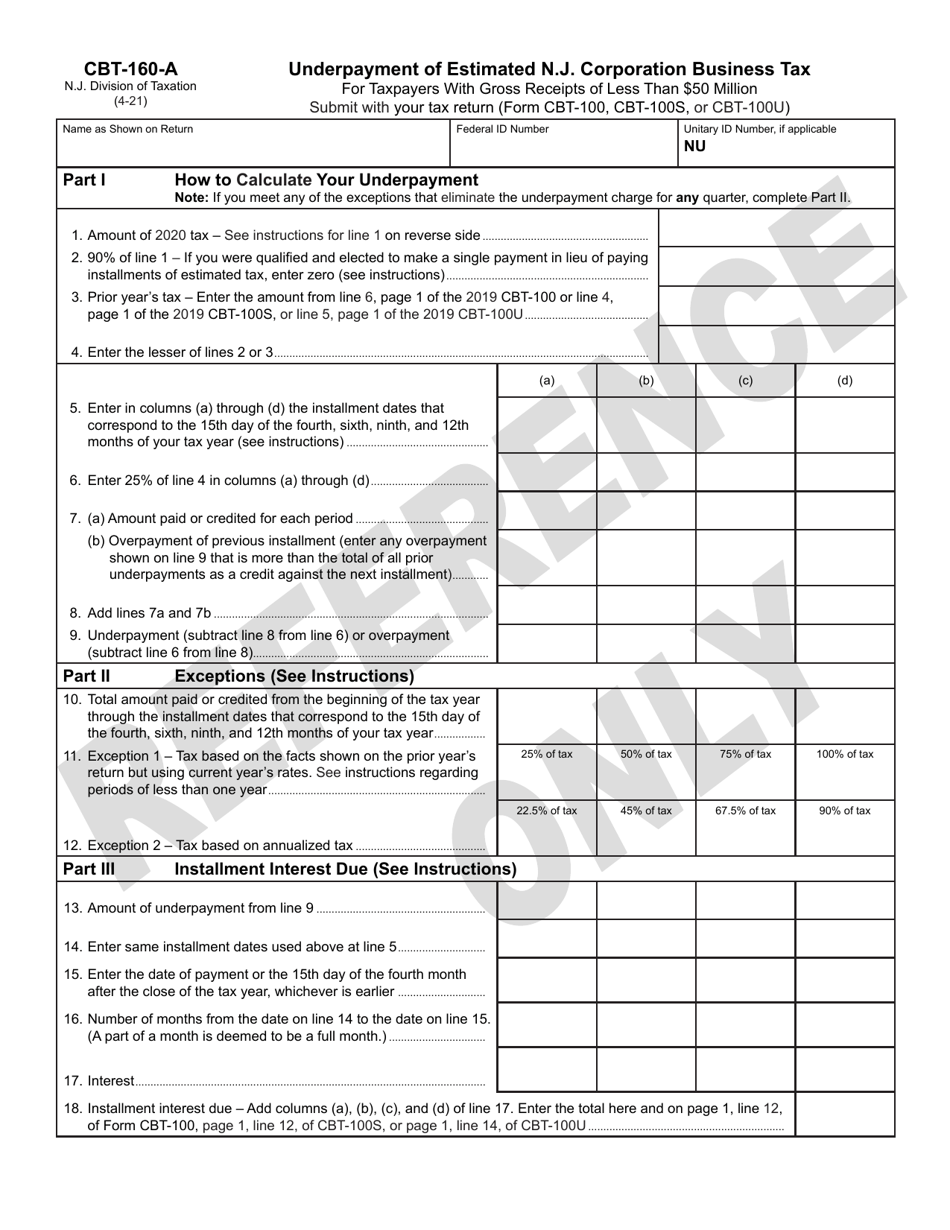

Form CBT-160-A

for the current year.

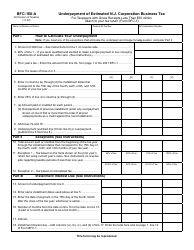

Form CBT-160-A Underpayment of Estimated N.j. Corporation Business Tax for Taxpayers With Gross Receipts of Less Than $50 Million - New Jersey

What Is Form CBT-160-A?

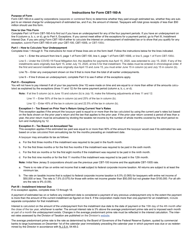

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-160-A?

A: Form CBT-160-A is a form used for reporting underpayment of estimated N.J. Corporation Business Tax for taxpayers with gross receipts of less than $50 million.

Q: Who needs to file Form CBT-160-A?

A: Taxpayers with gross receipts of less than $50 million who have underpaid their estimated N.J. Corporation Business Tax need to file Form CBT-160-A.

Q: What is the purpose of Form CBT-160-A?

A: The purpose of Form CBT-160-A is to report and calculate the underpayment of estimated N.J. Corporation Business Tax.

Q: When is Form CBT-160-A due?

A: Form CBT-160-A is generally due on or before the original due date of the corporation business tax return.

Q: Is there a penalty for underpayment of estimated N.J. Corporation Business Tax?

A: Yes, there may be a penalty for underpayment of estimated N.J. Corporation Business Tax. The penalty amount depends on the underpayment amount and the time period in which the underpayment occurred.

Form Details:

- Released on April 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-160-A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.