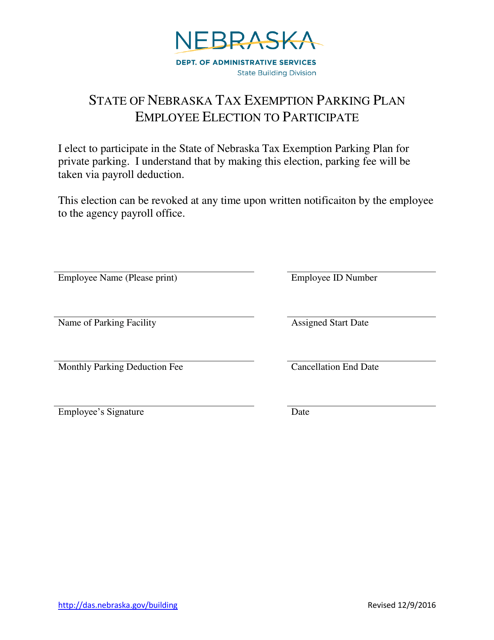

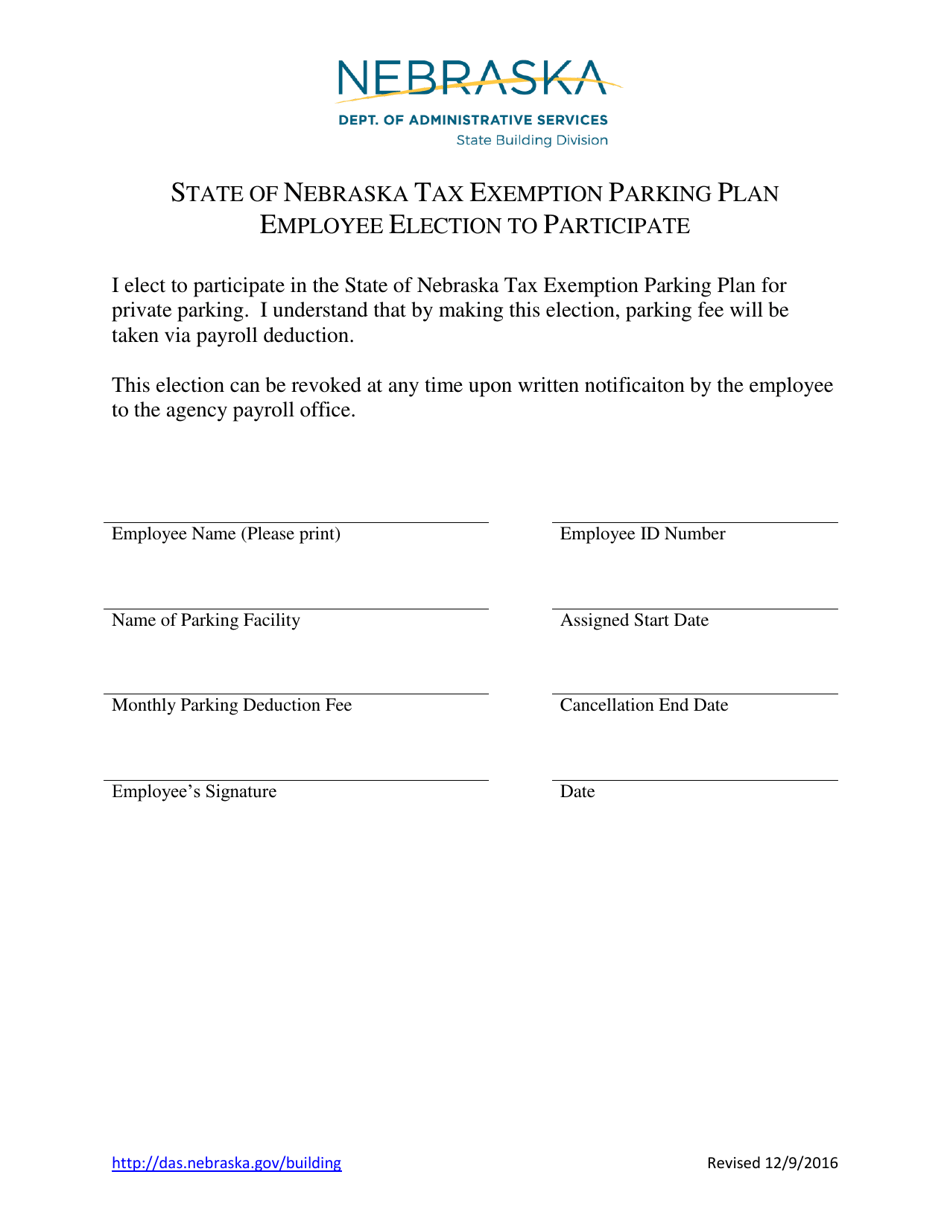

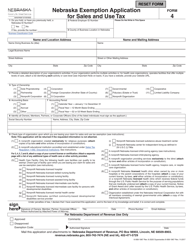

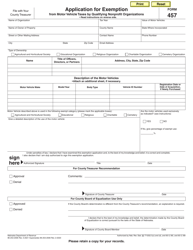

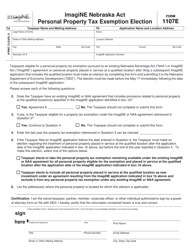

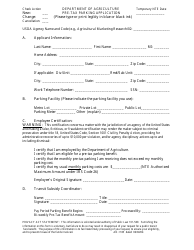

Tax Exemption Parking Plan Employee Election to Participate - Nebraska

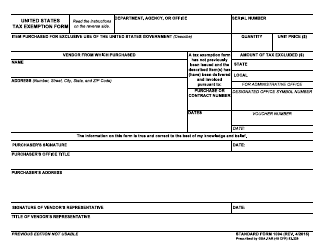

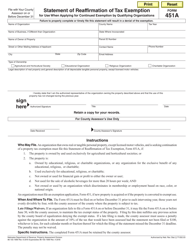

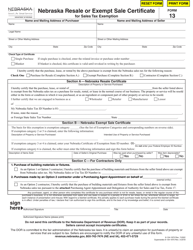

Tax Exemption Parking Plan Employee Election to Participate is a legal document that was released by the Nebraska Department of Administrative Services - a government authority operating within Nebraska.

FAQ

Q: What is a tax exemption parking plan?

A: A tax exemption parking plan is a benefit offered by employers that allows employees to pay for parking expenses with pre-tax income.

Q: What is the purpose of a tax exemption parking plan?

A: The purpose of a tax exemption parking plan is to provide a tax advantage to employees by allowing them to use pre-tax income to pay for parking expenses.

Q: Can employees choose to participate in the tax exemption parking plan?

A: Yes, employees can choose to participate in the tax exemption parking plan.

Q: Is the tax exemption parking plan available in Nebraska?

A: Yes, the tax exemption parking plan is available in Nebraska.

Q: Are there any limitations to the tax exemption parking plan?

A: There may be limitations on the amount of pre-tax income that can be used for parking expenses. Employees should check with their employer for specific details.

Form Details:

- Released on December 9, 2016;

- The latest edition currently provided by the Nebraska Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Nebraska Department of Administrative Services.