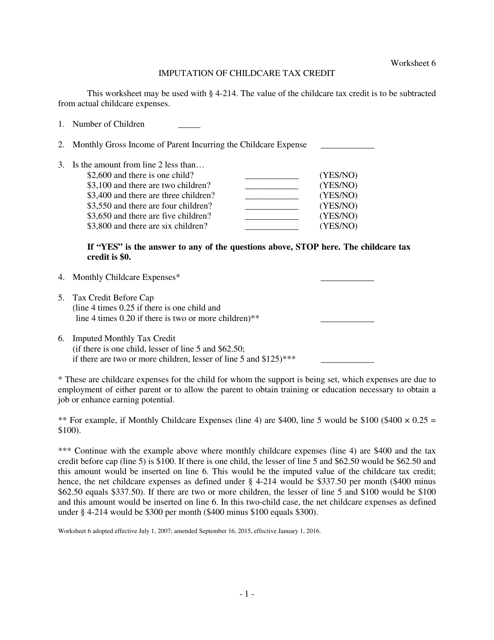

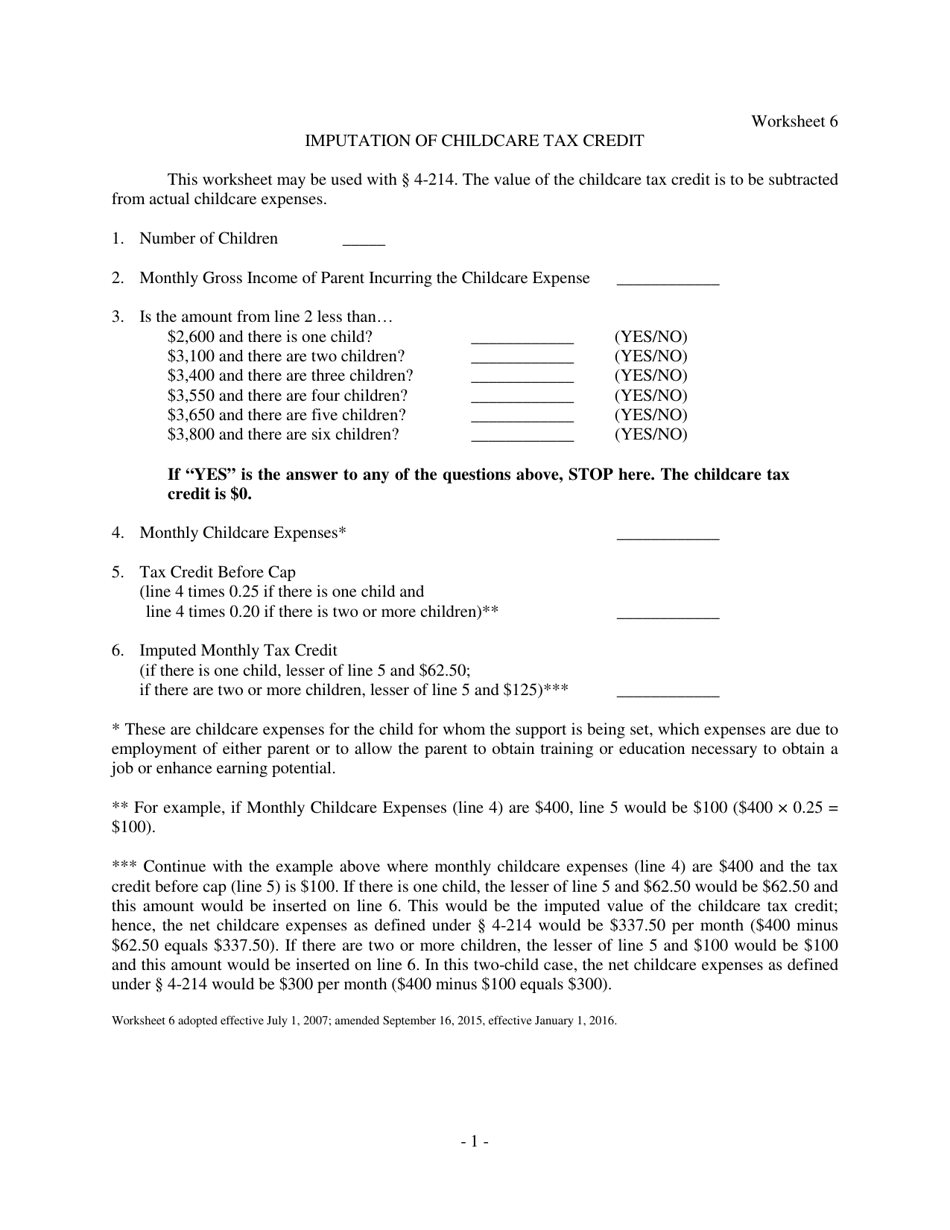

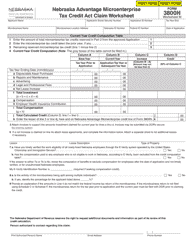

Worksheet 6 Imputation of Childcare Tax Credit - Nebraska

What Is Worksheet 6?

This is a legal form that was released by the Nebraska Judicial Branch - a government authority operating within Nebraska. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

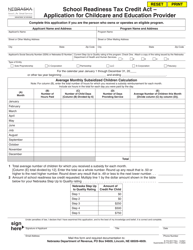

Q: What is the Childcare Tax Credit?

A: The Childcare Tax Credit is a tax credit that helps offset the costs of childcare expenses.

Q: Who is eligible for the Childcare Tax Credit?

A: Generally, individuals or families who have incurred childcare expenses for a qualified child are eligible for the credit.

Q: How much is the Childcare Tax Credit?

A: The amount of the credit depends on various factors, such as the taxpayer's income and the amount of childcare expenses incurred.

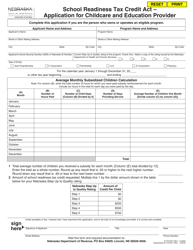

Q: What is the purpose of imputing the Childcare Tax Credit?

A: Imputing the Childcare Tax Credit allows individuals or families to deduct childcare expenses when calculating their tax liability.

Q: What is Worksheet 6?

A: Worksheet 6 is a form used to calculate the imputed Childcare Tax Credit for Nebraska residents.

Q: How does Worksheet 6 work?

A: Worksheet 6 guides individuals or families through the process of calculating their imputed Childcare Tax Credit, taking into account their income and other factors.

Form Details:

- Released on September 16, 2015;

- The latest edition provided by the Nebraska Judicial Branch;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Worksheet 6 by clicking the link below or browse more documents and templates provided by the Nebraska Judicial Branch.