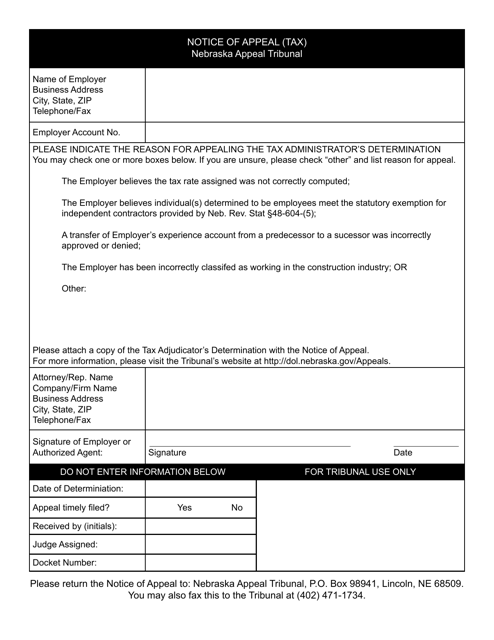

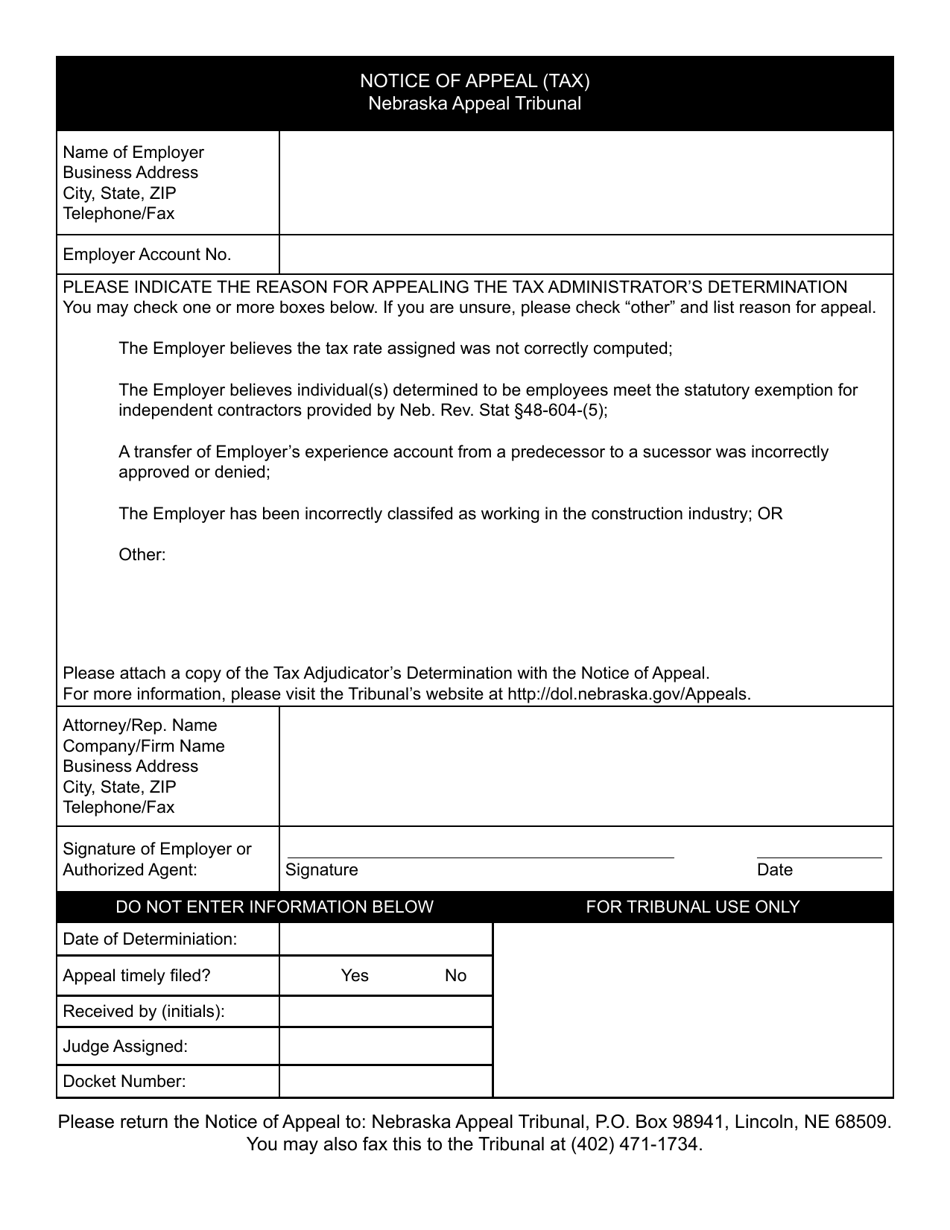

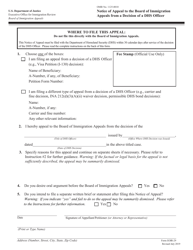

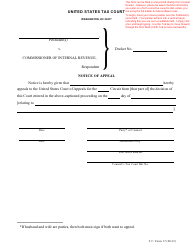

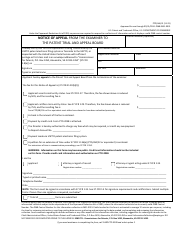

Notice of Appeal (Tax) - Nebraska

Notice of Appeal (Tax) is a legal document that was released by the Nebraska Department of Labor - a government authority operating within Nebraska.

FAQ

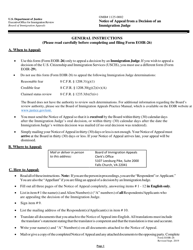

Q: What is a Notice of Appeal (Tax) in Nebraska?

A: A Notice of Appeal (Tax) in Nebraska is a legal document used to appeal a decision or ruling related to taxes.

Q: When should I file a Notice of Appeal (Tax) in Nebraska?

A: You should file a Notice of Appeal (Tax) in Nebraska within the specified time frame set by the Nebraska Department of Revenue.

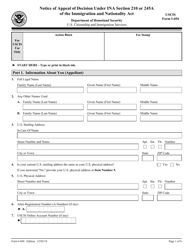

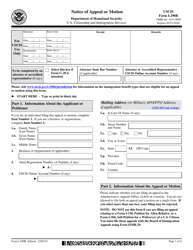

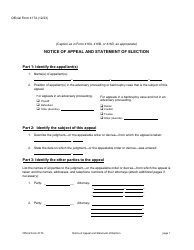

Q: What information should be included in a Notice of Appeal (Tax) form in Nebraska?

A: A Notice of Appeal (Tax) form in Nebraska should include your name, contact information, the tax issue being appealed, the reason for the appeal, and any supporting documentation.

Q: What happens after I file a Notice of Appeal (Tax) in Nebraska?

A: After you file a Notice of Appeal (Tax) in Nebraska, your case will be reviewed by the Nebraska Department of Revenue's Appeals Division. They will evaluate your appeal and make a decision based on the information provided.

Q: Can I represent myself during the appeals process for a Notice of Appeal (Tax) in Nebraska?

