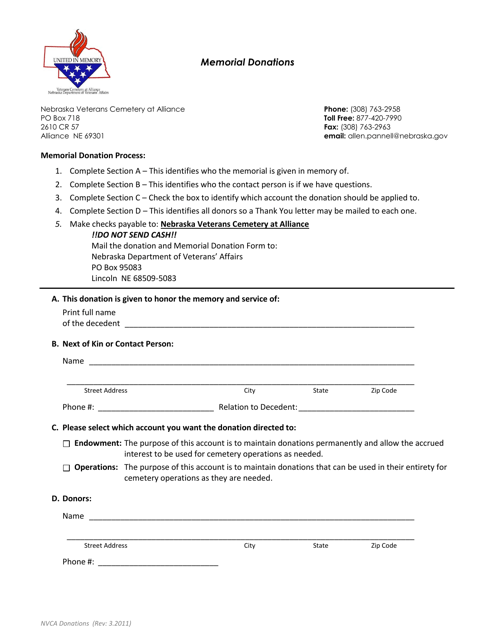

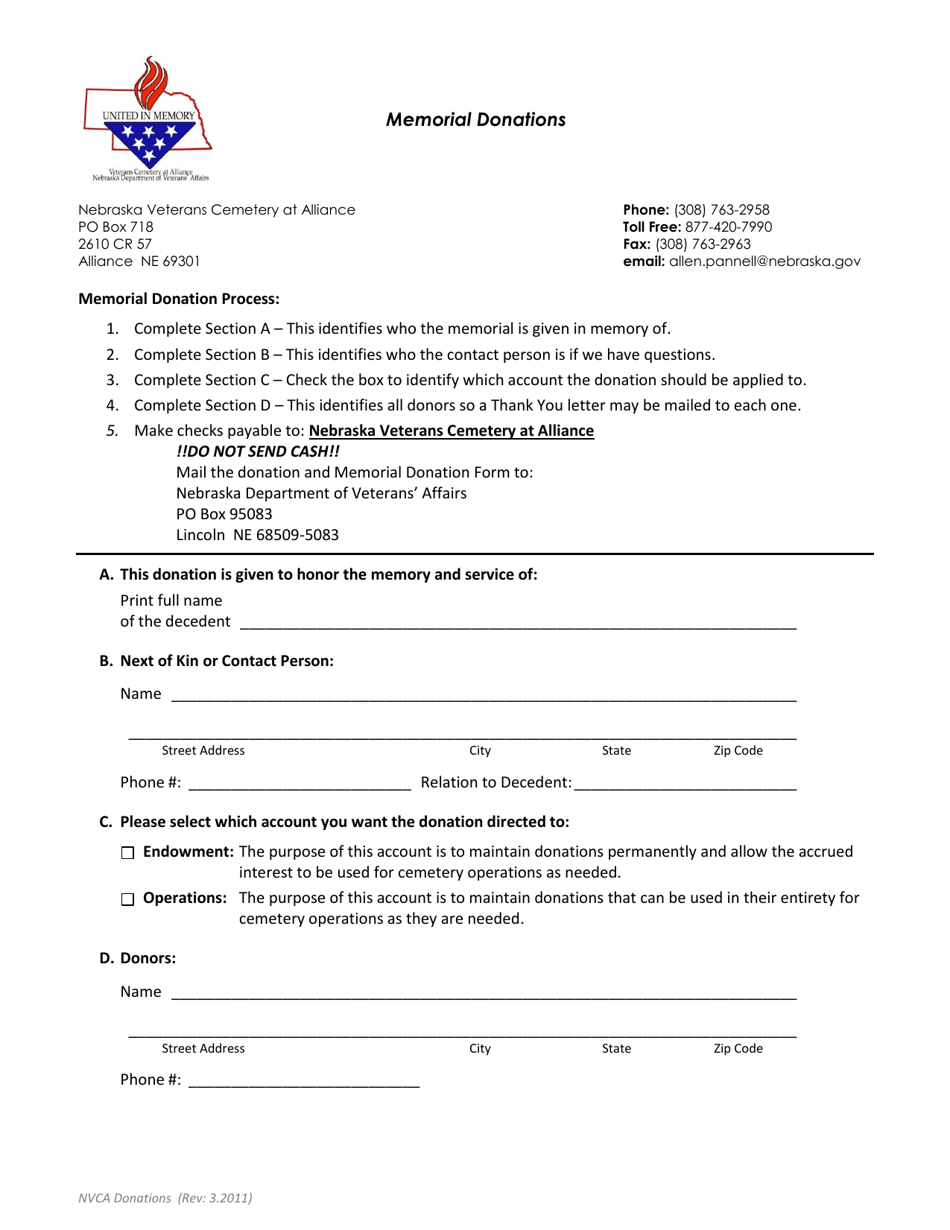

Memorial Donations - Nebraska

Memorial Donations is a legal document that was released by the Nebraska Department of Veterans' Affairs - a government authority operating within Nebraska.

FAQ

Q: What are memorial donations in Nebraska?

A: Memorial donations in Nebraska are contributions made in memory of a deceased individual.

Q: How do memorial donations work in Nebraska?

A: In Nebraska, memorial donations are typically made to honor the memory of a loved one who has passed away. These donations are often given to a charity or nonprofit organization of the donor's choice.

Q: Can you claim a tax deduction for memorial donations in Nebraska?

A: Yes, in some cases, memorial donations made to qualifying organizations in Nebraska may be tax-deductible. It is recommended to consult with a tax professional or refer to the IRS guidelines for specific details.

Q: Are there any restrictions on memorial donations in Nebraska?

A: While there may not be specific restrictions on memorial donations in Nebraska, it is important to ensure that the chosen charity or nonprofit organization is recognized and reputable. Researching the organization's mission, financial transparency, and impact can help ensure that your donation is used effectively.

Form Details:

- Released on March 1, 2011;

- The latest edition currently provided by the Nebraska Department of Veterans' Affairs;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Veterans' Affairs.