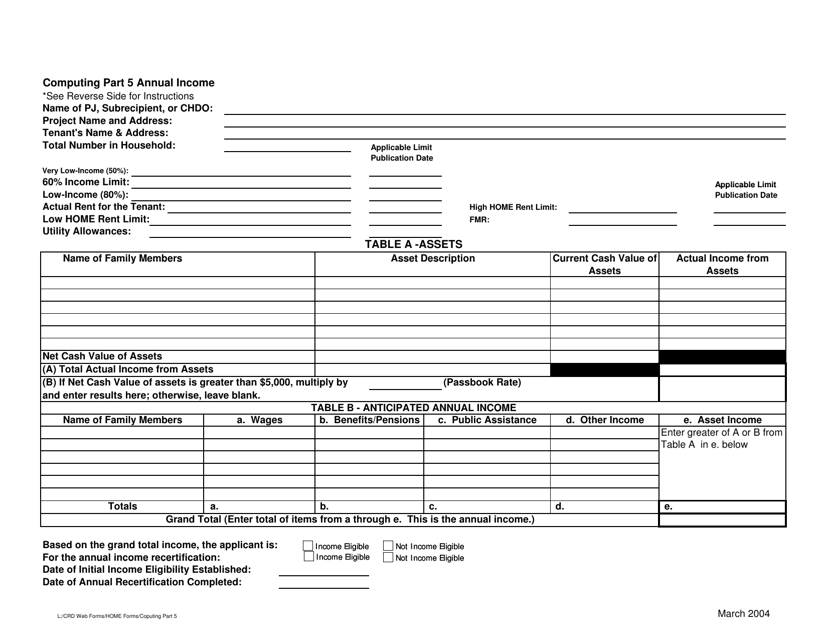

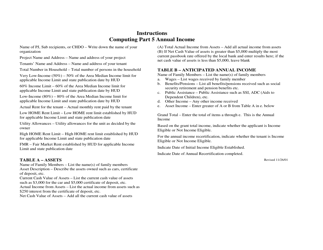

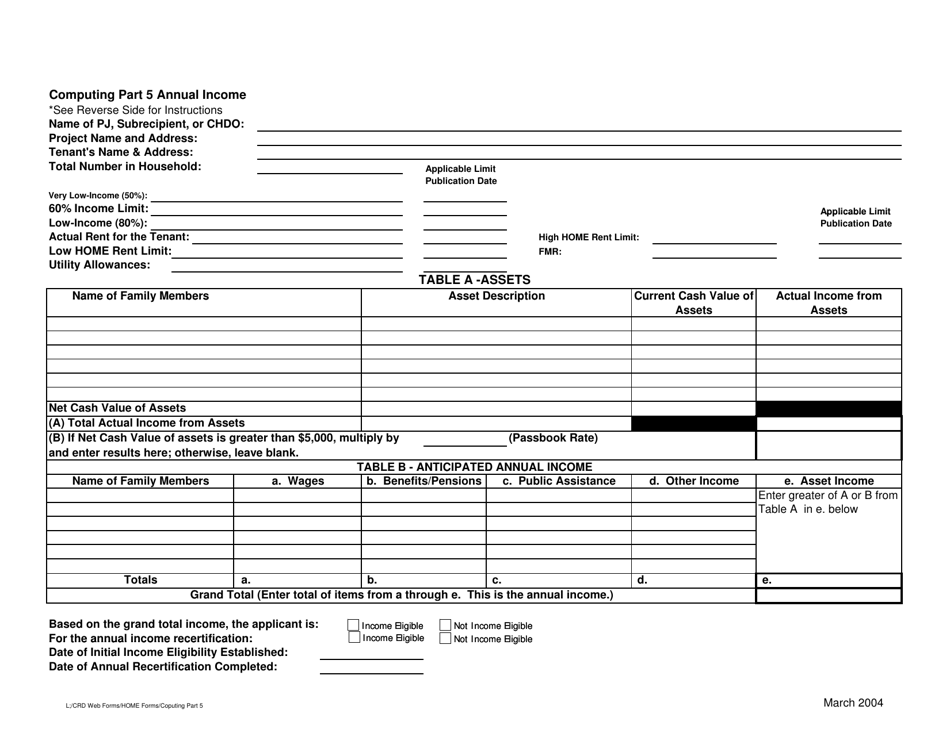

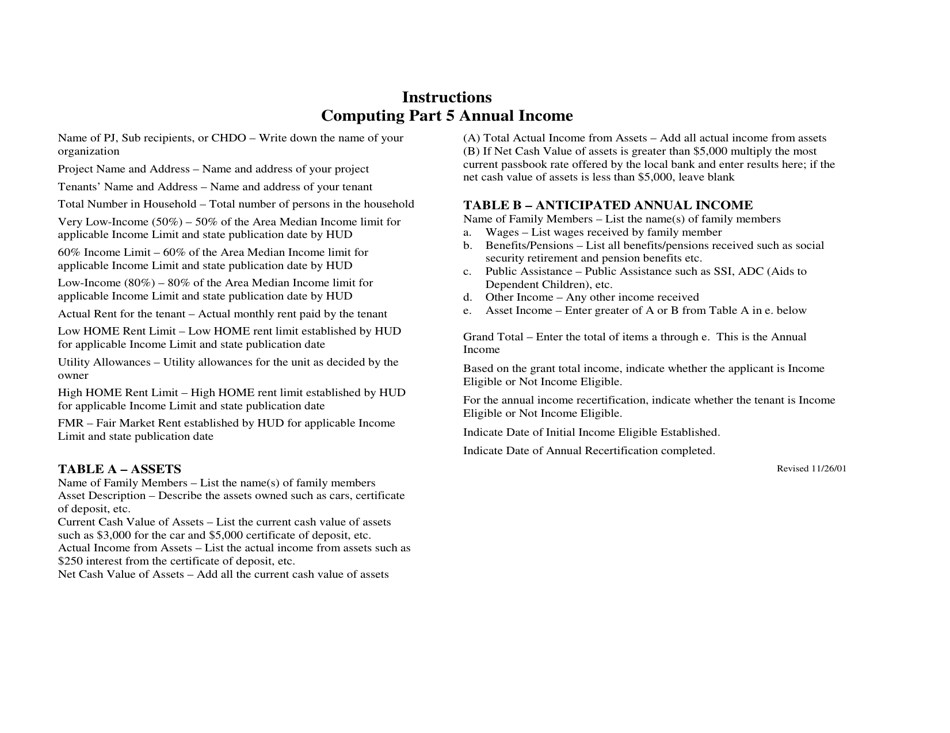

Computing Part 5 Annual Income - Nebraska

Computing Part 5 Annual Income is a legal document that was released by the Nebraska Department of Economic Development - a government authority operating within Nebraska.

FAQ

Q: What is Part 5 of the Nebraska income tax form?

A: Part 5 refers to the section of the Nebraska income tax form that deals with reporting annual income.

Q: What is considered annual income in Nebraska?

A: Annual income in Nebraska includes all income received by a taxpayer in a calendar year, including wages, salaries, tips, interest, dividends, and rental income.

Q: Do I need to report my annual income in Nebraska?

A: Yes, all taxpayers in Nebraska are required to report their annual income on the state income tax form.

Q: Are there any deductions or exemptions for annual income in Nebraska?

A: Yes, Nebraska offers various deductions and exemptions that can reduce your taxable income, such as deductions for mortgage interest, medical expenses, and charitable contributions.

Form Details:

- Released on March 1, 2004;

- The latest edition currently provided by the Nebraska Department of Economic Development;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Economic Development.