A: Yes, you can represent yourself during the appeals process for a Notice of Appeal (Tax) in Nebraska. However, you may also choose to have legal representation if desired.

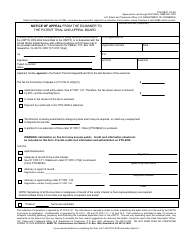

Q: What are the possible outcomes of a Notice of Appeal (Tax) in Nebraska?

A: The possible outcomes of a Notice of Appeal (Tax) in Nebraska can vary. The Nebraska Department of Revenue's Appeals Division may uphold the original decision, modify it, or reverse it based on their evaluation of the appeal.

Q: Is there a deadline for the Nebraska Department of Revenue's Appeals Division to make a decision on a Notice of Appeal (Tax)?

A: Yes, there is a deadline for the Nebraska Department of Revenue's Appeals Division to make a decision on a Notice of Appeal (Tax). The specific timeline may vary depending on the circumstances, and you can inquire about it with the department.

Q: Can I further appeal if I disagree with the decision made on my Notice of Appeal (Tax) in Nebraska?

A: Yes, if you disagree with the decision made on your Notice of Appeal (Tax) in Nebraska, you may have the option to further appeal to the Nebraska Tax Equalization and Review Commission or seek legal advice for additional options.

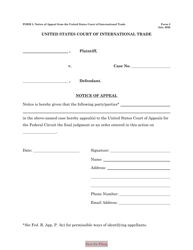

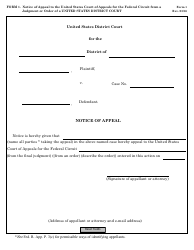

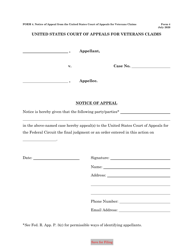

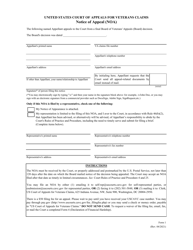

Form Details:

- The latest edition currently provided by the Nebraska Department of Labor;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Labor.