This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form CC16:2.44

for the current year.

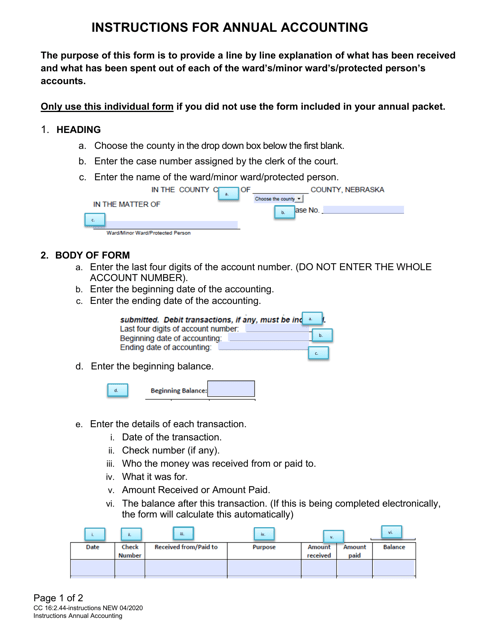

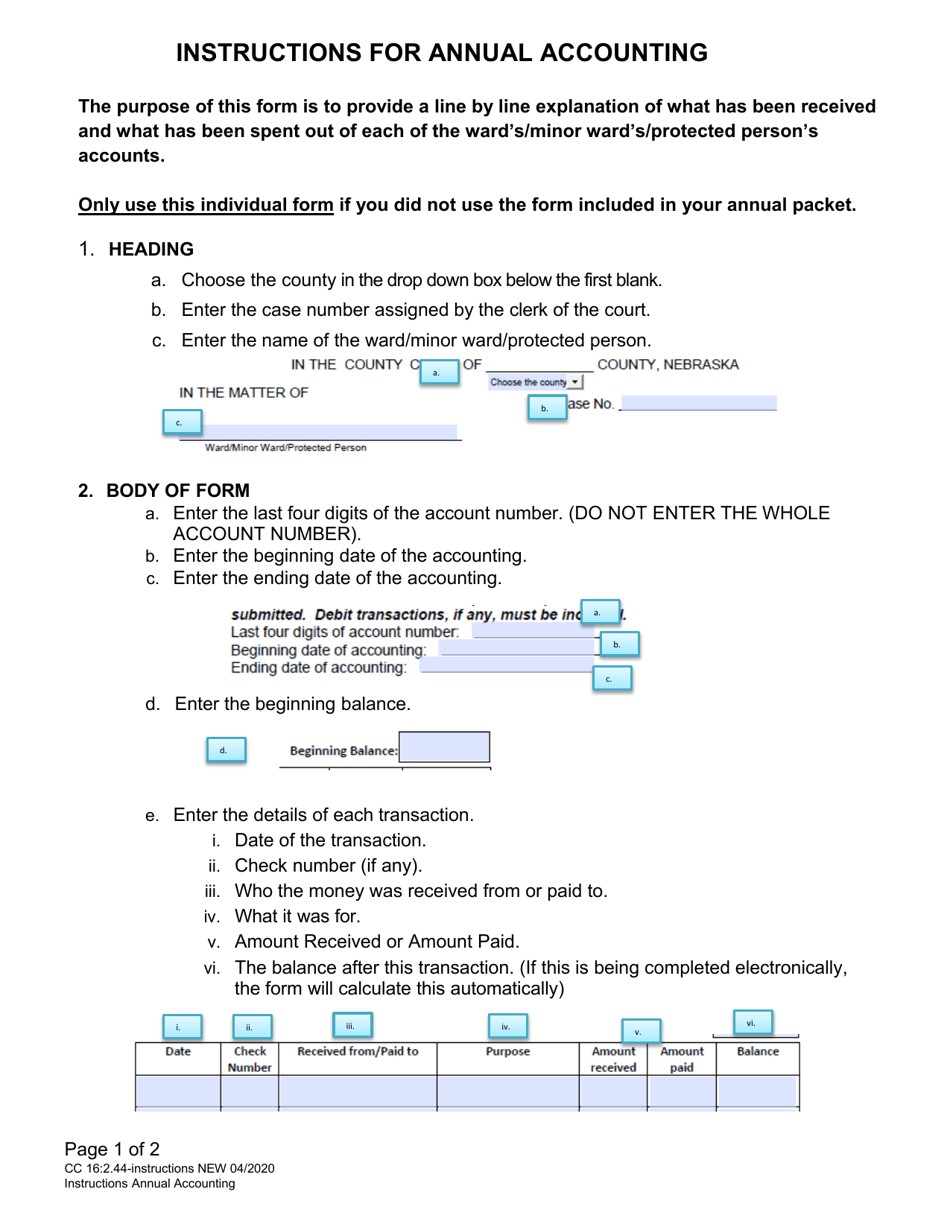

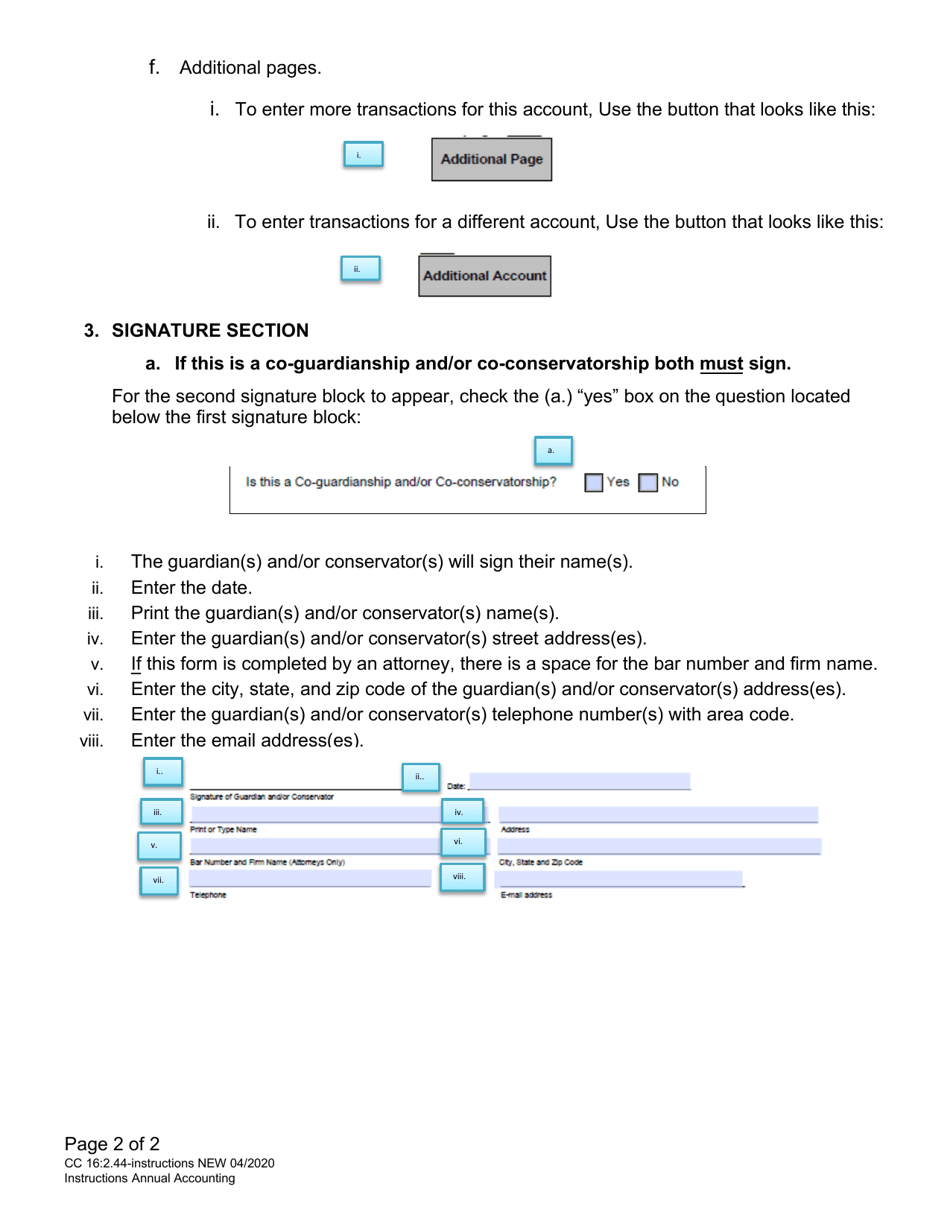

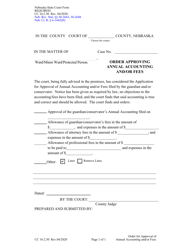

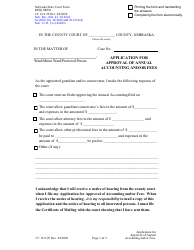

Instructions for Form CC16:2.44 Annual Accounting - Nebraska

This document contains official instructions for Form CC16:2.44 , Annual Accounting - a form released and collected by the Nebraska Judicial Branch. An up-to-date fillable Form CC16:2.44 is available for download through this link.

FAQ

Q: What is Form CC16:2.44?

A: Form CC16:2.44 is the Annual Accounting form for Nebraska.

Q: Who needs to complete Form CC16:2.44?

A: Any individual or organization who is required to file an annual accounting report in Nebraska needs to complete Form CC16:2.44.

Q: What information is required on Form CC16:2.44?

A: Form CC16:2.44 requires you to provide details about your financial accounts and transactions for the year, including income, expenses, and balances.

Q: What is the deadline for filing Form CC16:2.44?

A: The deadline for filing Form CC16:2.44 is typically April 15th of the following year, or the next business day if April 15th falls on a weekend or holiday.

Q: Are there any filing fees for Form CC16:2.44?

A: No, there are no filing fees associated with Form CC16:2.44.

Q: What penalties are there for late filing of Form CC16:2.44?

A: If you fail to file Form CC16:2.44 by the deadline, you may be subject to penalties and interest on any taxes owed.

Q: What if I have questions or need assistance with Form CC16:2.44?

A: If you have questions or need assistance with Form CC16:2.44, you can contact the Nebraska Department of Revenue for guidance.

Q: Is Form CC16:2.44 only for individuals or can businesses also use it?

A: Form CC16:2.44 can be used by both individuals and businesses who are required to file an annual accounting report in Nebraska.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Nebraska Judicial Branch.